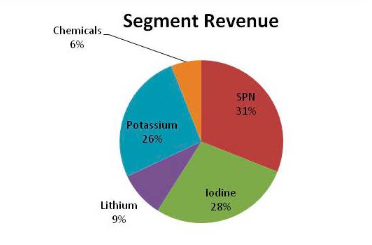

Chile’s Sociedad Quimica y Minera (SQM, Financial) is the world’s largest producer of lithium and a major producer of iodine. Chile is the world’s largest lithium producer, thanks to its abundance of dry lake beds — known as salars — that are a far cheaper source of the metal than elsewhere around the world. In addition, Sociedad Quimica y Minera produces and markets specialty plant nutrition (SPN) fertilizer, such as potassium nitrate, sodium nitrate and potassium sulfate (see chart below).

Source: Sociedad Quimica y Minera

Sociedad Quimica y Minera reported strong first-quarter 2012 earnings of USD150 million, an increase of 34.7 percent from the same period a year ago. Revenue totaled USD529.6 million for the first quarter, an increase of 10.3 percent over the USD480 million reported in the same period of 2011.

EBITDA reached USD26 million, an increase of 31 percent from the same period in 2011, with gross margins at a solid 45 percent. Net margin reached 28 percent in the first quarter, higher than the 23 percent achieved a year ago.

The commodities stock’s strong results this quarter were driven mainly by higher iodine volumes together with an increase in average prices for all business lines, which boosted gross margins.

Prices and volumes of iodine increased solidly because of tight world supplies, leading to a 53 percent jump in revenue from this segment, which accounts for 40 percent of gross profit. Potash volumes continued to decline, but higher prices led to a 7 percent increase in revenue year over year, representing 22 percent of gross profit.

The company remains optimistic about the remainder of 2012, expecting a recovery of potash volumes and strong demand and pricing in the iodine and lithium markets. As a result, the company continues to implement its capital expenditure plan of USD500 million for 2012, which should boost its production of iodine and potassium-based products by about 25 percent this year.

The most important single end-market for iodine is health care devices such as x-ray machines, accounting for 55 percent of all global consumption. Liquid crystal displays (LCDs) used for computer screens and televisions represent another fast-growing market for iodine. Although it’s possible to replace iodine in LCDs, the alternatives are all considered inferior or more expensive.

The company is a solid value investment, with total debt of USD1.4 billion and a cash position of USD656 million. The company offers exposure to markets with fast-growing demand for most of its products, while supplies remain tight. For more tips on investing in commodities, check out my free Rare Metals Stocks report.

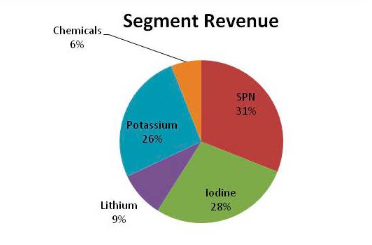

Source: Sociedad Quimica y Minera

Sociedad Quimica y Minera reported strong first-quarter 2012 earnings of USD150 million, an increase of 34.7 percent from the same period a year ago. Revenue totaled USD529.6 million for the first quarter, an increase of 10.3 percent over the USD480 million reported in the same period of 2011.

EBITDA reached USD26 million, an increase of 31 percent from the same period in 2011, with gross margins at a solid 45 percent. Net margin reached 28 percent in the first quarter, higher than the 23 percent achieved a year ago.

The commodities stock’s strong results this quarter were driven mainly by higher iodine volumes together with an increase in average prices for all business lines, which boosted gross margins.

Prices and volumes of iodine increased solidly because of tight world supplies, leading to a 53 percent jump in revenue from this segment, which accounts for 40 percent of gross profit. Potash volumes continued to decline, but higher prices led to a 7 percent increase in revenue year over year, representing 22 percent of gross profit.

The company remains optimistic about the remainder of 2012, expecting a recovery of potash volumes and strong demand and pricing in the iodine and lithium markets. As a result, the company continues to implement its capital expenditure plan of USD500 million for 2012, which should boost its production of iodine and potassium-based products by about 25 percent this year.

The most important single end-market for iodine is health care devices such as x-ray machines, accounting for 55 percent of all global consumption. Liquid crystal displays (LCDs) used for computer screens and televisions represent another fast-growing market for iodine. Although it’s possible to replace iodine in LCDs, the alternatives are all considered inferior or more expensive.

The company is a solid value investment, with total debt of USD1.4 billion and a cash position of USD656 million. The company offers exposure to markets with fast-growing demand for most of its products, while supplies remain tight. For more tips on investing in commodities, check out my free Rare Metals Stocks report.