The latest inflation numbers show an 8.6% rate, which is the highest level since 1981 and well above the Federal Reserve’s 2% target. To curb this high inflation, Fed Chairman Jerome Powell hiked the federal funds rate by 75 basis points to a 1.5% to 1.75% range in June. Rising interest rates increase the discount rate for stock valuations and thus causes a compression in multiples. As a result, we have seen a major downward correction for growth stocks, especially those in the technology sector.

Appaloosa Management leader David Tepper (Trades, Portfolio) has been loading up on two downtrodden technology stocks with huge brands and blue-chip credentials. Let’s dive into each company and the average price point Tepper was buying at.

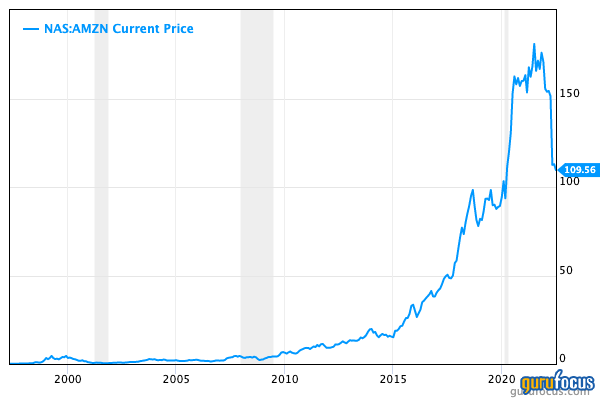

Amazon

Amazon.com Inc. (AMZN, Financial) is the undisputed king of e-commerce and cloud computing with its rapidly growing Amazon Web Services business. The company benefited hugely from the lockdowns as the closure of brick-and-mortar retail stores caused a surge in online shopping and accelerated digital transformation.

So why is the stock down almost 40% from the all-time highs reached in November 2021 and basically given up all pandemic gains? Well, this is for a few reasons. The first is the current macroeconomic environment, in which inflation and supply chain constraints caused operating costs to rise for the company.

Total operating expenses jumped by 13.1% from $99.6 billion to $112.7 billion in the first quarter of 2022. This was driven mainly by increasing fulfillment expenses, which jumped by $3.8 billion or 22%. Amazon’s slower revenue growth rates (just 7% in the first quarter of 2022) compared to a rapid 44% in the prior year, also did not help the situation. Then the real nail in the coffin was an eye-watering write down of $7.6 billion on its investment in electric vehicle maker Rivian (RIVN, Financial).

Despite these factors, Tepper was optimistic on Amazon, adding to his position in the first quarter at an average price of $154 per share, which is 29% higher than where the stock trades today.

AWS is also growing strong and beat Wall Street's expectations in the first quarter. This segment achieved $18.4 billion compared to analyst predictions of $18.3 billion. AWS is Amazon’s highest-margin segment and the driver of profitability for the company.

Given these factors, the stock is also significantly undervalued according to the GF Value Line, which analyzes historic multiples, past financial performance and future earnings projections.

Amazon still dominates both e-commerce and cloud computing with the number one market share in both categories. The company’s vast infrastructure, technology and logistics network act as a competitive advantage. The culture of the company also attracts the best talent from all over the world, which should be an increasingly valuable trait, especially during labor shortages.

Uber

Uber Technologies Inc. (UBER, Financial) is a technology stock that dominates the ride-hailing market with a 69% share according to Statista. Despite this dominance, the stock price has cratered down by 64% since April 2021. I believe this large decline was mainly driven by the high inflation and rising interest rate environment.

This high inflation environment more prominently affects Uber as it is a low-margin business. With rising fuel costs, employee labor concerns and slowing consumer spending, it is not surprising the stock has continued to fall.

Despite this, Uber had a strong first quarter of 2022, beating analysts' forecasts for revenue. Uber generated $6.85 billion versus $6.13 billion expected, which was up 135% year over year. The major increase was driven by increased Mobility revenue of $2.5 billion, which tripled over the same time last year.

The company did report an earnings loss of $3.03 per share, which was an increase over the prior year. This was caused mostly by a substantial $5.6 billion write down on investment losses in Aurora, Grab and DiDi. The good news is free cash flows are approaching breakeven and the company expects positive free cash flow for the rest of 2022.

Tepper was adding to his Uber position in the first quarter at an average price of $36 per share, which is approximately 40% higher than where the stock trades today.

The GF Value Line also indicates the stock is significantly undervalued but also a possible value trap due to the sharp and fast decline.

Final thoughts

Technology stocks are having a tough time. The macroeconomic environment has made Wall Street extra sensitive to changes and many one-off company issues are not helping the matter. While Amazon and Uber have been butchered by the market, I believe they may now offer value for the long-term investor.