Predicting the future is impossible in investing, but companies with sound business models tend to outperform those with weakening fundamentals.

This article will examine two such companies with strong business models that have three-to-five-year future earnings per share (EPS) without nonrecurring items (NRI) growth predictions of at least 10% from Morningstar (MORN, Financial) analysts. Each of these stocks also offers at least a 2% dividend yield, which is above the average yield of 1.6% for the S&P 500 index.

Honeywell

First up is Honeywell International Inc. (HON, Financial), a diversified industrial company. The company is valued at $118 billion and generated revenue in excess of $34 billion last year.

Honeywell operates four separate business units: Aerospace, which provides products to both commercial and military customers; Honeywell Building Technologies, which provides products and programs to help facilities run safely and efficiently; Performance Materials and Technologies, which offers automated solutions; and Safety and Productivity Solutions, which provides options to increase productivity, safety and performance. Honeywell is very much a multinational company as 40% of annual revenue comes from international customers.

Despite headwinds from the Covid-19 pandemic, Honeywell’s earnings per share have increased almost 7% annually since 2012. While businesses were impacted by the global pandemic, especially in Aerospace, the company is nearly back to where it was pre-pandemic on both the top and bottom lines.

Just as important, Honeywell is projected to see an acceleration in its earnings growth rate going forward. Morningstar analysts expect that Honeywell’s three-to-five-year EPS without NRI growth rate will be 11.22%. This is higher than 60% of the companies in Honeywell’s industry.

Honeywell’s current dividend yield is 2.2%, which is just below the 10-year average yield of 2.3% and superior to the stock’s 10-year average yield of 2.1%. The company has raised its dividend for 12 consecutive years and with a compound annual growth rate (CAGR) of 10.5% over the last decade.

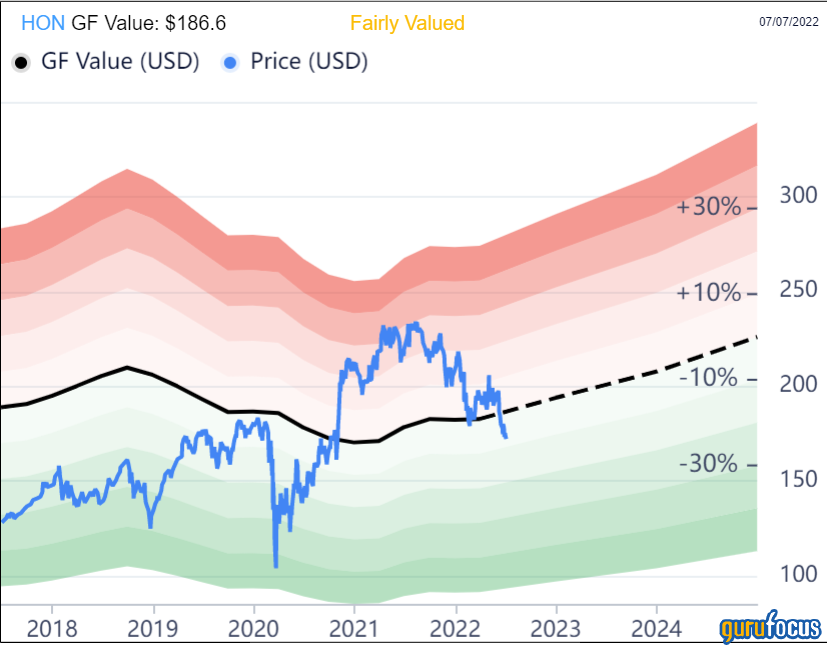

Shares of the company are trading below their intrinsic value according to the GF Value chart.

With a share price of $173.21 and a GF Value of $186.6, Honeywell is trading with a price-to-GF-Value ratio of 0.93. This implies that the stock could see a 7.7% gain in the share price if it were to rise to meet the GF Value. Add in the dividend and the stock’s total return could push closer to 10%. Honeywell is rated as fairly valued by GuruFocus.

NextEra Energy

Next up is NextEra Energy Inc. (NEE, Financial), an American utility company. The company is valued at $156 billion and generated revenue of $17 billion in its most recent fiscal year.

The company has three segments: Florida Power and Light, NextEra Energy Resources and Gulf Power. Florida Power and Light and Gulf Power are regulated electric utilities with close to 6 million customers in Florida. Approximately two-thirds of revenue and net income come from the regulated utility side of NextEra Energy.

The remainder comes from NextEra Energy Resources, a renewable energy company. This business produces more wind and solar energy than any other company in the world. As of the first quarter of the year, NextEra Energy Resources had an owned and operated solar portfolio of more than 3,600 megawatts and added close to 1,770 megawatts of renewable and storage projects to its backlog during the period.

NextEra Energy’s earnings per share have a CAGR of 5.3% for the 2012 to 2021 period. The company is projected to see a three-to-five-year EPS without NRI growth of 12.53% which comes in ahead of more than 93% of fellow utility names.

While many utility companies are known for their yields and low growth dividends, NextEra is the opposite. Shares currently yield just 2.1%, which is below the 10-year average yield of 2.8%. Helping to compensate for the low yield is that NextEra Energy has raised its dividend with a CAGR of 11% since 2012 and 12% since 2017. The most recent increase announced on Feb. 18 raised the dividend by 10.4%, so shareholders have often seen low double-digit increases from the company over the last 10 years. The company has increased its dividend for 26 consecutive years, qualifying it as a Dividend Aristocrat.

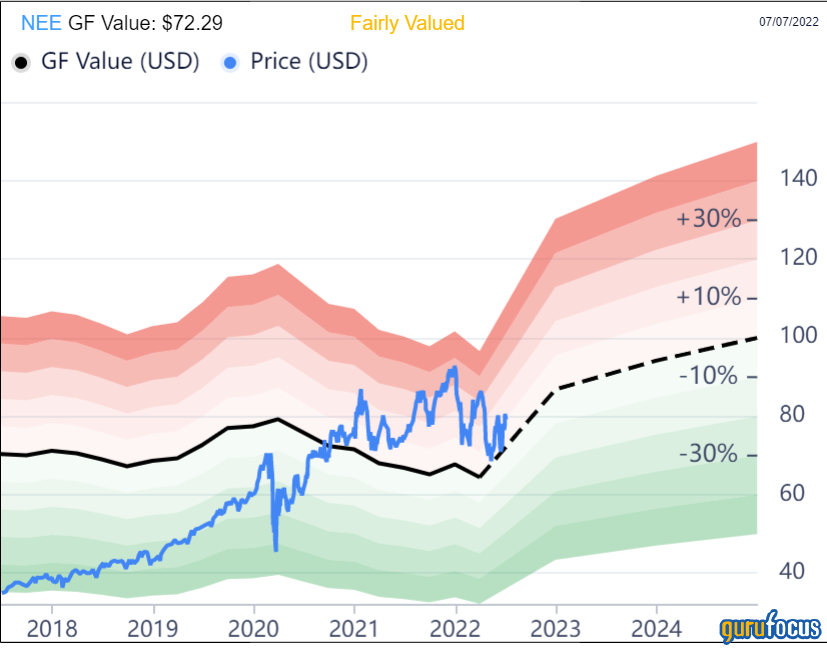

NextEra Energy is trading slightly ahead of its GF Value.

The stock closed the most recent trading session at $79.57. NextEra Energy has a GF Value of $72.29, implying a price-to-GF-Value ratio of 1.10. Based on this, NextEra Energy is 9.1% overvalued, but is still rated as fairly valued by GuruFocus.

Final thoughts

Honeywell and NextEra Energy are leading companies in their respective industries. Both companies have solid historical earnings growth rates. More importantly, both are expected to see earnings growth of at least 11% over the next three to five years. Both companies offer solid dividend yields and dividend growth histories, making them attractive options for those looking for decent yield and growth.