Although the media hysteria surrounding the initial public offering of Facebook.com (FB) reflects the promise and ubiquity of the social web, investors shouldn’t overlook evolutionary trends in the enterprise software space, where established heavyweights are betting big on software as a service (SaaS).

The appeal of SaaS solutions to business customers is simple: Operational efficiency and lower costs, a compelling proposition at a time of anemic economic growth.

Businesses traditionally run a combination of prepackaged software — which entails a hefty, up-front licensing fee — and proprietary applications that are developed and updated by an in-house information technology (IT) department. This burdensome model requires companies to purchase systems and data-storage equipment to support business functions. Hiring an extensive IT staff to maintain these systems adds to the cost.

Cloud operators host software applications at a central location and provide access to enterprise users via the Internet for a subscription fee. This approach limits customers’ need to invest in data storage and server infrastructure and yields a highly scalable solution that doesn’t require sizable capital spending to support new users or applications.

Central hosting also ensures that all users within the organization can access the most up-to-date version of the software, relieving IT departments from the time-consuming process of updating the programs on each individual computer.

These lower up-front costs have driven penetration of SaaS solutions among small and midsize businesses, many of which lack the financial wherewithal and IT expertise to implement full-fledged enterprise software packages. I expect demand for Internet-delivered business software to continue to grow, as these investments translate into improved efficiency.

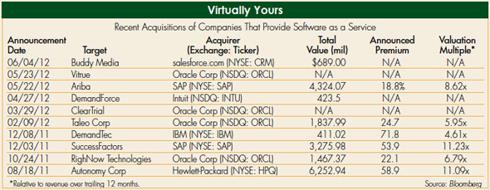

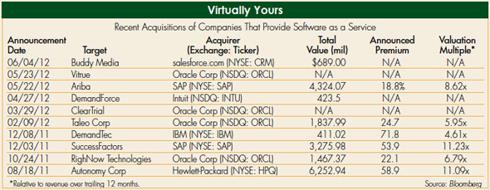

Over the past nine months, IT heavyweights such as SAP (Frankfurt: SAP)(SAP) and Oracle Corp (NSDQ: ORCL) have moved aggressively to beef up their cloud-based product offerings and boost their exposure to recurring revenue streams. (See “Virtually Yours.”)

This wave of consolidation reflects growing demand among large enterprises for web-accessible applications that fulfill previously unmet needs or provide superior solutions. A recent study conducted by Forrester Research (FORR) estimates that 68 percent of larger companies have started adopting SaaS solutions.

With investors expecting additional acquisitions in the space, shares of small-cap SaaS providers such as Concur Technologies (CNQR) have remained remarkably resilient in recent weeks, despite the weakness in the broader market. Concur Technologies provides cloud-based software that tracks, manages and pays employees’ travel and business-related expenses, a manual function at many companies.

In early 2011 the company purchased TripIt for $120 million, broadening the scope of its service offerings from expense tracking and reimbursement to trip planning and booking. This acquisition brings Concur Technologies one step closer to delivering a seamless travel experience, with TripIt automatically rebooking any canceled or delayed flights and checking in the business traveler to his or her hotel of choice. Rental cars and taxi rides can also be automatically paid for and reimbursed through Concur Technologies’ comprehensive platform.

The firm has grown and preserved its market share by partnering with potential rivals such as American Express (NYSE: AXP), Automatic Data Processing (ADP) and Bank of America Corp (BAC). Concur Technologies has invested heavily in building out its own sales staff, and management expects these efforts, coupled with a new partnership with salesforce.com (CRM), to double its distribution network by 2013.

In its fiscal second quarter ended March 31, 2012, the company posted revenue of $108.4 million, up 28 percent year over year and 8 percent sequentially. Management cited a robust uptick in bookings and strong demand, prompting it to raise its guidance for full-year sales growth to 26 percent. Investors should expect further upside. Management indicated that the company’s services usually deliver enough cost savings to pay for themselves within the first six to 12 months, a metric that hasn’t gone unnoticed. Earlier this month, the US General Services Administration (GSA) had awarded the firm a solesource contract that enables Concur Technologies to seek business from the roughly 90 civilian agencies under the GSA’s purview.

Even better, a renewal rate that exceeds 90 percent is testament to the firm’s execution and should ensure that much of these new sales will become recurring revenue. As a potential takeover candidate that also boasts strong growth prospects, Concur Technologies rates as a top growth stock.

The appeal of SaaS solutions to business customers is simple: Operational efficiency and lower costs, a compelling proposition at a time of anemic economic growth.

Businesses traditionally run a combination of prepackaged software — which entails a hefty, up-front licensing fee — and proprietary applications that are developed and updated by an in-house information technology (IT) department. This burdensome model requires companies to purchase systems and data-storage equipment to support business functions. Hiring an extensive IT staff to maintain these systems adds to the cost.

Cloud operators host software applications at a central location and provide access to enterprise users via the Internet for a subscription fee. This approach limits customers’ need to invest in data storage and server infrastructure and yields a highly scalable solution that doesn’t require sizable capital spending to support new users or applications.

Central hosting also ensures that all users within the organization can access the most up-to-date version of the software, relieving IT departments from the time-consuming process of updating the programs on each individual computer.

These lower up-front costs have driven penetration of SaaS solutions among small and midsize businesses, many of which lack the financial wherewithal and IT expertise to implement full-fledged enterprise software packages. I expect demand for Internet-delivered business software to continue to grow, as these investments translate into improved efficiency.

Over the past nine months, IT heavyweights such as SAP (Frankfurt: SAP)(SAP) and Oracle Corp (NSDQ: ORCL) have moved aggressively to beef up their cloud-based product offerings and boost their exposure to recurring revenue streams. (See “Virtually Yours.”)

This wave of consolidation reflects growing demand among large enterprises for web-accessible applications that fulfill previously unmet needs or provide superior solutions. A recent study conducted by Forrester Research (FORR) estimates that 68 percent of larger companies have started adopting SaaS solutions.

With investors expecting additional acquisitions in the space, shares of small-cap SaaS providers such as Concur Technologies (CNQR) have remained remarkably resilient in recent weeks, despite the weakness in the broader market. Concur Technologies provides cloud-based software that tracks, manages and pays employees’ travel and business-related expenses, a manual function at many companies.

In early 2011 the company purchased TripIt for $120 million, broadening the scope of its service offerings from expense tracking and reimbursement to trip planning and booking. This acquisition brings Concur Technologies one step closer to delivering a seamless travel experience, with TripIt automatically rebooking any canceled or delayed flights and checking in the business traveler to his or her hotel of choice. Rental cars and taxi rides can also be automatically paid for and reimbursed through Concur Technologies’ comprehensive platform.

The firm has grown and preserved its market share by partnering with potential rivals such as American Express (NYSE: AXP), Automatic Data Processing (ADP) and Bank of America Corp (BAC). Concur Technologies has invested heavily in building out its own sales staff, and management expects these efforts, coupled with a new partnership with salesforce.com (CRM), to double its distribution network by 2013.

In its fiscal second quarter ended March 31, 2012, the company posted revenue of $108.4 million, up 28 percent year over year and 8 percent sequentially. Management cited a robust uptick in bookings and strong demand, prompting it to raise its guidance for full-year sales growth to 26 percent. Investors should expect further upside. Management indicated that the company’s services usually deliver enough cost savings to pay for themselves within the first six to 12 months, a metric that hasn’t gone unnoticed. Earlier this month, the US General Services Administration (GSA) had awarded the firm a solesource contract that enables Concur Technologies to seek business from the roughly 90 civilian agencies under the GSA’s purview.

Even better, a renewal rate that exceeds 90 percent is testament to the firm’s execution and should ensure that much of these new sales will become recurring revenue. As a potential takeover candidate that also boasts strong growth prospects, Concur Technologies rates as a top growth stock.