The current bear market has thrown up some interesting bargains for value investors to consider. One good way to see how Mr. Market is "throwing out the baby with the bathwater," so to say, is to keep an eye on falling stocks that make it onto GuruFocus' Consensus Picks of Gurus page.

One such consensus pick is nLight Inc (LASR, Financial) which is trading in deep value territory. Five Premium gurus bought shares of the stock in the first quarter of 2022 and none of the Premium gurus sold the stock over this period. The below chart details the recent guru buys:

| Guru | Date | Action | Impact % | Price Range | Price Change from Avrg % | Current Shares |

| Chuck Royce | 2022-03-31 | Add+48.99% | +0.07% | ●14.15 -$18.82 -25.8 | -47.02% | 1,489,631 |

| PRIMECAP Management | 2022-03-31 | Add+0.6% | 0% | ●14.15 -$18.82 -25.8 | -47.02% | 1,165,674 |

| Jim Simons | 2022-03-31 | Add+161.82% | 0% | ●14.15 - $18.82 - 25.8 | -47.02% | 57,600 |

| Steven Cohen | 2022-03-31 | New Buy | +0.01% | ●14.15- $18.82 -25.8 | -47.02% | 169,600 |

| Paul Tudor Jones | 2022-03-31 | New Buy | +0.01% | ●14.15- $18.82- 25.8 | -47.02% | 15,446 |

What does nLight do?

NLight Inc. is engaged in supplying semiconductor and fiber lasers for industrial, microfabrication and aerospace and defense applications. It operates in two segments: Laser Products, which includes semiconductor lasers, fiber lasers and directed energy products; and Advanced Development, which includes revenue earned from research and development contracts. The majority of its revenue is generated from the Laser Products segment. The company's geographical segments include North America, China and the "Rest of the World." The company listed on the Nasdaq in 2018.

NLight designs, develops and manufactures all the key elements of its lasers. It has a vertically integrated business model enabling it to innovate across the industrial, microfabrication, aerospace and defense markets. It is headquartered in Camas, Washington, with additional sites in North America, Asia and Europe. The company has been in operation for more than 20 years.

Revenue has grown rapidly since 2016, as shown in the below slide from the company's recent earnigns report:

Source: NLight earnings presentation

However, nLight has trouble converting revenue and growth into profitability, as shown by net income declining even as revenue increases. In fairness Mr. Market has only recently transitioned from over-valuing fast revenue growth to a new found appreciation for net income.

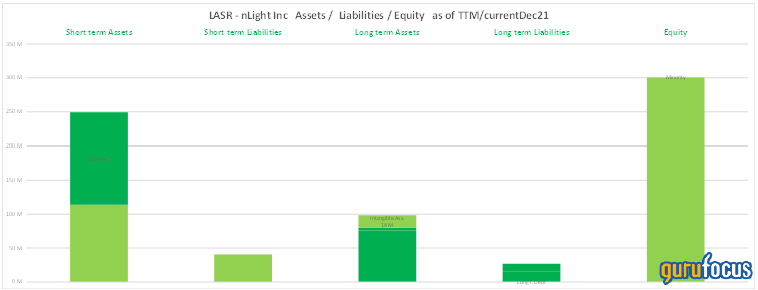

The company has plenty of cash on the balance sheet and debt level is low. The stock price is close to tangible book value.

The following is a diagramatic representation of the company's balance sheet, confirming low financial risk.

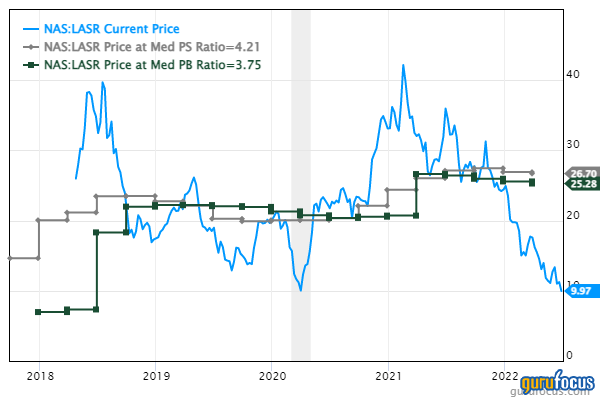

The stock price is in deep value territory. The GF Value chart warns of a possible value trap because of big discrepancy between GF Value and the stock price.

On the other hand, recent acquisitions are positive catalysts for future growth, as are emerging opportunities in additive manufacturing and electric vehicles.

Conclusion

Though nLight has not produced consistent profits yet, revenue growth is impressive and the balance sheet is strong with plenty of cash. Several gurus are buying the stock, which is a positive sign.

The company is spending heavily in research and development, with over 20% of revenues going into R&D.

The company's stock-based compensation is also high with over 13% of revenue going into compensating executives via this method.

Obviously the company needs to convert the R&D expenditure into future sales and bring its stock-based compensation under control. Investor patience is wearing thin with companies producing no profits for investors while granting (unearned) hefty payouts to the top brass. China is a big market for the company, which has resulted in pain due to the Covid lockdowns and lack of aerospace and defense spending. However, we should expect China-based business to soon recover for the company.

Having said that, I do not believe the present risk/reward ratio is bad. On five-year median price-sales and price-book justified prices, the estimated fair value for the stock should be somweher in the $20s. If investors see that the company can produce GAAP profits in the future, I believe the stock could easily hit that level, so for medium to long term investors, I think the outlook for this stock looks attractive.