Analysts seem divided on Meta Platforms Inc. (META, Financial) after its more than 50% year-to-date capitulation. On one side of the argument is a range of risk-averse investors who are waiting for the economy to convey stability. On the other side is a group of investors that believe the company is undervalued after a market overreaction.

I am siding with the latter as I believe Meta Platforms is a significantly undervalued stock with lucrative growth prospects.

Key value drivers

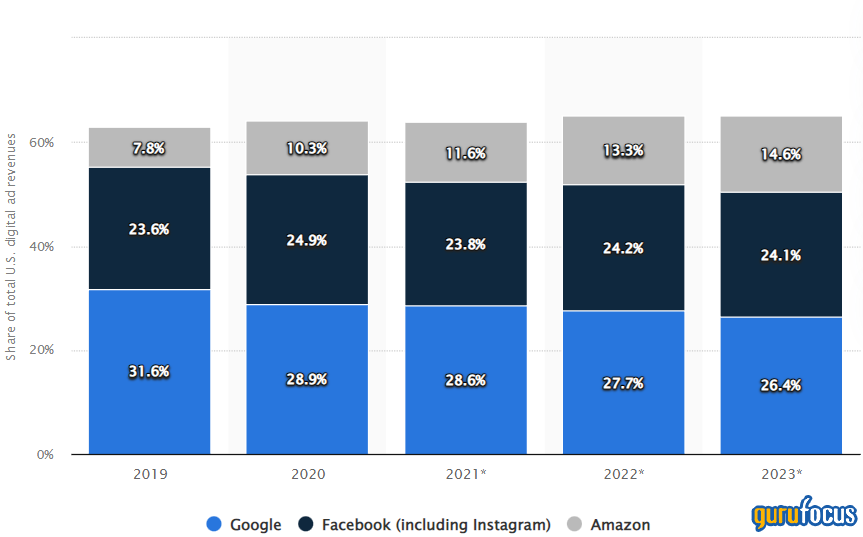

Although the Menlo Park, California-based social media giant is a horizontally integrated company, more than 90% of its revenue is derived from advertising. The company is projected to hold down approximately 24.1% of the online ad-selling space by 2023, which is expanding at a compound annual growth rate of roughly 21.6%. As such, it is safe to conclude that the company is part of a hypergrowth trend that could see its stock rebound even if a recession occurs.

Source: Statista

With all its verticals combined, Meta Platforms' growth is robust at a five-year revenue CAGR of 31.63%, supporting the argument that it is still a secular growth stock despite its maturity. Nevertheless, the company's excessive spending on the Metaverse has many worried due to uncertainty regarding the segment's financial feasibility.

However, investment bank and brokerage firm Tigress Financial Partners published in a note that it believes the Facebook parent company's metaverse offerings can be monetized successfully. According to Tigress' analyst, Iven Feinseth, Meta Platforms "remains well-positioned to benefit from the evolution of social commerce, commercial aspects, and future monetization potential of the Metaverse."

I believe that if the company successfully monetizes its metaverse project, it could be the ultimate sum of the parts stock on the market.

Valuation

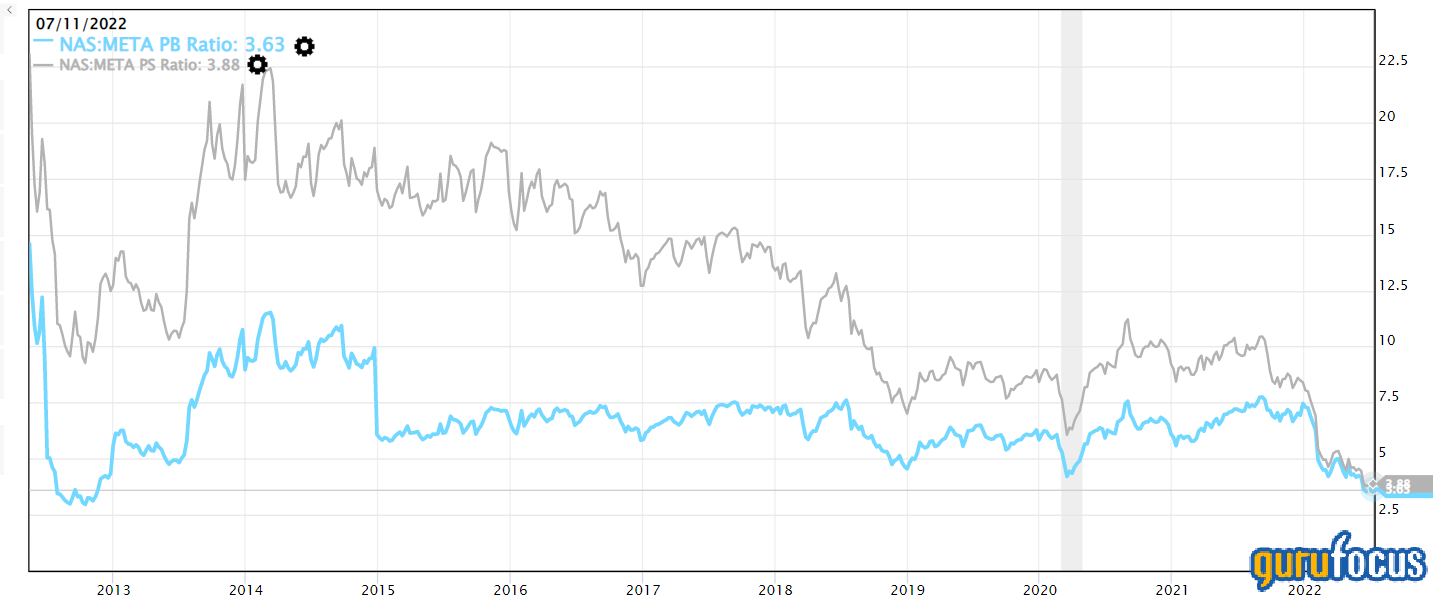

Although Meta Platforms trades above its recorded sales and measured book value, the stock is undervalued on a cyclical basis. The company's price-earnings ratio is at a 55.71% discount to its five-year average and its price-book ratio is at a 42.57% discount to its normalized average. Thus, the stock's relative valuation metrics intertwined with its secular growth imply that it is undervalued.

Concluding thoughts

Quantitative metrics, along with a qualitative overlay, convey that Meta Platforms is undervalued. In addition, the company's exposure to the tremendous growth in the online advertising industry and its metaverse potential add up to a powerful growth story.