Millicom International Cellular SA (TIGO, Financial) is a relatively unknown international pay-TV and wireless provider with operations mostly in emerging markets of Latin America. The low penetration rates of these markets allow for above industry average growth. The company operates in Bolivia (100% owned), Honduras (67%), Nicaragua (100%), Panama (80%), El Salvador (100%), Guatemala (100%), Paraguay (100%), Colombia (50%) and Costa Rica (100%).

As of Dec. 31, the company provided services to 53.3 million mobile customers, including 21.1 million 4G customers, which is defined as customers who have a data plan and use a smartphone to access the 4G network. Millicom also had 4.7 million customer relationships with a subscription to either high-speed internet or pay-TV services. The company offers packages that may combine fixed-line phone, broadband and pay television in conjunction with cellular services.

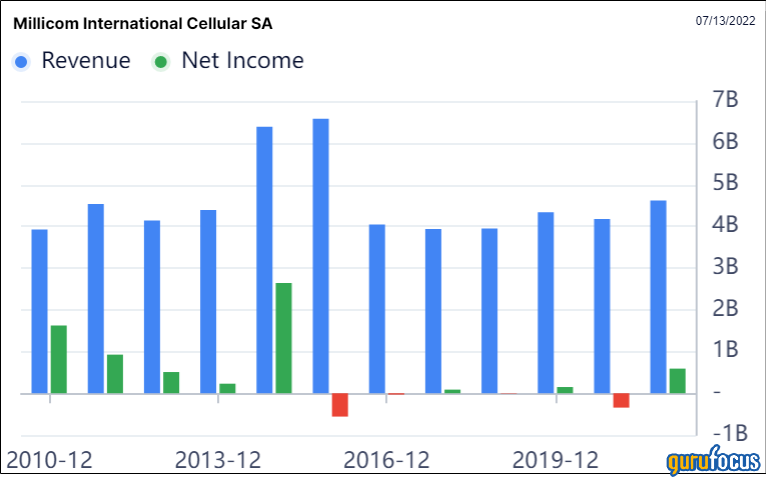

The company generated over $4.6 billion in revenue in 2021 and currently has a market capitalization of approximately $2.4 billion.

Strategy

The company is focused on two strategic aspects: increasing the penetration of broadband services in its markets and effectively monetizing its mobile services. This includes expanding the hybrid fiber-coax high-speed network as well as increasing fiber-to-the-home for even faster speeds. This growth strategy also includes small tuck-in acquisitions to support network efficiency.

On the mobile network side, the company has experienced rapid data traffic growth, which it plans on monetizing. As the company network speed grows, more smartphone adoption is possible in which additional data-centric services can be offered. Most of the company’s markets are still low in both smartphone and data-related products.

Financial review

The company reported a strong 2021 fiscal year as it recovered from Covid-related slowdowns in 2020. Revenue increased 10.7% to $4.6 billion as a result of positive growth from most of it markets and business units as well as the consolidation of its Guatemala operations in late 2021.

Millicom’s first-quarter results were also strong with continued growth in almost all business lines and regions. Revenue increased 40.9% and operating income increased 126.3%.

Operating income was $659 million, an increase of 47.5% compared to the prior-year period. Cable and wireless companies often report low operating margins due to the high levels of depreciation inherent in the business, which totaled $1.2 billion in 2021. Typical Ebitda margins are usually in the 35% to 40% range.

The company has a substantial amount of debt on the balance sheet, but is not highly levered based on high levels of Ebitda. Net debt as of the end of the first quarter was $6.7 billion, which creates a leverage ratio of approximately 3.4 times. However, after a recent rights offering and divestiture of a business in Africa, the leverage ratio is expected to drop below 3 times.

In June 2022, the company completed a rights offering in which 70.4 million shares were issued, raising approximately $105 million.

Valuation

Consensus analyst earnings per share estimates for Millicom are 91 cents for 2022 and $1.13 for 2023, which puts the company selling at 12 times next year's earnings. In addition, the company is selling at 4.5 times this year's Ebtda estimates.

The GuruFocus discounted cash flow calculator creates a value close to $20 using next year's earnings estimate of $1.13 as the starting point and a 10-year growth rate of 8%.

Guru trades

Gurus who have increased their positions in Millicom stock include Ray Dalio (Trades, Portfolio) and Mario Gabelli (Trades, Portfolio). Gurus who have reduced their exposure include Jim Simons (Trades, Portfolio)' Renaissance Technologies.

Conclusion

Millicom has been under pressure from the recent rights offering as well as other international risks. However, the growth story remains intact, which means the company appears to be substantially undervalued at this time. If the company can continue to show net profitability and generate free cash flow, then there is likely upside for the stock.

The company also could be a prime acquisition candidate for a U.S.-based broadband and entertainment provider that is looking for high-growth Latin America exposure.

Also check out: