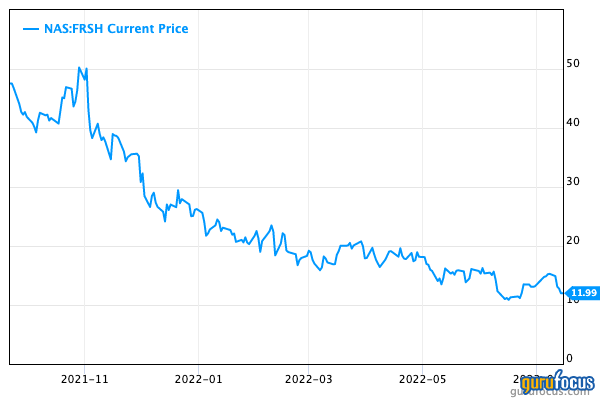

Freshworks (FRSH, Financial) is a disruptive technology company which offers a low cost, easy to use alternative to Salesforce (CRM, Financial). The company was founded in 2010, but didn’t IPO until September 2021. Since its $50 high in October 2021, the stock price has slid down by an eye-watering 71%.

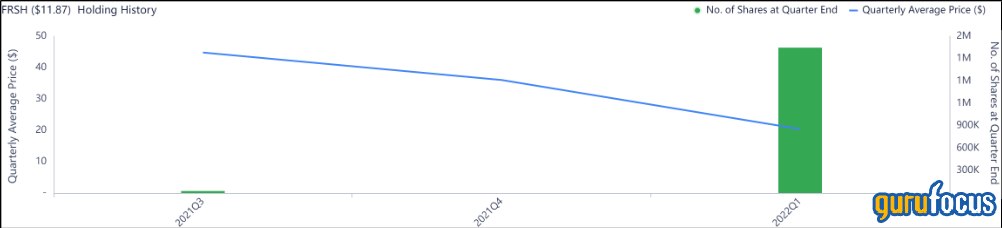

After the fall from grace, George Soros (Trades, Portfolio) took a new position in the stock worth 1,946,617 shares in the first quarter of 2022 at an average price of $20 per share, which is much greater than the $13 share price at the time of writing. This was after he had sold out of a previous, smaller investment in the stock in the fourth quarter of 2021. Could this stock now be a value opportunity?

Business model

Freshworks' mission is to make marketing, sales and support “ridiculously easy to use.” According to a recent company survey, nine out of 10 employees are frustrated by workplace technology. Freshworks found that the most popular complaints by employees include slow speed (51%), slow response from IT teams (34%), siloed departments (30%), important features not included (28%) and lack of automation (25%). Freshworks' goal is to try and solve these problems for businesses. The company offers three main services; Freshdesk for customer support, Freshservice for IT teams and Freshsales for marketing and sales.

Source: Freshworks investor materials

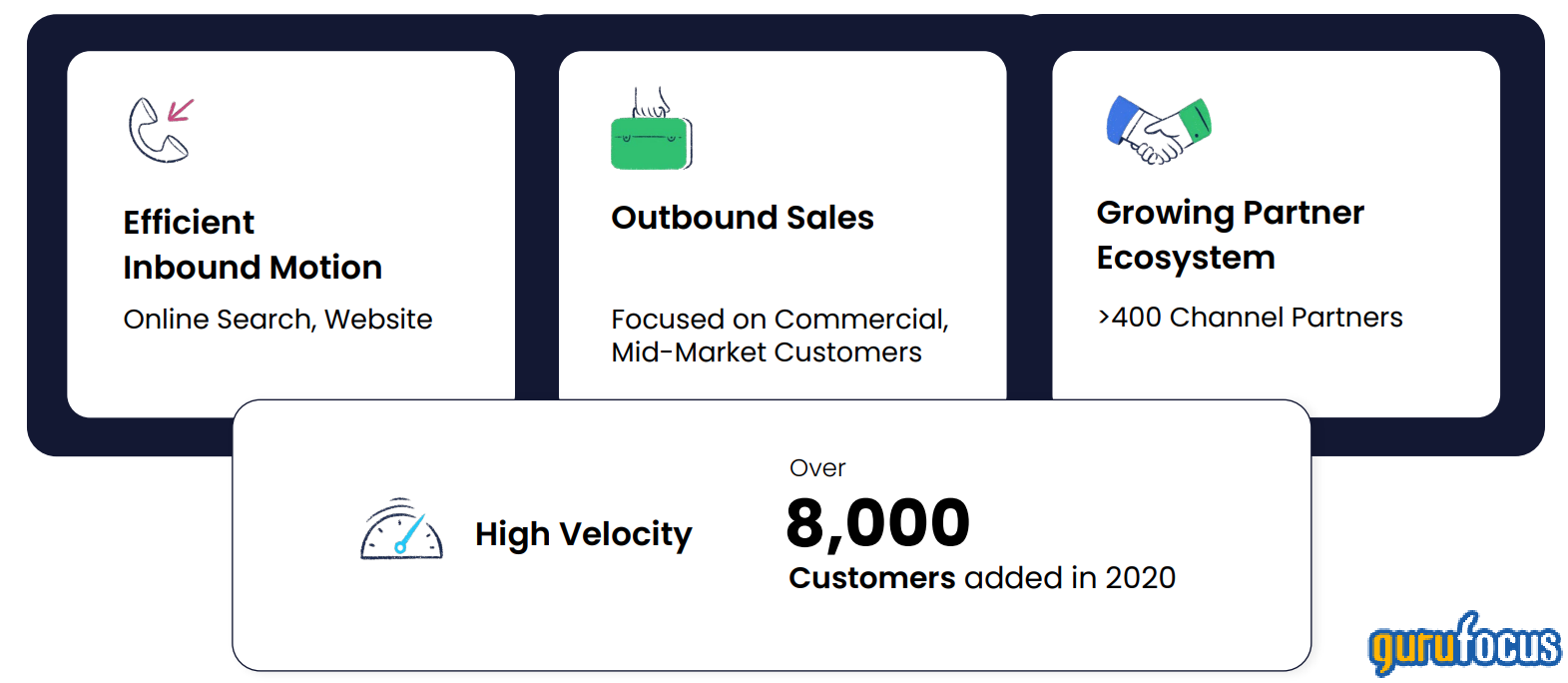

If you're familiar with the workplace software market, you may be thinking this sounds awfully similar to Salesforce and even HubSpot (HUBS, Financial). In that case you would be correct. The company offers very similar software to Salesforce, but with a few differences. Salesforce is primarily designed for enterprises and tends to forget about the disruptive startup or small/medium sized business. Thus, Freshworks offers a more affordable, easy to set up solutions with more seamless interaction between applications.

Source: Freshworks investor materials

A CRM (Customer Relationship Management) software review by Gartner indicates Freshworks slightly edges out Salesforce with a rating of 4.5 out of 5 stars compared to Salesforce at 4.4 out of 5 stars. A highlighted review raves about “Freshdesk Omnichannel,” which enables calls, chat and email to be tracked from the same place. In the first quarter of 2022, Freshworks launched a tailored CRM for e-commerce and scored new partnerships with Shopify (SHOP, Financial) and others.

Freshwork now serves over 50,000 customers which include big name brands such as American Express (AXP, Financial), Klarna and a leading ITV PLC (LSE:ITV, Financial).

Financials

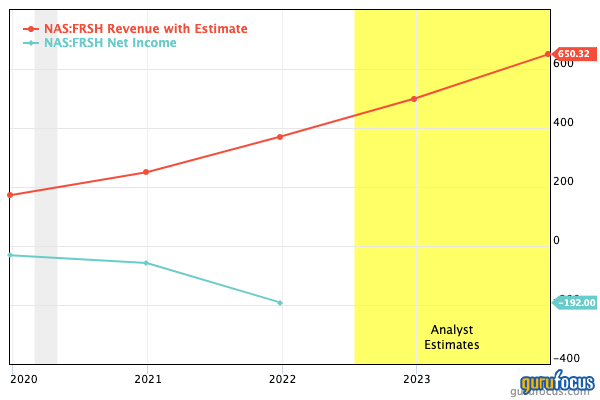

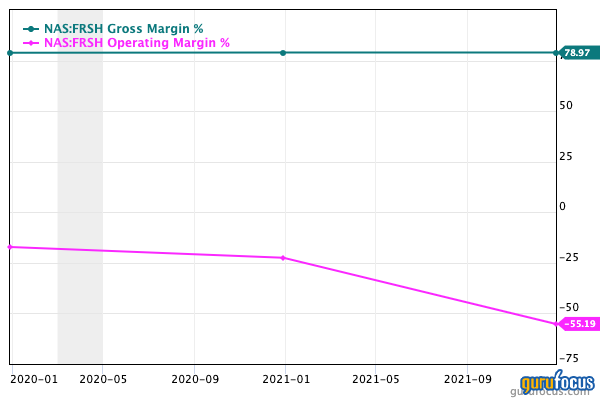

Freshworks generated strong results for the first quarter of 2022. Total revenue was $1.1 billion, up a rapid 42% compared to the first quarter of 2021. This was driven by an increase in premium customers by 34% to 15,639. I have defined “premium customers” in this case as those providing $5,000 or more in annual recurring revenue. The company’s net dollar retention rate also increased to 115%, up from 112% in the prior-year quarter. A high net dollar retention rate indicates customers are staying with the product and spending more.

The company did report a net loss of $47 million, which was greater than the $1.7 million net loss reported in the comparable 2021 quarter. This was mainly due to a large increase in general and administrative expenses, in addition to a proportional increase in sales and marketing.

The company has a fortress balance sheet with $1.2 billion in cash and short term investments and just $31 million in debt.

Valuation

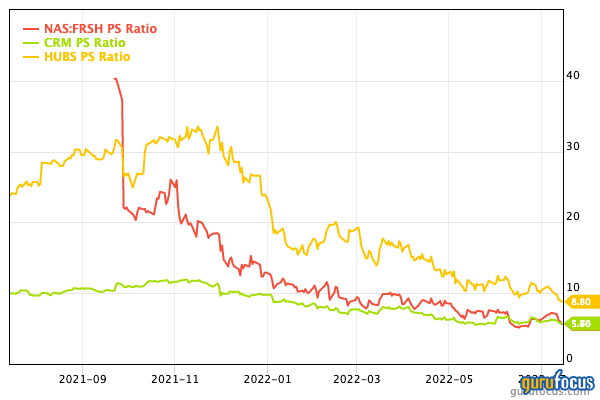

In terms of valuation, Freshwork trades at a price-sales ratio of 5.66, which is cheaper than historic levels. It trades at a similar price-sales ratio to Salesforce at 5.7 and is cheaper than Hubspot at 8.8.

Competition

There is plenty of competition in the business SaaS market. In the enterprise market, you have the whales of the industry such as Salesforce (with its $162 Bbillion market cap) and also Adobe's (ADBE) Marketing Cloud. For the disruptive startups and small/medium businesses, Hubspot is a prime competitor and offers a very similar low cost, easy to use solution.

Final thoughts

Overall, I think Freshworks is a fantastic company which offers a suite of cost effective and user friendly products. The company’s super high net retention rate of 115% indicates customers are finding its products “sticky” and spending more. The stock is currently undervalued relative to historic multiples, which makes me optimistic about the stock's future.