Beyond Meat (BYND, Financial) is a leading plant-based food producer that is known for its famous “Beyond Burger," which is a plant-based burger substitute that aims to taste and look like real meat. The company was founded in 2009 and had a celebrity fanfare-driven IPO in 2019.

The plant-based "meat imitation" food industry has been hyped up by some as being set to disrupt the trillion-dollar meat industry. Beyond Meat in particular is even backed by the Bill Gates (Trades, Portfolio) foundation due to its "ethical credentials," as some believe that eating meat is unethical and eating only plants is morally superior.

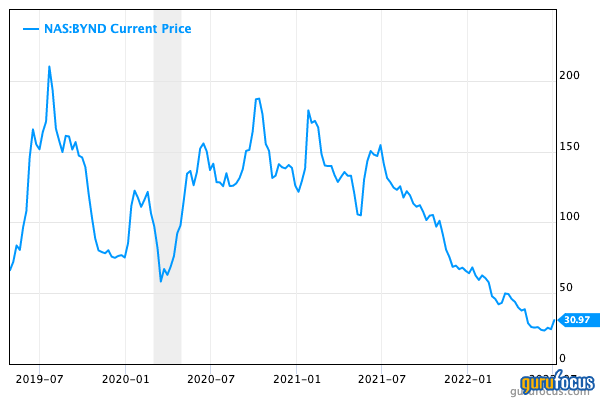

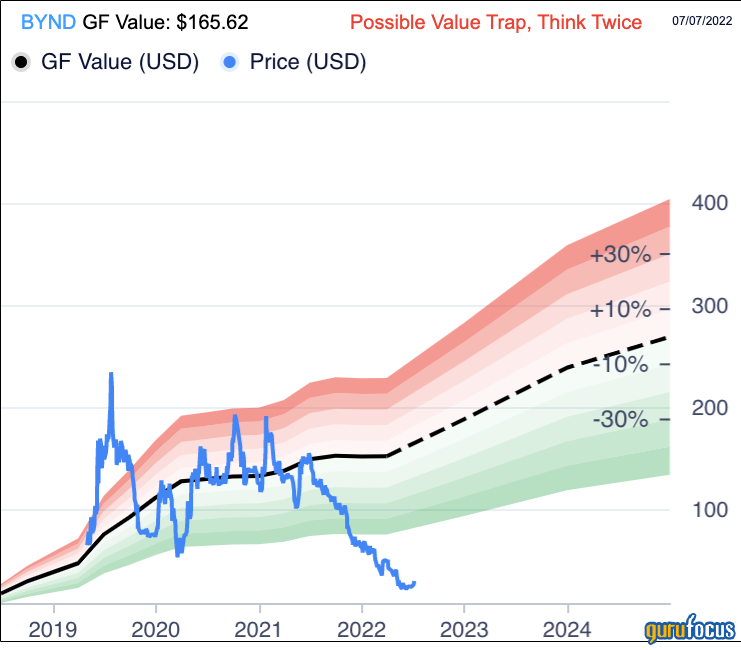

However, over the past few years the stock has been a rollercoaster for investors, bouncing between lows of $60 per share and highs of nearly $200 per share over the past two years. As a former investor in Beyond Meat, I sold at the highs as the stock was overvalued according to my valuation model. This was perfect timing because, since June 2021, the stock has nosedived by an eye-watering 80%.

Is Beyond Meat beyond help?

The stock finally seems to be taking a turn for the better recently after the most prolonged downturn in its history. Several gurus were also buying the stock during the first quarter of 2022. Could the company stage a recovery, or is it still a dud?

Some might say that the stock is doomed to permanent decline as the more intense hype over the novelty of plant-based meat has declined. However, that doesn't mean the long-term potential has disappeared.

Gurus who bought the stock recently include Ray Dalio (Trades, Portfolio) of Bridgewater Associates, who doubled his firm's stake at an average price of $55 per share, which is 45% higher than where the stock trades today. Growth stock investor Catherine Wood (Trades, Portfolio) of Ark Invest and Baillie Gifford (Trades, Portfolio) were also buying shares in the first quarter, though Wood reduced her firm's investment in the second quarter.

Business model

Beyond meat specializes in three main plant-based meat categories: beef, pork and poultry.

The company’s flagship product is the “Beyond Burger." According to my own product review and taste test, the product was definitely more “meat like" when compared to traditional veggie burger alternatives, which was a positive. However, it was also double the price of both the meat and veggie burger options. In the U.K., the Beyond Burger costs 5 pounds ($6), whereas other options cost just £2.50 in a popular U.K. supermarket. There is a similar price discrepancy in the U.S. I personally believe this cost discrepancy will be a major issue until the company can bring down product costs.

The good news is this is a priority for management, as the annual report stated plans on executing a “global cost down program” which would focus on manufacturing efficiency and ingredients optimization. The company is expected to exit 2022 with an “attractive cost trajectory” for 2023 and beyond.

Growth

Another key priority for Beyond Meat is to expand both the product range and distribution. Beyond Meat announced a partnership with McDonalds (MCD, Financial) in 2021 for its “McPlant” burger, which has been rolled out across the U.S. and parts of Europe. The company also scored a partnership with KFC for “Beyond Chicken,” which was first tested in Canada and is now being tested in select U.S. restaurants. Beyond Meat also has a partnership with Pizza Hut to supply plant-based meat across the U.S. and the U.K. More recently, the company has even announced a partnership with Disney's (DIS, Financial) Disneyland Paris to offer a “meatless option” with every meal which is served.

These partnerships are all tremendous tailwinds for the company, but in the past the issue was turning these partnerships into tangible numbers.

Financials

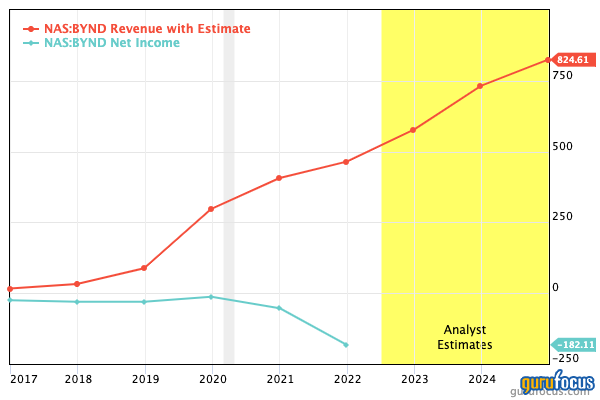

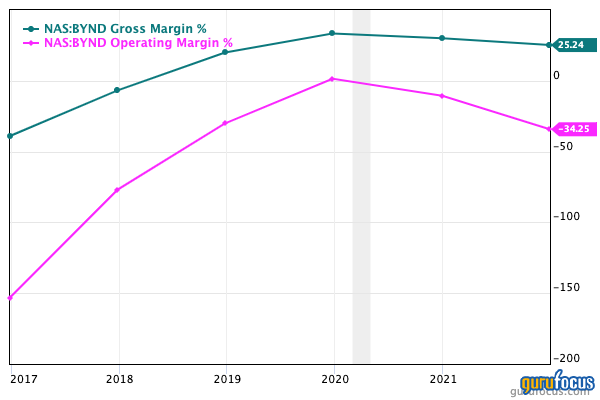

Beyond Meat's most recent earnings report for the first quarter of 2022 was underwhelming. Net revenue was $109.5 million, up just 1.2% year over year. The company also produced a heavy net loss of $100.5 million.

The good news is growth estimates are strong for next year, and with the company’s major partnerships, one could argue the heavy lifting is done and major tailwinds lie ahead. The issue is that sales through restaurant operators will be at lower profit margins, which isn't good given the company is already unprofitable. In addition, retail store sales face heavy competition from alternative products.

Beyond Meat’s balance sheet showed cash and cash equivalents of $548 million in the first quarter and total debt of $1.1 billion, which is substantial. Capital expenditures were $21.5 million at the quarter's end, which was similar to the $23.4 million produced in the prior-year period. This investment is going towards increasing expansion and production facilities.

Valuation

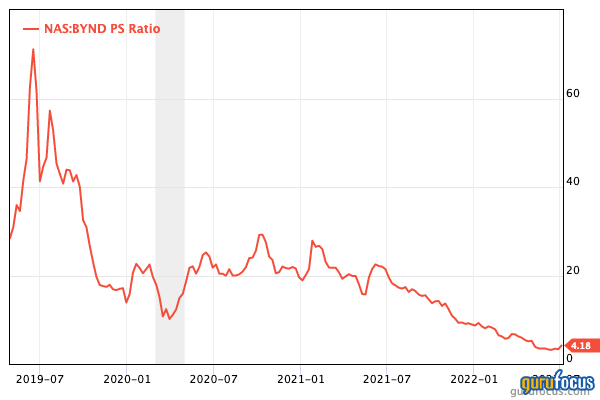

In terms of valuation, Beyond Meat trades at a price-sales ratio of 4, which is the cheapest it has ever traded historically.

The GF Value line indicates a fair value of $165 per share, which is significantly higher than where the stock trades today. However, due to the extreme decline from all-time highs and continued lack of profitability, the GuruFocus system flags it as a possible value trap.

Final thoughts

Beyond Meat has a great product, great partnerships and a tremendous growth story. However, the business fundamentals are still lagging the story, and thus the company still has a long way to go before it can "change the world" over to vegetarianism and veganism. The good news for potential investors is the stock is very cheap right now, but this could also be a value trap due to the lack of profitability and growth in the past quarters.