Las Vegas Sands Corp. (LVS, Financial) released its second-quarter earnings report on Wednesday, and although the company beat its revenue target by $100.6 million, it missed out on its earnings estimate by 5 cents per share.

Following the company's earnings report, CEO Robert G. Goldstein said, "While pandemic-related restrictions continued to impact our financial results this quarter, we were pleased to see the recovery in Singapore accelerate during the quarter, with Marina Bay Sands delivering $319 million in adjusted property EBITDA. We remain enthusiastic about the opportunity to welcome more guests back to our properties as greater volumes of visitors are eventually able to travel to both Singapore and Macao."

Even though Las Vegas Sands has recovered since the initial Covid-19 decline, I am bearish on the stock and believe its current risk versus reward is not justified.

Possible headwinds

Much of Las Vegas Sands' revenue derives from its Macau subsidiary. The Chinese territory has been struck with a renewed Covid-19 lockdown to curb a new variant of the virus. As such, the resort operator's capacity utilization remains very uncertain for the time being.

Furthermore, Las Vegas Sands' U.S. consumer base is burdened with rising inflation. It is possible that resilient inflation coupled with rising interest rates could wane on consumer cyclical companies as stagflation or even a recession becomes increasingly likely.

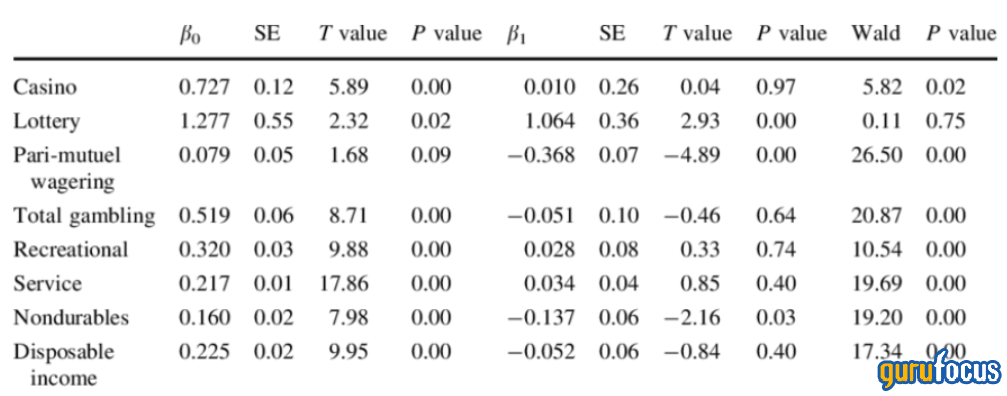

Contrary to popular belief, recent studies suggest gambling participation tends to recede whenever the economy contracts. The diagram below conveys a positive slope for gambling growth rates in expansionary economic environments and a negative slope in contractionary ones. Therefore, systemically, Las Vegas Sands could be in for a tough time moving forward.

Source: ResearchGate; Hovrath, C., 2011.

Valuation Concerns

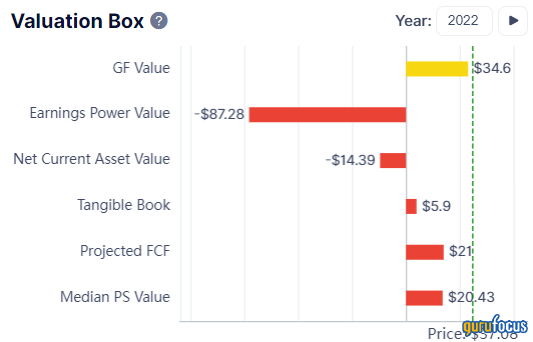

Las Vegas Sands' projected free cash flow implies its stock is overvalued by approximately 76%. In addition, the company's tangible book value is a mere $5.90, meaning its stock price of $37.08 is not justified at all.

Furthermore, Las Vegas Sands is overvalued on a relative basis as its price-sales ratio is at a 6.73 surplus to the sector median, conveying to investors the market overscores the company's topline growth.

Lastly, Las Vegas Sands does not hold much embedded growth. Even if lockdowns ease in Asia and inflations cools in the U.S., it will be an arduous task for the company to accumulate value with a 10-year Ebitda compound annual growth rate of -25.48%.

Concluding thoughts

Despite beating its second-quarter revenue estimate, GuruFocus' key metrics indicate Las Vegas Sands is significantly overvalued. Furthermore, lockdowns in Macau and rising inflation in the U.S. could wane on the company's sales in the coming quarters.

Therefore, it can be concluded that Las Vegas Sands is overvalued.