On Thursday, Rivian Automotive Inc. (RIVN, Financial) and its biggest customer Amazon.com Inc. (AMZN, Financial) announced a landmark step in their partnership; Amazon has now begun delivering packages with electric vans from Rivian.

As part of its push to achieve net-zero carbon emissions by 2040, Amazon announced it had bought 100,000 electric vehicles from Rivian in September 2019. Amazon debuted a version of the van in October 2020 and then tested them in several cities in 2021. Now, the company finally deems them fit to make deliveries in several cities, including Baltimore, Chicago, Dallas, Seattle and several others. Amazon says it expects to have “thousands” of Rivian vans on the road in over 100 cities by the end of this year.

With the Amazon partnership taking off and preorders for the R1T pickup and R1S SUV reaching a combined 90,000, could now be the last chance for investors to get on board with Rivian before the stock pulls a Tesla (TSLA, Financial) on us?

Rivian is scaling up despite struggles

Soon after Rivian rolled out its first all-electric pickup on Sept. 14, 2021, it went public on Nov. 9 in a much-anticipated initial public offering that raised $13.7 billion.

Producing the pickup at scale has proven a more elusive goal than the company originally anticipated, which has disappointed early investors immensely. While Rivian’s timeline has played out better than some other electric vehicle startups that went public without even a functional prototype, it is never a good look to over-promise and under-deliver.

The company blames supply chain issues for falling behind schedule. Its Illinois factory has an installed capacity of 150,000 units per year and is capable of producing all of its existing vehicles, but due to cost and supply constraints, it only expects to produce 25,000 units this year compared to its previous estimate of 50,000.

In particular, CEO RJ Scaringe highlights battery supply as the electric vehicle industry’s biggest challenge in the coming years. Even though demand is expected to grow exponentially, the industry is already experiencing critical shortages of essential battery materials such as lithium, nickel and cobalt. One of the keys to success for electric vehicle makers will be the ability to secure the necessary raw materials in a highly competitive environment.

Semiconductor shortages are also a concern, though this could ease in the next couple of years as chip production ramps up to meet demand. Even the U.S. is aiming to increase its domestic semiconductor output with the CHIPS and FABs Acts being debated in Congress.

However, while growth in production has not been as rapid as originally hoped, it still represents progress. The supply chain cards were stacked against Rivian, as it is typically tougher for newer companies to secure supply lines and favorable contracts when there are shortages.

The company plans to break ground on a $5 billion vehicle assembly and battery plant in Atlanta in the coming months. On May 2, it announced a $1.5 billion state and local incentive package with Georgia officials that includes tax credits, according to Reuters.

In a July 6 filing with the SEC, Rivian reported it produced 4,401 vehicles in the second quarter, up 72% from the prior quarter, and delivered 4.467 vehicles, up 264%. It also reiterated that it is on track to meet its unit goal of 25,000 for the year.

Layoffs spark worries

Despite scaling up its manufacturing operations, Rivian is planning to cut hundreds of jobs, representing approximately 5% of its entire workforce, according to a Bloomberg report citing anonymous sources. Scaringe confirmed this in a July 15 company meeting.

However, the layoffs will supposedly not affect manufacturing workers. While it is clear the company feels the need to cut costs somehow, this does not extend to the operations that produce the company’s vehicles.

It is possible the company is making this move to preserve cash, or as part of a restructuring effort to get rid of job posts deemed unnecessary. There is also a chance that it is planning the layoffs so that it can report higher earnings numbers, which is a strategy that is frequently employed even by highly profitable companies.

Profitability is still far off

Rivian does not expect to become profitable in the foreseeable future, intending to use its capital to fund growth.

The road to profitability has become longer due to supply shortages and cost increases. Rivian has two main goals, ramping up production and cutting the production costs of its vehicles so that they are more affordable for the general public, both of which will require supply shortages to ease.

It is worthwhile to note that Tesla grew from an unprofitable startup to one of the most well-recognized luxury electric vehicle brands in the world in a market where it did not have to deal with critical supply shortages and the prices of some of its components doubling unexpectedly. Given this additional struggle that Rivian and other electric vehicle makers face, it seems reasonable to expect that the route to profitability could be much rockier than Tesla’s.

In light of the company’s above-mentioned layoffs, it is possible that the company could be forced to make further sacrifices due to cost concerns, which runs the risk of causing it to fall behind competitors. Investors should keep a close eye on cost-cutting measures for this reason.

Valuation outlook

We are currently in the midst of a stock market environment that favors value over growth, which is being reflected in many analysts’ rhetoric on Rivian.

For example, Wedbush analyst Dan Ives wrote in a May 11 note to clients:

“Rivian has been a train wreck since its IPO and an overall black eye for the EV industry… We believe Rivian from a core engineering and design perspective along with the Amazon commercial relationship has potential to be a major EV stalwart over the next decade. However, for that to happen, they need to start delivering models to customers and stop the excuses."

With the general sentiment of “the company needs to prove its profitability first,” Wedbush maintains its outperform rating on Rivian and claims it believes in its long-term potential, but it also lowered its price target from $60 to $30.

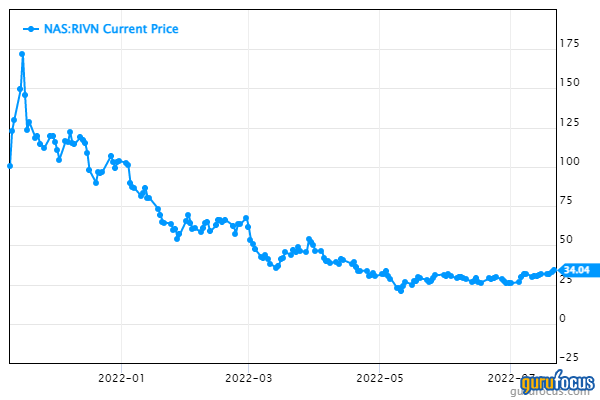

The stock trades around $34.04 as of this writing, reflecting the cautious approach both analysts and the general market are taking to Rivian as they focus solely on the present rather than future potential.

I do not think it is likely that the valuation outlook for Rivian will change significantly in the near future. With investors focusing more on safety due to rising inflation and the potential for a recession, combined with worries over supply chain issues, there is little to suggest that Rivian will suddenly become a stock market darling as long as it remains unprofitable.

Takeaway

Overall, I think the long-term outlook for Rivian is very positive. Its vehicles have amazing build and software quality compared to the admittedly limited competition, and it is making progress on ramping up production, which is essential to do if it wants to seize sufficient market share before competitors can catch up.

Profitability will have to come later, which means Rivian’s stock will likely remain depressed for now. I think investors who are interested in this stock still have some time to wait and watch without worrying about missing out on a sudden rally.