Joel Greenblatt (Trades, Portfolio) introduced the investing world to the “Magic Formula” when he published his bestselling book, “The Little Book That Beats the Market,” in 2005. The idea behind the Magic Formula is to apply a simple mathematical formula to find profitable businesses that trade at bargain prices.

The formula ranks companies primarily based on two metrics: earnings yield and return on capital. The earnings yield, which Greenblatt defines as earnings before interest and taxes (Ebit) divided by enterprise value, measures how much the company earns compared to how much the stock is valued by the market. The return on capital, which is calculated as Ebit divided by the sum of net fixed assets and net working capital, measures how much a company earns compared to what it spends to produce those earnings.

With the semiconductor industry expected to grow at a compound annual rate of 12.2% through 2029 according to Fortune Business Insights, driven by increasing semiconductor density in consumer electronics, growth of data processing applications, the migration to the cloud, artificial intelligence and more, here are three semiconductor stocks that rank highly on the GuruFocus Magic Formula Screen, a screener based on Greenblatt’s criteria. These stocks were also popular buys among gurus in the first quarter of 2022.

Lam Research

One stock that ranks highly on the Magic Formula Screen is Lam Research Corp. (LRCX, Financial), a leading supplier of wafer fabrication equipment. Lam Research boasts a return on capital of 123.64% and an earnings yield of 8.36%, which are higher than 90% and 64% of industry peers, respectively.

Gurus have been net buyers of the stock for the past four quarters. In the first quarter of 2022, buyers included Ray Dalio (Trades, Portfolio) and Jeremy Grantham (Trades, Portfolio), while sellers included Jim Simons (Trades, Portfolio)' Renaissance Technologies and Philippe Laffont (Trades, Portfolio).

Lam Research is a pick-and-shovel play for the semiconductor industry, so its profits are tied more to industry growth rather than industry profitability. This makes it especially attractive when we consider that it is not just companies ramping up their spending on semiconductor production, but also governments; for example, the U.S. Congress is debating a couple of bills to provide fiscal stimulus to the country’s domestic chipmakers.

In the fiscal year ended June 2021, Lam Research reported revenue of $14.6 billion and earnings per share of $26.90. Morningstar analysts are expecting revenue to rise to $16.8 billion for fiscal 2022 and $18.6 billion for fiscal 2023, with earnings per share of $32.06 in 2022 and $35.83 in 2023.

The GF Value chart rates the stock as modestly undervalued. As of this writing, shares traded around $456.14 for a market cap of $62.85 billion and a price-earnings ratio of 14.16.

STMicroelectronics

STMicroelectronics NV (STM, Financial), a semiconductor and electronics manufacturer with a focus on sustainability, also ranks highly on the Magic Formula Screen with a return on capital of 43.01%, which beats 70% of industry peers, and an earnings yield of 8.14%, better than 64% of peers.

In the first quarter of 2022, Grantham, Steven Cohen (Trades, Portfolio) and Ken Fisher (Trades, Portfolio) were buying shares of STMicroelectronics, while Simons' firm reduced its investment in the stock.

STMicroelectronics aims to play a key role in using technology to solve environmental and social challenges. It operates in a variety of industries, including automotive, data center, computer peripherals, internet of things (IoT) and health care, focusing on areas of innovation such as smart mobility that display long-term trends of reshaping their industries.

In full-year 2021, STMicroelectronics reported revenue of $12.7 billion and earnings per share of $2.16. Morningstar analysts are expecting revenue to rise to $15.2 billion for 2022 and $16.4 billion for 2023, with earnings per share of $3.31 in 2022 and $3.64 in 2023.

On July 25, shares of STMicroelectronics traded around $35.06 for a market cap of $31.75 billion and a price-earnings ratio of 15.34. The GF Value chart rates the stock as modestly undervalued.

ON Semiconductor

ON Semiconductor Corp. (ON, Financial), or onsemi as it styles itself, is a semiconductor company that specializes in intelligent power and sensing technologies. This Magic Formula stock has a return on capital of 51.11%, beating 75% of industry peers, and an earnings yield of 6.65%, outperforming 59% of peers.

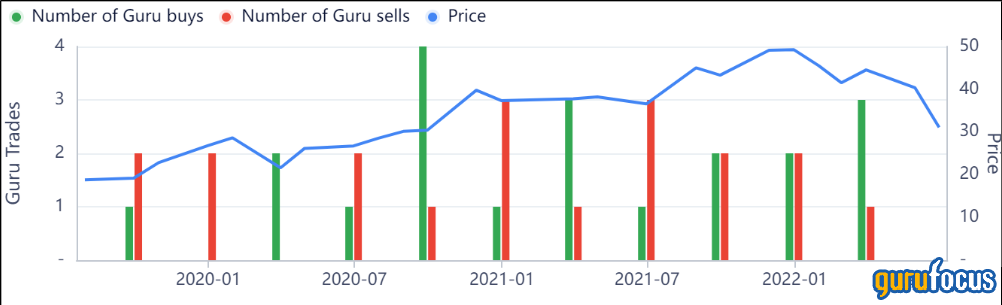

Gurus were net buyers of the stock in the first quarter of 2022; those buying the stock included Simons' firm and Louis Moore Bacon (Trades, Portfolio), while sellers included Lee Ainslie (Trades, Portfolio) and Fisher.

ON Semiconductor identifies its exposure to key megatrends such as vehicle electrification, advanced driver assistance systems (ADAS), energy infrastructure and factory automation as its primary drivers of growth. In particular, the company is benefitting from growing demand for sophisticated electronics in both electric and gas-powered cars. In an effort to improve profitability, ON Semiconductor has been weeding out less-profitable products to focus on growth markets.

In 2021, ON Semiconductor reported revenue of $6.7 billion and earnings per share of $2.27. Analysts surveyed by Morningstar call for revenue of $7.7 billion in 2022 and $8.1 billion in 2021, with earnings per share expected to rise to $4.50 in 2022 and $4.73 in 2023.

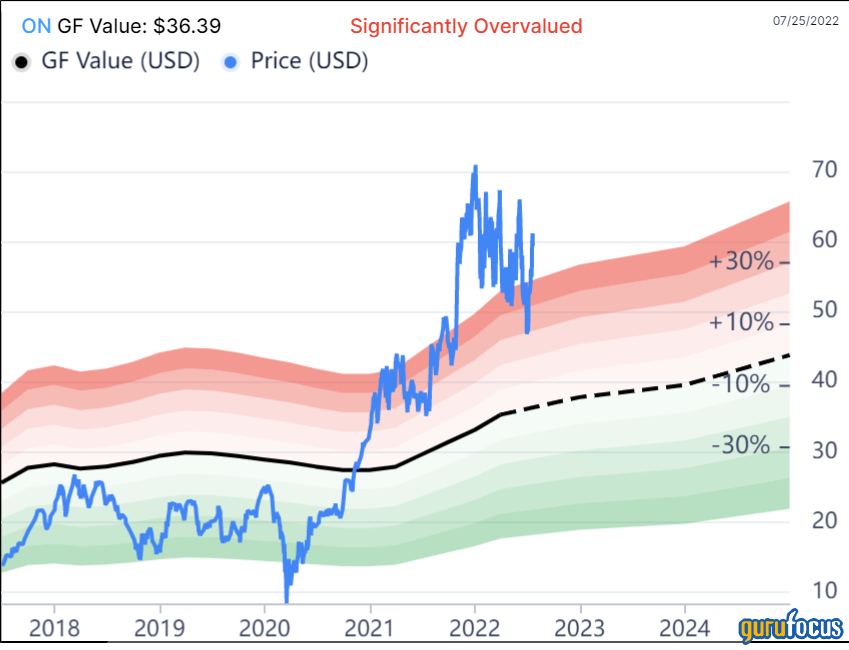

The GF Value chart rates the stock as significantly overvalued. On July 25, shares changed hands for $59.01 apiece, giving the stock a market cap of $25.61 billion and a price-earnings ratio of 18.01.

Also check out: