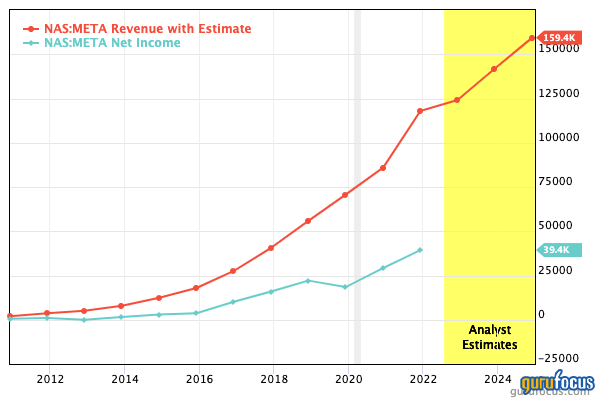

Meta Platforms (META, Financial), formerly known as Facebook, recently announced its financial results for the second quarter of 2022. The company reported poor results and missing analysts' estimates for both revenue and earnings. With revenue marking the company's first ever top-line decline since the company IPO’d in 2012, the stock price was down ~7% in pre-market trading the following day, which will compound upon the prior 54% decline in share price seen since September 2021. The stock now trades close to the pandemic lows of $149 per share.

To me, this is a prime example of Mr. Market overreacting, but that's to be expected given the enormous strategy shift the company is undergoing as its ad business flounders and it invests heavily in the metaverse. Meta's stock is now deeply undervalued in my view; here's why.

Second quarter bloodbath

Meta reported revenue of $28.82 billion in the second quarter of 2022, which was a decline of 1% from the $29 billion generated in the second quarter of 2021. However, when we look beyond the headlines, we see that revenue did increased by 3% sequentially over the previous quarter.

Gross profit was $23.6 billion, down half a percentage point from the equivalent quarter last year.

Operating income took the largest hit, declining by an eye-watering 34% from $12.4 billion in Q2 2021 to $8.4 billion in Q2 2022. This was driven by a large increase in operating expenses and costs, which ballooned by 22% year over year to $20.5 billion. The company’s previously untouchable operating margin of 43% was slashed to 29% due to the higher costs.

Earnings per share also dropped to $2.46, which was a 32% decline year over year.

The positives

The good news is, app users grew with Family Daily Active People (DAP) increasing by 4% year over year to 2.88 billion. This was slightly higher than the 2.87 billion reported in the last quarter. Facebook Monthly Active Users (MAUs) was also 1% higher than last year at 2.94 billion, which was the same as the prior quarter.

Ad impressions increased by 15% year over year across its family of apps, which was a positive sign. However, the average price per ad did decrease by 14% year over year, which reflects ad buyers cutting back on spending.

Instagram Reels has shown strong momentum and reached $1 billion in annualized revenue for the first time. The platform is battling with TikTok, which is growing at a blistering pace and has ~1.4 billion monthly active users. This is rapidly approaching Instagram, which has ~2 billion monthly active users. However, Meta's CEO Mark Zuckerberg alluded to the lower ad rates for reels, which impact the higher ad rate products such as stories and feed posts.

Free cash flow was also still strong with $8.5 billion generated in the quarter, up 8.9% year over year.

The company increased its R&D investments to $1.9 billion, up 35% year over year. Meta has historically generated great returns on past investments, and now Zuckerberg is betting big on the metaverse, which he hopes to be a growth driver that can make up for the declining profitability of the ad business.

According to estimates by Precedence Research, the worldwide metaverse industry is forecasted to grow at a blistering 50.7% compounded annual growth rate (CAGR) between 2022 and 2030, reaching a value of $1.6 trillion by the end of the period. Thus this means Meta has plenty of runway for huge growth.

Management was bullish on the company’s prospects, as shown by the fact that it repurchased $5 billion worth of stock in the second quarter. In addition, the company also authorized another $24.32 billion for repurchases.

The company still has a robust balance sheet with $40 billion in cash, equivalents and short term investments, with $16 billion in total debt (although some of this may include operating liabilities).

Zuckerberg also announced plans to curb spending and has recently told employees to “Do more, with less." He has announced a slowdown in hiring and now expects lower expenses of $85 billion to $88 billion, which is slightly less than the prior range guided for of $87 billion to $92 billion.

Cheap valuation

Meta is currently trading at anextremely cheapprice-earnings ratio of 14.95, which is 41% below its historic five-year average. Its price-to-free-cash-flow ratio is 7.97, which is 49% cheaper when compared to its five-year average.

The stock is now trading below even its pandemic lows in 2020. The GF Value chart indicates a fair value for Meta stock of $397 per share, making it significantly undervalued at the time of writing.

Final thoughts

Meta Platforms is still a great company and in an extremely dominant position when it comes to social networking and advertising. However, the recent dips in revenue and prior declines in users have caused Wall Street to “vote with their feet." Given the macroeconomic environment, I expect the stock could experience lots of short-term headwinds. However, in the long run, a bet on Meta is a bet on Zuckerberg's ability to lead the company to success in the metaverse.