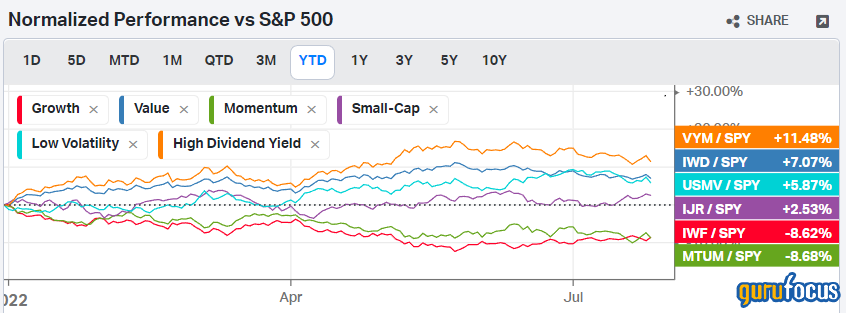

Vanguard's flagship dividend ETF, the Vanguard High Dividend Yield ETF (VYM, Financial), has experienced an incredible $1.86 billion worth of inflows amid an $8 billion rush towards equity Smart Beta funds. This ETF seems like it's garnering serious traction, which could result in a prolonged period of gains.

What is Smart Beta?

Smart Beta, also known as "factor investing," is a rules-based approach to the market which utilizes statistical segmentation to categorize assets. Smart Beta is a popular concept as its application to ETF formation is fundamental.

Factor investing concepts categorize stocks into groups such as value, growth, size, momentum, dividend-paying and more. As such, investors have the ability to invest in a vehicle that provides "intra-style" diversification but still allows for high conviction investing.

Dividend stocks and risk aversion

The Vanguard High Dividend Yield ETF is a special purpose vehicle that groups North American high dividend-paying stocks. The fund is managed passively and provides a lucrative flow-through yielding 3.04%.

The ETF's main purpose is conviction. There's no dearth of financial literature suggesting that high-dividend stocks outperform the market whenever inflation emerges. In addition, dividend stocks are usually mature companies, and as such, they might outperform in an economic contraction due to risk aversion.

Source: KoyFin

Prominent holdings

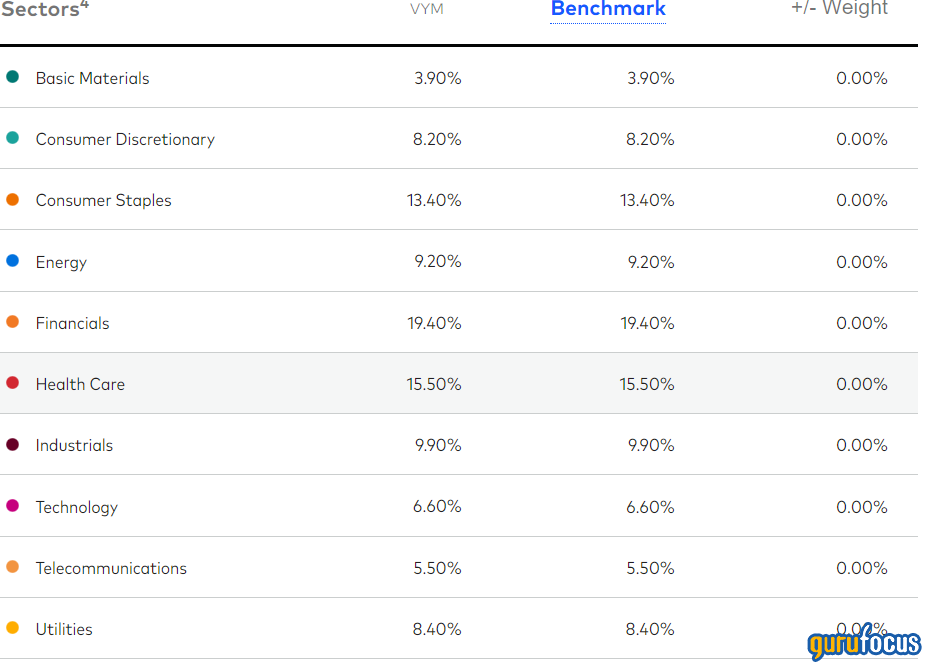

This ETF is highly exposed to mature industries, as conveyed by its portfolio weights. The investment vehicle leans towards sectors such as basic materials, consumer goods, energy, financials and technology.

Source: Vanguard

The most prominent holdings in the ETF include Johnson & Johnson (JNJ, Financial), Exxon Mobil (XOM, Financial), Procter & Gamble (PG, Financial), Pfizer (PFE, Financial) and Home Depot (HD, Financial).

As the Vanguard High Dividend Yield ETF possesses more than 400 holdings, its idiosyncratic risk is diversified, and risk is aligned towards the general performance of its sector weights as well as the dividend-seeking appetite of investors.

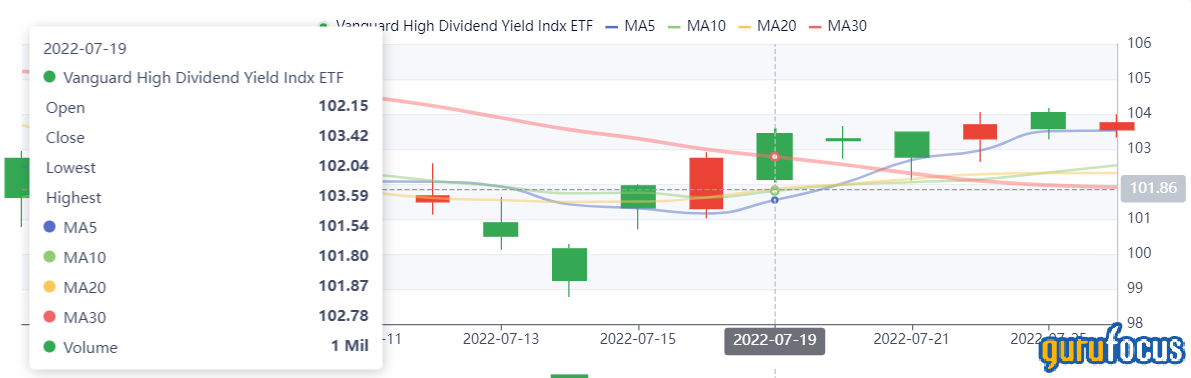

Valuation and technical analysis

Relative valuation metrics imply that the Vanguard High Dividend Yield ETF is undervalued. The ETF's price-earnings ratio has receded significantly during the past year, drawing down from above the 22.00 mark to the 15.00 handle.

Furthermore, technical analysis implies that the ETF has reached a support level at the $101 handle. Technical analysis should ideally never be looked at in isolation; however, it does provide help in hand when combined with fundamental analysis.

Concluding thoughts

The Vanguard High Dividend Yield ETF experienced fierce inflows during June, implying that investors are seeking "guaranteed yield" stocks in today's challenging market. The ETF diversifies idiosyncratic risk but lays focus on conviction as it speculates on high-dividend stocks only.

Based on empirical evidence, investors are likely to invest in this ETF during a bear market. Moreover, the Vanguard High Dividend Yield ETF is undervalued and presents a promising technical entry point. Thus, I deem the asset underpriced.

Also check out: (Free Trial)