When a company's return on equity ratio is superior to most of its competitors, it generally indicates the company has been very efficient in generating profits. Thus, investors may want to consider the following stocks, since they are performing better than most of their peer group companies in terms of a higher ROE ratio.

Tesla Inc.

The first stock investors could be interested in is Tesla Inc. (TSLA, Financial), an Austin, Texas-based manufacturer of electric vehicles as well as energy generation and storage systems that are sold in the United States, China and internationally.

Tesla has a ROE ratio of 25.61% versus the industry median of 5.97%, ranking higher than 94.15% of 1,214 companies that are operating in the vehicles and parts industry.

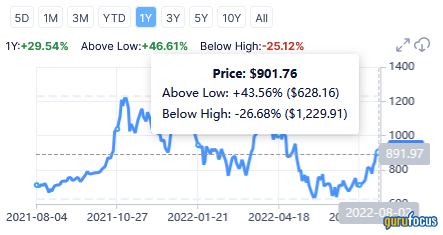

The share price was $901.76 at close on Tuesday, up 29.54% year over year, for a market capitalization of $960.87 billion and a 52-week range of $620.57 to $1,243.49.

The stock has a price-earnings ratio of 108.54 and a price-sales ratio of 15.3.

GuruFocus has assigned a score of 8 out of 10 to the company's financial strength and 4 out of 10 to its profitability.

On Wall Street, the stock has a median recommendation rating of overweight and an average target price of $944.18 per share.

Moderna Inc.

The second stock investors could be interested in is Moderna Inc. (MRNA, Financial), a Cambridge, Massachusetts-based developer of candidates for messenger RNA-based vaccines and therapies that can be used to treat diseases in immuno-oncology, rare diseases, infectious diseases and cardiovascular diseases.

Moderna has a ROE ratio of 93.71% versus the industry median of -38.48%, ranking higher than 99.17% of the 1,438 companies that are operating in the biotechnology industry.

The share price dropped 55.41% over the past year to trade at $160.81 at close on Tuesday for a market capitalization of $74.04 billion and a 52-week range of $115.61 to $497.49.

The stock has a price-earnings ratio of 4.73 and a price-book ratio of 3.77.

GuruFocus has assigned a score of 9 out of 10 to the company's financial strength and 4 out of 10 to its profitability.

On Wall Street, the stock has a median recommendation rating of overweight with an average target price of $219.69 per share.

Devon Energy Corp

The third stock investors may be interested in is Devon Energy Corp. (DVN, Financial), an Oklahoma City, Oklahoma-based oil and gas producer.

Devon Energy has a ROE ratio of 79.71% versus the industry median of 5.68%, ranking it higher than 89.73% of the 983 companies that operate in the oil and gas industry.

The share price has increased by 127.16% over the past year to close at $60.63 on Tuesday, determining a market capitalization of $37.66 billion and a 52-week range of $24.46 to $79.40.

The stock has a price-earnings ratio of 7.27 and an enterprise-value-to-Ebitda ratio of 4.57.

GuruFocus has assigned a score of 6 out of 10 to the company's financial strength and 5 out of 10 to its profitability.

On Wall Street, the stock has a median recommendation rating of overweight with an average target price of $77.85 per share.

Pfizer Inc.

The fourth stock investors may be interested in is Pfizer Inc. (PFE, Financial), a New York-based drug giant.

Pfizer has a ROE ratio of 39.41% versus the industry median of 4.02%, ranking it higher than 96.88% of the 1,027 companies that operate in the drug manufacturers industry.

The share price has increased by 10.22% over the past year to close at $49.69 on Tuesday, determining a market capitalization of $279.48 billion and a 52-week range of $40.94 to $61.71.

The stock has a price-earnings ratio of 9.76 and a price-book ratio of 3.37.

GuruFocus has assigned a score of 7 out of 10 to the company's financial strength and 8 out of 10 to its profitability.

On Wall Street, the stock has a median recommendation rating of overweight with an average target price of $56.82 per share.

Become a Premium Member to See This: (Free Trial):