Wedgewood Partners Chief Investment Officer David Rolfe (Trades, Portfolio) disclosed his equity portfolio for the second quarter of 2022 earlier this week.

The guru's St. Louis-based firm approaches potential investments with the mindset of a business owner, striving to generate significant long-term wealth by analyzing a handful of undervalued companies that have a dominant product or service, consistent earnings, revenue and dividend growth, are highly profitable and have strong management teams.

In his shareholder letter for the three-month period ended June 30, Rolfe noted “the bear market decline in the S&P 500 Index has masked brutal bear market declines (collapses, really) in countless stocks.”

“Even if inflation recedes below current, evolving expectations, Corporate America still faces higher levels of sticky cost structures that may take a few years to claw back,” he wrote. “Margin headwinds may dominate earnings well into 2023. Needless to say, we expect second quarter earnings (and third quarter forecasts) to add another whirlwind in stock prices.”

Keeping these considerations in mind, Rolfe’s 13F filings show he entered one new position, sold out of four stocks and added to or trimmed a number of other existing investments during the quarter. The most significant trades included a new holding in Pool Corp. (POOL, Financial), an increased bet on PayPal Holdings Inc. (PYPL, Financial) and reductions in the Starbucks Corp. (SBUX, Financial), Tractor Supply Co. (TSCO, Financial) and Progressive Corp. (PGR, Financial) positions.

Investors should be aware 13F filings do not give a complete picture of a firm’s holdings as the reports only include its positions in U.S. stocks and American depository receipts, but the reports can still provide valuable information. Further, the reports only reflect trades and holdings as of the most-recent portfolio filing date, which may or may not be held by the reporting firm today or even when this article was published.

Pool

Rolfe invested in 30,718 shares of Pool (POOL, Financial), allocating 1.86% of the equity portfolio to the position. The stock traded for an average price of $396.94 per share during the quarter.

The Covington, Louisiana-based company, which is a wholesale distributor of swimming pool supplies, parts and outdoor living products, has a $15.30 billion market cap; its shares were trading around $386.72 on Tuesday with a price-earnings ratio of 20.09, a price-book ratio of 12.44 and a price-sales ratio of 2.63.

The GF Value Line suggests the stock is modestly undervalued based on its historical ratios, past financial performance and analysts’ future earnings projections.

In his quarterly letter, Rolfe noted the company’s “strategy is beautifully simple; build a pool and become its customer for life” due to the maintenance and repairs that are required over time.

GuruFocus rated Pool’s financial strength 6 out of 10. Although the company has issued new long-term debt in recent years, it is still manageable due to adequate interest coverage. The robust Altman Z-Score of 6.43 also indicates it is in good standing even though assets are building up at a faster rate than revenue is growing and the Sloan ratio is indicative of poor earnings quality. The return on invested capital also overshadows the weighted average cost of capital, meaning value is being created as the company grows.

The company’s profitability fared even better with a 10 out of 10 rating, driven by operating margin expansion and returns on equity, assets and capital that top a majority of competitors. Pool also has a moderate Piotroski F-Score of 6 out of 9, meaning conditions are typical for a stable company. Consistent earnings and revenue growth contributed to a predictability rank of 4.5 out of five stars. According to GuruFocus research, companies with this rank return an average of 10.6% annually over a 10-year period.

Of the gurus invested in Pool, Ken Fisher (Trades, Portfolio) has the largest holding with 0.63% of its outstanding shares. Jim Simons (Trades, Portfolio)’ Renaissance Technologies, Steven Cohen (Trades, Portfolio), Jerome Dodson (Trades, Portfolio), Ron Baron (Trades, Portfolio), Chuck Royce (Trades, Portfolio), Ray Dalio (Trades, Portfolio) and Baillie Gifford (Trades, Portfolio) also have positions in the stock.

PayPal

The guru upped the PayPal (PYPL, Financial) holding by 22.53%, buying 61,041 shares. The trade had an impact of 0.74% on the equity portfolio. Shares traded for an average price of $87.21 each during the quarter.

He now holds 331,987 shares total, which make up 4% of the equity portfolio. GuruFocus says Rolfe has gained an estimated 62.69% on the investment, which was established in the third quarter of 2015.

The fintech company headquartered in San Jose, California, which operates an online payments system, has a market cap of $117.12 billion; its shares were trading around $101.46 on Tuesday with a price-earnings ratio of 58.19, a price-book ratio of 5.92 and a price-sales ratio of 4.49.

According to the GF Value Line, the stock is significantly undervalued currently.

In his letter, Rolfe wrote the company’s user base has grown by more than 50% since the onset of the pandemic, “so it makes sense for management to focus on driving higher transactions per account and better monetize this historical windfall of users. In our opinion, the shares have discounted away all of PayPal’s pandemic user and revenue gains, so we added to positions during the quarter.”

PayPal’s financial strength was rated 6 out of 10 by GuruFocus. Although the company has issued new long-term debt over the past several years, it is still manageable due to sufficient interest coverage. The Altman Z-Score of 2.12, however, indicates the company is under some pressure, though value creation is occurring since the ROIC eclipses the WACC.

The company’s profitability fared even better, scoring an 8 out of 10 rating due to operating margin expansion and strong returns that top a majority of industry peers. PayPal also has a moderate Piotroski F-Score of 4. Revenue per share, however, has recorded a slowdown in growth over the past 12 months.

With a 1.50% stake, Fisher is the company’s largest guru shareholder. Other top guru investors in PayPal are Dodge & Cox, Steve Mandel (Trades, Portfolio), PRIMECAP Management (Trades, Portfolio), Dalio and Philippe Laffont (Trades, Portfolio).

Starbucks

The investor slashed the Starbucks (SBUX, Financial) position by 77.90%, selling 167,875 shares. The transaction had an impact of -2.15% on the equity portfolio. The stock traded for an average per-share price of $77.03 during the quarter.

Rolfe now holds 47,612 shares of the company, which represent 0.63% of the equity portfolio. GuruFocus estimates he has gained 23.32% on the investment since the first quarter of 2019.

The Seattle-based coffee chain has a $102.80 billion market cap; its shares were trading around $89.58 on Tuesday with a price-earnings ratio of 25.23 and a price-sales ratio of 3.26.

Based on the GF Value Line, the stock appears to be modestly undervalued currently.

Rolfe said in his letter that while he appreciated Starbucks’ performance during the pandemic, “it was dealing with some concerning issues.”

“First, as a business reliant upon stores being open, the company faced continuing risks from rolling pandemic-related lockdowns, particularly in China, which is the company’s second-largest and fastest-growing market,” he wrote. “A second and related issue was employee illness; even as stores were open, various pandemic waves (Omicron, for example) caused many employees to miss shifts, making it very difficult and expensive for Starbucks to keep its stores staffed properly.”

GuruFocus rated Starbucks’ financial strength 4 out of 10. Although the company has been issuing new long-term debt in recent years, it is at a manageable level as a result of adequate interest coverage. The Altman Z-Score of 3 also indicates the company is in good standing even though assets are building up at a faster rate than revenue is growing. The ROIC also exceeds the WACC, so value is being created.

The company’s profitability scored a 9 out of 10 rating even though the operating margin is in decline. Starbucks is supported by strong returns that top a majority of competitors as well as a Piotroski F-Score of 6. Even though the company has recorded losses in operating income, steady earnings and revenue growth has contributed to a 2.5-star predictability rank. GuruFocus data shows companies with this rank return an average of 7.3% annually.

Dalio has the largest stake in Starbucks with 0.28% of its outstanding shares. Cohen, Baillie Gifford (Trades, Portfolio), Tom Gayner (Trades, Portfolio) and Joel Greenblatt (Trades, Portfolio) also have large holdings.

Tractor Supply

Impacting the equity portfolio by -0.91%, Rolfe curbed the Tractor Supply (TSCO, Financial) investment by 13.33%, selling 27,669 shares. During the quarter, the stock traded for an average price of $203.76 per share.

The guru now holds 179,920 shares total, accounting for 6.02% of the equity portfolio and the seventh-largest holding. GuruFocus data shows he has gained approximately 34.35% on the investment over its lifetime.

Headquartered in Brentwood, Tennessee, the retailer of farming and ranch supplies has a market cap of $22.66 billion; its shares were trading around $206.09 on Tuesday with a price-earnings ratio of 22.54, a price-book ratio of 11.87 and a price-sales ratio of 1.75.

The GF Value Line suggests the stock is fairly valued currently.

Tractor Supply’s financial strength was rated 6 out of 10 by GuruFocus, driven by a comfortable level of interest coverage and a high Altman Z-Score of 5.57, meaning it is in good standing even though assets are building up at a faster rate than revenue is growing. The ROIC also outshines the WACC, so value creation is occurring.

The company’s profitability received a 10 out of 10 rating on the back of operating margin expansion, strong returns that top a majority of industry peers and a moderate Piotroski F-Score of 5. Consistent earnings and revenue growth contributed to a five-star predictability rank. GuruFocus found companies with this rank return, on average, 12.1% annually.

Rolfe remains the company’s largest guru shareholder with 0.16% of its outstanding shares. Other Tractor Supply shareholders are Mario Gabelli (Trades, Portfolio), Jeremy Grantham (Trades, Portfolio), Greenblatt and Baillie Gifford (Trades, Portfolio).

Progressive

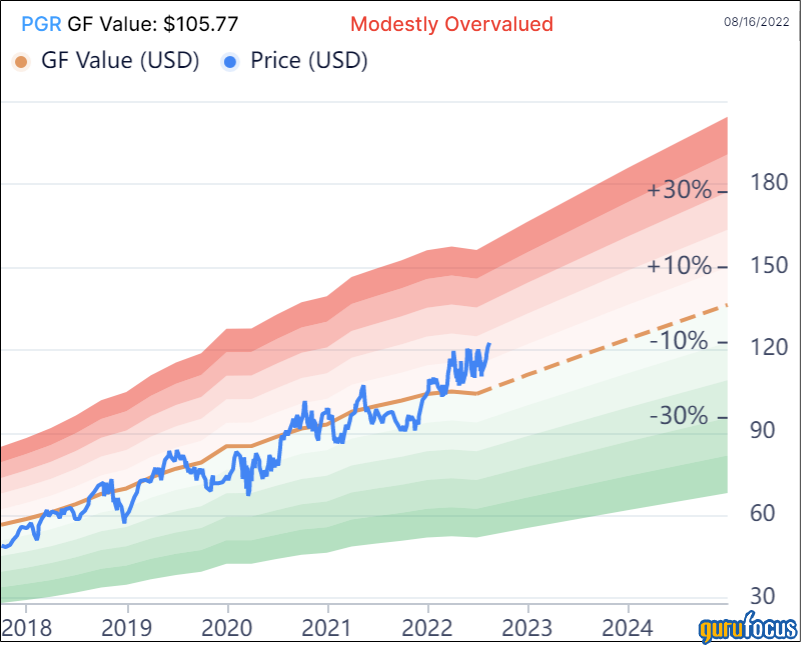

With an impact of -0.83% on the equity portfolio, the guru reduced the Progressive (PGR, Financial) position by 21.96%, selling 51,724 shares. During the quarter, shares traded for an average price of $113.39 each.

Rolfe now holds a total of 183,841 shares, giving it 3.69% space in the equity portfolio. He has gained approximately 28.08% on the investment so far.

The Mayfield, Ohio-based insurance company has a $71.64 billion market cap; its shares were trading around $122.48 on Tuesday with a price-earnings ratio of 87.49, a price-book ratio of 4.73 and a price-sales ratio of 1.50.

According to the GF Value Line, the stock is modestly overvalued currently.

In his commentary, Rolfe said Progressive saw a 12% increase in net premiums written during the quarter as it “grew both policies in force and took rate to offset high loss cost trends that are being driven by inflation.”

Despite having adequate interest coverage, GuruFocus rated Progressive’s financial strength 5 out of 10. Further, the company is struggling to create value since the WACC surpasses the ROIC.

The company’s profitability scored an 8 out of 10 rating. Although the margins and returns are underperforming versus competitors, it has a moderate Piotroski F-Score of 4. Due to a slowdown in revenue per share growth over the past year, the three-star predictability rank is on watch. Based on GuruFocus data, companies with this rank return an average of 8.2% annually.

Of the gurus invested in Progressive, PRIMECAP has the largest stake with 0.27% of outstanding shares. The Parnassus Endeavor Fund (Trades, Portfolio), Andreas Halvorsen (Trades, Portfolio), Gayner, Simons’ firm and Ray Dalio (Trades, Portfolio), among others, also have positions in the stock.

Additional trades and portfolio performance

During the quarter, Rolfe also added to his holdings of Old Dominion Freight Line Inc. (ODFL, Financial) and First Republic Bank (FRC, Financial), while cutting back the Visa Inc. (V, Financial), Edwards Lifesciences Corp. (EW, Financial) and CDW Corp. (CDW, Financial) positions.

Wedgewood's $579 million equity portfolio, which is composed of 40 stocks, is most heavily invested in the technology and financial services sectors.

The firm posted a return of 32.1% for 2021, outperforming the S&P 500 Index's 28.7% return.

Also check out: