Renaissance Technologies, the hedge fund founded by Jim Simons (Trades, Portfolio), disclosed in a regulatory filing that its top trades during the second quarter included new positions in Microsoft Corp. (MSFT, Financial) and Shopify Inc. (SHOP, Financial), boosts to its holdings of Berkshire Hathaway Inc. (BRK.B, Financial) and Chevron Corp. (CVX, Financial), a reduction to its stake in Tesla Inc. (TSLA, Financial) and the closure of its positions in Amazon.com Inc. (AMZN, Financial) and Alphabet Inc. (GOOGL, Financial).

The New York-based firm applies complex mathematical models to analyze and execute trades, most of them automated. Renaissance predicts price changes using computer-based models that first gather as much data as possible and then look for non-random movements.

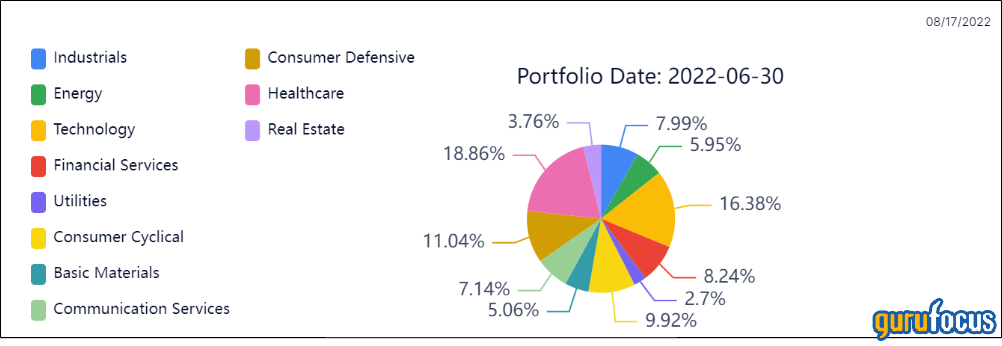

As of June, the firm’s $84.40 billion 13F equity portfolio contains 4,175 stocks, with 707 new positions and a quarterly turnover of 31%. The top four sectors in terms of weight are health care, technology, consumer defensive and consumer cyclical, representing 18.86%, 16.38%, 11.04% and 9.92% of the equity portfolio.

Investors should be aware that 13F filings do not give a complete picture of a firm’s holdings as the reports only include its positions in U.S. stocks and American depository receipts, but they can still provide valuable information. Further, the reports only reflect trades and holdings as of the most-recent portfolio filing date, which may or may not be held by the reporting firm today or even when this article was published.

Microsoft

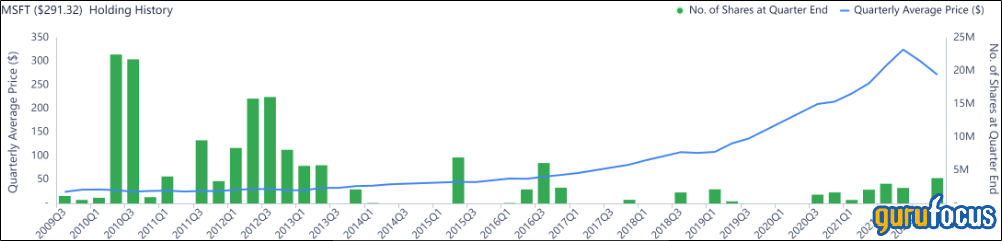

Renaissance purchased 3,820,133 shares of Microsoft (MSFT, Financial), giving the stake 1.16% equity portfolio weight.

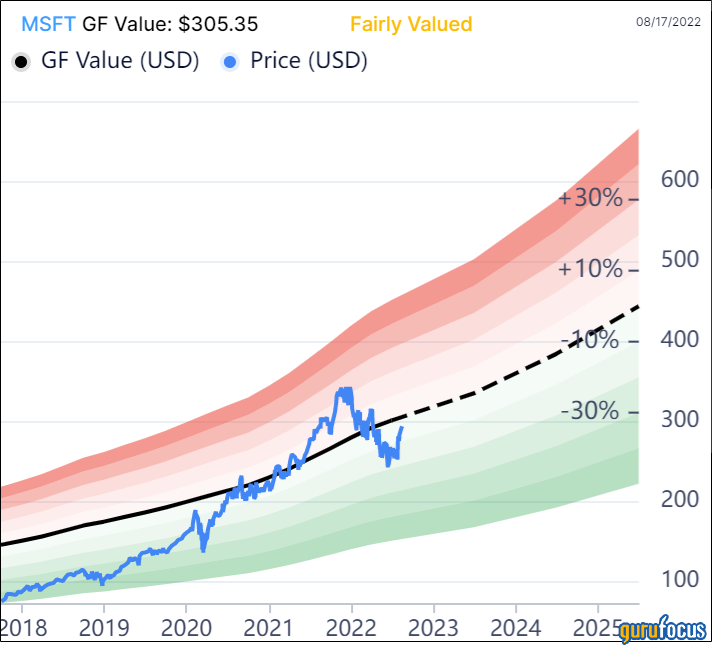

Shares of Microsoft averaged $271.99 during the second quarter; the stock is fairly valued based on Thursday’s price-to-GF Value ratio of 0.95.

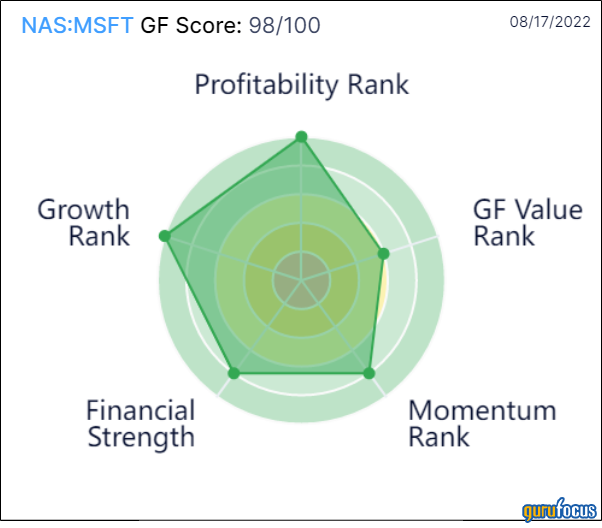

The Redmond, Washington-based software giant has a GF Score of 98 out of 100, driven by a rank of 10 out of 10 for profitability and growth and a rank of 8 out of 10 for financial strength and momentum despite GF Value ranking just 6 out of 10.

Other gurus with holdings in Microsoft include Ken Fisher (Trades, Portfolio)’s Fisher Investments and PRIMECAP Management (Trades, Portfolio).

Shopify

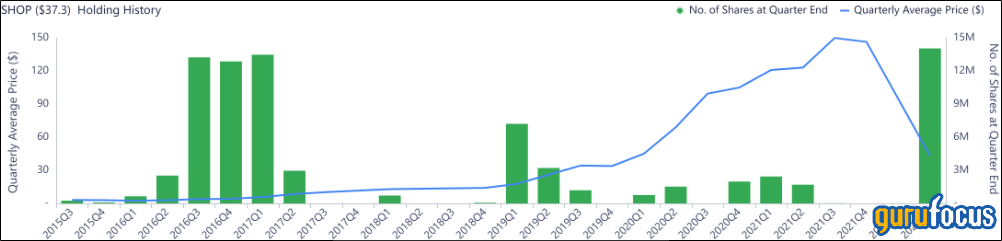

Renaissance purchased 14,036,600 shares of Shopify (SHOP, Financial), giving the position 0.52% equity portfolio weight.

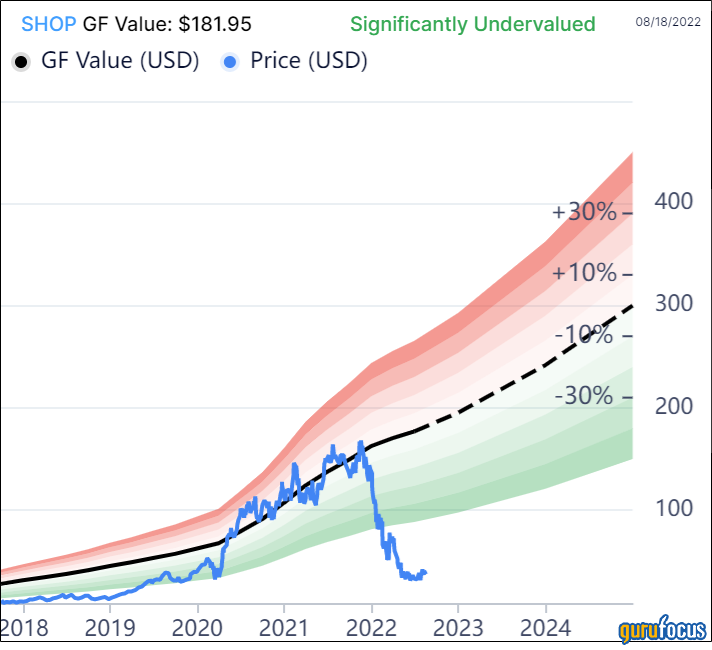

Shares of Shopify averaged $43.10 during the second quarter; the stock is significantly undervalued based on Thursday’s price-to-GF Value ratio of 0.20.

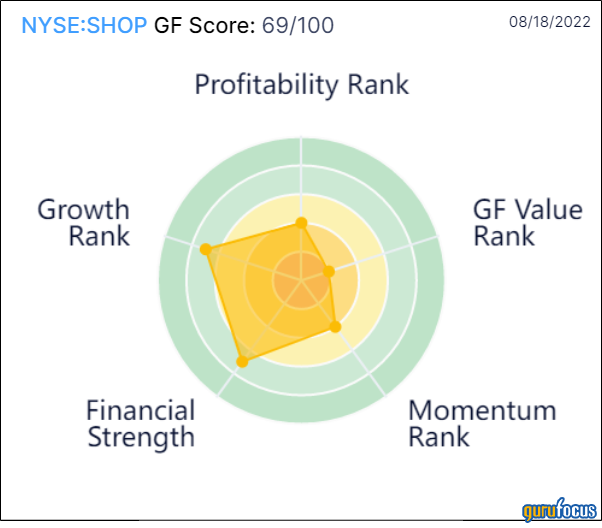

The Ottawa, Ontario-based e-commerce company has a GF Score of 69 out of 100 based on a rank of 7 out of 10 for growth and financial strength, a GF Value rank of 2 out of 10 and a rank of 4 out of 10 for momentum and profitability.

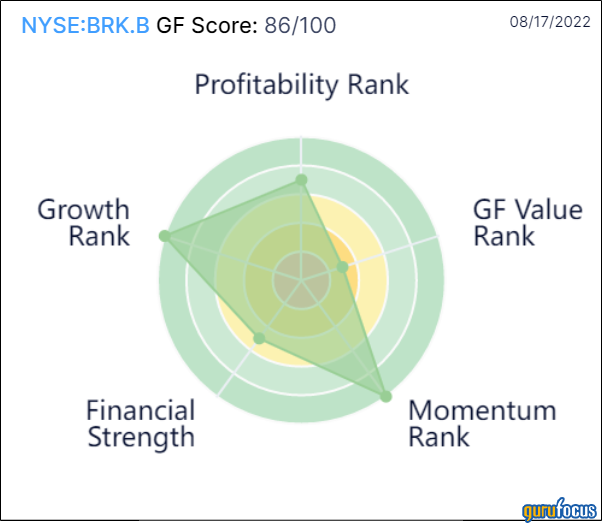

Berkshire Hathaway

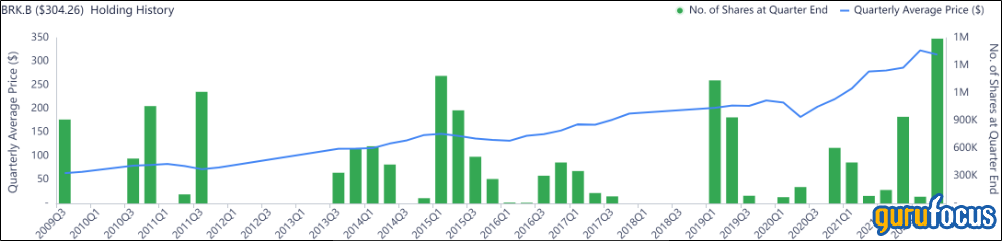

Renaissance purchased 1,718,500 Class B shares of Berkshire Hathaway (BRK.B, Financial), expanding the position by 2,370.34% and its equity portfolio by 0.56%.

Class B shares of Berkshire averaged $314.34 during the second quarter; the stock is modestly overvalued based on Thursday’s price-to-GF Value ratio of 1.24.

Warren Buffett (Trades, Portfolio)’s insurance conglomerate has a GF Score of 86 out of 100 based on a rank of 10 out of 10 for growth and momentum, a profitability rank of 7 out of 10, a financial strength rank of 5 out of 10 and a GF Value rank of 3 out of 10.

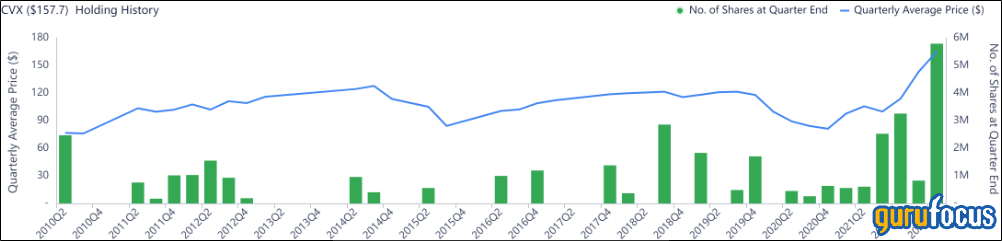

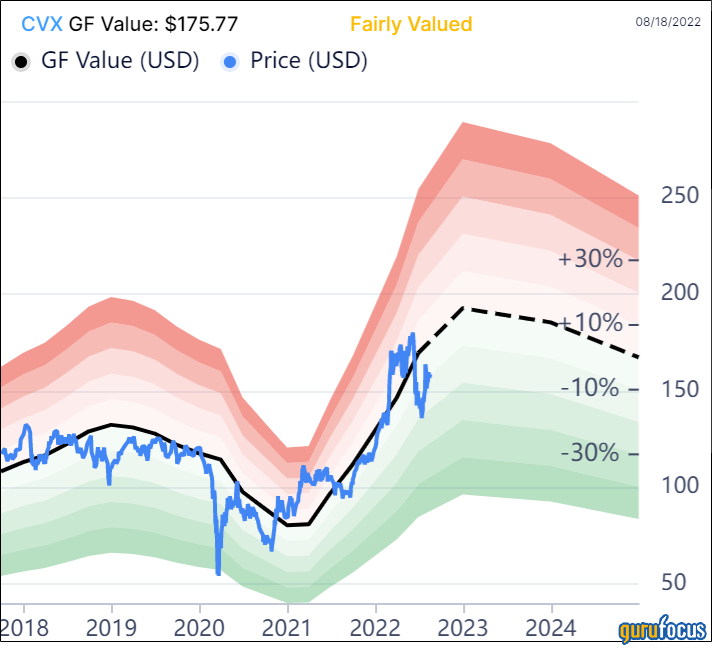

Chevron

Renaissance purchased 4,960,475 shares of Chevron (CVX, Financial), increasing the position by 600.67% and its equity portfolio by 0.85%.

Shares of Chevron averaged $165.26 during the second quarter; the stock is fairly valued based on Thursday’s price-to-GF Value ratio of 0.90.

The San Ramon, California-based energy company has a GF Score of 81 out of 100 based on a financial strength rank of 8 out of 10, a rank of 7 out of 10 for profitability and GF Value, a momentum rank of 6 out of 10 and a growth rank of 5 out of 10.

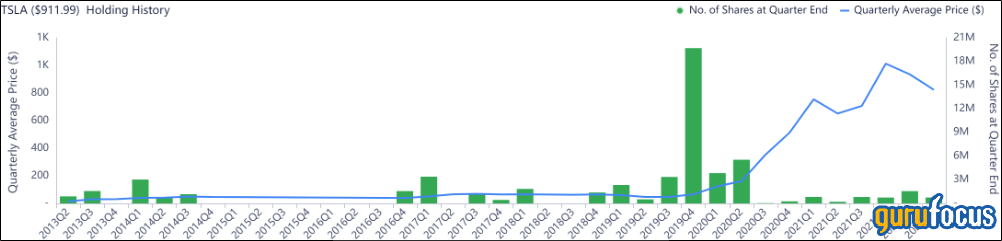

Firm trims holding in Tesla and exits Amazon.com and Alphabet

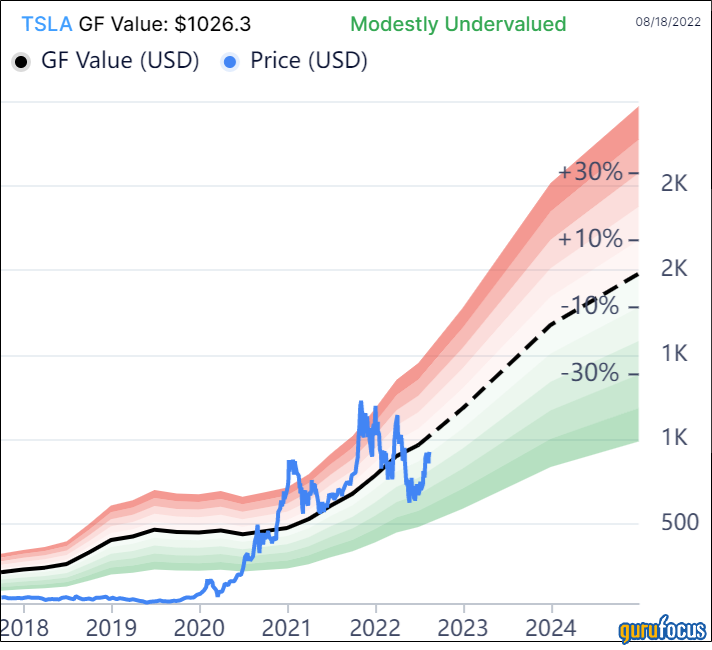

Renaissance sold 806,900 shares of Tesla Inc. (TSLA, Financial), slicing 51.88% of the position and 1.02% of its equity portfolio.

Shares of Tesla averaged $822.98 during the second quarter; the stock is modestly undervalued based on Thursday’s price-to-GF Value ratio of 0.90.

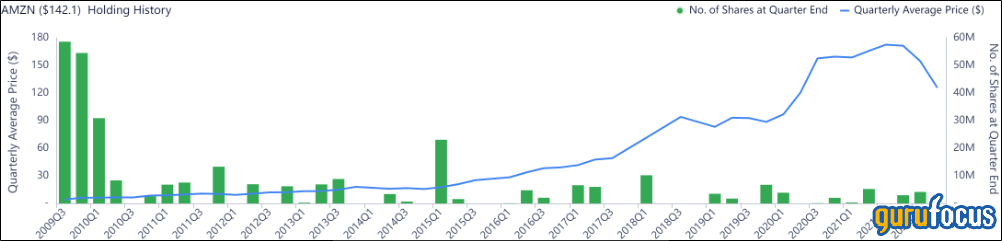

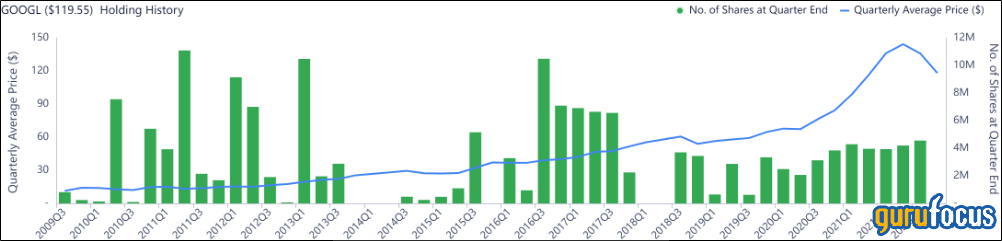

The firm also sold all 4,141,100 shares of Amazon.com (AMZN, Financial) and 4,552,960 Class A shares of Alphabet Inc. (GOOGL, Financial). The two transactions reduced the equity portfolio by 0.79% and 0.74%.

Also check out: