George Soros (Trades, Portfolio) is the founder and chairman of Soros Fund Management, an investment firm with $3.92 billion in its latest 13F portfolio. He has an extremely diversified portfolio of ~236 stocks and bought 28 new stocks in the second quarter. In this article, I’m going to dive into two big technology stocks which Soros has been buying recently.

Investors should be aware that 13F reports do not provide a complete picture of a guru’s holdings. They include only a snapshot of long equity positions in U.S.-listed stocks and American depository receipts as of the quarter’s end. They do not include short positions, non-ADR international holdings or other types of securities. However, even this limited filing can provide valuable information.

Alphabet

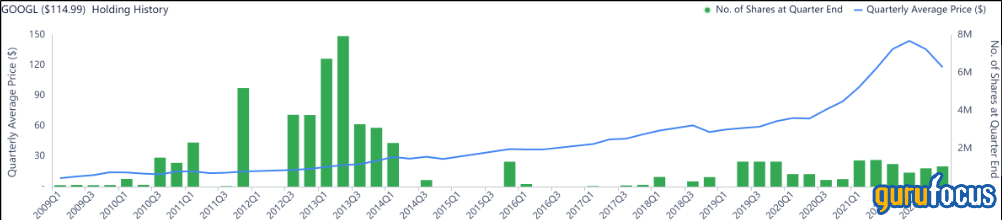

Soros' firm increased its position in Alphabet's voting shares (GOOGL, Financial) by 10% in the second quarter of 2022 and now has over 1 million shares. The stock traded for an average price of $118 per share during the quarter, which is close to where the stock is trading at the time of writing.

Alphabet, the owner of the world's premiere search engine Google, is the backbone of the internet and is the number one leader in internet search. The company also owns Android, which is the most popular mobile operating system.

Then we also have Google Maps, the most popular navigation application. Google Chrome is the world's most popular web browser and even Gmail is the most popular email client for non-Apple (AAPL, Financial) devices.

But that is not all. Google's “Moonshot” businesses, such as its self-driving taxi company, provide avenues for the next breakthrough technology. In Arizona, you can already download the Waymo One App and hail yourself an autonomous taxi.

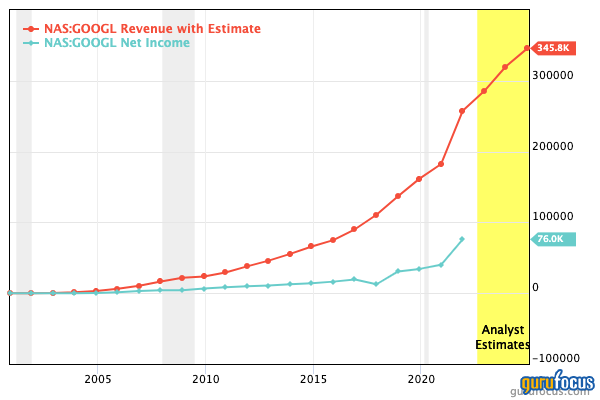

For the second quarter of 2022, Alphabet's revenue was $69.7 billion, which increased by 13% year over year, though it was below analyst expectations by $111 million.

Alphabet makes approximately 97% of its revenue from advertising and thus its income correlates with advertizer sentiment and spending. This lower than expected revenue is part of the reason why Alphabet's share price is down by over 20% from its all-time highs in 2021.

The company is also facing headwinds from a strong dollar, which impacted its international revenue. Earnings per share was $0.08 lower than analyst expectations in the second quarter at just $1.21 due to the aforementioned reasons.

The good news for Alphabet is the majority of these headwinds are temporary macroeconomic factors and don’t impact the company’s dominant advertizing business.

The GF Value chart indicates a fair value of $136 per share, making the stock modestly undervalued at the time of writing.

Amazon

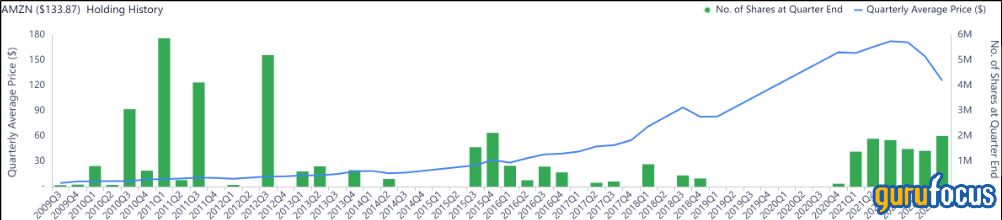

Soros Fund Managemetn was also buying e-commerce giant Amazon (AMZN, Financial) in the second quarter of 2022, during which shares traded at an average price of $125 per share. Soros increased his position by over 41%. His investment fund now owns over 2 million shares.

Amazon is the American market leader in e-commerce with over 200 million people as Amazon Prime members. The company operates with a “scaled economic shared” model in which the company passes on its economies of scale cost savings directly to the consumer through lower prices. This is a risky tactic in the short term, but over the long term has generated strong results for the company.

Amazon is a master of what I like to call “value stacking." It’s Prime membership includes free delivery, Prime Video, reading, food delivery service, free trials and much more. The idea is to make its service virtually a no-brainer to sign up to.

Having interviewed a few senior employees at Amazon recently, I have discovered its culture is deeply embedded into the company’s decisions and how people work. Whereas most companies have a set of “values” or principles on their wall, Amazon lives and breathes its principles. Examples include the philosophy of “it’s always Day One,'' which basically creates a kind of startup feel in the trillion-dollar company.

Another principle of Amazon’s unique culture includes its “ban on Powerpoints” and memo-focused meeting strategy. For example, if a senior executive wishes to launch a new product, they must write a narrative or story backed up with data which sells this idea to other team members. Then during the meeting, the first few minutes are spent in silence as everyone reads the memo before asking questions.

Amazon also has a “customer obsession” and a culture of “frugality” which focuses on keeping lean despite being so large. At the end of the day, a company is just a collection of people and systems. If the people are aligned with a strong proven culture, this creates a long term competitive advantage.

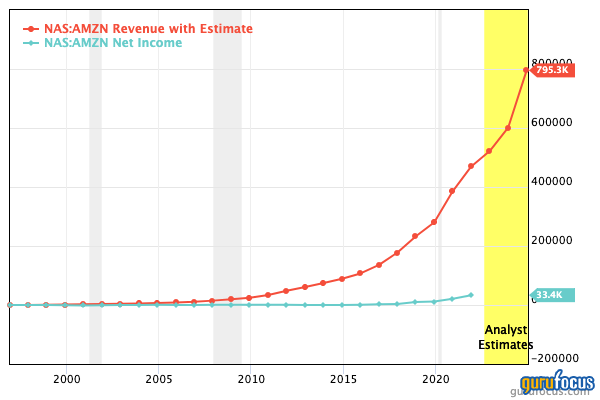

Amazon generated strong results in the second quarter of 2022. Revenue popped by 7% year over year to $121.2 billion, which surpassed analyst estimates by $2 billion. Now although this growth rate is slower than prior years, foreign exchange rates did impact the sales growth, as did margin pressures from inflation in the e-commerce business.

Amazon's operating income declined 57% year over year to $3.3 billion. Although this may seem catastrophic, it should be noted that this was mainly driven by higher than normal fulfillment costs, which increased by nearly one third to an eye-watering $20.4 billion. The catalyst for this increase was inflation in oil prices combined with higher freight and transport costs.

The good news is Amazon Web Services (AWS), the market leader in cloud, is the fastest growing part of Amazon. AWS saw its net sales increase by a staggering 33% year over year to $19.74 billion. Operating income also popped by 36% to $5.7 billion.

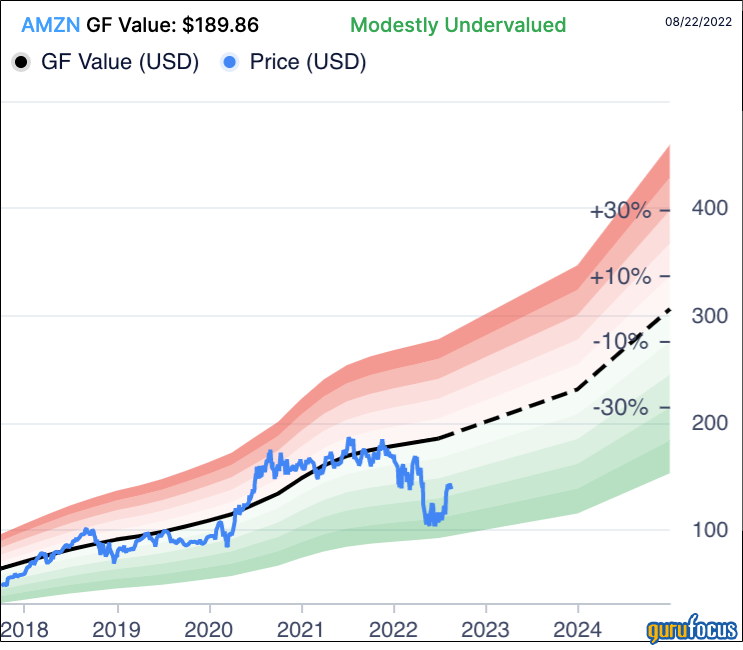

The GF Value chart indicates a fair value of $189 per share, which means the stock is modestly undervalued at the time of writing.

Also check out: