A central concept in growth investing is that stocks grow in value because of companies investing retained earnings. It is the compounding effect of retained earnings which is the key ingredient in the secret sauce of outstanding results.

So what are retained earnings? Retained earnings refers to the amount of net income left over for the business after it has paid out dividends to its shareholders. It the portion of the money the company retains to invest back into the business.

Return on retained earnings (RORE) isa calculation that shows how well a company's profits, after dividend payments, are reinvested and is an indicator of its growth potential (and the skill of the company's management). If the long-term RORE is high, then it means the company has been profitably reinvseting money into itself. If it's low, it might mean it would be better if the company pays out its earnings in the form of dividends.

In his 2019 Letter to shareholders, Warren Buffett (Trades, Portfolio) elaborated on the power of retained earnings as follows:

"In 1924, Edgar Lawrence Smith, an obscure economist and financial advisor, wrote Common Stocks as Long Term Investments, a slim book that changed the investment world. Indeed, writing the book changed Smith himself, forcing him to reassess his own investment beliefs. Going in, he planned to argue that stocks would perform better than bonds during inflationary periods and that bonds would deliver superior returns during deflationary times. That seemed sensible enough. But Smith was in for a shock. His book began, therefore, with a confession: “These studies are the record of a failure – the failure of facts to sustain a preconceived theory.” Luckily for investors, that failure led Smith to think more deeply about how stocks should be evaluated. For the crux of Smith’s insight, I will quote an early reviewer of his book, none other than John Maynard Keynes: “I have kept until last what is perhaps Mr. Smith’s most important, and is certainly his most novel, point. Well-managed industrial companies do not, as a rule, distribute to the shareholders the whole of their earned profits. In good years, if not in all years, they retain a part of their profits and put them back into the business. Thus there is an element of compound interest operating in favour of a sound industrial investment. Over a period of years, the real value of the property of a sound industrial is increasing at compound interest, quite apart from the dividends paid out to the shareholders.” And with that sprinkling of holy water, Smith was no longer obscure. It’s difficult to understand why retained earnings were unappreciated by investors before Smith’s book was published. After all, it was no secret that mind-boggling wealth had earlier been amassed by such titans as Carnegie, Rockefeller and Ford, all of whom had retained a huge portion of their business earnings to fund growth and produce ever-greater profits. Throughout America, also, there had long been small-time capitalists who became rich following the same playbook. Nevertheless, when business ownership was sliced into small pieces – “stocks” – buyers in the pre-Smith years usually thought of their shares as a short-term gamble on market movements. Even at their best, stocks were considered speculations. Gentlemen preferred bonds. Though investors were slow to wise up, the math of retaining and reinvesting earnings is now well understood. Today, school children learn what Keynes termed “novel”: combining savings with compound interest works wonders."

A key insight here is that much of the wealth of stock ownership accrues from the compounding effect of retained earnings in the long term. This approach is epitomized by Buffett by his famous quote. "Life is like a snowball, all you need is wet snow and a really long hill."

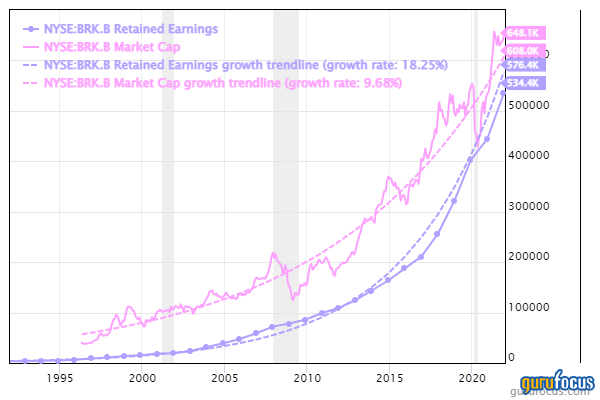

We can see the compounding of retained earnings in Berkshire's balance sheet over time. Since Berkshire does not pay a dividend and all earnings are retained, every dollar is constantly compounding. This has led to as massive accumulation of value over time.

GuruFocus has recently introduced RORE calculations as part of its All-in-One Screener as well as on the financial pages of stocks. RORE is calculated over multiple years as it is only meaningful over the medium to long term. GuruFocus has calculated data for three years, five years and 10 years. The five-year RORE% is available on the financial pages under the ratios section while the three, five and 10 year RORE% are all available in the screener under the fundamental tab.

The five-year RORE% is calculated as:

| 5-Year RORE % | = | ( Most Recent EPS (Diluted) | - | EPS (Diluted) ) 5 years ago | / | ( Cumulative EPS (Diluted) for 5-year | - | Cumulative Dividends per Share for 5-year ) |

The numerator is the increase in earnings per share over five years and denominator is the cumulative earnings retained by the company .

Note that this is just one way of calculating RORE. Other ways may be to use free cash flow or increase in book value instead of earnings depending on the situation.

For example, if I was to screen for U.S. based mid-size companies with ROIC and RORE of above 15% which are also "significantly undervalued" according to the GF Value, I get the following results:

| Ticker | Company | CurrentPrice | ROC (ROIC)% | 3-YearRORE % | 5-YearRORE % | 10-YearRORE % | Is OTCStocks | Market Cap($M) | GF Valuation |

| - | - | Above 15% | Above 15% | Above 15% | Above 15% | No | $1.0B - mid/small -$5.0B - mid | 1 Selected | |

| TPX | Tempur Sealy International Inc | $28.94 | 19.71 | 34.24 | 32.50 | 30.13 | False | 4,983.32 | Significantly Undervalued |

| COLM | Columbia Sportswear Co | $77.43 | 19.68 | 26.05 | 22.60 | 16.47 | False | 4,807.72 | Significantly Undervalued |

| SID | Companhia Siderurgica Nacional | $3.10 | 22.66 | 47.43 | 27.95 | 58.46 | False | 4,301.31 | Significantly Undervalued |

| SMTC | Semtech Corp | $54.36 | 19.48 | 46.49 | 30.83 | 27.16 | False | 3,450.65 | Significantly Undervalued |

| LCII | LCI Industries Inc | $135.69 | 18.08 | 62.62 | 44.86 | 39.36 | False | 3,450.56 | Significantly Undervalued |

| KLIC | Kulicke & Soffa Industries Inc | $48.11 | 79.07 | 67.03 | 60.71 | 40.30 | False | 2,793.65 | Significantly Undervalued |

| SHOO | Steven Madden Ltd | $33.65 | 35.82 | 91.15 | 31.31 | 16.72 | False | 2,658.36 | Significantly Undervalued |

| EXPI | eXp World Holdings Inc | $16.29 | 31.84 | 46.81 | 245.08 | 308.54 | False | 2,472.80 | Significantly Undervalued |

| WGO | Winnebago Industries Inc | $68.24 | 26.56 | 54.19 | 35.29 | 28.61 | False | 2,166.89 | Significantly Undervalued |

| MMI | Marcus & Millichap Inc | $41.11 | 32.70 | 39.95 | 23.63 | 24.97 | False | 1,642.93 | Significantly Undervalued |

| PATK | Patrick Industries Inc | $63.40 | 17.82 | 53.50 | 32.24 | 34.28 | False | 1,449.60 | Significantly Undervalued |

This gives me a nice list of mid-size companies which are compounding shareholder equity consistently at a high rate over the long term and which may also be undervalued.

Of course, RORE is only one metric, but it is an important one. This powerful metric helps narrow down investment opportunities and find the elusive compounders which have proven their ability to create wealth.