Generation Investment Management, the firm co-founded by Al Gore (Trades, Portfolio) and David Blood, disclosed in a regulatory filing that its top five trades during the second quarter included a new position in Mastercard Inc. (MA, Financial), a boost to its holding in Microsoft Corp. (MSFT, Financial), a reduction to its holding in Alphabet Inc. (GOOGL, Financial)(GOOG, Financial) and the closure of its positions in Visa Inc. (V, Financial) and TE Connectivity Ltd. (TEL, Financial).

The U.K.-based firm seeks long-term capital appreciation by focusing on sustainability within markets with companies that strategically manage their economic, social and governance performances. Generation applies fundamental analysis and bottom-up stock selection to build its equity portfolio.

As of June, Generation’s $18.35 billion 13F equity portfolio contains 46 stocks, with four new positions and a quarterly turnover ratio of 22%. The top four sectors in terms of weight are technology, health care, consumer cyclical and industrials, representing 35.13%, 23.67%, 11.69% and 10.58% of the equity portfolio.

Investors should be aware that 13F filings do not give a complete picture of a firm’s holdings as the reports only include its positions in U.S. stocks and American depository receipts, but they can still provide valuable information. Further, the reports only reflect trades and holdings as of the most-recent portfolio filing date, which may or may not be held by the reporting firm today or even when this article was published.

Mastercard

Generation purchased 1,997,919 shares of Mastercard (MA, Financial), giving the stake 3.44% equity portfolio weight.

Shares of Mastercard averaged $344.59 during the second quarter; the stock is modestly undervalued based on Tuesday’s price-to-GF Value ratio of 0.80.

The Purchase, New York-based credit card company has a GF Score of 98 out of 100, driven by a GF Value rank of 9 out of 10 and a rank of 10 out of 10 for profitability, growth and momentum despite financial strength ranking just 6 out of 10.

Other gurus with holdings in Mastercard include Chuck Akre (Trades, Portfolio)’s Akre Capital Management, Ken Fisher (Trades, Portfolio)’s Fisher Investments, and Warren Buffett (Trades, Portfolio)’s Berkshire Hathaway Inc. (BRK.A)(BRK.B).

Microsoft

The firm added 3,690,460 shares of Microsoft (MSFT, Financial), expanding the position by 673.91% and its equity portfolio by 5.16%.

Shares of Microsoft averaged $271.99 during the second quarter; the stock is fairly valued based on Tuesday’s price-to-GF Value ratio of 0.90.

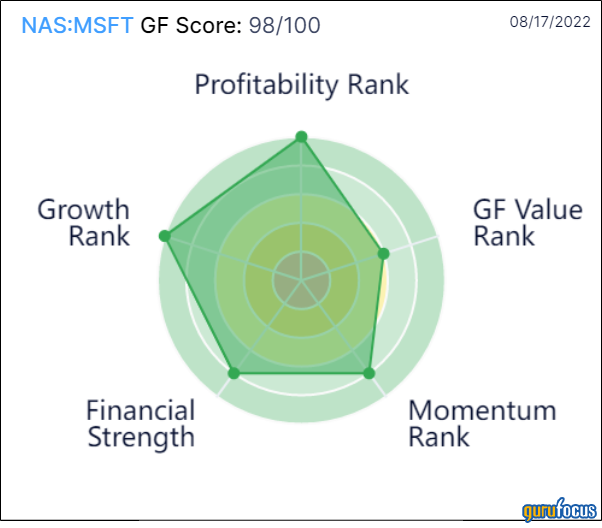

The Redmond, Washington-based software giant has a GF Score of 98 out of 100, driven by a rank of 10 out of 10 for profitability and growth and a rank of 8 out of 10 for financial strength and momentum despite GF Value ranking just 7 out of 10.

Other gurus with holdings in Microsoft include Fisher Investments and PRIMECAP Management (Trades, Portfolio).

Alphabet

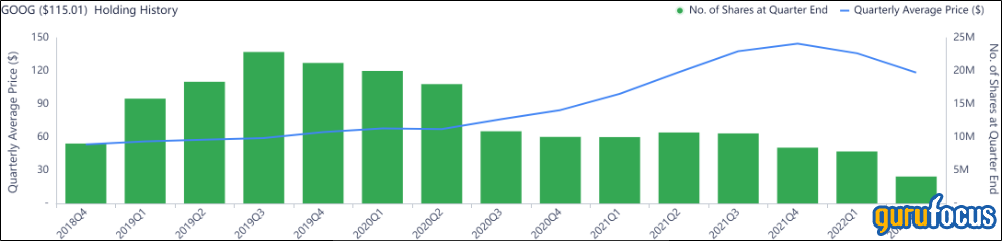

Generation sold 3,787,900 Class B shares of Alphabet (GOOG, Financial), slicing 48.3% of the position and 2.42% of its equity portfolio.

Class B shares of Alphabet averaged $118.50 during the second quarter; the stock is modestly undervalued based on Tuesday’s price-to-GF Value ratio of 0.84.

The Mountain View, California-based search engine operator has a GF Score of 97 out of 100 driven on a growth rank of 10 out of 10, a momentum rank of 8 out of 10, and a rank of 9 out of 10 for financial strength, profitability and GF Value.

Other gurus with holdings in Alphabet include Dodge & Cox, PRIMECAP Management (Trades, Portfolio) and Baillie Gifford (Trades, Portfolio).

Visa

The firm sold all 3,195,216 shares of Visa (V, Financial), trimming 3.24% of its equity portfolio.

Shares of Visa averaged $206.91 during the second quarter; the stock is modestly undervalued based on Tuesday’s price-to-GF Value ratio of 0.80.

The San Francisco-based payment processing company has a GF Score of 99 out of 100, driven by a rank of 10 out of 10 for profitability, growth and momentum, a GF Value rank of 9 out of 10 and a financial strength rank of 7 out of 10.

TE Connectivity

Generation sold all 2,709,476 shares of TE Connectivity (TEL, Financial), trimming 1.63% of its equity portfolio.

Shares of TE Connectivity averaged $123.99 during the second quarter; the stock is fairly valued based on Tuesday’s price-to-GF Value ratio of 0.94.

The Swiss electrical hardware company has a GF Score of 87 out of 100 based on a GF Value rank of 6 out of 10, a rank of 8 out of 10 for profitability and momentum and a rank of 7 out of 10 for financial strength and growth.