According to top 10 holdings statistics, a Premium feature of GuruFocus, the top 10 holdings of Warren Buffett (Trades, Portfolio)’s Berkshire Hathaway Inc. (BRK.A)(BRK.B) had a few changes over the past several years even though the guru’s top five holdings have primarily remained the same.

The top five holdings as of the second-quarter 13F filing are Apple Inc. (AAPL, Financial), Bank of America Corp. (BAC, Financial), Coca-Cola Co. (KO, Financial), Chevron Corp. (CVX, Financial) and American Express Co. (AXP, Financial).

Birthday guru background

Buffett, who celebrated his 92nd birthday on Tuesday, studied during the 1950s under the legendary Benjamin Graham at Columbia University. The Oracle of Omaha built Berkshire from a struggling textile company into a major insurance conglomerate: Berkshire’s market cap as of Tuesday stands at approximately $631 billion, compared to approximately $647 billion on Aug. 30, 2021 and approximately $525 billion on Aug. 31, 2020.

Buffett and co-Berkshire leader Charlie Munger (Trades, Portfolio) seek companies using a four-criteria investing approach: understandable business, favorable growth prospects, shareholder-oriented management and attractive valuation.

Website improves top 10 holdings-related pages

GuruFocus added a few improvements to the top 10 holdings pages, including the ability to view past-quarter top 10 holdings lists for all gurus. For the individual top 10 holdings pages, the color-coded map allows users to visualize the changes in the top holdings quarter over quarter.

As the above image shows, while Berkshire’s top five holdings have remained relatively the same since December 2019, the stocks ranked numbers six through 10 had higher turnover: Although stocks like Wells Fargo & Co. (WFC, Financial), JPMorgan Chase & Co. (JPM, Financial) and DaVita Inc. (DVA, Financial) took top 10 spots from 2019 to 2021, none of these stocks are among Buffett’s top 10 holdings as of June. Instead, the top 10 holdings include stocks like Occidental Petroleum Corp. (OXY, Financial) and Activision Blizzard Inc. (ATVI, Financial).

13F equity portfolio overview

As of June, Berkshire’s $300.13 billion 13F equity portfolio contains 47 stocks with a quarterly turnover ratio of 1%. The top four sectors in terms of weight are technology, financial services, consumer defensive and energy, representing 42.92%, 25.66%, 13.38% and 10.90% of the equity portfolio.

Investors should be aware that 13F filings do not give a complete picture of a firm’s holdings as the reports only include its positions in U.S. stocks and American depository receipts, but they can still provide valuable information. Further, the reports only reflect trades and holdings as of the most-recent portfolio filing date, which may or may not be held by the reporting firm today or even when this article was published.

Apple

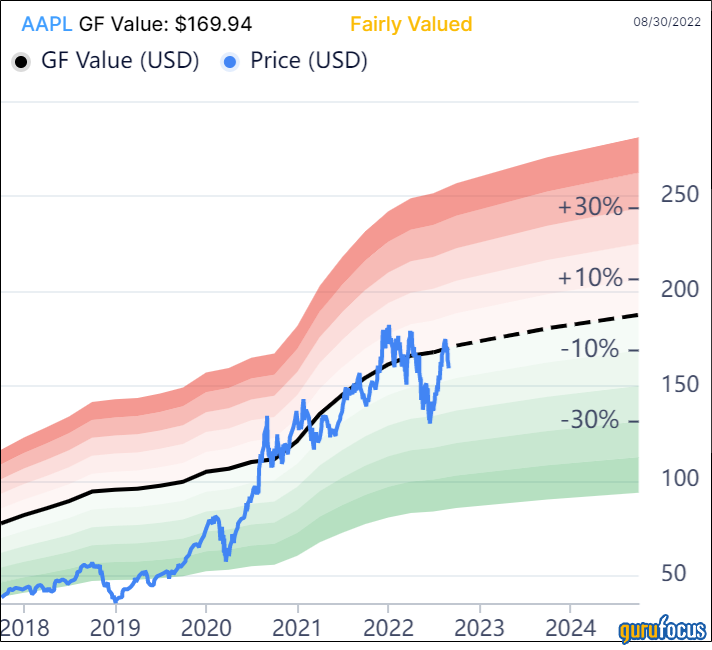

Berkshire owns 894,802,319 shares of Apple (AAPL, Financial), giving the position 40.76% equity portfolio weight. The stock has occupied the top spot since December 2017.

Shares of Apple averaged $151.81 during the second quarter; the stock is fairly valued based on Tuesday’s price-to-GF Value ratio of 0.94.

The Cupertino, California-based tech giant has a GF Score of 98 out of 100, driven by a rank of 10 out of 10 for profitability, growth and momentum despite financial strength and GF Value ranking just between 6 and 7 out of 10.

Other gurus with holdings in Apple include Ken Fisher (Trades, Portfolio)’s Fisher Investments and Spiros Segalas (Trades, Portfolio)’ Harbor Capital Appreciation Fund.

Bank of America

Berkshire owns 1,010,100,606 shares of Bank of America (BAC, Financial), giving the stake 10.48% equity portfolio weight. The stock has been the second-largest holding in terms of weight since September 2018.

Shares of Bank of America averaged $36.09 during the second quarter; the stock is modestly undervalued based on Tuesday’s price-to-GF Value ratio of 0.88.

The Charlotte, North Carolina-based bank has a GF Score of 71 out of 100 based on a rank of 7 out of 10 for GF Value and momentum, a profitability rank of 5 out of 10, a growth rank of 4 out of 10 and a financial strength rank of 3 out of 10.

Other gurus with holdings in Bank of America include Dodge & Cox and PRIMECAP Management (Trades, Portfolio).

Coca-Cola

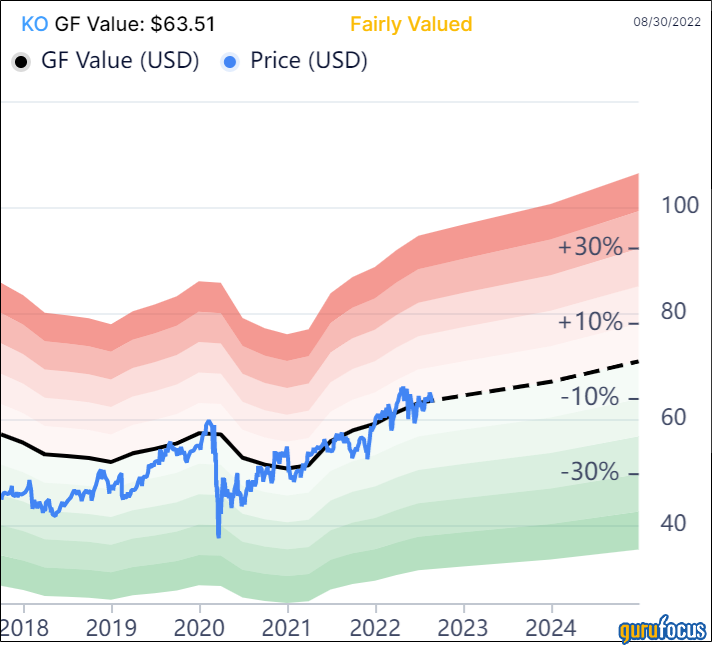

Berkshire owns 400 million shares of Coca-Cola (KO, Financial), giving the holding 8.38% equity portfolio weight. While the stock was Berkshire’s fourth-largest holding from June 2019 to December 2020. The stock then dropped to fifth place during March before returning to third place in June.

Shares of Coca-Cola averaged $63.37 during the second quarter; the stock is fairly valued based on Tuesday’s price-to-GF Value ratio of 0.99.

The Atlanta-based beverage giant has a GF Score of 80 out of 100: Although the stock has a profitability rank of 8 out of 10, Coca-Cola's momentum and GF Value rank just 6 out of 10 while financial strength and growth rank just 5 out of 10.

Chevron

Berkshire owns 161,440,149 shares of Chevron (CVX, Financial), giving the position 7.79% equity portfolio weight. The stock entered Berkshire’s top 10 holdings in September 2020, yet now ranks fourth on Berkshire’s top 10 list.

Shares of Chevron averaged $165.26 during the second quarter; the stock is modestly undervalued based on Tuesday’s price-to-GF Value ratio of 0.90.

The San Ramon, California-based energy company has a GF Score of 81 out of 100 based on a financial strength rank of 8 out of 10, a growth rank of 5 out of 10, a momentum rank of 6 out of 10 and a rank of 7 out of 10 for profitability and GF Value.

American Express

Berkshire owns 151,610,700 shares of American Express (AXP, Financial), giving the position 7% equity portfolio weight. Although the stock has ranked in the top three throughout 2021, American Express is now fifth on Berkshire’s top 10 list.

Shares of American Express averaged $165.52 during the second quarter; the stock is fairly valued based on Tuesday’s price-to-GF Value ratio of 0.92.

The New York-based payment processing company has a GF Score of 84 out of 100 based on a rank of 8 out of 10 for growth and momentum, a profitability rank of 7 out of 10, a GF Value rank of 6 out of 10 and a financial strength rank of 4 out of 10.