On Monday, CVS Health Corp. (CVS, Financial) announced it has reached a deal to acquire in-home health care company Signify Health Inc. (SGFY, Financial) in an all-cash deal worth $8 billion, or $30.50 per share. This marks the latest step in the health care retailer’s bid to expand its health care services.

Some investors are skeptical about how successful CVS will be in its health care service ambitions. On the one hand, the company aims to address a pressing need in the U.S. for lower-cost health care, as the broken health care system is all too often prohibitively expensive for those not earning higher than the average wage in the country. On the other hand, since CVS also owns a health insurance company, it would encounter many conflicts of interest if it were to expand its health care services.

There is another factor to consider that may make the potential conflicts of interest worth it, though, and that is improving relationships with customers. Brick-and-mortar retailers are increasingly having to defend their market share from online stores. By offering more health care services, CVS hopes to strengthen the loyalty of its existing customers and bring in new ones.

The Signify deal

Signify Health provides technology, analytics and services to assist with in-home patient care. Partnering with patients’ health insurance, the company provides in-home health visits. It also leverages its provider networks to create value-based payment programs and guide patients away from outcomes that create excessive costs.

“This acquisition will enhance our connection to consumers in the home and enables providers to better address patient needs as we execute our vision to redefine the health care experience,” said CEO Karen Lynch in a press release announcing the news. “In addition, this combination will strengthen our ability to expand and develop new product offerings in a multi-[payer] approach.”

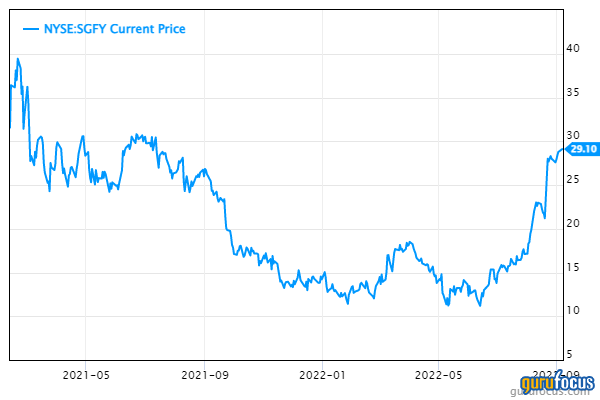

The market already knew that CVS was planning to make an offer for Signify, so the news does not come as a surprise to many. Signify was also previously rumored to be an acquisition target of Amazon. Once it came to light in early August that Signify was open to the option of being acquired, the stock price began steadily rising. As of this writing, it trades around $29.10 per share, which is only slightly below the acquisition price and just 1.15% above the previous day’s closing price.

Signify’s goal of saving patients money aligns well with CVS’s goal to provide lower-cost health care. Not only is CVS aiming to take advantage of prohibitively high health care costs in order to grab a share of the market for itself, it also owns a health insurance company, Aetna, which would benefit from a cooperative relationship with more care providers.

Lowering costs for health care providers and patients alike is not just an exercise of advising patients away from procedures that would be costly for the insurer; if such a thing was easy to do, someone would have done it ages ago. Instead, the better way for retailers to go about disrupting the health care industry would be to provide easier access to preventative care, so acquiring Signify seems like it would be a move in the right direction.

“We are both building an integrated experience that supports a more proactive, preventive and holistic approach to patient care, and I look forward to executing on our shared vision for the future of care delivery,” the CEO of Signify, Kyle Armbrester, said on Monday.

Aside from the expansion of health care services, part of the transformation plan that CVS is putting into place involves a winding-down of the brick-and-mortar business. While the stores will certainly be essential for CVS for many years to come, they are no longer in a growth phase, and the company plans to close roughly 900 stores over the next three years. For reference, CVS operated 9,932 brick-and-mortar stores in 2021, so the planned closures represent approximately 9% of its footprint.

The retail primary care rush

CVS is not the only company that is expanding into primary health care and adjacent services. Its main competitor, Walgreens Boots Alliance Inc. (WBA, Financial), has formed a strategic partnership with VillageMD to offer the Village Medical at Walgreens chain of primary care practices, aiming to open the first 20 locations in the Dallas are in 2022.

Walgreens and CVS make sense, but then there is e-commerce and cloud data giant Amazon.com Inc. (AMZN, Financial) that is also trying to get a slice of the primary care pie. In July, Amazon announced its plans to acquire primary care provider One Medical for $3.9 billion. Amazon has also launched a telehealth service and an online pharmacy.

Discount big-box retailer Walmart Inc. (WMT, Financial) expanded into primary care and other health services in 2014, building off of its existing pharmacy and optical services, though this effort has been slow to get off the ground. Target Corp. (TGT, Financial) followed right behind, though unlike Walmart, Target offers its primary care services under a different label, Included Health.

From Walmart and Target’s slow growth in health care services, one might expect other retailers to have similar difficulties, but some analysts are claiming it is only recently that the industry has become ripe for disruption.

The breaking points for many consumers are cost and convenience. Especially with the economy worsening and wages failing to keep up, health care is becoming increasingly unaffordable. Then we have to consider that for many consumers, it takes so long to get in to see a doctor that by the time they can get an appointment, the issue has either resolved on its own or sent them to the emergency room.

According to Fierce Healthcare, the primary care market in the U.S. is estimated to be worth around $260 billion. A report from Bain and Company suggests that retailers, startups and other non-traditional health care companies could grab as much as 30% of the market by 2030.

Valuation

The move to acquire Signify Health appears to be a move in the right direction in CVS’ plan to expand its health care services. The in-home health care provider could improve the company’s value proposition, reduce the insurer’s cost per customer via preventative care and help cement relationships with customers that might be faltering in the face of a plethora of online alternatives.

Given that CVS seems to be on track to disrupt the health care industry for the better, its shares might look cheap at a price-earnings ratio of 16.05 with a dividend yield of 2.17%. However, change in the health care industry tends to be slow, which does not lend itself to improving valuations for an already-large company like CVS with its market cap of $129.62 billion. When we factor in the slow winding-down of the brick-and-mortar stores, it seems more likely that CVS will stagnate rather than grow.