Campbell Soup Co. (CPB, Financial) reported its fourth-quarter 2022 financial results recently. There were no great surprises, as the processed foods manufacturer met analysts’ expectations for most metrics. Like other companies, its margins were impacted by increased transportation, raw materials, packaging and labor costs, precipitated by historically unprecedented inflation and supply chain issues. How did the company fare under such trying economic conditions?

The company posted revenue of $1.99 billion for its latest quarter ending July 31, versus $1.87 billion for the same period last year. Campbell’s profit was $96 million, or 32 cents per share, versus $288 million for the same period in the prior year. However, when adjusted for one-time restructuring charges, including pension and commodity market adjustments, the company generated a profit of 56 cents per share that was in line with consensus estimates.

Although higher prices led to a 6% increase in sales to $2 billion, sales volumes fell 4% as inflationary price increases have forced some consumers to switch to lower-priced brands. These results reduced the company’s gross margins for the latest quarter. Even though Campbell’s market share for most of its food product brands remains slightly above 2019 levels, CEO Mark Clouse acknowledged that the company is seeing some pressure from store brands, especially in its condensed-soup and broth brands.

Campbell offered guidance for its new fiscal year, projecting revenue growth between 4% and 6% versus a 1% gain for the previous year.

Additionally, the company provided some detail on which customers are opting for store substitutes. Clouse indicated the company’s analysis revealed that baby-boomer consumers are more sensitive to price increases, but are likely to return back to Campbell’s well-known and familiar products over time, while millennial consumers have been more loyal.

This prognostication, however, seems somewhat sanguine and presumptuous given the difficulty in projecting the future trajectory of inflation as well as predicting when supply chain issues will return to pre-pandemic conditions. The idea that millennials will be immune to continuing price hikes seems rather contrary to overall consumer behavior — especially when the company’ s food products are easily fungible with lower-cost replacements.

Even though it has a different product mix than Campbell, it would be instructive to compare the company’s latest results with those of Hormel Foods Corp. (HRL, Financial), one of its peers in the consumer packaged goods industry.

By way of contrast, despite declining sales volume, Hormel reported an increase in profit for its most recent quarter. The company posted a profit of $219 million, or 40 cents per share, slightly below analysts’ expectations of 41 cents per share. For the same period in the prior year, the company earned $177 million, or 32 cents per share.

Hormel’s net sales for the period increased 6% to $3.03 billion, modestly beating Wall Street's expectations.

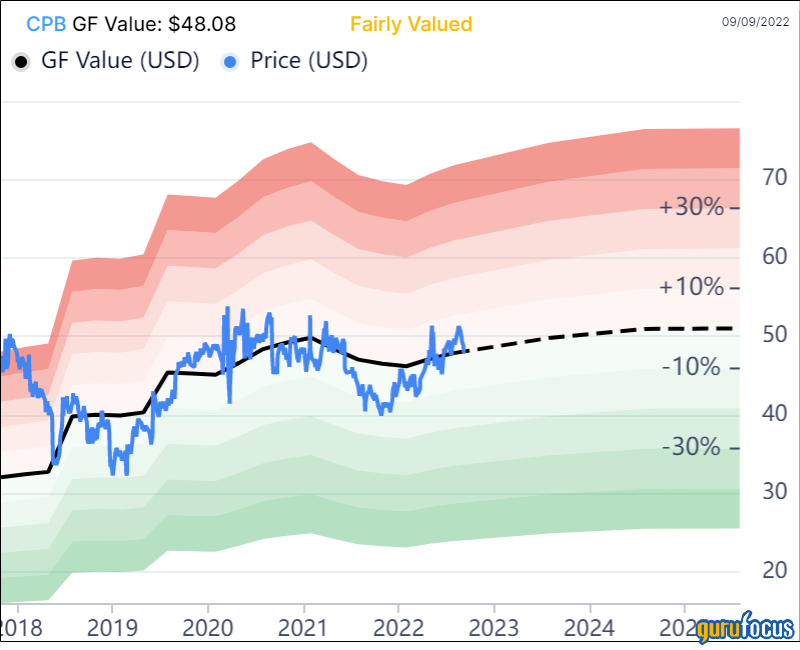

As noted by the chart below, at its current price of $47.87 per share, GuruFocus shows Campbell is fairly valued.

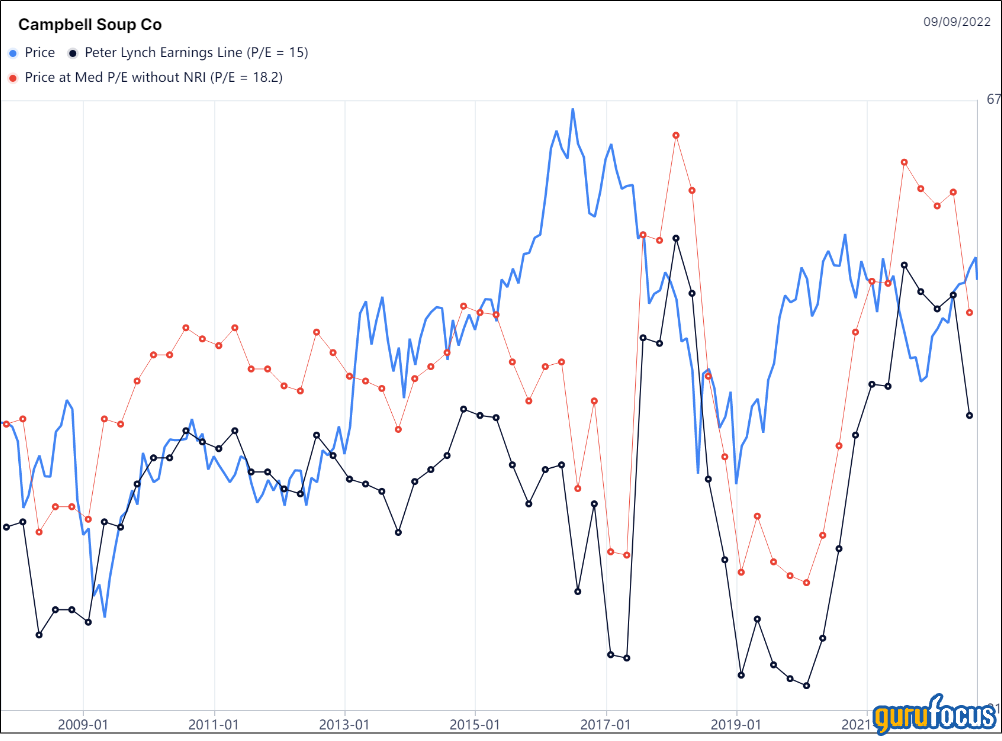

The Peter Lynch chart also indicates the company is approximately selling at fair value:

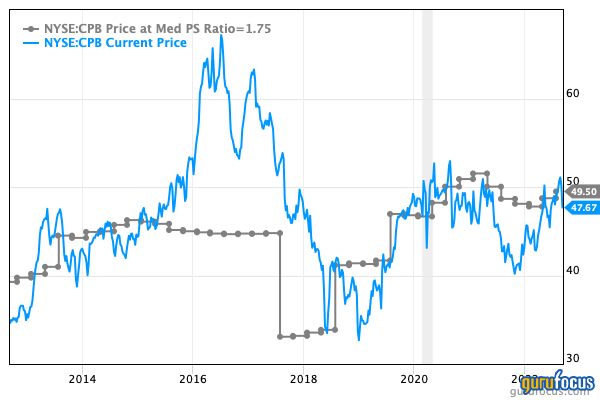

The price at Campbell’s median price-sales ratio indicates the company is slightly undervalued:

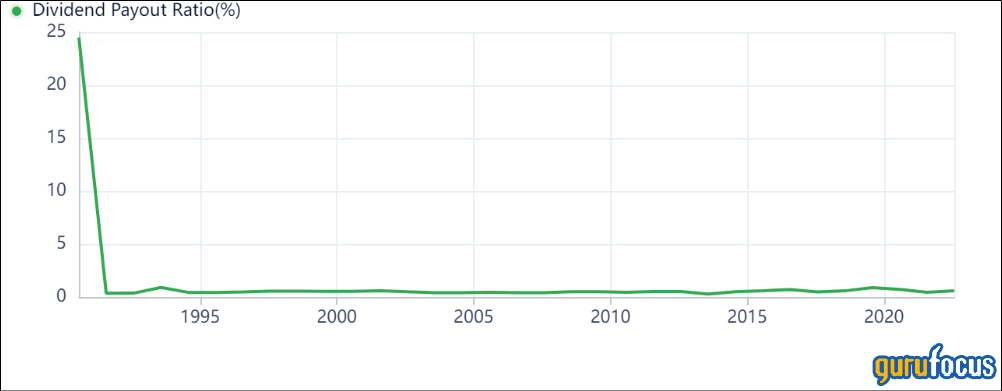

How safe is the company’s dividend for defensive investors seeking a modest yield with the continuing prospect of dividend growth? There have been no dividend reductions since 2013, nor, as the chart below indicates, for the dividend payout ratio. The company’s 10-year dividend growth rate is 5.2%.

The chart below shows the company’s dividend yield history:

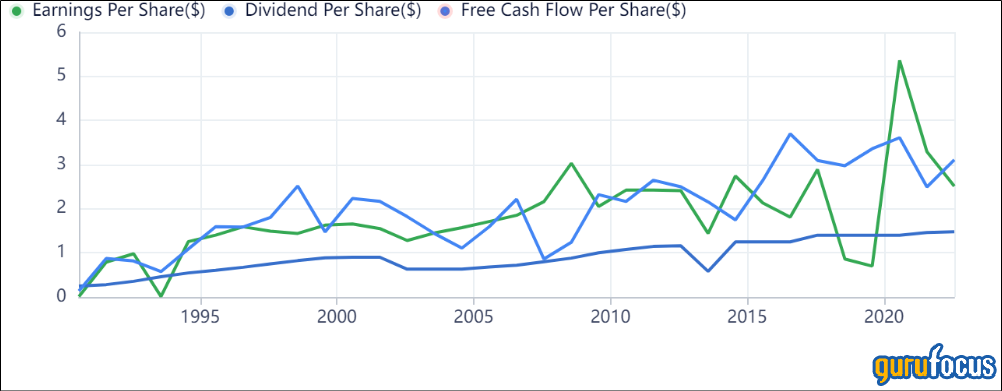

Another chart reveals Campbell’s dividend per share history. It indicates that both on a free cash flow and earnings per share basis, the company’s dividend is well covered.

Given its steady results in a difficult consumer market, I believe Campbell should continue to provide a relatively safe haven for defensive investors.