Micron Technology Inc. (MU, Financial) produces computer memory and computer data storage, including dynamic random-access memory, flash memory and USB flash drives. The company is the last remaining pure-play U.S.-based memory company and is the third-largest supplier of memory chips, including DRAM, NAND and NOR.

The company's chips support advanced technology trends, including artificial intelligence, 5G, machine learning and autonomous vehicles. Its chip brands include Crucial and Ballistix. Micron and Intel Corp. (INTC, Financial) together created IM Flash Technologies, which produces NAND flash memory.

Micron had historically focused on designing and manufacturing DRAM for personal computers and servers. It then expanded into the NAND flash memory market. The company increased its DRAM scale with the purchase of Elpida in 2013 and Inotera in 2016. The DRAM and NAND products are developed for PCs, data centers, smartphones, game consoles, automotive applications and other internet of things devices.

Semiconductors have a relatively short life and become obsolete when new and faster products are developed. This industry is very cyclical. The upturns occur during periods of high demand, which cause supply shortages, and the resulting tight supply leads to higher prices and strong revenue growth. The downturns are caused by excessive inventory buildups, which result in falling prices and negative or zero revenue growth.

The company has been public since 1984 and currently has a market capitalization of $60 billion. Micron is expected to generate $30 billion in revenue in 2022.

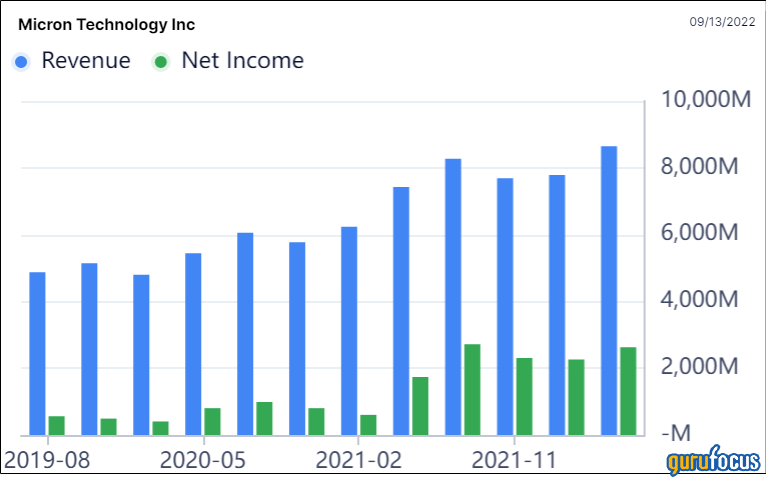

Financial results

On June 30, Micron reported its third-quarter operating results. For the period ended June 2, revenue increased 16.4% to $8.6 billion and gross profits improved to $4.1 billion from $3.2 billion in the prior-year period. Both net income and earnings per share increased in the mid-30% range.

The company spent $2.5 billion in capital expenditures and still generated $1.3 billion in free cash flow. Share repurchases totaled $981 million and the company ended the quarter with cash and investments of $12 billion and total debt of $7 billion.

In a statement, President and CEO Sanjay Mehrotra commented on the current environment.

"Recently, the industry demand environment has weakened, and we are taking action to moderate our supply growth in fiscal 2023," he said. "We are confident about the long-term secular demand for memory and storage and are well positioned to deliver strong cross-cycle financial performance.”

Valuation

Due to the cyclical nature of the microchip business, Micron often sells at low price-earnings ratios. Earnings per share estimates for the fiscal year ending August 2022 are $8.34 and for the following year, a decline is expected to $5.38. The current enterprise value/Ebitda ratio is 4.5 times based on estimates for this fiscal year. These are very low valuation ratios, but earnings in the chip business can turn suddenly in the wrong direction based on excess inventory or pricing issues.

The GuruFocus discounted cash flow calculator creates a value of $68 using next year's lower earnings of $5.38 per share as a starting point and a 5% long-term growth rate.

The company currently pays a small dividend of 46 cents on an annualized basis, which equates to a below-average 0.81% dividend yield. The current S&P 500 dividend yield is 1.69%.

Guru trades

Gurus who have purchased Micron stock recently include Ray Dalio (Trades, Portfolio) and Yacktman Asset Management (Trades, Portfolio), while those who have reduced their positions include PRIMECAP Management (Trades, Portfolio) and Julian Robertson (Trades, Portfolio).

Conclusion

Micron is facing some headwinds currently, which include weak consumer end demand in the areas of computers and smartphones, lingering effects of China lockdowns and slower commercial sales to large businesses. Earnings will likely decline in the next fiscal year.

However, that is likely priced into the stock after a 45% decline from recent highs. Investors with a long time horizon might find an attractive entry point currently as the next strong chip cycle could result in substantial gains, though some analysts do not expect this to occur until around 2024.

Become a Premium Member to See This: (Free Trial):