Walgreens Boots Alliance Inc. (WBA, Financial) operates the iconic drug store chains Walgreens in the U.S. and Boots in the U.K. The stock is now selling at close to 10-year lows, which could be an incredible value opportunity. However, a cheap stock can stay cheap forever if the company behind it never grows. The question for investors is, is Walgreens a value opportunity or a value trap?

Company background

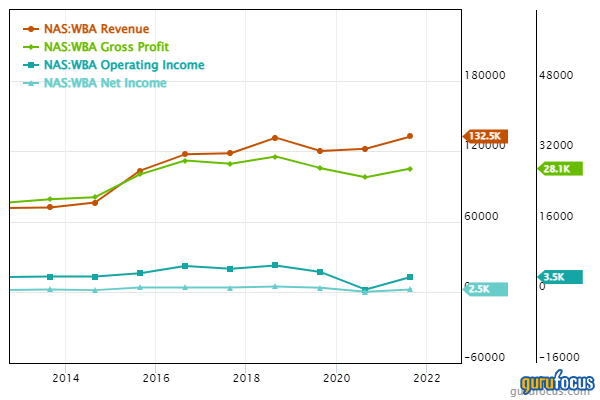

Walgreens Boots is know for the wide reach of its drug stores. It is one of the largest retail pharmacies in the world, with sales of $132.5 billion in 2021 and 12,996 retail store locations (69% are in the U.S., 18% in the U.K. and 13% in other countries). Walgreens Boots' operations are organized into two reportable segments: United States (85% of fiscal 2021 sales) and International (15%). Beginning in 2022, Walgreens Boots will report results under three segments: United States, International and Walgreens Health.

Walgreens Boots has an ~29% equity stake in AmerisourceBergen (ABC, Financial), one of the largest drug wholesale companies in the United States. Walgreens Boots and AmerisourceBergen initiated a strategic partnership back in 2013 and has been slowly expanding this alliance. As part of this partnership, Walgreens Boots sources branded and generic pharmaceutical products from AmerisourceBergen. AmerisourceBergen accounts for its stake in AmerisourceBergen using equity method accounting.

I have broken down the revenue and operating income by business segment in the following table:

| $ USD Millions (M) | Revenues (millions) | Operating Income (millions) | ||||

| Year | 2021 | 2020 | 2019 | 2021 | 2020 | 2019 |

| United States | 112,005 | - | - | 5,019 | - | - |

| International | 20,505 | - | - | 466 | - | - |

| Retail Pharmacy USA | - | 107,701 | 104,532 | - | 4,099 | 5,255 |

| Retail Pharmacy International | - | 10,004 | 11,462 | - | 130 M | 747 |

| Pharmaceutical Wholesale | - | 23,958 | 23,053 | - | 980 | 939 |

| Total | 132,509 | 141,663 | 139,046 | 5,485 | 5,209 | 6,941 |

Valuation

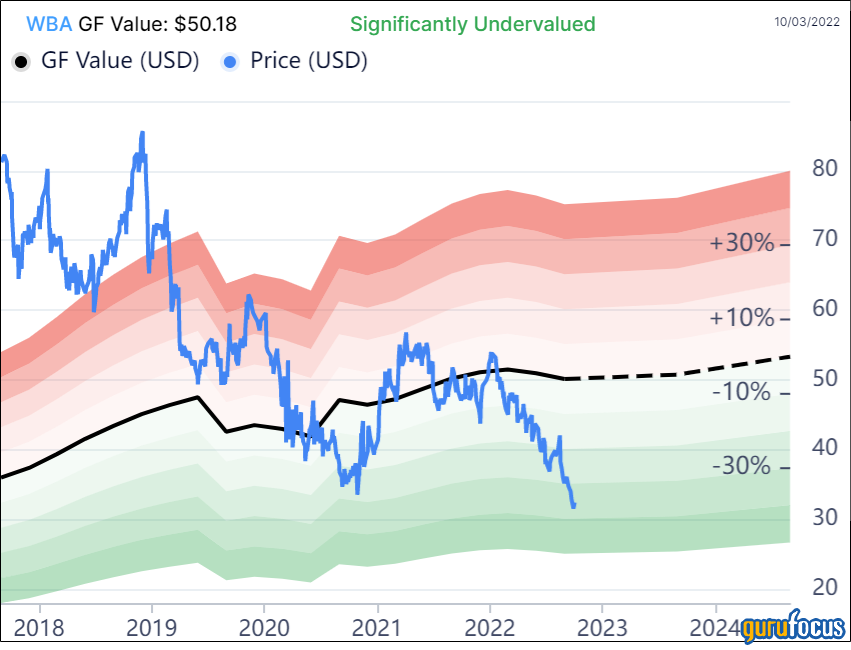

By looking at the stock price, one would assume that all is not well with this company:

Walgreens Boots is having trouble growing its business due to increasing competition from online pharmacies and retailers and the squeeze in reimbursement rates from Pharmacy Benefit Managers (PBMs), which adjudicate most prescriptions in the U.S. The question is, has the company permanently lost its competitive advantage? And if yes, has the market overreacted to the downside?

The problem is reflected in its operating earnings, which are declining because of the structural reasons described above.

Walgreen combined with Boots Alliance in a cross-Atlantic merger in 2014. The current structure of the company was formed on Dec. 31, 2014, after Walgreens purchased the 55% stake in Boots that it did not already own. The total price of the acquisition was $4.9 billion in cash and 144.3 million common shares with fair value of $10.7 billion).

Since then, growth has been erratic with challenges in profitability.

| WBA | Growth per share over six years |

| → | Aug. 2015 to Aug. 2021 |

| Revenue per Share | 7.7% |

| EBITDA per Share | -4.2% |

| EBIT per Share | -8.3% |

| Earnings per Share (Diluted) | -5.1% |

| Dividends per Share | 5.4% |

| Book Value per Share | -0.8% |

| Tangible Book per Share | -7.5% |

| Operating Cash Flow per share | 3.0% |

| Free Cash Flow per Share | 2.4% |

| Core FCF/share | 2.3% |

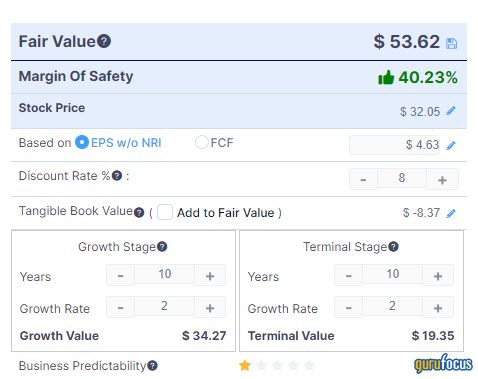

In spite of growth challenges, the company currently looks extraordinarily cheap with a forward price-earnings ratio of below 7. The GF Value chart is also flagging the stock as significantly undervalued. The GF Value is an intrinsic value estimate from GuruFocus that uses the stock's historical price multiples, past returns and analysts' estimates of future business performance.

Checking with the GuruFocus discounted cash flow (DCF) calculator with the following conservative parameters, I get a large margin of safety. For the earnings per share, I assumed analyst consensus estimates, a discount rate of 8% and growth of only 2%.

Business strategy

Nevertheless, Walgreens Boots will likely need to show some growth if this value is ever to be realized. To diversify outside the pharmacy business recently, Walgreens Boots announced a $5.2 billion investment in VillageMD, bringing its stake in the company to 63% from 30%. VillageMD currently operates 230 medical practices, 52 of which are colocated practices with Walgreens. The company expects the opening of 80 additional Village Medical at Walgreens locations in the next quarter, with 600 locations anticipated by 2025.

This partnership is a promising value proposition combining primary care with the company's strategic physical store-based advantage and convenience-oriented nature (about 75% of the U.S. population lives within five miles of a Walgreens store).

Also, in 2021, Walgreens Boots sold the majority of its mostly European wholesale distribution business (Alliance Healthcare) to AmerisourceBergen for $6.5 billion ($6.275 billion cash and 2 million shares of stock). This deal should deliver synergies for both companies and help Walgreens Boots free up resources to accelerate investments in it core retail pharmacy segment, which has been facing competition from other traditional retail pharmacies and new online entrants.

Dividend and margin of safety

Walgreens Boots is currently paying a 5.89% dividend yield and has also been buying backs stock (with a three-year share buyback ratio of 3.1%). The balance sheet is in good shape with a debt-to-equity ratio of 1.42. The company produces excellent free cash flow. It is trying to evolve its business model from a drug store to more of integrated primary care provider, and the jury is still out whether it will succeed. However, there is a large margin of safety at the current price for the company's shares, and the dividend is there in the meantime.