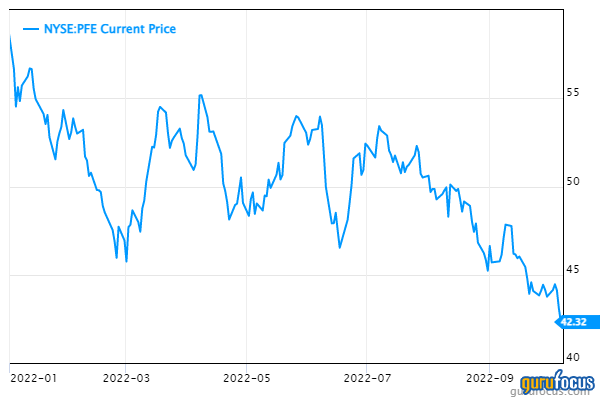

Shares of health care giant Pfizer Inc. (PFE, Financial) have fallen 25% year-to-date and currently sit 3% above the stock’s 52-week low. The decline in the share price is slightly ahead of the 23.64% decrease in the S&P 500 Index.

While the stock hasn’t been doing well this year, it is actually very much ahead of the 47.61% decline in the overall health care sector for 2022.

Leaving the stock price aside, Pfizer as a company has performed extremely well the past few quarters. It is now trading well below its GF Value and its historical valuation levels. The stock also pays a generous dividend yield that appears to be very safe. Here's why I think Pfizer could be very appealing to investors looking for a combination of growth and income.

Company background and recent results

Pfizer is a health care giant with a market capitalization of $238 billion. The company generated sales of $81 billion in 2021. Following several spinoffs of its over-the-counter and off patent businesses, Pfizer is now primarily focused on the pharmaceutical and vaccine industries.

Pfizer last reported earnings results on July 29, where the company’s revenue grew 46% to $27.7 billion for the second-quarter. This was $1.54 billion above what analysts had expected. Adjusted earnings per share of $2.04 almost doubled from the prior year’s result of $1.07 and was 26 cents better than anticipated.

A good portion of the year-over-year growth was from the company’s Covid-19 products, including the vaccine Comirnaty and the anti-viral drug Plaxlovid. Sales for Comirnaty grew 20% on a currency natural basis to $8.8 billion and had 63% market share, which was up from 52% in January. Plaxlovid generated revenue of $8.1 billion and had a staggering 91% market share, which is close to the average since the end of the first quarter.

Also in the area of vaccines, the Prevnar family had sales growth of 15% to $1.4 billion. Eliquis, which Pfizer shares with Bristol-Myers Squibb Company (BMY, Financial), improved 18% to $1.7 billion. In rare diseases, Vyndaqel/Vyndamax was up 10% to $552 million.

There were some mild declines compared to the prior-year period. In oncology, Ibrance fell 3% to $1.3 billion, but revenue grew 1% in the U.S., marking the first quarterly growth since the end of 2020. Volume in the region was higher by 3%. Xtandi was lower 4% by $290 million.

Pfizer offered revised guidance for the year, with the company expecting adjusted earnings per share of $6.30 to $6.45 for 2022 compared to a prior range of $6.25 to $6.45. At the midpoint, this would be a 44% improvement from the prior-year quarter.

A good portion of this projected growth is due to the company’s Covid-19 vaccine and anti-viral drug, which should decrease somewhat going forward. However, analysts surveyed by Morningstar (MORN, Financial) expect earnings per share without non-recurring items of $4.96 for 2023, which would be a record for Pfizer outside of what is expected for the current year.

Takeaways

Covid-19 remained a tailwind for Pfizer during the most recent quarter, with more than $16 billion of revenue from sources related to treating the virus. This will eventually lessen somewhat as more people worldwide receive the vaccine, though booster shots will probably be provided for some time. The appearance of different variants will likely mean that Covid-19 remains with us in some form for the next several years.

The positive for Pfizer is that its vaccine has a sizeable market share and its anti-viral is the most used in the world. Usage for Paxlovid among international developed markets was up 116% from the prior year, showing that there remains a strong demand for the product. Morningstar analysts peg annual sales of Paxlovid at $20 billion for 2022, but that the drug will then contribute nearly $2 billion in annual revenue in the ensuing years.

At the same time, most of Pfizer’s core products are showing growth. For example, Eliquis is the top name in blood clot prevention and has peak sales estimates approaching $19 billion. Prevnar benefited from an increase in market share and a strong uptick in adult revenue in the U.S.

Pfizer also has an extensive pipeline as the company has more than 100 products in trials or registration as of the most recent quarter. The pipeline consists of 34 products in both phase 1 and phase 2 trials, 28 in phase 3 trials and eight in registration. The products address all areas that Pfizer has a presence, including inflammation and immunology, internal medicine, oncology, rare disease and vaccines. This robust pipeline should provide Pfizer will products to continue to fuel growth.

In addition, Pfizer has not been shy about bolstering its existing businesses through the use of strategic acquisitions. Earlier this month Pfizer announced it completed its nearly $12 billion purchase of Biohaven Pharmaceutical Holding (BHVN, Financial) for its migraine therapy treatment.

Shortly after this transaction was completed, Pfizer completed its acquisition of Global Blood Therapeutics (GBT, Financial). The $5.4 billion purchase strengthens the company’s positioning in the treatment of sickle cell disease.

Finally, estimates for Pfizer beyond the current year show that analysts project that the company will be able to continue to see strong business results even as Covid-19 revenue is further in the rearview mirror. The added cash flow infusion will allow the company to further invest in its pipeline and make strategic acquisitions in order to propel future growth.

Dividend analysis

The added cash flow will also benefit the company's dividend. Pfizer has paid a dividend every year since 2011. The company did cut its dividend in 2009 and 2010 as it digested its almost $70 billion acquisition of Wyeth. The dividend has a CAGR of 6.6% since 2012. Shares yield 3.8% as of Friday’s close, which is slightly above the stock’s 10-year average yield of 3.6% and more than twice the average yield of 1.75% for the S&P 500.

Even better, Pfizer’s dividend looks very safe. The company distributed $1.56 of dividends per share in 2021 while earning $4.42 per share for a payout ratio of 35%. This year, shareholders will receive a $1.60 per share, equating to a projected payout ratio of 25%. For context, Pfizer has an average payout ratio of 48% since 2012.

The free cash flow payout ratio looks very strong as well. The company distributed $8.867 billion of dividends over the last 12 months while generating free cash flow of $28.44 billion for a payout ratio of 31%. This compares to the average free cash flow payout ratio of 39% since 2018.

It should be noted that free cash flow has exploded over the last two years, thanks in part to Covid-19 related products. Free cash flow was still solid prior, ranging from $10 billion to $13.6 billion pre-2020, but dividends consumed the majority of it. If, as predicted by the company and analysts, Covid-19 will still be a tailwind to results over the next few years, then free cash should remain at somewhat elevated levels. Perhaps dividend growth, which has slowed over the past three years, will be closer to its long-term average now that Pfizer is flush with cash.

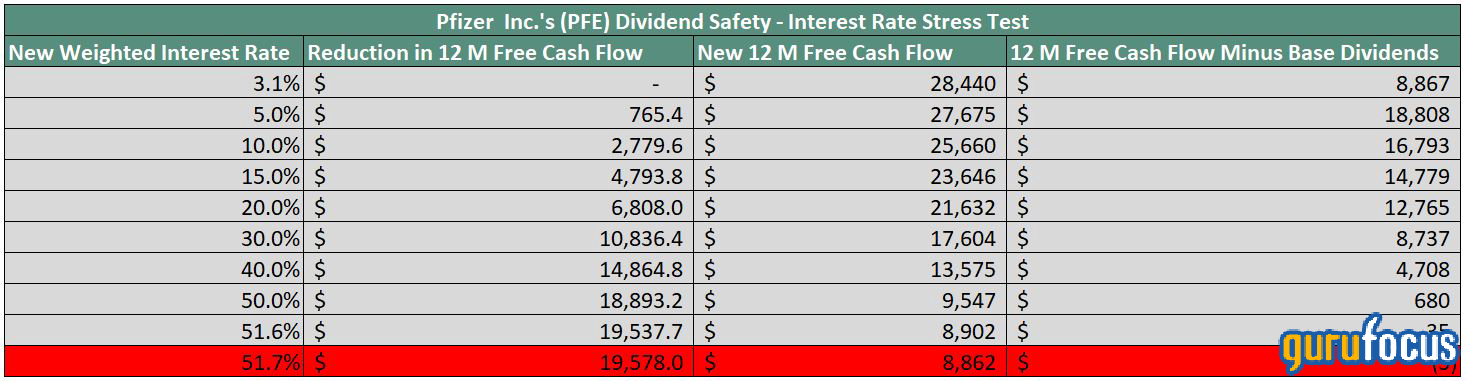

Debt doesn’t appear to have much impact on the company’s ability to continue to pay its dividend. Pfizer paid interest expenses of $1.254 billion over the last year. Total debt stood at $40.284 billion at the end of the most recent quarter for a weighted average interest rate of 3.1%.

Below is how high the company’s weighted average interest rate would need to reach before free cash flow no longer covered dividend payments.

Source: Author’s calculations

As you can see, Pfizer’s weighted average interest rate would need to soar above 51.6% for the dividend to be in jeopardy from a free cash flow perspective.

Valuation analysis

Turning to valuation, Pfizer appears to be very undervalued using the GF Value chart:

Pfizer closed Friday's trading session at $42.32. The stock has a GF Value of $87.74, giving shares a price-to-GF-Value ratio of 0.48. Reaching the GF Value would mean a 107% return from current levels. GuruFocus rates the stock as significantly undervalued.

Using 2022 and 2023 earnings estimates, Pfizer trades with forward price-earnings ratios of 6.6 and 8.3, respectively. Excluding 2015, 2016 and 2020, when valuations were extremely high, Pfizer has an average price-earnings ratio of slightly more than 17 since 2012.

A fair value range of 14 to 16 times earnings seems appropriate in my opinion given the tailwinds benefiting the company and takes into account the stock’s historical valuation. This results in a price target range of $89 to $102 using this year’s earnings estimates. Looking for a more conservative estimate, investors might want to use next year’s estimates, which result in a price target range of $71 to $81 and would still provide considerable upside potential from the current price.

The GF Score of 90 out of 100 results from high marks for momentum, growth, GF Value and profitability and middle-of-the-road marks for financial strength.

Pfizer’s profitability rank is an 8 out of 10, driven by operating and net margins and returns on capital, assets and equity that are better than at least 94% of the more than 1,000 companies in the drug manufacturers industry. Outside of net margin, these marks are among the best in the last decade for Pfizer.

The company’s financial strength rating is 7 out of 10. Debt levels have remained relatively steady over the last decade. Interest coverage is adequate, though below the majority of the industry. That said, the interest coverage ratio of 25.7 is the best that Pfizer has had in the last 10 years. The Piotroski F-score of 7 out of 9 reflects the soundness of Pfizer’s financial position. The return on invested capital of almost 19% greatly outweighs its weighted average cost of capital of 5.6%, showing that value is being created from the company’s investments in its business.

Final thoughts

Health care has been a tough place to invest this year. Even Pfizer’s stock has declined, but not nearly to the degree that the sector has experienced.

The company has posted strong results, driven by Covid-19 related revenues. This isn’t the whole story as Pfizer’s core products have largely seen growth. The company has also made acquisitions to reinforce its positioning in certain areas and should have the cash flow to continue to pay and raise its generous dividend.

The stock is also trading at a steep discount to its GF Value and historical valuation levels, which could mean the potential for capital gains to go along with a market-beating yield. This could make Pfizer an attractive option for value and income investors alike.