When the stock price of a company falls, it could either indicate a value opportunity or a value trap. It can be difficult to tell the difference, which means value investors have our work cut out for us just deciding on which opportunities deserve further research.

One sign value investors can use to help identify potential value opportunities is insider buying. Insiders such as CEOs and chief financial officers are very familiar with how their companies operate and are often privy to information that is not available to retail investors. When insiders buy shares of their companies on the open market, it could mean they see the stock as undervalued (though this is by no means guaranteed).

According to GuruFocus insider trade data, a Premium feature, these three S&P 500 stocks have been bought by their respective CEOs over the past three months.

Intel

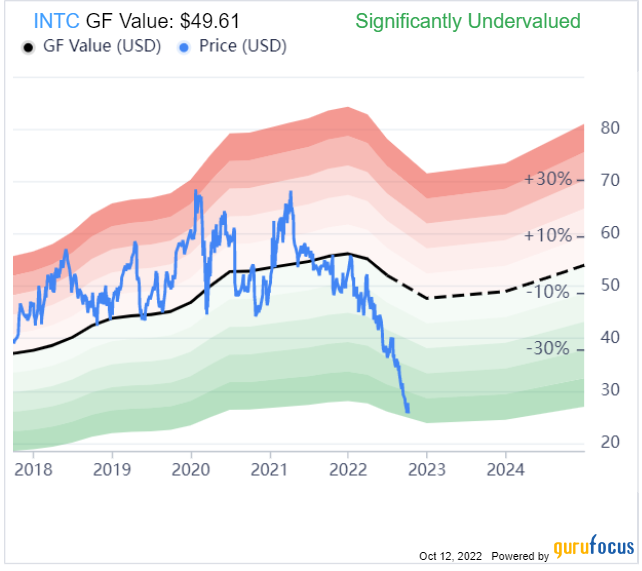

On Aug. 24, the CEO of Intel Corp. (INTC, Financial), Patrick P. Gelsinger, purchased 14,800 shares of his company’s stock, bringing his total number of shares owned to 210,481. On the day of the trade, shares changed hands for an average price of $33.86.

Since then, shares are down 25% to $25.33 as of this writing. The GF Value chart rates the stock as significantly undervalued.

Other insiders that have been buying Intel shares in 2022 include director Omar Ishrak and Executive Vice President and CFO David Zinsner. The chart below shows insider buying and selling of the stock for the past couple of years; we can see a big spike of insider buying in October 2021.

Intel is a divisive name among the value investing community. This fallen giant has lost the near-monopoly that it once held over the PC processor market, which has been a huge blow both to its growth and its valuation. Now, it is trading cheap with a price-earnings ratio of just 5.43 compared to its historical median of 12.73, but it needs to return to growth. Intel is pinning its hopes for future growth on financial incentives provided by the U.S. government to build domestic semiconductor fabrication facilities (also known as "fabs"). Intel previously closed down its last U.S. fab in 2008 to take advantage of cheaper labor in other countries, but government incentives could make domestic fabs a worthwhile investment again. While success could indeed return Intel to growth, a large part of this thesis relies on favorable government policy.

Fastenal

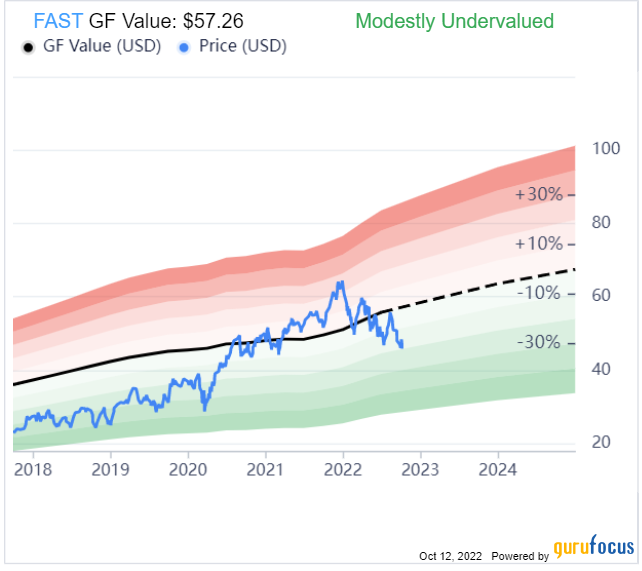

The CEO and president of Fastenal Co. (FAST, Financial), Daniel L. Florness, bought 5,000 shares of his company on Sept. 15, bringing his total number of shares owned to 303,271. Shares traded around $47.85 apiece on the day of the trade.

Since then, the stock has dropped 4% to trade at $45.81 as of this writing. According to the GF Value chart, the stock is modestly undervalued.

Other insiders that have been buying Fastenal shares recently include directors Sarah N. Nielsen and Michael J. Ancius. The chart below shows there has been an uptick in insider buying this year. Interestingly, insider selling seems to have declined at the same time.

Fastenal is a distributor of a wide range of industrial and construction products and tools. The competition in this industry is tough, especially with the advent of e-commerce, and Fastenal has been forced to close approximately 18% of its physical store locations since 2013. Even so, the company has managed to keep growing its top and bottom lines as well as its dividend thanks to its shift to a vending machine model. Fastenal’s vending machines offer on-site convenience and keep costs low, both of which are strong competitive advantages.

Sealed Air

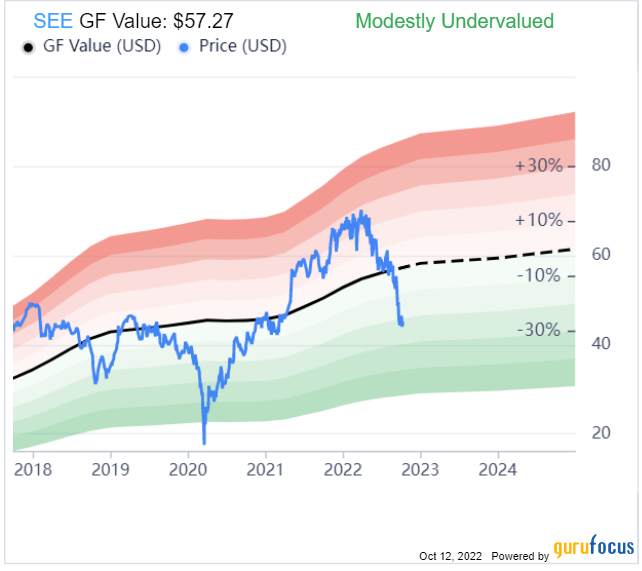

Edward Doheny, the president and CEO of Sealed Air Corp. (SEE, Financial), bought 4,500 shares of his company on Aug. 3, bringing his total holding to 517,092 shares. The stock price averaged $56.95 on the transaction date.

Since then, the stock has lost 20% to trade at $45.40 as of this writing. The GF Value chart rates the stock as modestly undervalued.

There were three other insiders buying the stock in August: Senior Vice President Sergio A. Pupkin, director Henry R. Keizer and Senior Vice President and Chief Operating Officer Emile Z. Chammas. Aside from these trades, no other insiders have bought or sold the stock on the open market since the end of 2020.

Sealed Air is the packaging company that owns Cryovac food packaging and Bubble Wrap cushioning packaging. This stock often flies under the radar due to the boring nature of its business, but safe, effective and efficient packaging solutions are key parts of the supply chain in any industry that requires moving goods from point A to point B, including packaged foods, health care products, consumer goods, e-commerce and more. Following promising investments in automation and waste reduction, the company could be poised to increase its market share.