Like humans, animals also need medicine, vaccines, diagnostics, devices, supplements and doctors (veterinarians). The animal health industry has been growing organically at a pace of about 5% to 7%, and related stocks have also enjoyed volume and price increases of about 2%. Altogether, animal health products and services total $150 billion of global sales. The animal health market for medicine and vaccines alone is around $34 billion. This market can be broadly broken down into companion animals (31%) and livestock (69%).

Following in a list of the largest animal health pharmaceutical companies operating globally.

- Zoetis Inc. (ZTS, Financial)

- Elanco Animal Health Inc. (ELAN, Financial)

- Boehringer Ingelheim Animal Health

Among these three, I like Elanco because it is a publicly traded stock that appears to be undervalued by my estimates. Sure, it's under-earning at the moment, but it has great potential if it executes well and can reduce debt, and its current weakness could provide a value opportunity.

Animal health market overview

The animal health market serves both food animals (livestock) and companion animals (pets).

The livestock market includes the animals we use for food – cattle, swine, poultry, sheep and fish. The rapid growth in the world population has resulted in an increasing demand for livestock. Notably, with the increased standard of living in developing markets, dietary changes have resulted in increased meat and dairy consumption. The world’s population is estimated to reach 9.7 billion by 2050, an increase of 2 billion from today, and therefore the global livestock herds are growing with it.

Companion animals are pets that people adopt. Pet adoptions are growing with approximately 68% of U.S. households owning at least one pet in 2018. This is up from 56% in 1988. The upward trend in pet ownership and adoption has contributed to a greater portion of discretionary income being spent on pets.

Spending on U.S. veterinary care has grown at a 4.5% CAGR since 2012, as common vaccines for animals including rabies, hepatitis and pink eye all exist to protect animal health. Regular visits to veterinary clinics for check-ups and treatments have become increasingly important for pet owners. This trend is expected to rise as emerging markets are also expected to show significant growth in pet ownership.

Within the fragmented animal health industry, there are only a handful of large players. Many of the largest animal health businesses were originally divisions of larger pharmaceutical companies. For example, Zoetis was the result of Pfizer’s (PFE, Financial) 2013 spin-off of its animal health division and Elanco was a spin-off from Eli Lilly (LLY, Financial) in 2018.

About Elanco

In the animal health industry, there are a few players that are vying for bigger market shares – this especially goes for pharmaceutical companies. This is where Elanco's growth potential lies. This animal health company is now the second largest player in the industry. Elanco has a market cap of $5.49 billion and an enterprise value of $11.10 billion.

Elanco was spun out of Eli Lilly in 2018 as an IPO. At that time, 72.33 million shares were sold to the public at an average price of $24.00 per share. The shares are now at less than half the IPO price.

After two years of operating as a standalone company, Elanco acquired Bayer Animal Health in August 2020, marking the largest acquisition in the animal health industry history. This addition has allowed it to expand its portfolio to provide a larger set of animal health solutions, equally split between pet health and farm animals. With the Bayer acquisition, Elanco has become the second largest animal health pharmaceutical company.

In 2021, the company launched eight new products across pet health and farm animals. Additionally, it advanced its opportunities to access the fast-growing pet dermatology market through the acquisition of KindredBio on Aug. 27, 2021, adding three potential pipeline blockbusters with launches anticipated by 2025. The company also secured full ownership of the canine parvovirus therapy that is currently in development.

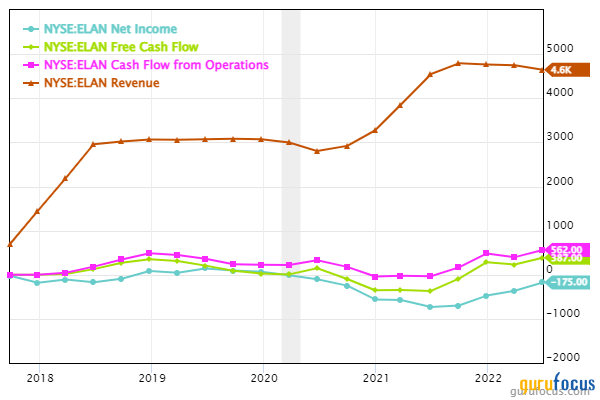

The following chart shows Elanco's revenue, net income and cash flows. The company is currently not profitable on a GAAP basis owing to large asset impairment and amortization and depreciation charges, but the company is generating positive operating and free cash flow. I believe GAAP accounting hides the potential of this company and investors should focus on cash flow.

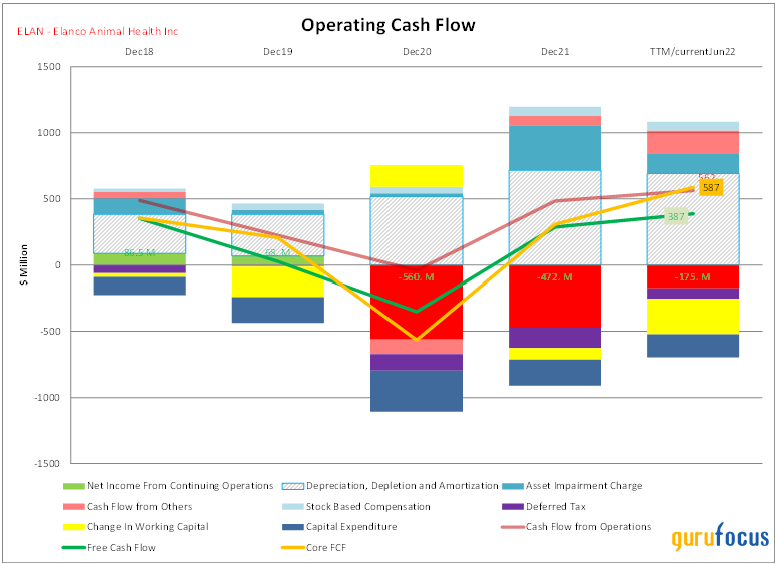

A more detailed look at the cash flow can be seen in the chart below. The core cash flow (which nets out changes to working capital and represented by the orange line) is quite good at $587 million on a trailing 12-month basis.

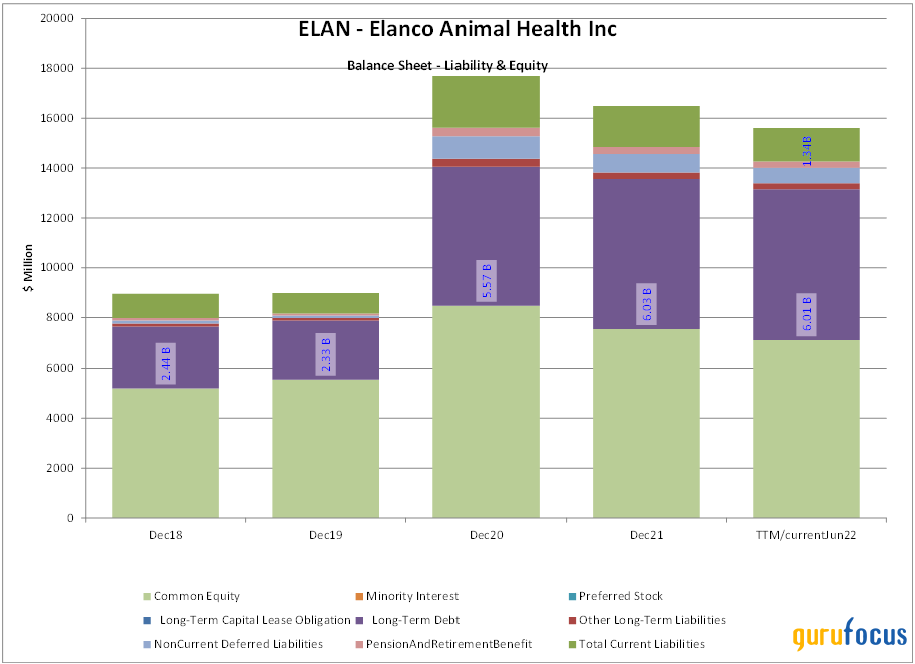

As mentioned above, Elanco acquired Bayer's animal health business in 2020 using a combination of equity and debt. Due in part to this, the company has over $6 billion of long term debt. In spite of the large debt load, debt servicing does not appear to be a large issue as company generate healthy cash flow as seen in the above cash flow chart. The following chart presents Elanco's liability and equity side of the balance sheet.

GuruFocus reports an effective interest rate on debt of 4.39% for the company in the last quarter. However, this is likely to grow as financing is renewed, so paying off debt needs to be a higher priority for Elanco.

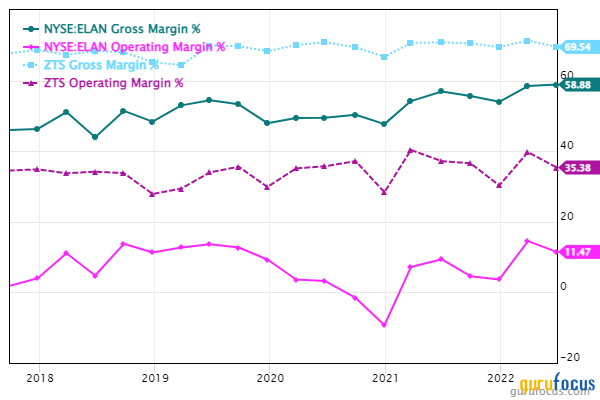

Another thing of note is that Elanco's gross and operating margins are quite a lot lower than its larger competitor Zoetis. This means Elanco is under-earning and has a large opportunity for improvement.

Comparison with competitors

The animal health industry has attractive fundamentals, like the relatively inelastic demand profile for its products and services, the cash-pay nature of the business, the lack of intermediaries exhibiting formulary and price control like you have in the human health industry and a low level of generic product adoption. The industry structure is oligopolistic, with pricing power and regulatory barriers to entry being high, which prevents easy entrance for new players. Companies have to develop deep expertise to play in this field effectively.

Warren Buffett (Trades, Portfolio) has said the following about businesses in general, according to "The Essays of Warren Buffett (Trades, Portfolio):

“I've said many times that when a management with a reputation for brilliance tackles a business with a reputation for bad economics, it is the reputation of the business that remains intact.”

Taking this thought a step further, it seems animal health pharmaceuticals is a business area with great economics. If Elanco's management proves itself to be at least a little better than mediocre, I think it should do quite well. While Elanco has an established and global business, the company as an independent entity is relatively new and management is untested.

Investors have heavily sold down the stock due to a combination of unfamiliarity and poor initial performance. The following table compares Elanco with its major U.S. peers IDEXX Laboratories (IDXX, Financial) and Zoetis. Elanco compares favorably in key metrics like the price-sales ratio. This shows that Elanco has great potential. However, investors will require patience as the company strives to catch up to the competition.

| Ticker | Company | CurrentPrice | Market Cap($M) | EnterpriseValue ($M) | Revenue($M) | Cash Flow fromOperations | Free CashFlow | PE Ratio | PB Ratio | PS Ratio | Price-to-Operating-Cash-Flow | Price-to-Free-Cash-Flow | EV-to-EBITDA |

| ELAN | Elanco Animal Health Inc | 11.91 | 5,634.84 | 11,169.51 | 4,646 | 562 | 387 | At Loss | 0.82 | 1.26 | 10.29 | 14.96 | 15.39 |

| IDXX | IDEXX Laboratories Inc | 326.34 | 27,159.86 | 28,416.56 | 3,308 | 577 | 429 | 42.09 | 59.56 | 8.45 | 48.56 | 65.44 | 29.66 |

| ZTS | Zoetis Inc | 146.92 | 68,575.28 | 72,352.31 | 7,995 | 1,977 | 1,429 | 33.21 | 15 | 8.66 | 35.21 | 48.70 | 22.44 |

The following table provides Elanco's profit margins vis-a vis its peers and reinforces the large gap the company needs to catch up on:

| Ticker | Company | Gross Margin% | OperatingMargin % | Net Margin % | EBITDA margin | FCF Margin% |

| Result | ||||||

| ELAN | Elanco Animal Health Inc | 56.80 | 8.74 | -3.77 | 15.65 | 8.33 |

| IDXX | IDEXX Laboratories Inc | 58.70 | 25.77 | 20.07 | 29.08 | 12.97 |

| ZTS | Zoetis Inc | 70.23 | 35.51 | 26.14 | 40.48 | 17.87 |

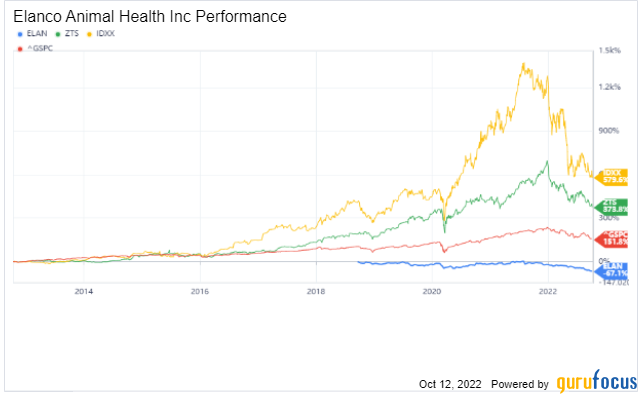

Zoetis and IDEXX have outperformed the S&P 500 by a wide margin over the last 10 years, while Elanco has underperformed. Given the trajectory of the business I think the company has a lot of potential to catch up.

Also check out: