The latest inflation numbers for the month of September have been eagerly anticipated. On Oct. 13, this data point was released, showing that the inflation rate was 8.2% for September. Mainstream news outlets will tell you to run for the hills, as inflation came in hot yet again. However, I think it makes sense to take a step back and look at the overall trend.

U.S. inflation peaked in June 2022 at 9.1%. In July it dropped to 8.5%, and by August it was 8.3%. In September the downward trend continued with the 8.2% reported, though this was still above analyst forecasts of 8.1%. This is a key point to realize as inflation is not just about the absolute data, it is also about inflation expectations. If businesses expect high inflation, they will likely raise prices, which may actually cause even higher inflation. This is a dangerous part of human psychology and a tactic Federal Reserve chairman Jerome Powell warned against.

If we dive into the granular makeup of the inflation numbers, we can see this is governed by the CPI, or Consumer Price Index. This is basically a basket of everyday goods and commodities that have their prices tracked against historic levels. For example, the energy part of this index increased by a substantial 19.8% in September which was extremely high but lower than the 23.8% rate in August. This was mainly driven by rising gasoline, electricity and oil prices. A large part of these increases were due to the psychology of fear rather than supply and demand.

The fact that energy prices are driving a significant portion of inflation is fascinating. In light of this, I want to take a closer look at a stock Warren Buffett (Trades, Portfolio) has been aggressively buying over the past couple of quarters: Occidental Petroleum (OXY, Financial). With energy driving inflation, is this Buffett's way to combat inflation?

Buffett has been buying this stock

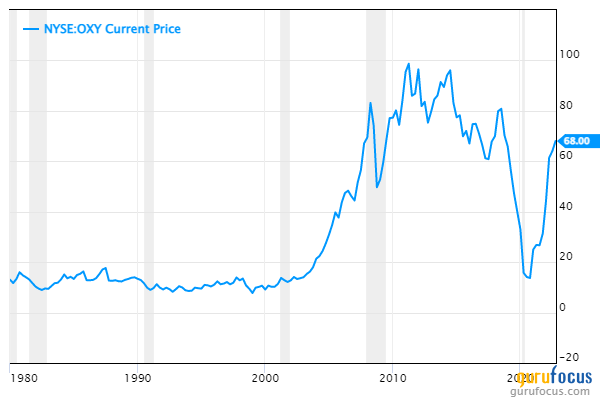

Buffett was relatively conservative during the pandemic market crash, and many people said he had “lost his touch." However, Buffett has been aggressively buying stocks in 2022 when the rest of the market has been fearful. In particular, Berkshire Hathaway (BRK.A)(BRK.B) has been continually loading up on shares of Occidental Petroleum in the second and third quarters of 2022. Buffett has paid an average price of between $58 and $61 per share during his shopping spree, based on average prices during the trade dates. Berkshire now owns over 278 million shares of Occidental with a value of nearly $19 billion. Buffett owns 29.87% of all the company's shares outstanding, so I think it is safe to say he is extremely bullish on the stock. There are rumors that he may even acquire the entire company.

About Occidental

Occidental Petroleum is an oil and gas exploration and production company, so it directly benefits from higher oil prices. The West Texas Oil Index currently trades ~$88 per barrel, which is down from the $120 per barrel high in June but is still higher than the $59 per barrel pre-pandemic level. In addition, global energy uncertainty driven by the Russia-Ukraine war has also caused the market to stay on high alert.

Occidental Petroleum operates across three business segments; Oil and Gas, Chemical and Midstream marketing. Its flagship oil and gas segment runs exploration and production operations globally. Oil companies tend to calculate an av erage cost for oil production, for example ~$40 per barrel, and they make profits if they can realize an average sales price above this level. With oil prices above $88 at the time of writing, the company is poised to bring in huge profits.

The business is also well-diversified internationally with setups in the U.S. split between New Mexico, Texas and Colorado and global operations in the Middle East and North Africa. Its business is also diversified through product types which range from oil to natural gas and natural gas liquids (NGL). This is especially important given the recent explosions at the Nordstream gas pipeline which connects Russia to Europe. U.S. gas could be a key answer to this supply problem,.

Occidental has the benefit of mixture of production types which include both long-cycle and short-cycle operations. With inflation still at high rates, it's important to identify businesses that invested into exploration already. In this case, Occidental is a prime candidate as it has many “long cycle” operations around the Gulf of Mexico already producing oil.

The company develops a mixture of short cycle and long cycle opportunities, which offer diversification of production. Occidental also owns other parts of the oil and gas production chain through its investments in pipeline companies such as Western Midstream Partners (WES, Financial). Its Chemical business OxyChem adds further diversification to the products as it uses waste from fuel production to create and sell chemicals.

Financials and cash flow

Occidental Petroleum generated soild financial results for the second quarter of fiscal 2022. The company generated revenue of $10.74 billion, which beat analyst consensus estimates by $963 million. Overall earnings per share was $3.47 for the second quarter, which beat analyst estimates by $0.47 per share.

By segment, the company's Oil and Gas segment generated pre-tax income of $4.1 billion, which was up substantially from the $2.9 billion generated in the equivalent quarter last year.

The Chemical segment generated record pre-tax earnings of $800 million, which was driven by higher product demand. However, ironically, this was partially offset by higher energy costs, which raise production input costs.

The Midstream marketing segment generated pre-tax income of $264 million. This includes a healthy gain of $96 million from some derivative hedging.

Occidental generated monster free cash flow of $4.2 billion (before working capital) in the second quarter, which was a record for the business.

During the Berkshire Hathaway shareholder meeting in 2022, Buffett stated that identifying businesses with “low capex” or pricing power is the key to combating inflation. In this regard, Occidental had capital spending of $972 million in the quarter, which is manageable given the strong cash flow. Occidental also has temporary pricing power from rising oil prices.

Occidental has been strategically using its excess cash flow to reduce the debt. The company repaid $4.8 billion of debt, which is a staggering 19% of the outstanding debt. The company has $1.36 billion in cash and short-term investments, which is solid given the current profitability. The company also pays a dividend of 0.76%, which is better than nothing, although I was expecting higher for an oil company currently raking in the dough.

Valuation

In order to account for the business' debt, I will use the enterprise-value-to-Ebitda ratio to value Occidental as opposed to the price-earnings ratio. The stock trades at an enterprise-value-to-Ebitda ratio of 3.99, which is 45% cheaper than its five-year average rate of over 7.

Occidental trades at a mid-single-range enterprise-value-to-Ebitda ratio (red line) which is about the middle of the pack compared to other companies in the sector. For example, Exxon Mobil (XOM, Financial) trades at a higher enterprise-value-to-Ebitda ratio of 5.82.

Final thoughts

Occidental Petroleum has turned out to be a tremendously successful investment and an ideal inflation hedge as oil prices have skyrocketed. The business' stock has been aggressively bought by Buffett, whose investment firm now owns nearly one-third of the company. The stock is not exactly cheap, but it does look to be fairly valued, and given the global energy uncertainty, I think there could be further upside potential ahead.

Also check out: