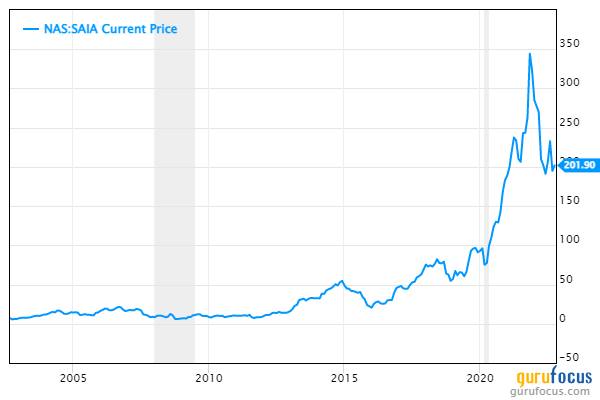

When earnings go up, the stock price goes down. That’s the 2022 story in a nutshell for Saia Inc. (SAIA, Financial), a less-than-truckload transportation company. Indeed, its earnings have grown at an average clip of 25.66% per year over the past 10 years. Yet the share price began dropping late last year and still hasn’t recovered, creating a rare margin of safety.

About Saia

Saia is a transportation company that specializes in LTL, or less-than-truckload services, i.e., shipments between 400 and 10,000 pounds. According to its website, the company handles more than 30,000 daily shipments, using 185 terminals and employing 12,000 people. It serves the contiguous U.S. as well as Alaska, Hawaii, Puerto Rico, Canada and Mexico.

Initially formed in 1924, it has been expanding both through organic growth and acquisitions. It has two operating groups: Saia Logistics Services and LinkEx.

For LTL carriers, technology is a key part of the business model. In its 10-K for 2021, Saia explained, “LTL carriers typically pickup numerous shipments, generally ranging from 100 to 10,000 pounds, consolidate them at local carrier-operated freight terminals and then transport the shipments from the terminal to the carrier-operated destination terminal for delivery to the ultimate destination. As a result, LTL carriers require expansive networks of pickup and delivery operations around local freight terminals and linehaul operations to transport freight between the local terminals.”

Competition

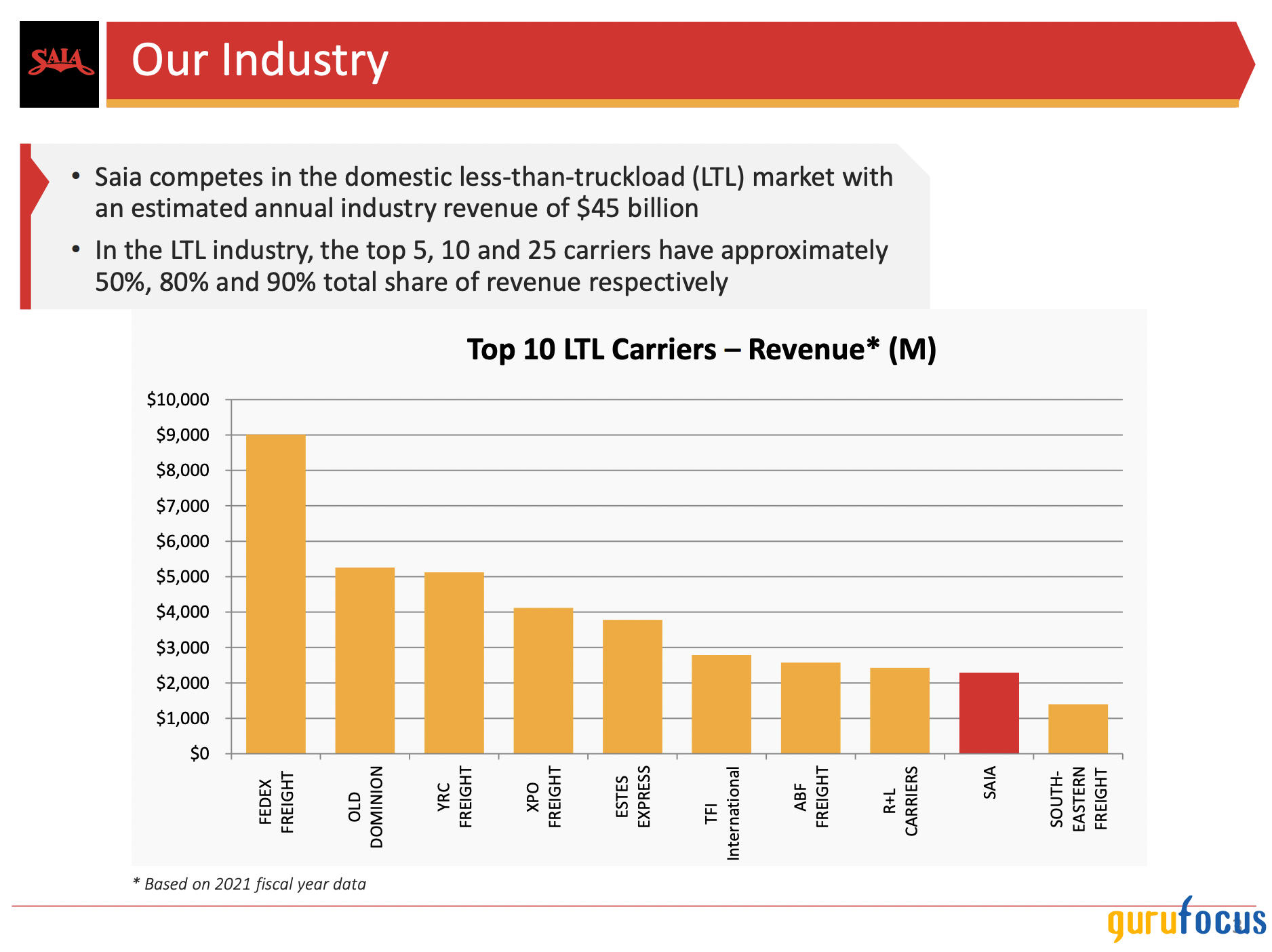

In its second-quarter 2022 investor presentation, Saia reported it is the ninth-largest LTL carrier in the U.S.

As the slide from the company's investor materials shown above suggests, there are many competitors, ranging from giants like FedEx Corporation (FDX, Financial) to local one-truck delivery services. Other big LTL carriers include Old Dominion Freight Line Inc. (ODFL, Financial), YRC-Yellow Corporation (YELL, Financial) and XPO Logistics Inc. (XPO, Financial).

Despite the competition, Saia argued in its investor presentation that it foresees significant growth in the coming years.

Financial strength

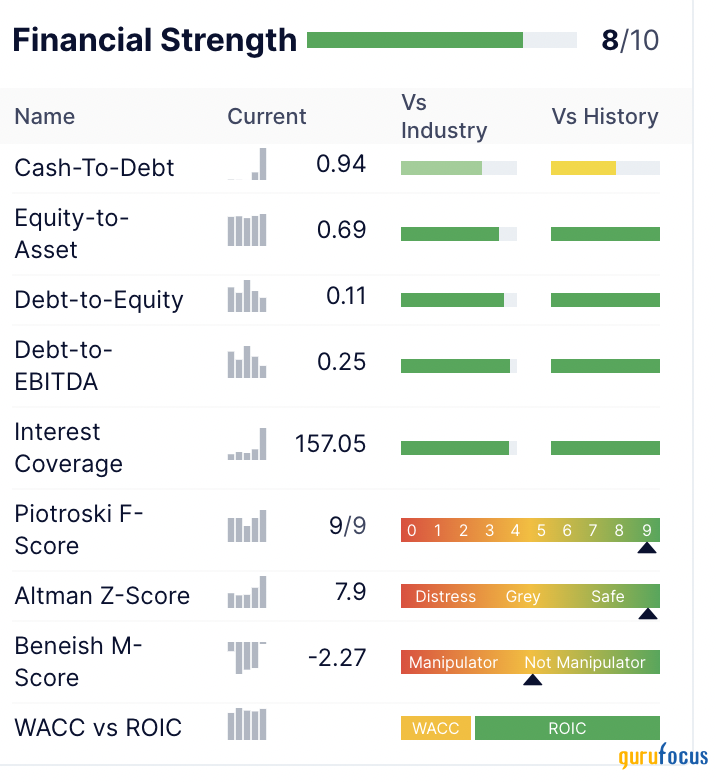

Based on the interest coverage ratio, the debt-to-revenue ratio and the Altman Z-Score, Saia receives a high GuruFocus ranking for financial strength:

The company has been quite conservative in its use of debt, as the dark green bars attest (dark green means industry-leading). That’s backed up by a Piotroski F-Score of 9 out of 9, indicating excellent financial management.

In addition, the weighted average cost of capital (WACC) versus return on invested capital (ROIC) shows this business creates value for its shareholders. The WACC is 9.19% while the ROIC is more than twice that at 23.02%.

Profitability

GuruFocus gives this company a high profitability rank based on the operating margin, Piotroski F-Score, trend of the operating margin, consistency of profitability and business predictability rank.

Its operating margin is 17.17%, more than double the transportation industry median of 6.46%. The Piotroski F-Score is as high as it can get. The operating margin has been increasing at an average of 11.56% per year over the past decade:

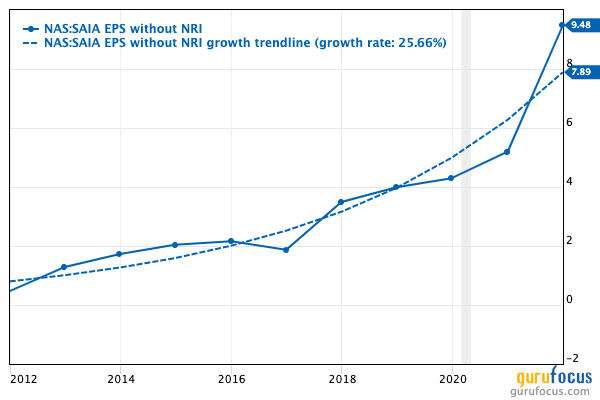

Regarding consistency, profitability has grown steadily over the past decade, with earnings per share without non-recurring items averaging a robust 25.66% growth per year.

It has an adequate, but not compelling, business predictability rank of 3.5 out of stars. This ranking is based on the consistency of revenue per share and Ebitda per share over the past 10 years.

Growth

Saia gets full marks for growth with a GuruFocus growth rank of 10 out of 10:

The first thing to observe on this table is the differences between revenue growth, Ebitda and EPS without NRI. EPS growth is roughly triple the revenue growth, indicating the company is operating very efficiently and effectively.

This EPS growth doesn’t cover just the past three years, it’s been true for the past 10 years:

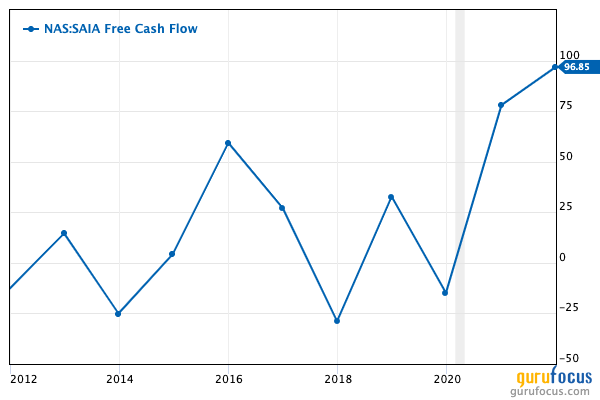

The growth of free cash flow has been less consistent. Growth was very rapid over the past two years, but the rest of the past decade was a rollercoaster:

Dividends and share repurchases

Saia does not pay dividends and has a three-year average share buyback ratio of -0.7. This means the company has issued more shares than it has bought back. The average share buyback ratio falls further to -0.91% over the past decade.

The company noted in its annual report, “Under our current credit facilities, we are subject to certain debt covenants, which limit our ability to pay dividends and repurchase our capital stock, require us to maintain a minimum debt service coverage ratio and provides for a maximum leverage ratio, among other restrictions, that could limit availability of capital to meet our future growth.”

Valuation

The company gets a GF Value rank that’s slightly better than average at 7 out of 10, based on its price-to-GF-value ratio:

The price-to-GF-value ratio shows the relationship between the current share price and the GF Value. At the close of trading on Oct. 18, the share price sat at $205.20, while the GF Value was $252.73. That indicates modest undervaluation and a 23.16% margin of safety.

The GF Value rank, meanwhile, indicates how well the stock is likely to perform over time based on how other stocks with the same price-to-GF-Value ratio performed in a GuruFocus historical study.

The PEG ratio also indicates undervaluation, mainly because its Ebitda is growing so rapidly. Over the past five years, Ebitda has increased by an average of 23.45% per year.

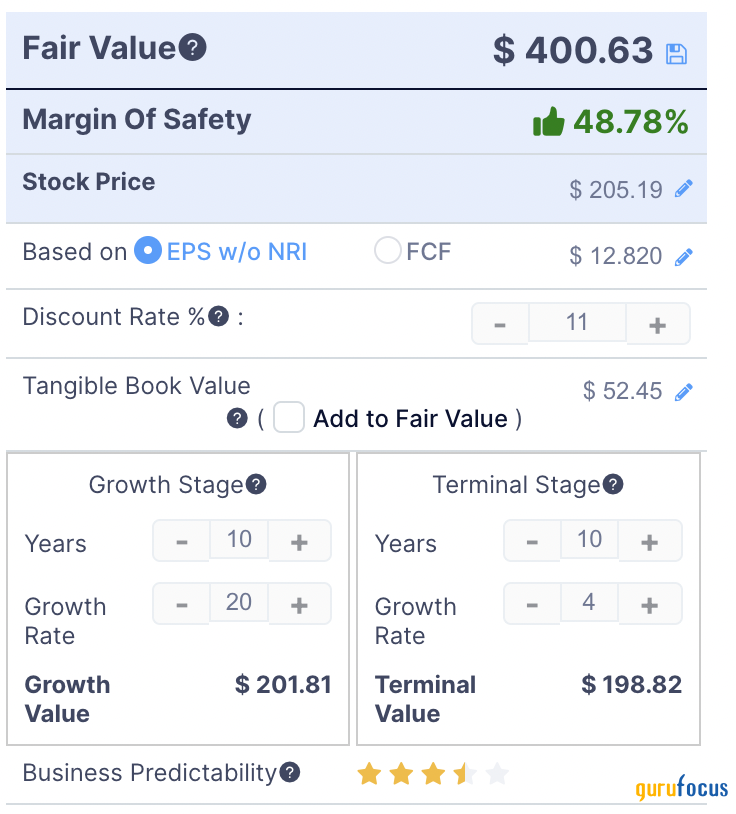

Even the discounted cash flow calculator sees serious undervaluation and a big margin of safety based on the following assumptions:

For the DCF calculator, I estimated a 10-year growth rate of 20% per year, which is well below the historical average growth rate of 25.66%, and an 11% discount rate.

Saia has one of the highest available GF Scores on the market at 97 out of 100:

Gurus

Six of the investing gurus followed by GuruFocus had stakes in Saia at the end of the quarter, including:

- Jim Simons (Trades, Portfolio) of Renaissance Technologies with 138,898 shares, representing a 0.53% stake in Saia and 0.03% of the firm's 13F equity portfolio after a 13.51% during the second quarter.

- PRIMECAP Management (Trades, Portfolio) held 77,200 shares; this is a new holding for the fund.

- Joel Greenblatt (Trades, Portfolio) of Gotham Asset Management also added the company as a new holding, buying 12,514 shares.

Institutional investors have taken a liking to Saia; they now own 98.73% of the shares outstanding. Insiders own 1.4%, with President and CEO Frederick J. Holzgrefe, III taking the largest stake among insiders at 14,623 shares.

Conclusion

Saia has many characteristics that value investors like. It has a modest amount of debt and an undervalued share price. The valuation metrics we reviewed suggest healthy margins, and the company has reported stellar growth over the past decade.