A few months ago, gene sequencing juggernaut Illumina Inc. (ILMN, Financial) seemed like it was well on its way to becoming a fallen giant. Amid flagging growth, the company had jumped the gun by re-acquiring Grail, a cancer testing startup that it had previously spun off in 2016, before securing regulatory approval in the EU. As it turned out, the European Commission decided to block the deal on antitrust grounds, adding significant legal fees and a lost growth pipeline to Illumina’s troubles.

Yet, just as all looked lost, at the end of September, Illumina announced a new product that could become its saving grace by slashing two-thirds of the price tag off of the operating costs of its previous gene sequencing device. The new product, called NovaSeqX, will drop the cost to sequence a genome from $600 to $200, and it will be able to generate more than 20,000 whole genomes a year, a 2.5-fold increase compared to the older model. The NovaSeqX is set to begin shipping next year.

There are still concerns about increasing competition in the gene sequencing space, but even so, getting the cost of this technology down will open new doors for expanding the market. The previous major gene sequencing cost reduction grew sequencing volumes by fivefold, as J.P. Morgan’s (JPM, Financial) Julia Qin pointed out in a note. When we add in the growth potential of Grail, which will be spun out of Illumina again, could Illumina’s stock be a value opportunity?

Scaling up the gene sequencing market

The potential for the gene sequencing market is huge, but thus far, costs have prohibited this technology from being used in many settings, especially health care. This has mostly limited its use-cases to research.

Amid this backdrop, Illumina has grabbed an 80% global market share over the years, making it the unquestioned leader in gene sequencing thanks to competitive costs, higher capacity and superior accuracy. However, as Illumina’s growth slowed down more recently, talk of market saturation began circulating. Unless costs came down, the use-cases of gene sequencing would remain limited.

Then, newer startups like Ultima Genomics began making headlines by claiming that they could offer a $100 genome. It’s important to note that similar promises have fizzled out in the past, but with Ultima’s technology making new strides, it became clear that Illumina needed to step up its game if it didn’t want to be left in the dust.

So how will cheaper sequencing increase the total addressable market for gene sequencing? For starters, it will make it easier for researchers to accelerate the development of a database that can be used to identify disease-causing genes, study the influence genes have on each other and even detect the presence of cancer early on.

Research will be the first step, but once this technology advances enough, the real commercial opportunity lies with diagnostic capabilities and the development of new treatments.

The competition is hitting its stride

While getting the cost of its genome sequencing down to $200 is a commendable step, new competitors are cropping up left and right for Illumina, which could spell trouble for its market share. If the gene sequencing market can grow rapidly enough, this might not be too big of an issue, but if researchers end up unanimously preferring a competitor’s product, things could get dicey.

Ultima Genomics promises a comparable product to Illumina’s that only costs $100 to sequence a genome. The cheaper cost will certainly be enough to lure some customers away, even though the consensus at the moment is that Ultima’s product sacrifices accuracy to lower the cost and improve capacity. For use-cases that don’t require as much accuracy, Ultima’s product may turn out to be a winner, but for those that don’t allow for error, Illumina could keep its place.

Another up-and-coming competitor is MGI, a subsidiary of Chinese sequencing giant BGI Genomics (SZSE:300676, Financial). According to a June article from Science’s Elizabeth Pennisi, “MGI’s technology is similar to Illumina’s, but it increases accuracy by adding all four bases at once as it sequences DNA. To track which bases are incorporated, it uses antibodies, which are brighter and less expensive than fluorescent dyes.”

The biggest issue for Illumina is that competition is only just getting started. Its original cluster generation IP has already expired, and several more key patents are set to expire in the months and years to come.

Another major IP blow came earlier this year, when Illumina and BGI sued each other over patent infringements. While the jury did find that both companies infringed on each other’s patents, it also said Illumina’s relevant patents shouldn’t have been issued in the first place.

As more of Illumina’s patents expire and/or end up being struck down in court, the barrier to entry in the gene sequencing device market will keep getting lower, which should be further accelerated by the dropping cost of gene sequencing brining more researchers to the field.

Grail is no hot potato

Even if Illumina is making progress with its technology, what about Grail? It will certainly be a blow to Illumina to have to turn around and spin off this company again right after spending $8 billion to re-acquire it in August 2021.

The European Commission voted to prohibit the acquisition on antitrust grounds, since Illumina already commands 80% of the gene sequencing market. The EC held that Illumina’s proposed steps to remedy the competitive situation were not enough since Illumina has both the ability an the incentive to obstruct the technological advancement of rivals.

Illumina does plan to appeal the EC’s decision, but even if it is forced to dissolve the deal and divest Grail once again, it might not necessarily be a bad deal for shareholders. With a solid outlook for Grail and an improving picture for Illumina, investors could be undervaluing both companies due to the negative press.

The regulatory backlash surrounding Grail’s re-acquisition means the market seems to mostly be ignoring its value for now. It was acquired for $8 billion and has huge potential as the maker of a breakthrough early cancer detection test. Even if it seems like the market is tossing it around like a hot potato, that couldn’t be further from the truth.

Valuation

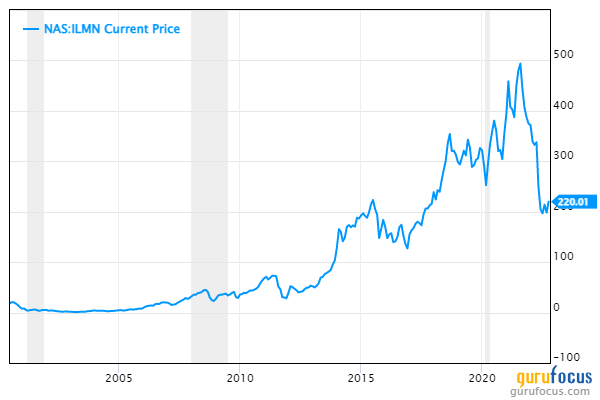

In summary, a combination of slowing growth, rising competition, patent expiration and re-acquiring Grail without securing regulatory approval has understandably decimated Illumina’s stock. When we add in the generally bad economy, Illumina never really stood a chance. Its stock has fallen 56% from all-time highs.

However, as technological advancements from Illumina and its competitors appear set to rapidly expand the use-cases for gene sequencing, growth in its total addressable market could propel Illumina’s earnings back into a growth era (though investors may want to wait for more studies comparing Illumina’s newest product to its competitors before making a judgement call on this end).

There’s also the fact that the stock being cut in half doesn’t take Grail’s growth prospects into consideration.

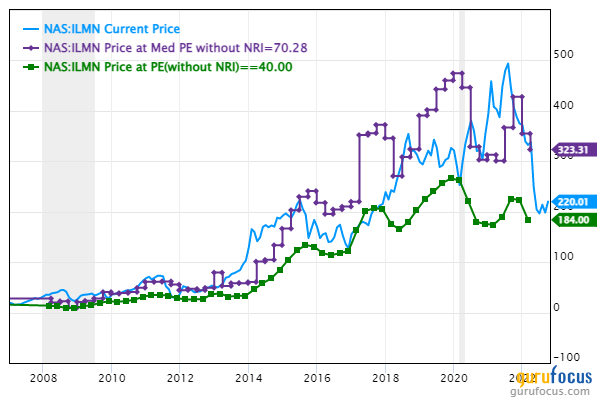

Assuming that the addition of Grail combined with the development of a cheaper gene sequencing product would have eventually helped Illumina return to its historical growth rates in a few years’ time, I have compared Illumina’s stock price to what its price would be if it traded at a price-earnings ratio of 40 (green line) and its median price-earnings ratio for the past decade (purple line). With this, we get a present fair value estimate between $184 and $323.

This model does not take into account long-term growth for the gene sequencing market or the possibility that that Illumina may successfully appeal the EC’s decision.

While Illumina may look undervalued at the moment, though, there is a lot that could go wrong for the company in the near future, which is why the discount may be justified for most investors at this time. If the stock falls another 30% or so from here, even the Grail spinoff may not make up for it.