VF Corp. (VFC, Financial) has increased its dividend every year for at least 25 years, making it a Dividend Aristocrat, the epitome of stable securities. What, then, should we make of the fact that the stock has cratered by nearly 70% since the 52-week highs reached on Dec. 1, 2021? And can we trust its hefty 7% dividend yield to remain?

About VF Corp

On its website, the company describes itself as “one of the world’s largest apparel, footwear and accessories companies connecting people to the lifestyles, activities and experiences they cherish most through a family of iconic outdoor, active and workwear brands.” This image from its website displays some of its leading brands:

VF Corp. sells through both wholesale and direct-to-consumer channels. In fiscal 2022, which ended on April 2, 54% of its revenue came from wholesale. Geographically, it earned 57% of its revenue in the Americas, 29% from Europe and 14% from Asia-Pacific.

Headwinds

VF Corp.'s share price fell sharply over the past 11 months, even more than the S&P 500’s drop of about 23% (as of the end of September).

The decline reflects the market’s concern about what the company has to contend with. The company noted in a Sept. 28 news release, “VF is revising its FY23 outlook due to lower-than-expected Q2 FY23 results, coupled with ongoing uncertainty in the current environment, weaker than anticipated back-to-school performance at Vans® and increasing inventories leading to a more promotional environment in North America in the fall”.

The above news release’s main topic was a five-year plan that will take it through to fiscal 2027. What it calls the “Long-Term Strategic Growth Plan” has four key pillars:

- Find and amplify consumer tailwinds.

- Build brands on multiple growth horizons.

- Leverage platforms for speed to scale and efficiency.

- Resource for portfolio agility and performance.

In an established and mature industry, these elements seem logical and achievable. Given the returns we’ve seen, it is obviously time for some sort of change.

Competition

The apparel and footwear industries have relatively low barriers to entry, which means they will be highly competitive.

Prominent names include Ralph Lauren (RL, Financial), Levi Strauss (LEVI, Financial), Gildan Activewear (GIL, Financial), Columbia Sportswear Company (COLM, Financial) and Under Armour (UAA, Financial). Until almost a year ago, shareholders enjoyed much more success with VF Corp. than with Ralph Lauren and Levi Strauss:

Industry troubles

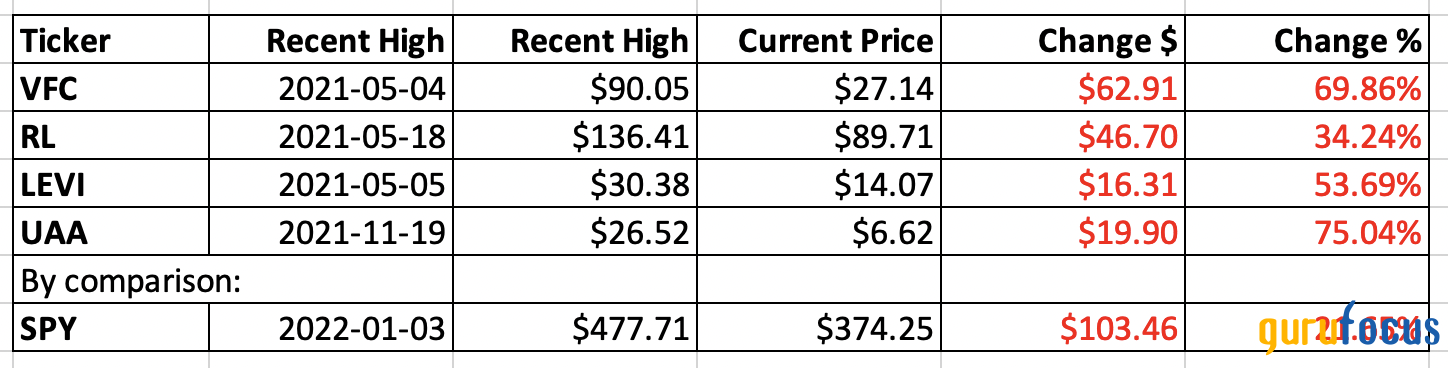

A look at industry peers and competitors underlines the idea that at least some of the problems facing VF Corp. are also industry-wide problems (based on an admittedly small sample). As the table below shows, share prices of all four of these companies fell further than the S&P 500 over the last year:

Similarly, the SPDR S&P Retail ETF (XRT) has also fallen since hitting a new high on Nov. 16, 2021, going from from $104.16 to $58.84 on Oct. 21, 2022. The retail index has fallen 43.50%.

So, I think it’s fair to assume the biggest problem here is the market-wide price decline that began late last year and hasn’t yet reversed (with perhaps some exceptions). The lesser problems include those listed above, including a weaker-than-expected performance from Vans.

Presumably, then, much of VF Corp.'s recovery will depend on the market’s recovery, and that may be a while if there is a recession in 2023, as some economists project.

As for its internal problems, management has a plan for the next five years, one that should help its major brands get back on track.

Financial situation

But, does it have the financial resources it needs to keep paying investors? The short answer is yes. Let's take a look at the company's financials to see why I came to that conclusion.

While VF Corp. has a large debt load, the GuruFocus financial strength table tells us it generates $11.13 in operating income for every dollar of interest expense. That’s an adequate amount of interest coverage.

According to its 10-K for fiscal 2022, it recently had $2.2 billion in liquidity available: "At March 2022, VF had approximately $1.3 billion of cash and equivalents. Additionally, VF had approximately $1.9 billion available for borrowing against the Global Credit Facility, subject to certain restrictions.”

Its returns to shareholders in fiscal 2022 included share repurchases of $350 million and dividends of $773.2 million.

The company has still been profitable, despite the setbacks in recent years. The net margin sits at 8.45%, which is better than average for the industry. It’s also worth noting on the profitability table that its return on equity is 28.91%, which is higher than its return on invested capital at 11.70%. That indicates the debt is carries is expensive and cuts returns by more than half.

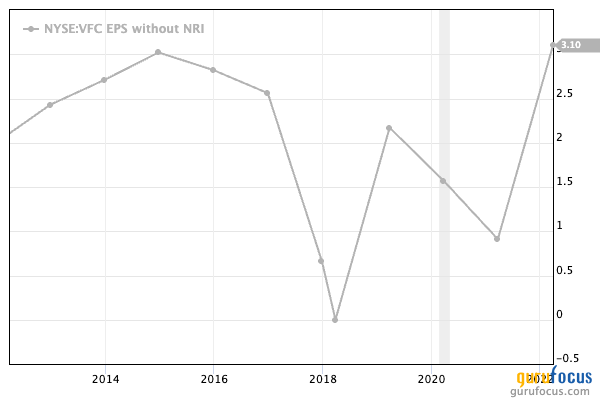

VF Corp. has been profitable for nine out of the past 10 years, but earnings per share without non-recurring items has certainly been bumpy:

Free cash flow appears to be a concern, based on the three-year growth rate of -26.8%, but it too has spiked up and down:

Gurus

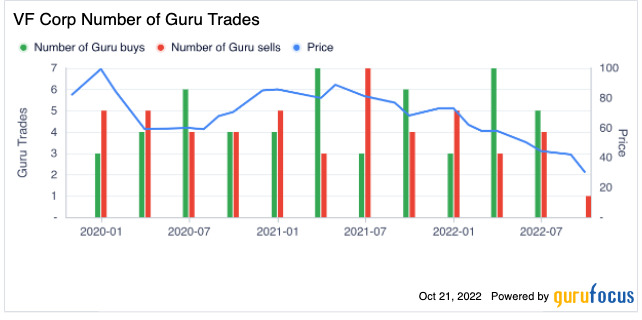

What do the gurus think of VF Corp..? Over the past three years, they’ve bought more of the stock than they sold:

Professional investors who manage institutional investments are also confident. They own 84.6% of the shares outstanding, a proportion that’s grown fairly steadily since 2014.

Based on these snapshots of the company’s financial metrics, as well as the confidence of management, gurus and institutional investors, the company’s financial foundation and future appear strong.

The dividend

VF Corp. offers a high dividend when compared with the S&P 500 average of just 1.70% as of the end of September:

As we’ve noted, VF Corp. is a dividend aristocrat, which means it is a constituent of the S&P 500 and has raised its dividend every year for at least 25 years. Having the status of Dividend Aristocrat is highly prized among boards of directors, and VF Corp. is likely no exception. That means the company will make every effort to keep from cutting its dividend.

Conclusion

Income investors who can live with some uncertainty will want to give VF Corp. a closer look. It’s not often that a mature and profitable company provides a dividend yield this high.

In this case, a quality company has had a low share price imposed upon it by mostly external forces (and a few of its own making). As a result, its dividend has risen to the point of being very attractive. For those willing to play the long game, there may be capital gains as well.