We are now entering a “crypto winter” as the price of bitcoin has fallen over 62% from its all-time highs in November 2021. People are talking about the asset class less, after it was previously on national news almost daily in 2020. However, now is the ideal time for contrarian investors to research stocks related to this industry.

In this case, you can think of cryptocurrency as entering a phase similar to the post-tech crash of 2000. Therefore, I believe this is an opportune time to reveal my top two stock picks poised to benefit from crypto tailwinds. By investing in companies related to the industry, you gain exposure, but in a lower-risk manner. This stems from my favorite quote of all time: "During a gold rush, sell shovels."

Coinbase

Kicking things off is Coinbase Global Inc. (COIN, Financial), which was founded in 2012 and is a true pioneer in “trustworthy” crypto exchanges. The company has about $3 billion in trading volume each day and is the largest cryptocurrency exchange in the U.S. The company is also the second-largest cryptocurrency exchange in the world, behind Binance.

The platform offers over 210 coins and 520 pairs, which can be traded across its platform. The company was also backed by leading venture capitalists such as Andreessen Horowitz (about 6% owner) and LinkedIn founder Reid Hoffman (Greylock, 0.29%).

Coinbase has scored an array of industry-leading partnerships. For example, in October, the company partnered with tech giant Alphabet Inc.'s (GOOG, Financial) Google in order to enable bitcoin and ethereum payments for its cloud services. This is part of the Coinbase Commerce solution, which enables merchants to accept cryptocurrency. Payments platform Primer has also adopted this solution to enable users to select crypto as a payment method.

The company is also the first global crypto exchange to receive registration approval from the Netherlands central bank for crypto-related products.

Blackrock (BLK, Financial), the world's largest investment manager with over $10 trillion in assets, also partnered with Coinbase to enable institutional clients to trade bitcoin. These are game-changing partnerships that could help cement the company as the most credible cryptocurrency exchange in the world.

Mixed financials

Coinbase generated mixed financial results for the second quarter of 2022. The company reported trading volume of $217 billion, which was down 30% year over year. This was driven by the aforementioned crypto winter as traders and investors have been scared out of the asset class thanks to volatile declines and the recessionary environment. Cryptocurrency, and bitcoin especially, was thought to originally behave as an inflation hedge due to its limited supply. However, analysis of data shows the asset class tends to act more like a speculative growth stock.

Coinbase makes the majority of its revenue from “order flow.” Therefore, less people trading means less revenue. In the second quarter, transaction revenue was $655 million, which declined 35% year over year.

The good news is that if we take a step back, we see that overall trading volume was just $28 billion several quarters previously and thus is about 9 times higher despite the decline. Management did notice that many of its 6 million users are increasing participation in other financial products, such as staking-based saving accounts, despite the decline in trading activity.

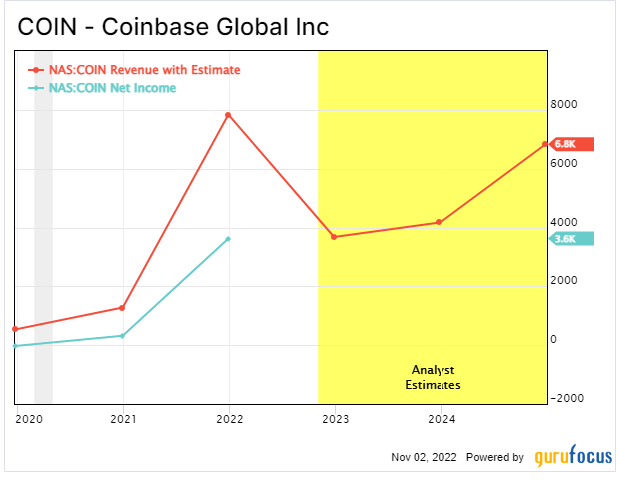

Coinbase did report negative profitability in the second quarter. The company reported a loss of $1.09 billion, which was worse than the $430 million loss reported in the first quarter. The good news is that due to the trading boom in 2021, the company is still profitable on a trailing 12-month basis, as it generated $1.4 billion over this period.

The company also has a robust balance sheet with $5.7 billion in cash and short-term investments, in addition to $3.1 billion in long-term debt.

Valuation

Coinbase is difficult to value as it is hard to forecast whether crypto trading will bounce back in popularity. The business is trading at a price-sales ratio of 2.32, which is significantly cheaper than its historic average.

Growth investors Catherine Wood (Trades, Portfolio) of Ark Invest and Baillie Gifford (Trades, Portfolio) were buying shares in the second quarter. Both investors paid an average price of $96 per share, which is 34% cheaper than where the stock trades at the time of writing. This entry point could give an indication of the fair value of the stock.

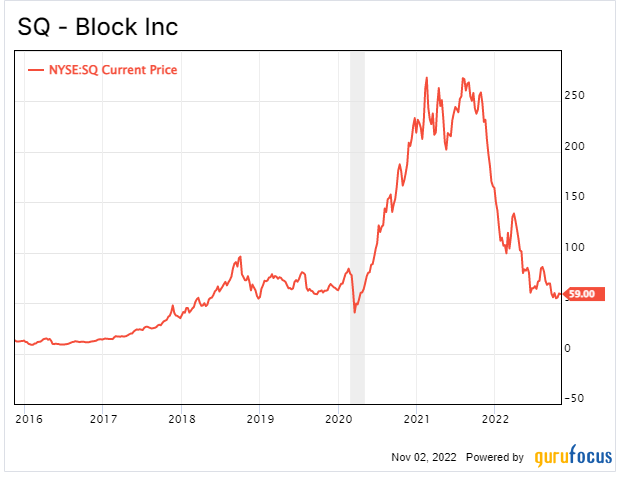

Block

The second stock is Block Inc. (SQ, Financial). Formerly known as Square, the company changed its name to signify its new push toward blockchain technology. Despite this, the company’s products are highly diversified across its Cash App ecosystem, which enables peer-to-peer payments and bitcoin trading.

In addition, its small business product, Square, is popular with merchants as a payment method. The beautiful thing about Square’s technology is it tracks every single transaction a business makes and can offer credit to small businesses, which is a historically underserved market.

Mixed financials

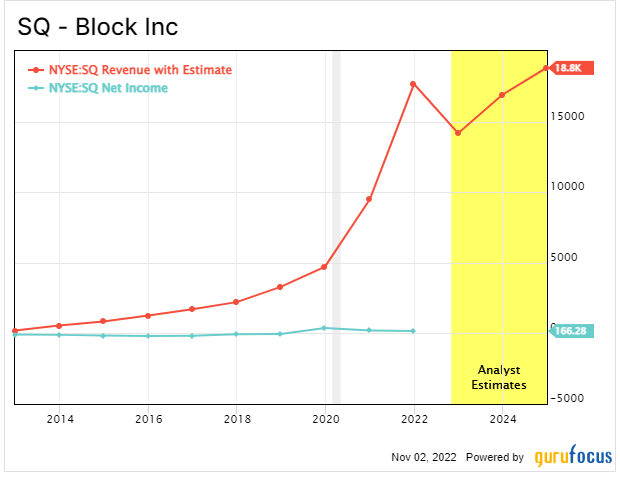

Block generated mixed financial results for the second quarter of 2022. Revenue of $4.4 billion declined by 6% year over year, but still beat analysts' expectations by $42 million. The revenue decline was driven by a massive slowdown in bitcoin transactions, which is a macro issue. With bitcoin excluded, revenue actually increased by a blistering 34% year over year to $2.6 billion.

The gross profit increased by 29% year over year to $1.47 billion. Block's adjusted Ebitda was $187 million, which was lower than the $360 million produced in the equivalent quarter last year. This was primarily driven by higher operating expenses related to its acquisition of buy now, pay later provider Afterpay. Therefore, I do not feel this is a major issue overall.

The company has a solid balance sheet with $6.2 billion in cash, cash equivalents and restricted cash. Its debt is quite high at around $5 billion, but just $1 billion of this is a short-term debt due within the next two years and is, therefore, manageable.

Valuation

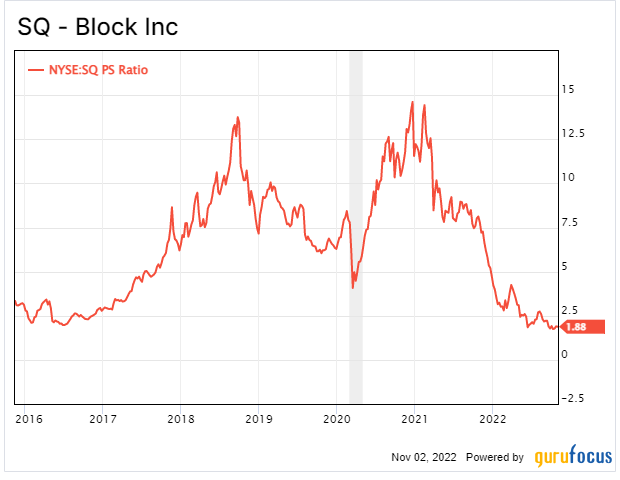

Block trades at a price-sales ratio of 1.85, which is 75% cheaper than its five-year average.

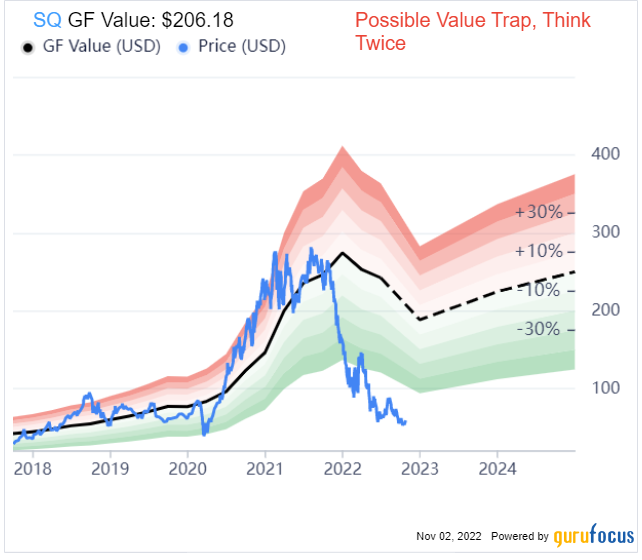

The GF Value Line indicates a fair value of $206 per share, which means the stock is significantly undervalued relative to the $56 share price at the time of writing. However, GuruFocus does warn of a possible value trap. I believe this is driven by the sharp revenue decline, which is is related to bitcoin trading and macro issues, so it is not a major problem overall.

Final thoughts

Both Coinbase and Block are financial companies with strong exposure to the cryptocurrency industry.

Coinbase is a pure-play cryptocurrency exchange and, therefore, offers strong exposure to the asset class. A bet a Coinbase is a bet on the future of cryptocurrency. Block is more diversified and a much safer bet in my opinion.