There are two ways to make money in the stock market. You can go long on stock, which is when you buy it normally and bet that its fundamentals will improve and thus raise its share price over time. Alternatively, you can short a stock if you are betting its share price will decline due to declining fundamentals and likely a high valuation. The process to sell a stock short is often more complex and involves borrowing the stock and selling it on the stock market, before buying it back later after it declines in share price (if your thesis is right).

A long/short hedge fund often buys a basket of stocks that it thinks will go up in price while simultaneously short-selling a basket of overvalued stocks. However, short selling stocks is a difficult strategy and does come with more risk, because if you're wrong, a stock's price can theoretically go to infinity, whereas the maximum loss on a long position is 100%.

An even riskier type of bet is so-called meme stocks. These are heavily-shorted stocks that buyers will sometimes organize together and target for a short squeeze, which occurs when a heavily shorted stock starts to rise in price and short sellers must buy it back to cover their positions. If successful, this creates a flywheel which can cause a stock to rise to meteoric levels.

Investors should note this is an incredibly risky strategy that is more akin to gambling than investing, so it might be better to first organize with other investors on a platform like Reddit before considering this strategy seriously. In this post, we will go over my top two favorite stocks with high short interest that I believe have good potential as meme stocks; lets dive in.

1. Beyond Meat

Short Interest: 41%

Beyond Meat (BYND, Financial) is a new-age food company that aims to disrupt the meat industry. The company is most famous for its “Beyond Burger” which it claims looks and tastes just like real meat, but contains no animal products. Beyond Burgers differ from traditional vegan or veggie burgers in that many people struggle to tell the difference during blind taste tests with sauces added. I personally did a blind taste test of multiple burgers on my YouTube channel Motivation 2 Invest as part of my analysis of the stock. My conclusion was real meat burgers tasted more succulent and juicy, but Beyond Burgers were still much nicer than traditional vegan burgers and were not massively different from real meat burgers if you add sauce.

The case for veganism is based not only on saving animals but also on saving the environment because producing meat supposedly is worse for the environment according to some studies. According to a study by UC Davis, cows are the number one agricultural source of greenhouse gasses worldwide. Cows and other farm animals produce around 14% of the world's greenhouse gases, with methane as the primary driver, which is a much more damaging gas than carbon dioxide.

Major partnerships

Beyond Meat has scored a series of major partnerships with leading restaurant chains. In 2021, Beyond Meat partnered with McDonald's (MCD, Financial) for its McPlant burger, which was launched in the U.S and Europe. In addition, the company scored a partnership with KFC for its “Beyond Chicken” which apparently tastes like real chicken. Progress looked to be solid, as KFC reported strong demand across Canada during testing. Beyond Meat also has a partnership with Pizza Hut and even Disney's (DIS, Financial) Disneyland Paris for its meat-free meal options.

More recently, on Oct. 24, Beyond Meat has launched its “Beyond Steak,” which is a steak-like meat substitute that is being rolled out across giant supermarket chains such as Walmart (WMT, Financial) and Kroger (KR, Financial).

Volatile financials

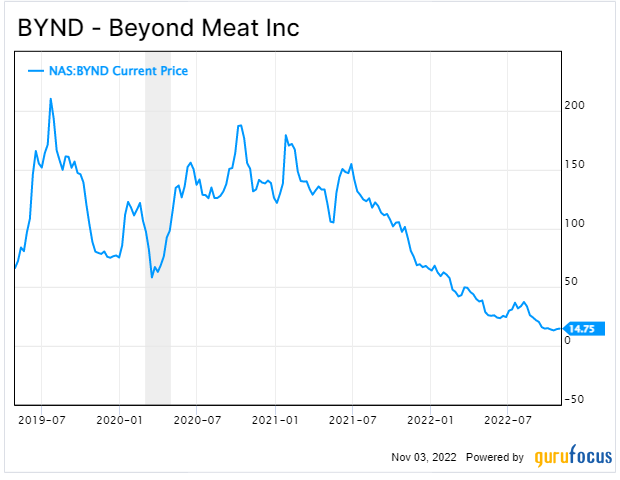

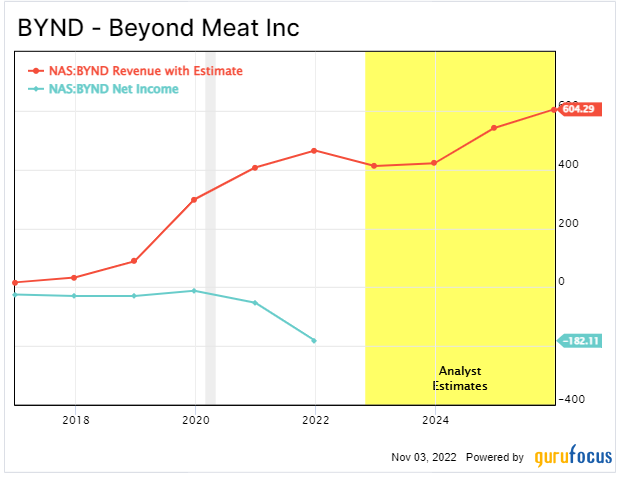

With Beyond Meat scoring such an array of new partnerships, one would expect its financial to be tremendous, but unfortunately, this is not the case. Beyond Meat generated $147 million in revenue during the second quarter of 2022. This missed analyst expectations by $2 million and was pretty much flat relative to the prior year. As a former growth stock, this is not a great sign.

This was driven by a sequential contraction in U.S. household penetration for the first time in four years. The high inflation environment has caused consumers to be more cautious with their spending, and Beyond Meat is a fairly premium product. I compared prices for its products in a U.K. supermarket and saw it was between £4 to £5 ($4.50 to $5.50) for a pack of two Beyond Burgers. This is fairly expensive given the animal-based equivalent was roughly half that price at £2, or $2.50. This high price was a risk I highlighted previously and it seems that is now starting to show up in the business's financials.

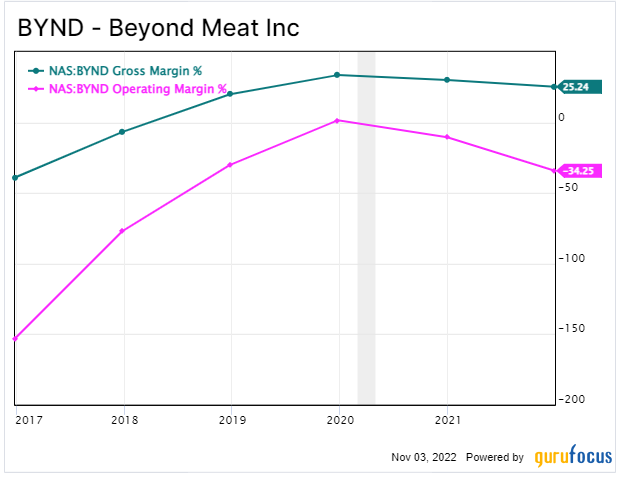

Gross profit during the second quarter of 2022 was -$6.2 million, or -4.2% of net revenues, as compared to $47.4 million, or over 31% of net revenues, in the second quarter of 2021. This decline in profitability was a major issue and was driven by the company having to sell its products at a steep discount into a “liquidation channel” due to lower demand.

Earnings per share were $0.41, which missed analyst expectations by $0.41.

These declining fundamentals mean it is no surprise that the business has 41% of its outstanding shares shorted by short sellers. The company could recover as we come out of the other side of the recession and its new products come online, but it still has a long way to go,and it is still only viable for the wealthier population to buy its products.

The company has $454 million in cash and short-term investments on its balance sheet. However, the company has fairly high debt of $1.1 billion.

Valuation

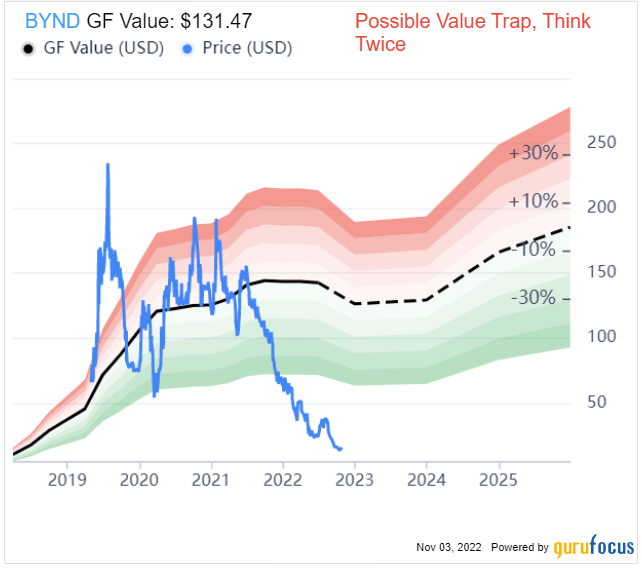

Beyond Meat trades at a price-sales ratio of 2, which is 85% cheaper than its five-year average. The GF Value chart rates the stock as a “value trap” that could decline further. Although the secular growth in veganism is a strong tailwind, it's losing steam in a recession.

2. Bed, Bath and Beyond

Short Interest: 39%

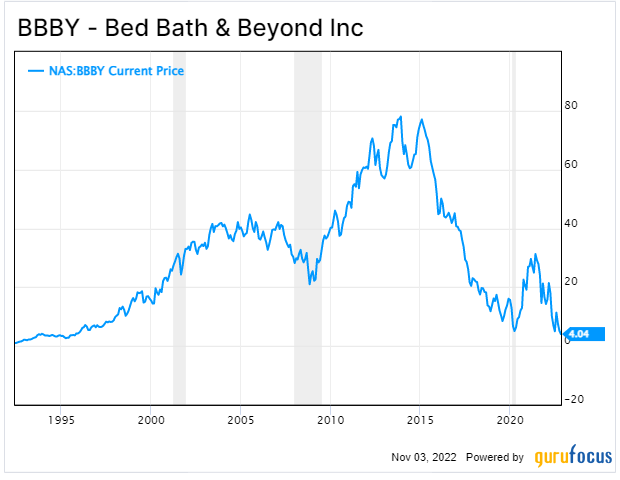

Bed, Bath and Beyond (BBBY, Financial) is a retail store chain in the U.S. which focuses on bedding, bathroom and other household products. The business has been heavily disrupted by pure online retailers such as Amazon (AMZN, Financial), which has a lower cost structure and effectively unlimited inventory. Bed, Bath and Beyond sells many products from bed sheets to coffee makers and cookware sets. These product types tend to have low margins and many alternatives online.

The fall of Bed, Bath and Beyond

Bed, Bath and Beyond generated a solid $10.9 billion in sales way back during 2013. Sales have steadily declined over the past few years and were just $7.8 billion in 2021, down nearly 30%. To make things worse, its operating profit has dropped from a positive $1.6 billion in 2013 to -$644 million in the trailing 12 months.

In the third quarter of 2022, the company reported $1.44 billion in revenue, which missed analyst expectations by $9.27 million. Earnings per share was -$4.59, which missed analyst expectations by $2.78.

Given these factors, it is no surprise that the company has over 39% of its outstanding shares shorted by short sellers.

The company is trying to regain its crown and has announced a series of over 55 store remodels and launched over eight of its higher-margin own-brand products. Bed, Bath and Beyond also announced a loyalty program in order to help retain its customers. The business has a strong e-commerce presence with its website and aims to drive a greater number of sales through the online channel. Management has also automated a variety of its facilities to help lower fulfillment costs in the long term.

The business has $135 million in cash and short term investments. However, it has over $1.7 billion in long-term debt, which is another negative for the company.

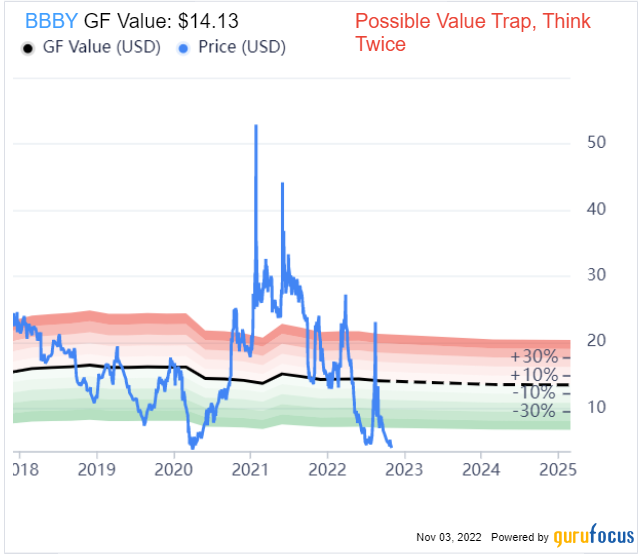

Valuation

Bed, Bath and Beyond trades at a price-sales ratio of 0.05, which is 73% cheaper than its historic average. However, the business looks to be a solid “value trap” at this time based on the GF Value chart.

Final thoughts

Both Beyond Meat and Bed, Bath and Beyond are stocks that have seen their businesses and fundamentals decline heavily. I personally see Bed, Bath and Beyond as a strong short-sell opportunity given its declining fundamentals and lack of tailwinds. However, caution should be taken as it is also a popular meme stock and has already seen an epic few short squeezes in the past. I believe Beyond Meat could recover in the long term due to secular tailwinds, but the business has many challenges, such as reducing the costs of its products.