The high inflation and rising interest rate environment has caused a huge compression of valuation multiples. In such a situation, a company can still maintain its stock price if it continues to grow its earnings strongly. However, in the current environment, we are seeing slower growth and higher expenses, which are squeezing profit margins across the board.

Thus, in this article, I’m going to revealk my two favorite big tech stocks which are deeply undervalued based on my valuation model after huge share price declines; let’s dive in.

1. Amazon

The world's largest e-commerce company Amazon (AMZN, Financial) was the darling of the pandemic stocks in 2020. As traditional brick-and-mortar retail was closed, people had no choice but to shop online. Therefore it is no surprise that the stock price increased by over 100% from the March 2020 low of $89 to a high of $183 per share in November 2021. But since November 2021, its stock price has been butchered, and even as investors “bought the dip,” it kept dipping further. At the time of writing, Amazon is trading back at its pandemic low of $89 per share, as if the gains of 2020 never occurred.

Third quarter earnings

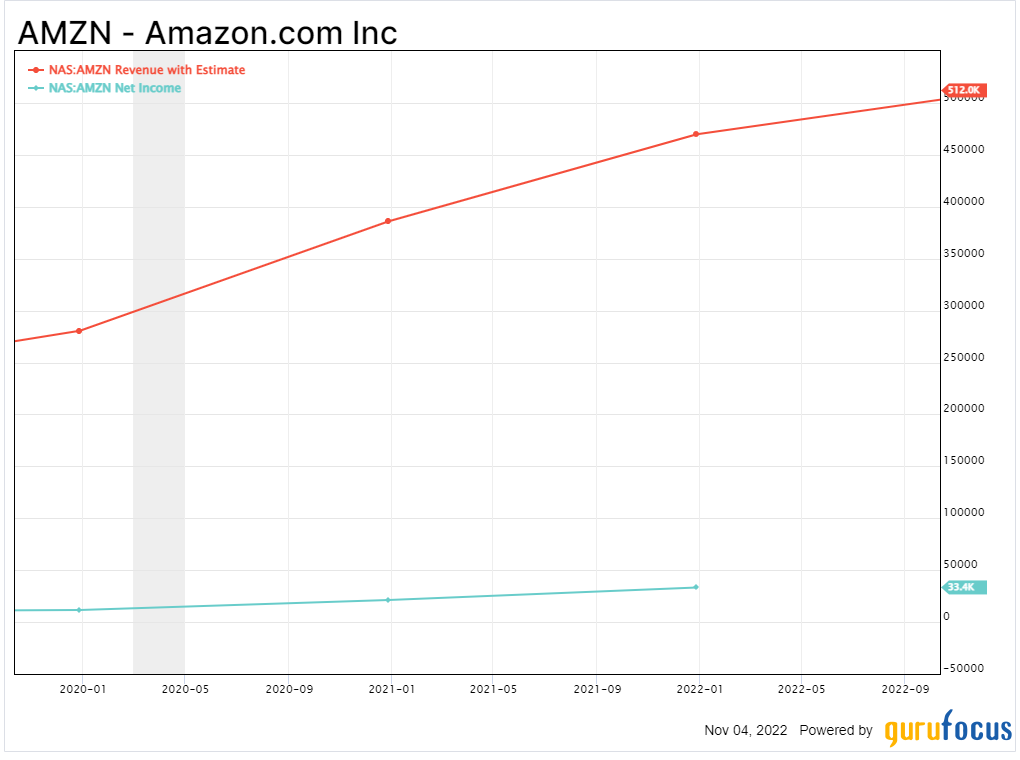

Amazon recently reported its financial results for the third quarter of 2022. Revenue was a solid $127.1 billion, which increased by 15% year over year, which was a positive. However, the business did miss analyst consensus estimates by ~$370 million.

The main cause of the revenue miss was unfavorable foreign exchange headwinds caused by a strong dollar, which impacted international sales. This was combined with tepid consumer demand as a recession approaches. I expect both these issues to be cyclical short-term headwinds and not long-term issues affecting the business. In five years' time, will we still be talking about the exchange rates today? I don’t think so. Will we be using an alternative e-commerce store? I also don’t think so.

Cloud is king

Amazon’s Cloud business, Amazon Web Services, is the largest cloud infrastructure provider in the world and the growth engine of the company. Revenue for this segment increased by a solid 28% year over year to $20.5 billion. AWS is poised to continue to benefit from the secular shift towards the cloud as well as the ongoing digital transformation of businesses. Enterprises are moving their IT services to the Cloud in order to increase their flexibility and gather data while also saving costs long term. The business case is strong and takes a long period of time to implement. Therefore I expect a slight slowdown in new business over the next few quarters but solid growth to continue thereafter.

Profitability challenges

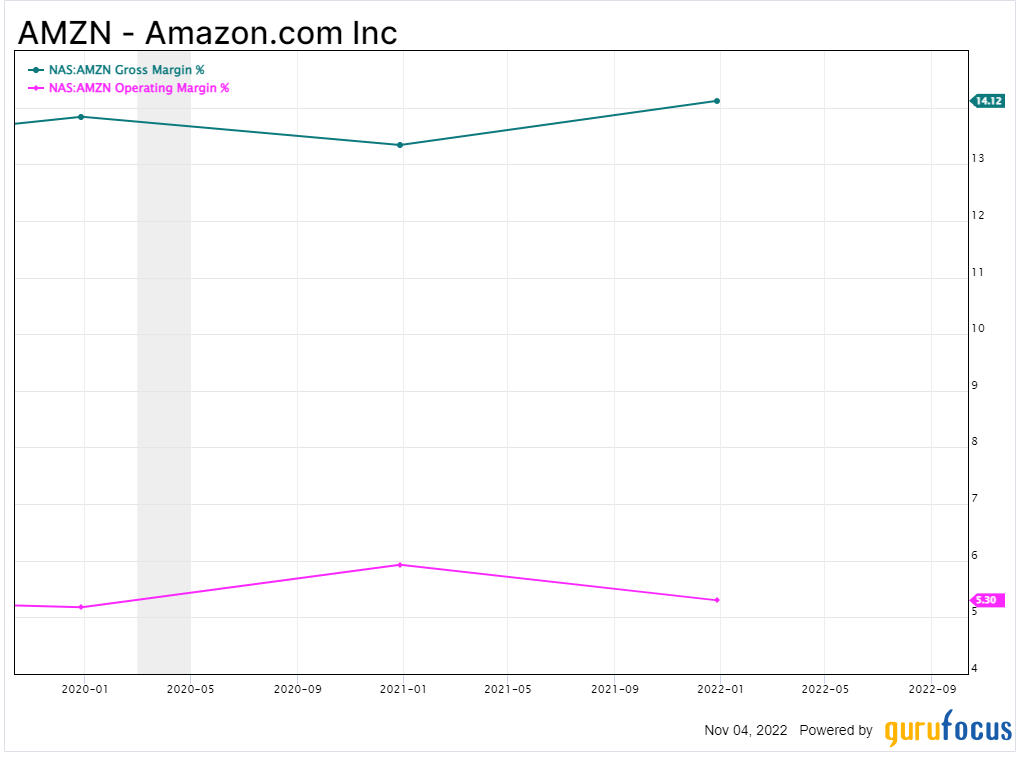

Amazon’s overall profitability is a major challenge as the business generated $2.5 billion in operating income during the third quarter of 2022, which declined by a traumatic 48% year over year. This was driven by a 17% increase in operating expenses to $125 billion, which was driven by high fulfillment center costs, supply chain constraints and inflation. These issues could last longer if inflation doesn’t start to come down further. However, the growth of the higher margin Cloud segment should increase profitability in the long term.

Advanced valuation

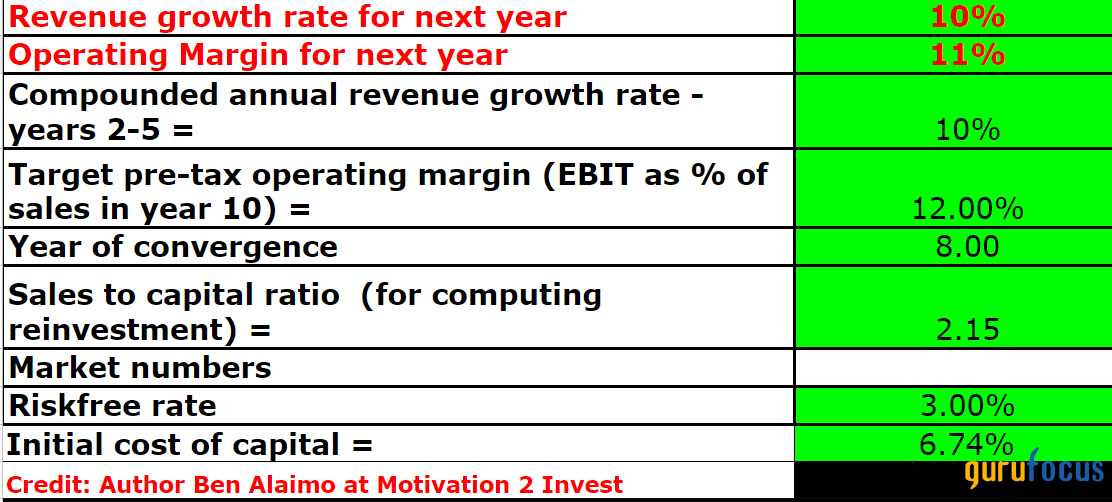

I have plugged Amazon’s financials into my valuation model, which uses the discounted cash flow method of valuation. I have forecasted a 10% compounded annual growth rate on the revenue over the next five years. This is fairly conservative given prior growth rates of 15% for this year and higher in previous years.

I also expect the business to increase its margins over time thanks to the Cloud segment.

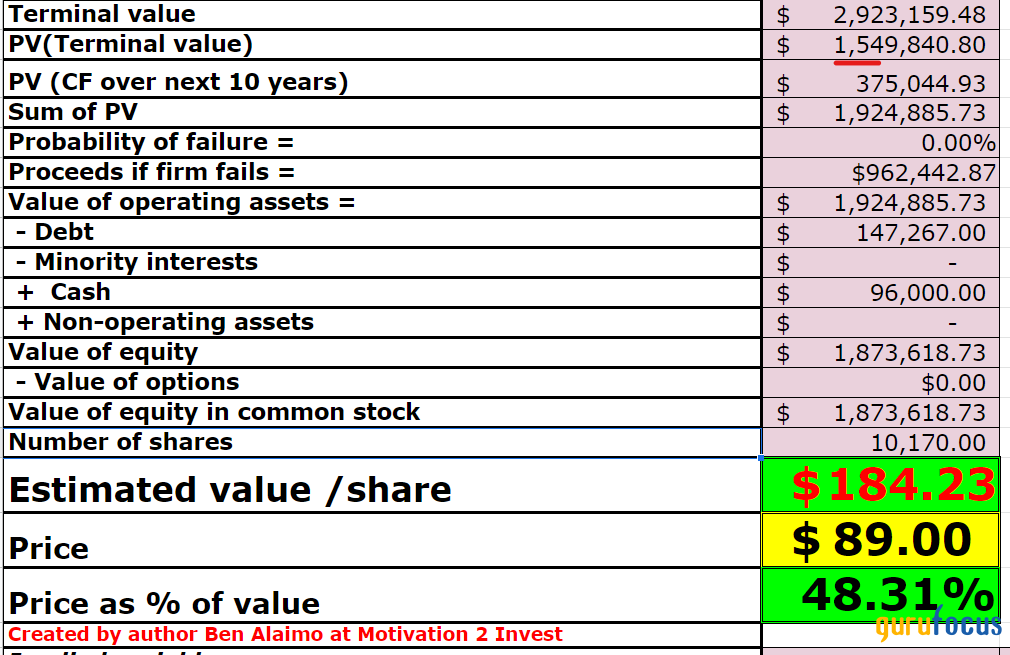

The result I got using these estimates is a terminal market cap value of $2.9 trillion for Amazon stock and a present value of $1.5 trillion, or $184 per share. Given Amazon is trading at below $1 trillion at the time of writing, or $89 per share, the stock is ~50% undervalued in my opinion.

2. Alphabet

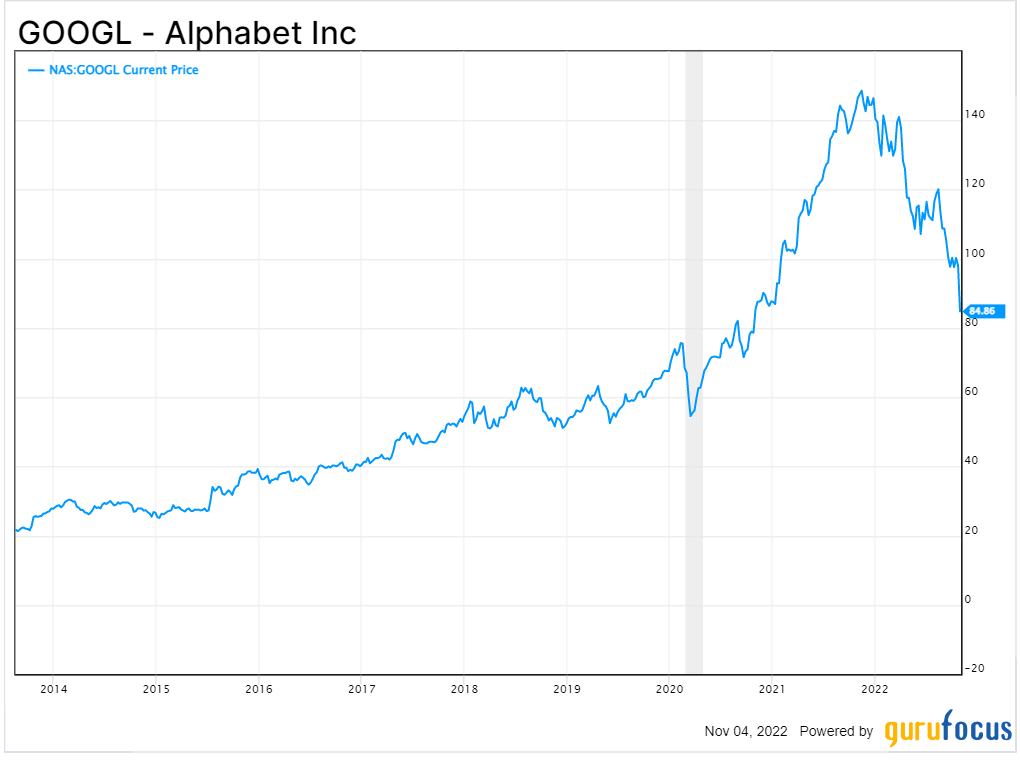

Alphabet (GOOG, Financial)(GOOGL, Financial), the parent company of Google, is one of the greatest technology titans in the world. The company owns the most popular search engine in addition to the most popular mobile operating system Android. The company also has a plethora of other business units from YouTube, which is the world's most popular video platform, to moonshots like self-driving startup Waymo. Yet, not even Alphabet has escaped the market downturn as ad revenues flag.

Poor third quarter

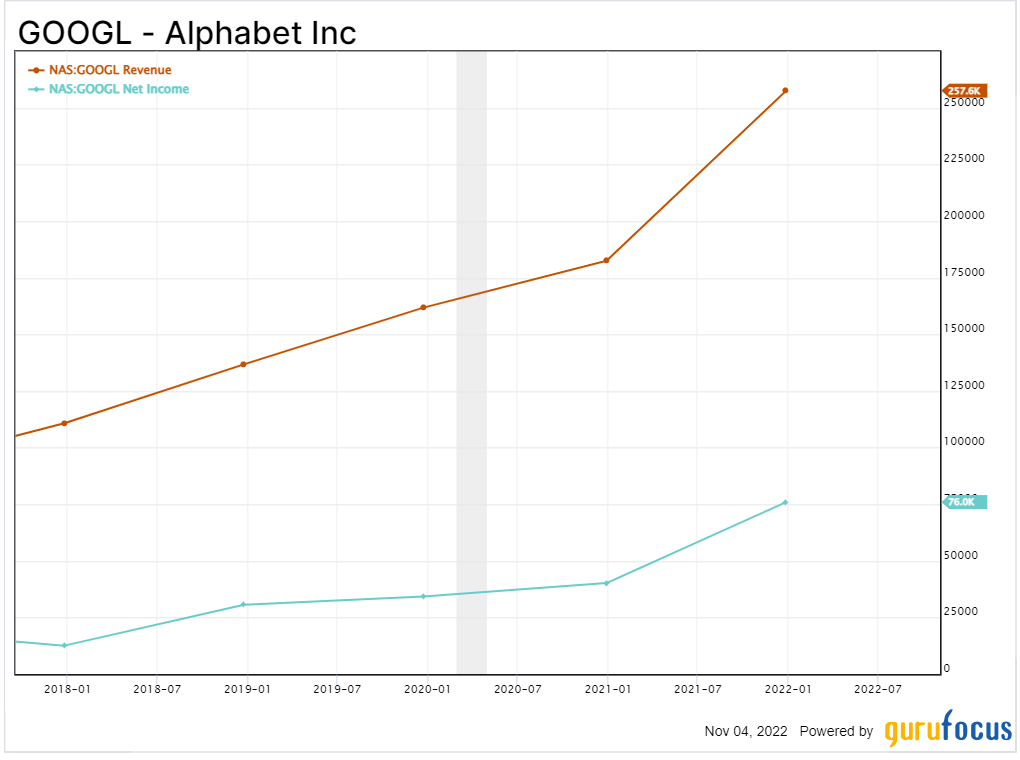

Alphabet reported pretty poor financials for the third quarter of 2022. Its revenue growth slowed down to just 6% year over year to $69 billion. This was a far cry from the prior growth rates in 2020 and 2021 of over 40%. This slower growth was driven by a series of factors such as unfavorable forex headwinds and lower advertising spending by companies. The good news is, advertising spending is cyclical by nature and a similar pattern should appear in the future. I am forecasting an uptick in advertising spend during the holiday season as well.

Alphabet and Meta (META, Financial) dominate the advertising market and together capture over 70% of all advertising spend globally.

The company’s overall operating expenses popped by 26% year over year to $20 billion. This was driven by strong sales and marketing spend for the launch of its new products such as the Google Pixel phone and headcount growth. This increase in expenses squeezed the company's operating profit margin from 32% to 25%, as operating income fell by 19% to $17.1 billion. The majority of its expenses look to be by choice and thus I don’t deem this to be a major issue long term. Amazon has a much tougher challenge managing its expenses as running a vast logistics network is an expensive and complex system with a lack of centralized control.

Alphabet’s Cloud segment is also continuing its strong growth and increased by 38% year over year to $6.9 billion.

Advanced valuation

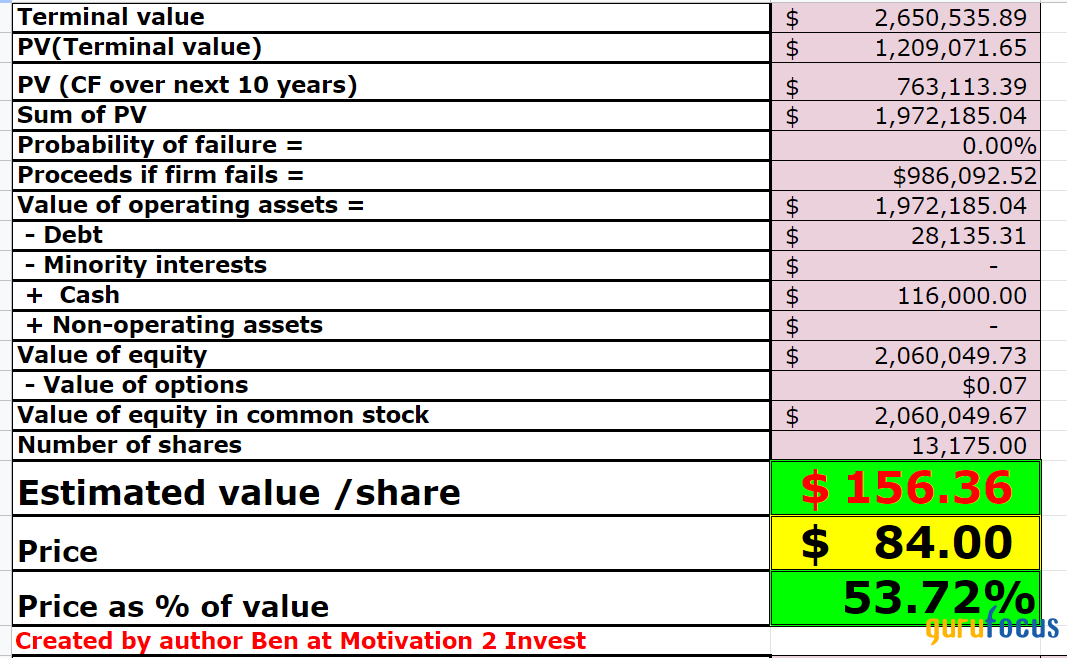

I have plugged conservative revenue growth forecasts of 5% for next year and 8% over the next two to five years into my valuation model for Alphabet.

The result of the above assumptions is an intrinsic value estimate of $154 per share, which is ~46% cheaper than its share price of ~$83 per share at the time of writing.

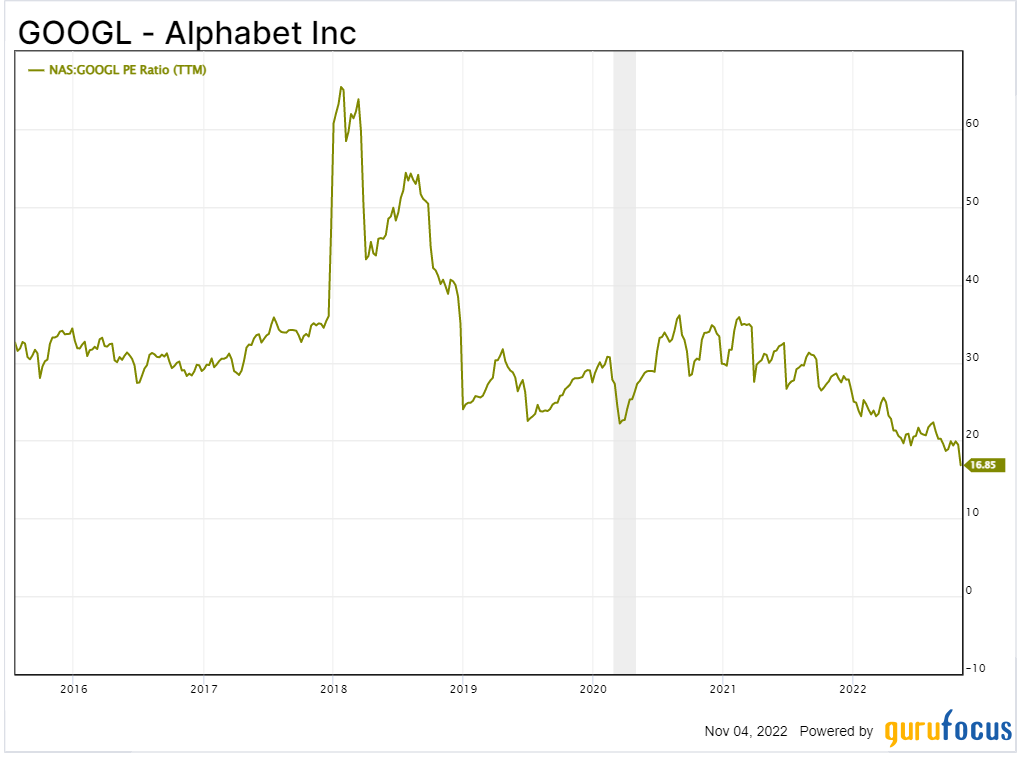

Alphabet trades at a price-earnings ratio of just 19, which is ~28% cheaper than its five-year average.

Final thoughts

Both Amazon and Alphabet are high-quality technology companies with strong leadership positions in their respective markets. The companies are facing a series of macroeconomic challenges right now due to the high inflation and rising interest rate environment. However, both businesses have a strong culture of attracting the best talent and are deeply undervalued by my estimates. I do expect continued volatility in the short term, but in the long term, I believe these two stocks could be great long-term opportunities.