The fifth generation mobile internet network, also known as 5G, is set to change our world and how we interact with digital devices. It is forecasted to offer 50 times more speed, 10 times lower latency and 1000 times more capacity than the current 4G network, according to a study by Intel (INTC, Financial).

Any time there is an improvement or shift in technology, new business opportunities get opened up. For example, the improvement in camera technology and 3G caused a surge in social media platforms such as Snapchat and Instagram because all of a sudden a vast number of people had a fast internet-connected device, no matter where they were in the world, and could use said device to immediately upload quality photos to social media.

The next revolution in high-powered internet is 5G, the technology can help power the Metaverse, augmented reality, live streaming, Internet of Things (IoT) devices and even 3D video streams. Therefore, it is no surprise that the 5G services market was valued at $48 billion in 2021 and is forecasted to grow at a rapid 56.7% compounded annual growth rate up until 2030 according to a study by Grandview research. Thus, in this article, I reveal my top two favorite stocks which are poised to benefit from the growth in 5G; let’s dive in.

1. Verizon

Verizon (VZ, Financial) is the largest wireless carrier in the U.S. and also has a global presence. In the third quarter of 2022, the company reported total broadband net additions of 377,000, which was an increase of 109,000 over the second quarter. Verizon provides over 40 million households with fixed wireless, and 5G technology could disrupt the traditional fixed wireless broadband industry as it effectively offers the same speed as Wi-Fi 6 but at home, work, or even outdoors.

Verizon owns the 5G Spectrum

Verizon is spearheading the 5G industry and launched its “Network as a Service” strategy a few years back. The company was the first carrier to launch a 5G mobile network and has since deployed 5G technology across 80 cities. In 2021, the company acquired the “C-Band” of the 5G spectrum in an auction for a staggering $45 billion. This humongous bid beat analyst expectations and meant Verzion secured more spectrum licenses than any other carrier. Verizon acquired 3,511 licenses, which is more than double what AT&T (T, Financial) acquired at 1,621.

Image: Verizon 5G Ultra Wideband Coverage, Source: Verizon investor materials

The “C-Band” is often referred to as the “mid-band” spectrum because it sits at between 1 gigahertz to 7 gigahertz range. This enables Verizon to offer greater speed than the low-band spectrum while also offering vast coverage. Over 70% of the 5G devices such as the iPhone 12 onwards and the latest Samsung Galaxy models are C-Band compatible.

Verizon has already managed to cover 30 million households with its 5G ultra wideband network and is on track to reach its 50 million household target by 2025.

In September 2022, the company won an $11.5 million contract from the U.S. Department of Defense for a private and secure 5G network for an aircraft hanger and military base, Pearl Harbor Hickam.

Verizon is also spearheading the use of multi edge computing (MEC) and has partnered with wireless tech hardware giant Cisco (CSCO, Financial). MEC is a new technology that aims to bring the power and speed of the data center to local devices. This could enable the use of Artificial Intelligence powered mobile applications and even 3D video streaming inside the Metaverse.

Third quarter earnings

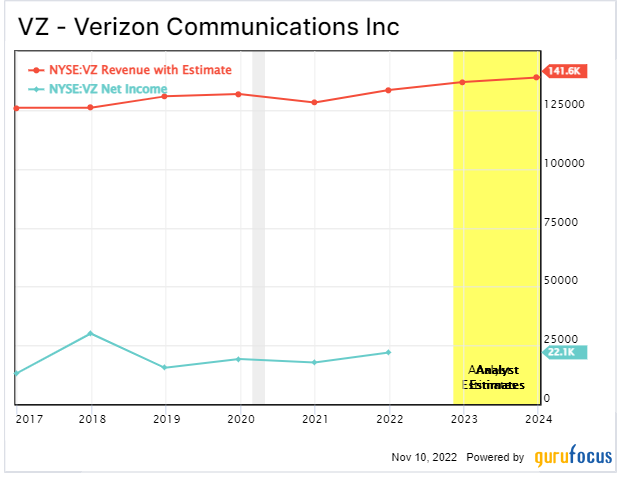

Verizon generated solid financial results for the third quarter of 2022. The company reported revenue of $34.34 billion, which beat analyst expectations by $452 million. This was driven primarily by wireless service revenue growth and strong wireless equipment sales.

The company generated net income of $5 billion, which declined by 23.3% year over year, which isn’t a great sign to see. However, earnings per share on an adjusted basis was $1.32, which beat analyst estimates by $0.03.

Verizon has started a new cost saving program, which is expected to reduce costs by between $2 billion and $3 billion by 2025. This is program should improve margins moving forward, which is a positive.

The business has fairly high unsecured debt of $131.4 billon, but this did decrease by $1.1 billion year over year. The company generated approximately $12.7 billion in free cash flow in the third quarter and has $2.1 billion in cash and cash equivalents on its balance sheet.

Valuation

Valuing Verizon is fairly challenging as it is a complex giant with many bets based on the future of 5G technology. We do know the company is trading at a price-earnings ratio of just 7, which is 34% cheaper than its five-year average.

The GF Value calculator indicates a fair value of $57 per share, which means the stock is undervalued at the time of writing but is also a possible value trap due to the decline in the bottom line alongside the share price. However, as Verizon is a capital-intensive comany, I'm not too worried about earnings volatility.

Last but not least, Verizon has a dividend yield of 6.95% as of this writing. This dedication to shareholder returns goes a long way towards making up for the stock price volatility and the capital-intensive nature of the business.

2. American Tower

American Tower (AMT, Financial) is an international provider of wireless communications infrastructure. The company effectively offers the backbone wireless infrastructure which powers mobile networks and 5G. The company has a smart business model in which it constructs, acquires and develops cell tower sites and then leases them to large carriers such as Verizon and AT&T. For example, American Tower has recently signed a long-term lease agreement with Verizon to secure its 5G network deployment across the U.S. American Tower operates as a real estate investment trust, or REIT.

The beautiful thing about American Tower is even if Verizon’s investments into 5G don’t generate a significant enough return, American Tower will still get paid its rent. This means consistent cash flow for investors. Its 2.92% dividend yield may not be terribly high due to the premium multiple at which shares are traded, but it is all but guaranteed based on American Tower's incredibly consistent history of share price gains.

Image: American Tower sites, Source: American Tower inestor relations

Third quarter earnings

In the third quarter of 2022, American Tower generated revenue of $2.67 billion, which beat analyst expectations by $18.13 million.

The company also generated strong earnings per share of $1.80, which beat analyst expectations by $0.55.

American Tower has just over $2.1 billion in cash and cash equivalents. Its current portion of long-term debt is fairly high at $3 billion, but this is not a surprise for a company that effectively grows by using leverage to purchase real estate.

Valuation

American Tower is an REIT, and thus the best method of valuing it is to use the price-to-funds-from-operation ratio. In this case, its price-to-funds-from-operation ratio is 15.9, which is 18% higher than its five-year average. This means the company is slightly overvalued, which makes sense given its strong margins and consistent cash flow.

Final thoughts

The 5G revolution has huge potential, and much of it we haven’t even realized yet. Verizon owns a wide portion of the 5G spectrum, while American Tower offers the backbone infrastructure. American Tower is a much higher quality company in my eyes, as it has more consistent earnings. However, it is also more expensive than historic levels. Verizon looks cheap at the time of writing but is more of a long-term bet with short-term volatility likely.

Also check out: (Free Trial)