Palantir (PLTR, Financial) is a big data company providing analytical tools for governments and private organizations. It has grown rapidly in recent years, thanks mostly to contracts with its biggest customer, the U.S. government.

However, recent changes in the investment landscape have pressured Palantir's stock. In particular, rising interest rates and inflation have led many investors to pull back from growth stocks. This has made it difficult for Palantir to attract attention.

The company went public in 2020, and since then, it has been under pressure to show that it can become profitable. A key hurdle it needed to clear was positive earnings. Unfortunately, Palantir has yet to deliver the goods on that end, with earnings falling short of analyst expectations yet again in the third quarter of 2022.

Palantir is not the only tech company to have struggled recently. The sell-off in tech stocks has raised concerns about whether the market is due for a further correction, and Palantir is still losing money. Investors will be closely watching to see if the company can turn things around in the year's final quarter.

For investors that believe in the company's long-term potential, Palantir has never been this cheap. While I think short-term pain could still be in the cards, I think this company is headed for success in the long run; here's why.

Palantir earnings fail to impress

Earnings are a big announcement for any company. They give insight into how the company is doing and can help show where it is headed in the future. Earnings are especially important in today's market, where inflation and high interest rates impact companies. Companies can't afford to miss their mark in the earnings season. If they do, it could mean big losses for shareholders. That's why it's so important for companies to focus on their earnings and make sure they hit their targets. Otherwise, they risk disappointing investors and damaging their reputation as well as their borrowing power.

Hence, it was no surprise that Palantir, an unprofitable and highly indebted company, struggled after its earnings release disappointed.

On the plus side, Palantir's quarterly results suggest that the company is successfully transitioning from a government contractor to a commercial enterprise. Palantir was founded in 2004 to help government agencies make sense of large data sets. The company's software is now used by various companies, including banks, hedge funds and pharmaceutical companies.

For comparison, Palantir's overall revenue increased by 22% for the quarter, while its commercial revenue grew by 53% in the U.S. This is encouraging as diversification into the private sector could be the boost the company needs to become profitable.

The outlook seems solid

Palantir's management believes it is well-positioned to continue its transition to a successful commercial software company. The company's U.S. commercial customer count increased by 124% compared to the year-ago quarter. The count grew from 59 customers to 132 in just one year. Palantir forecasts it will post between $503 million and $505 million in revenue during the fourth quarter, which aligns with analyst estimates.

However, growth is not spectacular in Europe. CEO Alexander Karp identified the slowness of Europe to adopt new technologies as one of the organization's key challenges. Additionally, the company's reliance on the U.S. government could very well be hurting its chances with foreign companies due to posing a national security risk. Palantir is well known for its work with the CIA, and while it has been trying to reduce its reliance on government contracts, they will likely always be part of its business.

Palantir's government revenue did fall last quarter as it struggled to diversify its business away from military contracts. Investors are ideally looking for the best of both worlds, commercial revenue and U.S. contracts, but should be aware that international diversification is unlikely to be very successful with this model. Analysts were hoping a lot of contracts would come in this quarter because of the Russian-Ukraine crisis, but that did not happen.

Value investors will find the current price very enticing

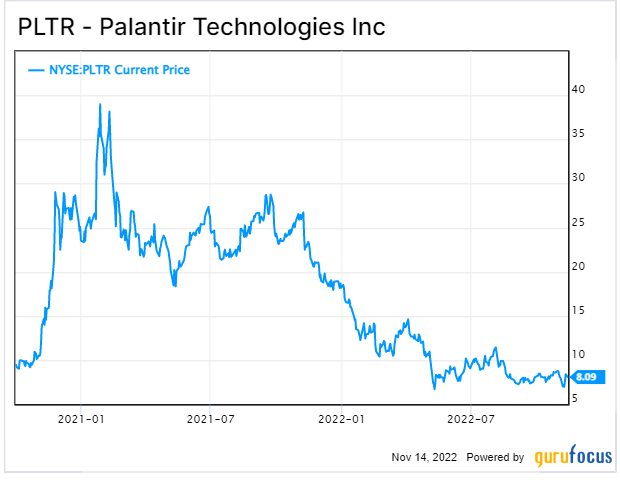

Palantir went public in October 2020, closing on its first trading day at $9.20 but rising to $23.64 in a few months. However, Palantir's stock price has fallen since its IPO, and it is now changing hands for less than $10. Palantir's valuation is depressed for the first time since it hit the markets.

Palantir predicts its foundational data platforms will continue doing well. It estimates that its artificial intelligence can be applied across industries and could draw in a total addressable market of $119 billion.

While some investors may be worried about the continued reliance on government contracts, I believe Palantir benefits from having most of its contracts with the U.S. government because this gives it a much more sustainable source of revenue than companies. That makes the business model more recession-resistant. Commercial companies are always under pressure when it comes to their budgets. In contrast, governments can have a wide variety of resources available to them regarding budgets. This can allow them to track down promising companies and ensure they get the most out of them.

Additionally, the bear market will not last forever, which could help the stock recover a higher valuation. Morgan Stanley's (MS, Financial) Mike Wilson, who correctly predicted the market downturn, now believes the bear market will end in early 2023. Investment advisor Luke Lango, quoting data that goes back decades, said that the weeks after the midterm elections are some of the best for the stock market.

Takeaway

Palantir's stock is currently in rough waters because of the bad economy as well as hiccups in its latest earnings report. However, in the long run, I believe the company will continue to do well, considering the importance of its services to the U.S. government. I think this company will benefit more from focusing on the U.S. market than trying to diversify elsewhere, and it will likely shape up to be a defense-adjacent stock in the long run.