Shares of coffee powerhouse Starbucks Corp. (SBUX, Financial) have fallen nearly 16% this year, but have staged a very strong rally ever since hitting a new 52-week low of $68.39 on May 12. Shares are higher by more than 43% ever since.

A portion of these gains have taken place in the last two weeks, sparked in part by a consumer price index reading for October that showed inflation slowed to 7.7% for October to 8.2% in September. The annual inflation rate is the fourth consecutive month of slowing, with October’s reading the lowest since January.

Also contributing to returns was an earnings report that showed Starbucks continues to demonstrate growth.

Despite the gains since May, Starbucks looks like it still has more room to the upside. Let’s dig deeper into the company and its most recent quarter to see why I believe gains can still be had.

Earnings highlights

Starbucks reported fourth-quarter and fiscal year 2022 results on Nov. 3. Revenue grew 3.2% to $8.41 billion, which was $90 million more than analysts had anticipated. Adjusted earnings per share of 81 cents were below the $1 the company saw in the prior year’s fourth quarter, but results did beat estimates by 9 cents.

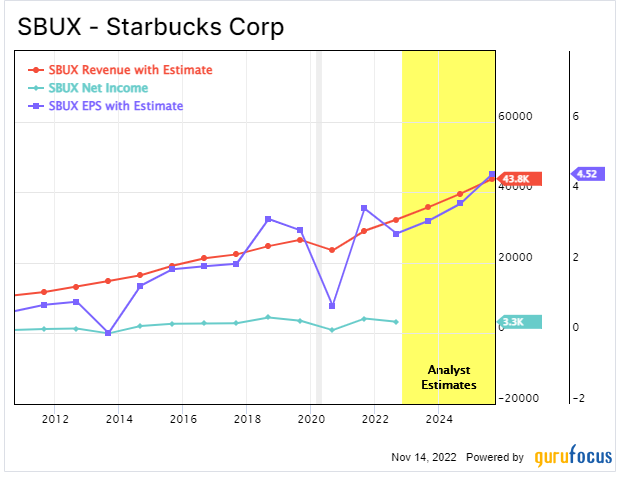

For the fiscal year, revenue grew 11% to $32.3 billion, while adjusted earnings per share of $2.96 compared to $3.20.

The all-important same-store sales were up 7% worldwide for the fourth quarter. The U.S. improved 11%, driven by a 10% increase in average ticket and a 1% improvement in comparable transactions. Consensus estimates were for growth of 7.6%. Much of the average ticket increase was due to price increases implemented over the past few quarters.

Comparable sales for international markets declined 5% for the fourth quarter as transaction volumes fell 5% while average ticket was down 1%. Almost the entirety of the decrease was due to weakness in China stemming from Covid-19 restrictions in place. China same-store sales were down 24% as comparable transactions fell 22%. Excluding China, the second-biggest market for Starbucks outside of the U.S., comparable sales for international markets were up 30%.

Starbucks continues to expand aggressively, with the company opening 763 net new stores during the quarter. The company had a new record of 35,711 stores at the end of the quarter.

On the downside, higher wages in North America stores were a significant overhang on margins. The operating margin for this region contracted 320 basis points to 18.6%. International margins were down even more, falling 750 basis points to 12.2% for the quarter, though much of this was due to closed stores in China.

Analysts expect that Starbucks will earn $3.40 per share in fiscal year 2023, which would be a 15.6% improvement from the prior period. Revenue is projected to grow 11% to $35.86 billion.

Takeaways

The fourth quarter was largely a continuation of the strength seen during the fiscal year. In fiscal year 2022, North America and the U.S. both had same-store sales growth of 12%, mostly due to price increases, but the number of tickets increased 5% and 4%, respectively. International sales were down 9%, again due to weakness in China.

Speaking of China, the restrictions placed on the population to quell further Covid-19 outbreaks weighed meaningfully on the performance of international markets. As a result, volume was way down.

The weakness in this region is in regard to mobility of the population and not the opening of new stores. In fact, management said on the conference call that they are opening a record number of locations within China. Still, the nation’s leadership has not been shy about locking down parts of the country due to Covid-19 resurgence and likely would not in the future.

Higher employee compensation did pressure margins, especially in North America. This has, and will likely be, an issue for those in the restaurant industry, especially with unemployment below 4% and the need for workers remaining high. Therefore, margins will continue to be lower than usual for Starbucks, though the worst of this could be lapped by the end of the next fiscal year.

On the positive side, quarterly revenue was up slightly and followed a 31.3% increase in the same period of fiscal 2021 due to an incredibly strong response following the easing of pandemic conditions in much of the world.

Throughout much of the last 15 years, Starbucks has generally showed impressive growth.

At its investor day in September, management outlined its goals for the coming years, with an expectation of U.S. same-store sales growth of 7% to 9% annually. The most recent fiscal year already topped this range and initial estimates for fiscal year 2023 are also above this level.

There are several reasons as to why I believe Starbucks is capable of generating this type of comparable sales growth.

The first item that shareholders should note is that demand outside of China was very strong, especially when considering the price increases the company had. Domestic sales were up mostly due to higher prices. Total transactions actually grew 1% from the prior year, showing the price increases did not negatively affect demand. The company also noted that its loyalty program grew 16% to nearly 29 million members in the U.S.

Not only did price hikes not cause a drop in transaction volume, they did nothing to stop a surge in the number of Starbucks Rewards members. More than half of U.S. sales come from those enrolled in the loyalty program.

Second, drive-through and mobile orders make up almost three-quarters of sales volume. When mobile order was first introduced, it was more of a mosh pit and the wait times were extensive. This has largely been corrected and remains an incredibly popular way for people to receive their orders.

While the company will always be known for and rely on its coffee products, food sales showed strong sales growth, increasing 18% in 2022.

Finally, Starbucks does not appear to be a mature company yet as it continues to open new stores. The company hit a new record for stores at the end of the fiscal year. Even in China, stores continue to be opened as Starbucks is looking beyond the near-term challenges of Covid-19.

Valuation analysis

Shares of Starbucks are trading at 28.7 times forward earnings estimates, which is above the price-earnings ratio of 26 that the stock has averaged over the last decade. Based on the historical multiple, the stock is slightly overvalued.

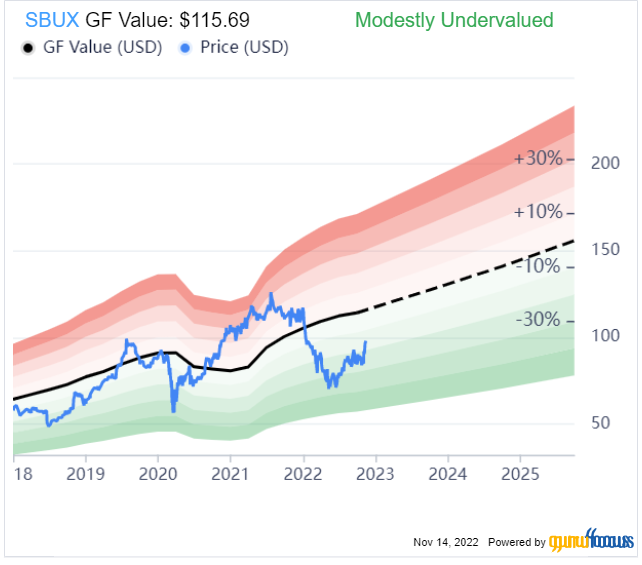

However, using a combination of historical multiples, past returns and growth as well as future estimates, the GF Value Line shows that Starbucks could have further room to run.

Starbucks is currently trading with a price-to-GF Value of 0.84, implying a potential return of 18.7%. Factor in the stock’s current yield of 2.2%, and total returns could push into the low 20% range.

Final thoughts

Starbucks delivered a fourth-quarter result that beat both revenue and earnings estimates. Global comparable sales were up a high single-digit figure, with U.S. results comfortably ahead of forecasts. China is an issue as mobility within the country is subject to limits resulting from Covid-19 resurgences. Other international markets performed considerably better.

The company has ambitious plans to grow domestic same-store sales, but is already ahead of those projections. Estimate for the new fiscal year show that analysts believe that double-digit top- and bottom-line growth is achievable.

Starbucks should be able to reach its goals as price increases have done little to stop traffic and Starbucks Rewards continues to see high penetration levels.

These factors are a major reason why the stock has climbed as much as it has since May, but shares still trade at a discount to their intrinsic value as calculated by GuruFocus. While the recent rally may turn off value investors, Starbucks appears to still offer a solid return from current levels.