Berkshire Hathaway Inc. (BRK.A, Financial)(BRK.B, Financial), the conglomerate spearheaded by Warren Buffett (Trades, Portfolio), disclosed in a regulatory filing recently that it chopped over half of its U.S. Bancorp (USB, Financial) stake in October. The bank was one of Berkshire’s top-10 holdings as of the second-quarter 13F filing. Investors can find this trade and more real-time trades on GuruFocus Real-Time Picks, a Premium feature.

Guru background

Known as the “Oracle of Omaha,” Buffett studied under the legendary Benjamin Graham at Columbia University. Buffett built Berkshire from a textile company into a major insurance conglomerate. Berkshire has a market cap of $679.62 billion as of Tuesday.

Buffett follows a four-criteria approach to investing. The insurance conglomerate seeks companies that have understandable businesses, favorable growth prospects, shareholder-oriented management and attractive valuations.

The insurance conglomerate's $300.13 billion second-quarter 13F equity portfolio contained 47 stocks with a quarterly turnover ratio of 1.25%. The top four sectors in terms of weight were technology, financial services, consumer defensive and energy, with weights of 42.92%, 25.66%, 13.38% and 10.90%.

In the second quarter, U.S. Bancorp was one of its top holdings, but that changed after a third-quarter reduction as well as the real-time reduction in October.

Transaction details

According to GuruFocus Real-Time Picks, a Premium feature based on SEC Schedule 13-D, 13-G and Form 4 filings, the Omaha, Nebraska-based insurance conglomerate sold 24,742,666 shares of U.S. Bancorp on Oct. 31, slicing 31.81% of the position.

The Minneapolis-based bank occupied 1.84% of Berkshire’s second-quarter 13F equity portfolio, representing the guru’s ninth-largest holding. The new equity portfolio weight of U.S. Bancorp knocks it out of the top 10, behind the new 10th-largest holding Activision Blizzard Inc. (ATVI).

Investors must be aware that the trade in U.S. Bancorp is not part of Berkshire’s third-quarter 13F filing but a real-time pick that took place during the fourth quarter. Berkshire was also selling U.S. Bancorp in the third quarter, trimming 42,016,921 shares, or 35.07%. When both the third-quarter reduction and the real-time pick are combined, Buffett has knocked more than 50% off the position in the second half of 2022 so far.

Investors must also take note that 13F filings do not give a complete picture of a firm’s holdings as the reports only include its positions in U.S. stocks and American depository receipts, but the reports can still provide valuable information. Further, the reports only reflect trades and holdings as of the most-recent portfolio filing date, which may or may not be held by the reporting firm today or even when this article was published.

Company background

The bank operates primarily in the western and midwestern regions of the U.S., offering services ranging from retail banking to commercial banking, trust and wealth services, credit cards and mortgages. As of Monday, U.S. Bancorp has a market cap of $66.67 billion with an enterprise value of $89.58 billion.

Shares of U.S. Bancorp traded around $42.45 on the Oct. 31 transaction date. The stock is modestly undervalued based on its price-to-GF-Value ratio of 0.85 as of Monday.

U.S. Bancorp has a GF Score of 80 out of 100 based on a growth rank of 8 out of 10, a GF Value rank of 7 out of 10, a profitability rank of 6 out of 10, momentum rank of 5 out of 10 and a financial strength rank of 4 out of 10.

Financial strength

U.S. Bancorp’s financial strength ranks 4 out of 10 on the back of cash-to-debt and debt-to-equity ratios underperforming more than 68% of global competitors. As of the third quarter, the company had $41.652 billion in cash and cash equivalents compared to $25.066 billion in short-term debt and $32.228 billion in long-term debt.

The bank’s equity-to-asset ratio of 0.08 underperforms approximately 56% of global banks. Despite this, the bank has a modest Piotroski F-score of 4 out of 9 while its Beneish M-score of -2.57 suggests that the bank is unlikely to manipulate its earnings results.

Profitability

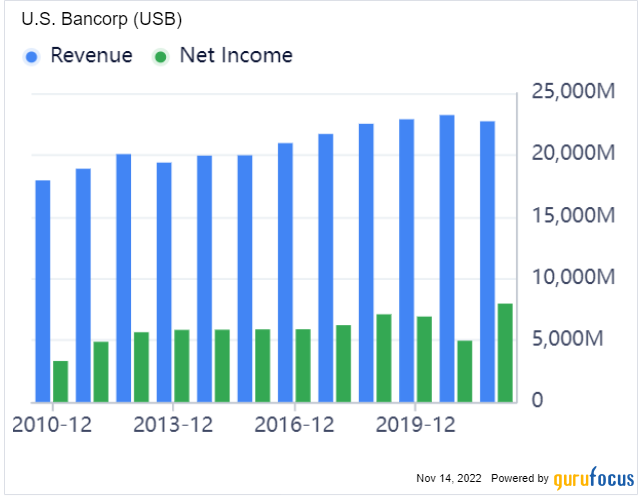

U.S. Bancorp’s profitability ranks 6 out of 10. Even though the company’s net margin of 27.96% outperforms just over 52.83% of global competitors, U.S. Bancorp has a five-star business predictability rank, 10 years of positive income over the past 10 years and a return on equity that outperforms more than 62% of global banks.

Valuation

U.S. Bancorp has a GF Value rank of 7 out of 10. While the stock is modestly undervalued based on its price-to-GF-Value ratio of 0.85 as of Monday, several of the stock's valuation ratios underperform more than half of global competitors.

The bank currently trades at a price-earnings ratio of 10.42, which underperforms approximately 57% of global banks. Likewise, the bank’s price-sales ratio of 2.77 underperforms approximately 56% of global competitors while the bank’s price-book ratio of 1.6 underperforms more than 80% of global peers.

Growth

U.S. Bancorp’s growth ranks 8 out of 10 on the heels of a five-star business predictability rank despite three-year revenue and earnings growth rates underperforming more than 55% of global competitors.

According to GuruFocus Warning Signs, a Premium feature, U.S. Bancorp’s revenue has declined by approximately 0.9% over the past year, compared to 3.5% growth on average over the past three years, 5% growth on average over the past five years and 4.9% growth on average over the past 10 years.

Momentum

U.S. Bancorp’s momentum ranks 5 out of 10 on the back of 14-day relative strength index values underperforming approximately 70% of global competitors. Additionally, the bank’s 6-1 month momentum indicator of -19.95% and 12-1 month momentum indicator of -36.18% underperform over 85% of global banks.

Other financial service holdings

Other major financial service holdings in Berkshire’s third-quarter 13F equity portfolio include Bank of America Corp. (BAC, Financial), American Express Co. (AXP, Financial) and Moody’s Corp. (MCO, Financial).