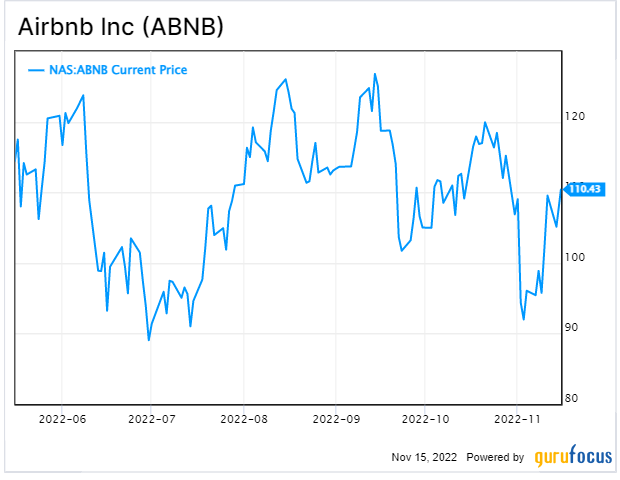

Airbnb (ABNB, Financial) had a solid third-quarter earnings report recently, but even with better-than-expected numbers, shares dipped lower following disappointing guidance for the fourth quarter.

I still consider Airbnb a growth stock and believe it will likely continue posting impressive performance numbers in the long-term as it disrupts the hotel industry. However, the markets are unforgiving right now due to the poor economic situation, and even a slight misstep could prove very costly.

Even as Airbnb expects to suffer near-term setbacks, though, management is not letting that slow it down. The company is taking proactive steps to ensure that it resolves these issues, which is a major positive, both for users and investors.

For example, Airbnb has long been criticized for the way it displays the pricing on its platform, with many users finding the fees attached to their bookings to be exorbitant. The company is now taking steps to address this issue, introducing "all-in" pricing that includes all fees upfront. Consumers will welcome this change as they will no longer be caught off guard by hidden costs when booking their stay.

Airbnb has also been working hard to upgrade its platform lately. The company is conscious that it needs to make sure it addresses various issues, and at this point, there is little that the company can do about the macroeconomic environment. What it is doing is focusing on the areas where it can improve.

Making some much-needed changes

Airbnb reported impressive third-quarter results on Nov. 1. Interestingly, investors were both excited and discouraged by the report - while some were pleased with revenue of $2.9 billion, others reacted negatively to guidance for the fourth quarter.

The company has recently made several changes designed to improve guests' experiences. First and foremost among these was the introduction of a new fee structure. Airbnb guests will now be charged a service fee, a cleaning fee and a rental fee. The rental fee is variable and depends on the cost of the listing, while the other two fees are fixed. Airbnb has historically been criticized for sneaking in hidden fees, so the new structure is a welcome transparency initiative.

Another major change is Airbnb's house rules policy. Some hosts have been accused of implementing unreasonable rules, such as requiring guests to vacuum the entire house before checkout. Airbnb is now cracking down on these rules and will only allow hosts to implement reasonable and necessary rules. This should help to create a more consistent and enjoyable experience for Airbnb guests.

Overall, these changes appear to be positive ones for Airbnb guests. By introducing more transparency and cracking down on unreasonable house rules, Airbnb is making it easier for guests to have a positive experience with its platform. These changes should lead to increased bookings in the future.

Airbnb is asset-light, which means that it does not own any of the inventory or fulfill any of the orders. It charges a fee to the host, which is 14% to 16% of the subtotal of the reservation. Airbnb is similar to other intermediary businesses because it takes a commission to connect two parties.

With the trend toward more relocations, Airbnb is positioned for growth in the long-run as the work-from-home crowd often likes to relocate or travel around. It is a unique travel company that has created its niche in the industry. It isn't like a hotel because it offers rentals for days, weeks, or even months. Airbnb also increasingly caters to rural areas outside popular metropolitan travel destinations.

Airbnb is introducing a search function to make it easier for users to discover homes in locations they may not have thought to search for. The new search function will allow users to specify their desired location, travel dates and the number of guests, and Airbnb will then provide a list of homes that meet their criteria. Airbnb hopes this new feature will encourage users to explore new destinations and experience the unique cultures each location has to offer.

Airbnb has also made some popular service launches like AirCover and Split Stays, which should improve the user experience further.

AirCover is a brand new travel protection service by Airbnb that provides guests with a booking and check-in protection guarantee. If the host cancels before the guest arrives, AirCover will find an alternative place to stay or issue a refund. The service is free and included in all bookings.

Finally, Airbnb's new Split Stays feature is perfect for those who want to experience two different sides of a destination. With 14 different categories to choose from, including national parks and skiing, there's a lot on offer for the company's user base.

Takeaway

It has been a tough year for investors. Inflation has been high and interest rates have been rising. This has made it difficult to make money in the stock market. However, the market should eventually take a turn for the better. Personally, I expect the Federal Reserve to raise interest rates again in December, but this may be the last rate hike. If inflation starts to fall, it will be good news for the markets as an interest rate cut will become more likely.

Regardless of what the short-term brings, I believe in Airbnb's long-term growth story. The enhancement of its products will pay dividends for many years to come.