One of the most revolutionary, transformative and disruptive stories in recent decades is the ride-sharing concept. It takes a lot to disrupt a century-old business like taxi service. But as we have seen in recent years, disruptive businesses or technologies do not always make a lot of money, at least at the beginning. The innovator and creator in this space is Uber Technologies Inc. (UBER, Financial), which began operations in 2009.

The company was one of the innovators that links consumers with independent providers of ride-sharing services. It also connects riders and other consumers with restaurants, grocers and other stores with delivery service, primarily for meal preparation and groceries.

The Mobility segment connects consumers with drivers who provide rides in a variety of vehicles, such as cars, rickshaws, motorbikes, minibuses or taxis. The Delivery segment allows consumers to search for and discover local restaurants, order a meal and either pick up at the restaurant or have the meal delivered. The Freight segment connects carriers with shippers on the company’s platform and gives carriers upfront and transparent pricing. This segment also includes transportation management and other logistics services offerings.

Founded in 2009 and formerly known as Ubercab, the company changed its name to Uber Technologies in February 2011. The company is expected to generate over $31 billion in revenue this year and currently has a market capitalization of $62 billion.

Recent legislative actions

Since 2020, Uber and its competitors have been under fire from various labor groups that are accusing the company of misclassifying its drivers as independent contractors. Multiple lawsuits have been filed in California that seek to force the company to pay drivers certain wages and benefits. In 2020, Proposition 22 was passed in that state that confirmed the right for Uber to treat its drivers as independent contractors. Similar legal action has also taken place in Massachusetts and in other countries. If these actions do not turn out favorably for the company, material and significant additional expenses will be incurred. The company is still not profitable, so this would be very damaging to financial results.

Financial review

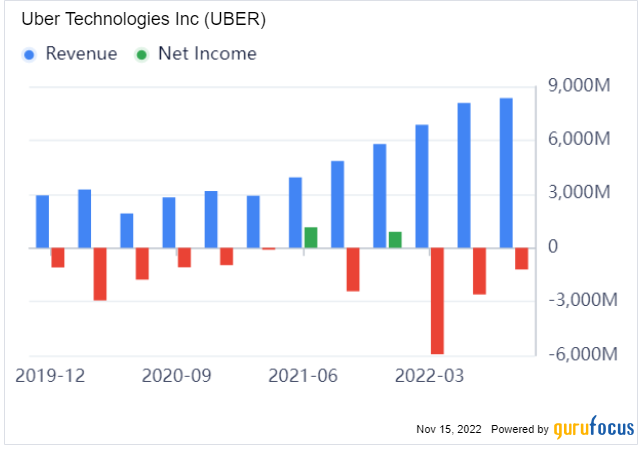

The company reported third-quarter financial results on Nov. 1, which were largely in line with expectations. Gross bookings increased 32% on a constant currency basis and total revenue increased 81%. The revenue increase was driven by an acquisition and change in the U.K. business model. Total revenue was $8.3 billion, but total operating expenses were $8.8 billion and the company reported a net loss of $1.2 billion.

The company noted there is strong consumer spending in the Mobility segment, but weakness in the Freight segment with shipping and logistics demand moderating. Shipping rates were down sequentially. The company anticipates this downturn will last into 2023.

In a statement, CEO Dara Khosrowshahi commented on the company's performance.

"Our global scale and unique platform advantages are working together to drive more profitable growth, with Gross Bookings growth of 32% and record Adjusted EBITDA of $516 million," he said. "Even as the macroeconomic environment remains uncertain, Uber’s core business is stronger than ever."

Chief Financial Officer Nelson Chai also made remarks about Uber's results.

"Strong demand for our offerings, better marketplace efficiency, and our asset-light platform helped to deliver adjusted EBITDA well above our guidance, even as foreign exchange and inflationary headwinds impact all global businesses," he said. "We remain focused on excellent execution and disciplined cost management to deliver on our growth and profitability commitments for the coming years.”

For the nine-month period ending Sept. 30, the company recorded massive stock compensation expenses totaling $1.3 billion. In 2021, the company reported $1.2 billion in stock compensation expenses. The total share count has ballooned from 1.25 billion in 2019 to 1.97 billion currently as the company continues to dilute existing shareholders.

The company had $9.4 billion in cash and investments on the balance sheet at quarter end as well as long-term debt totaling $9.3 billion. The company also maintains large insurance reserves to support its business, which totaled $4.4 billion.

Valuation

The company is not profitable at this time and consensus earnings per share estimates for 2022 are for a loss of $4.87. Losses are expected again next year with earnings per share projections of a loss of approximately 21 cents. Valuations for price-to-cash flow and enterprise value/Ebitda are at elevated levels.

The GuruFocus discounted cash flow calculator creates a value close to today’s stock price using 2024 estimates of $1 in earnings per share and a 15% long-term growth rate. The company does not pay a dividend and has no plans to for the foreseeable future.

Guru trades

Gurus who have purchased Uber stock recently include George Soros (Trades, Portfolio), Philippe Laffont (Trades, Portfolio) and Chase Coleman (Trades, Portfolio), while those who have reduced or sold out of their positions include Joel Greenblatt (Trades, Portfolio), Ken Fisher (Trades, Portfolio) and Ray Dalio (Trades, Portfolio)'s Bridgewater Associates.

Conclusion

Uber can be given credit for disrupting the transportation industry, but the company needs to generate GAAP profits in order to attract a new investor base. The days of relying on adjusted Ebitda and non-GAAP profits are coming to an end after a multiyear run. In addition, the worker misclassification risk is still very high, which makes the stock unappealing at this time.

Also check out: