Five Below Inc. (FIVE, Financial) may not be on the radar of many investors for a couple of reasons. First, it has a market cap of only $8.40 billion and second, its target market is pre-teens and teenagers.

But it has had a powerful growth story over the past 20 years. In addition, it has no debt and is undervalued.

About Five Below

Pre-teens and teenagers, along with price points below $5, are the two key characteristics of Five Below’s business model. According to census data cited in its 10-K for the year that ended on Jan. 29, there were over 62 million Americans between five and 19 years of age. That makes it a large niche, with lots of room for growth by the company.

It serves these markets with what it calls “trend-right, high-quality products.” It refers to trend-right in the sense that it monitors trends in the pre-teen and teen markets, so it can respond quickly and effectively.

Based in Philadelphia, the company was founded in 2002 and began trading publicly in 2012. Over those 20 years, it has grown to 1,252 stores in 40 states (at the end of its fiscal second quarter on July 30). It also has an online platform.

Competition

Five Below competes with a broad range of retailers, from discount to grocery and drug stores.

Still, it believes it has competitive advantages that keep it ahead of many competitors. In the annual report, management wrote, “We believe that we compare favorably relative to many of our competitors based on our merchandising strategy, edited product assortment targeted at tweens and teens, store environment, flexible real estate strategy and company culture.”

GuruFocus’ performance chart shows Five Below compares favorably with Casey’s General Stores Inc. (CASY, Financial) and Dick’s Sporting Goods Inc. (DKS, Financial).

Its net margin is a leader in the retail-cyclical industry and its return on invested capital is above average, as we will see.

Over the past five years, its annualized return has averaged 21.85% per year, and over the past 10 it has averaged 18.39%.

Financial strength

Five Below receives a score of 6 out of 10 for financial strength, based on the size of its debt (as measured by the interest coverage), its debt-to-revenue ratio and its Altman Z-Score:

I was initially surprised by the relatively low score Five Below receives. As the table indicates, it generated $28.89 in operating income for every dollar of interest expense. That’s better than the industry average (higher than 70.05% of industry players) and seems safe to me.

But that interest expense ratio really should read “N/A,” as in not applicable. The balance sheet shows no short- or long-term debt, and what we are seeing in the table and charts on the Summary page are long-term capital lease obligations. In other words, this is what it pays to lease space for its brick-and-mortar stores.

Given that there is no debt, the revenue-to-debt ratio becomes zero and meaningless. As for revenue, Five Below had trailing 12-month revenue of $2.91 billion.

It is a different story when I look at the Altman Z-Score. The scale points to a high score of 4.52, which is very good and indicates the company is in the "Safe Zone."

Overall, the retailer is a strong financial player, one that has grown from nothing to 1,252 stores in 20 years. It did take on $20 million in long-term debt in fiscal 2013 and repaid it in full the following year.

Profitability

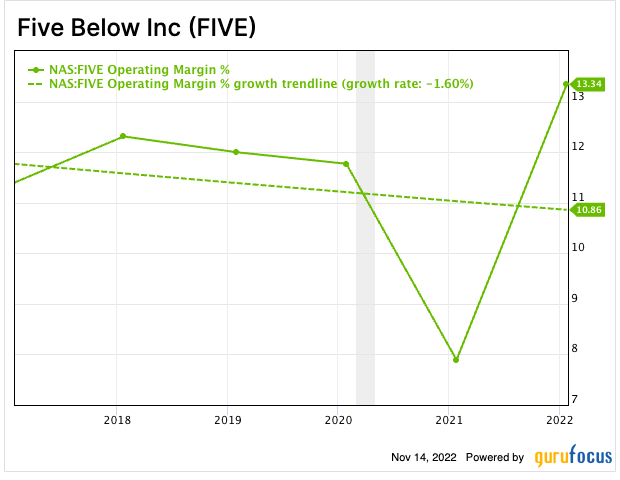

This 10 out of 10 ranking for profitability is based on five factors: the operating margin, Piotroski F-Score, the five-year trend of the operating margin, consistency of profitability and predictability rank.

While this five-year chart of the operating margin does not impress, it is dragged down mainly by fiscal 2021, which included the Covid-19 store closure quarters.

As we saw on the financial strength table, the Piotroski F-Score is just 4 out of 9, which is adequate, but hardly robust.

On the other hand, there is a strong showing for the consistency of profitability. Earnings per share without non-recurring items has grown consistently, except for fiscal 2021, which, as noted, included the pandemic’s worst days.

As for predictability, the company has earned a full five out of five stars for consistently growing its revenue and Ebitda.

Despite a few rough edges, we have a company that deserves the high profitability rating it receives.

Growth

Once again, Five Below receives a perfect score of 10 out of 10 for growth based on its revenue growth over the past three and five years, five-year Ebitda growth and the predictability of its five-year revenue growth:

I doubt there are many companies that boast as much revenue consistency over the past five years (although 2021’s growth was hampered by the pandemic).

It is the same story when we look at Ebitda growth (and, as with revenue, note the rapid growth rate).

As noted, earnings per share growth has been consistent, helping to produce a perfect ranking for predictability.

One more note before we leave the growth section: free cash flow has been inconsistent.

After looking at the charts for revenue and Ebitda expansion, it is easy to see how the company got its reputation for being a growth company. And it plans more of the same, according to its 2022 investor presentation:

Dividends and share repurchases

Five Below does not pay a dividend. It has bought back a modest number of shares, but not enough to offset the number of new shares issued over the past decade.

Valuation

Based on the price-to-GF Value ratio, Five Below gets full marks for value.

At the close of trading on Monday, Nov. 14, Five Below’s price was $151.36, while the GF Value indicated an intrinsic value of $216.42. Considering the gap between these two prices, the company is considered to be significantly undervalued.

However, the price-earnings ratio is quite high. That means that although five-year Ebitda growth has been robust, the PEG ratio (price-earnings divided by the five-year Ebitda growth rate) of 1.75 is above the fair value mark of 1.

Further, because Five Below has a five out of five predictability rating, we can look at the discounted cash flow calculation with confidence.

The price and the margin of safety are based on using the five-year earnings per share without non-recurring items growth rate (a 10-year rate is not available) in the growth stage and 5% in the terminal stage.

More confirmation of undervaluation comes from a 10-year price chart, showing how the price has fallen from a high of $236.21 on Aug. 25, 2021.

Fundamentals summary

Considering the five key fundamentals covered by the GF Score, Five Below is a highly attractive company:

Gurus

Six gurus had stakes in Five Below at the end of September. The three largest of those positions were those of Chuck Royce (Trades, Portfolio) of Royce Investment Partners, PRIMECAP Management (Trades, Portfolio) and Lee Ainslie (Trades, Portfolio) of Maverick Capital. None of them had over 50,000 shares and two of them reduced their holdings significantly during the quarter.

Despite the coolness of the gurus, other institutional investors have been buying and they hold 78.87%. Insiders own another 2.6% of shares outstanding. The biggest holding is that of Thomas G. Vellios, co-founder, director and CEO, with 410,915 shares.

Conclusion

Five Below deserves at least a look from value investors because of its debt-free status and current undervaluation. This is a robust company and, judging by the metrics, a well-managed one.

Growth investors also might take notice, given the rapid growth of its revenue, Ebitda and earnings. It may not have found a bottom yet, but share prices could rise significantly over the next five years.