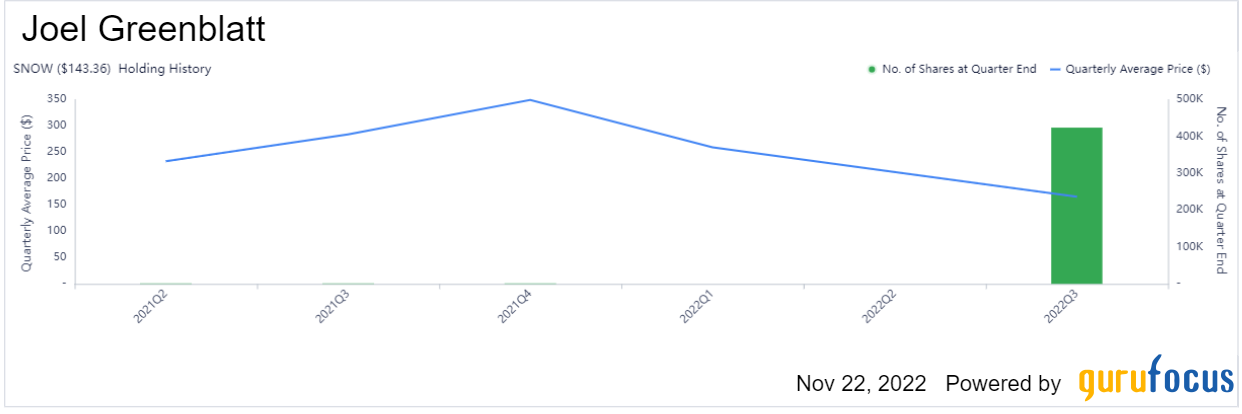

Joel Greenblatt (Trades, Portfolio), the managing principal and co-chief investment officer of Gotham Asset Management and inventor of the “Magic Formula” investing strategy, recently disclosed the firm’s portfolio updates for the third quarter of 2022, which ended on Sept. 30.

Gotham Asset Management offers a range of both long-only and long-short funds, all of which are based on valuation. The group holds that stock prices can be volatile and emotion-based in the short term, but that they will generally trade closer to their fair value after a period averaging around two to three years. The funds are centered on U.S. large and mid-cap companies that are trading at the biggest discount to the managers’ assessment of their value, based on factors such as return on capital, earnings yield and risk.

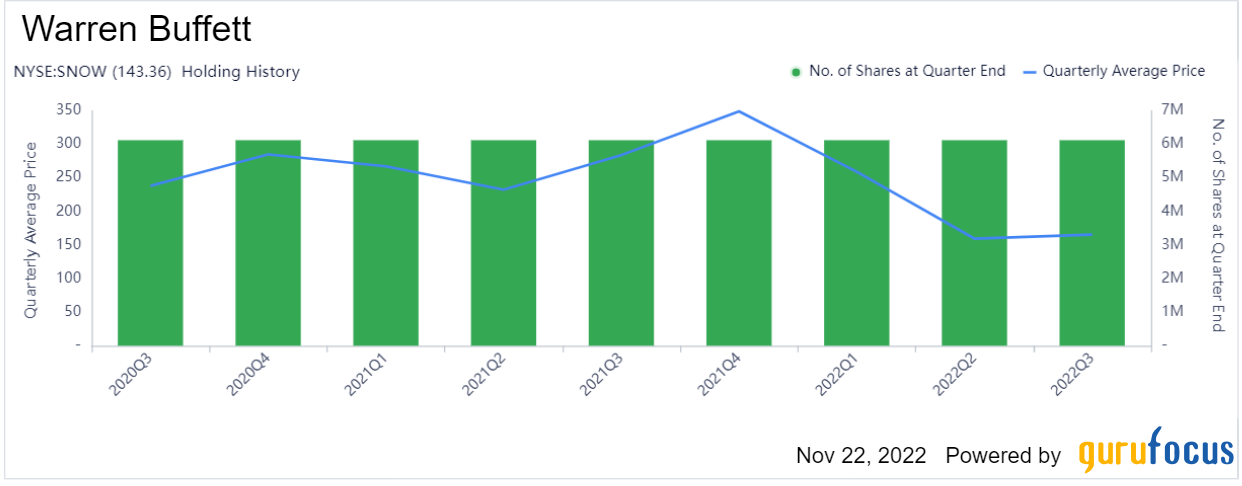

In its latest 13F filing, the firm reported that it took a new stake in Snowflake Inc. (SNOW, Financial), a cloud data warehousing company that also counts Warren Buffett (Trades, Portfolio)’s Berkshire Hathaway (BRK.A)(BRK.B) as one of its investors. When the news broke that Berkshire had bought an expensive tech stock like Snowflake, investors were shocked because it does not seem to fit with the firm’s typical investable universe. However, could Greenblatt’s investment contribute to the argument that Snowflake truly is a value stock?

Investors should be aware that 13F reports do not provide a complete picture of a guru’s holdings. They include only a snapshot of long equity positions in U.S.-listed stocks and American depository receipts as of the quarter’s end. They do not include short positions, non-ADR international holdings or other types of securities. However, even this limited filing can provide valuable information.

Snowflake’s business

Snowflake has carved a unique niche for itself by offering data warehousing that is cloud native. All of the company's components can run on public cloud infrastructure built by Alphabet’s (GOOG) (GOOGL) Google Cloud, Microsoft’s (MSFT) Azure and Amazon’s (AMZN) AWS.

This means it can be integrated into a user’s existing cloud infrastructure. Users can load data into the cloud without converting or transforming it into a fixed schema, allowing structured and semi-structured data to be combined for analysis.

Snowflake also requires almost no administration. The company boasts that customers can typically set up and manage Snowflake without the help of the IT team. Processes like auto-scaling, software updates and increasing clusters and virtual warehouses are automated.

It also offers unlimited compute sizes and storage, which is made possible by its cloud-native structure. Meanwhile, competitors like Teradata (TDC) provide fixed capacity, and when you exceed that capacity, you have to restructure systems with additional hardware and upgrades.

The company’s direct competitors are mainly subsidiaries of tech giants, such as Amazon’s Redshift and Alphabet’s BigQuery. Two consistent ways that Snowflake differentiates itself are via instant scaling and more automated maintenance, though it does lose out on the more natural integration of cybersecurity solutions that some of the big tech giants offer. Snowflake and BigQuery have solidified themselves as the industry leaders, and customer preference often boils down to the specific company needs.

Still pricey but cheaper than before

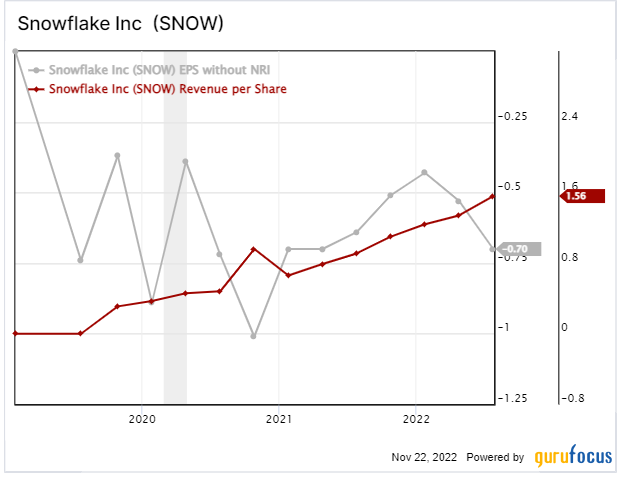

While Snowflake’s three-year revenue per share growth rate of 115.5% is truly impressive, the company is still focusing on growth rather than profitability, as reflected by its three-year earnings per share without non-recurring items growth rate of -39.6%.

Analysts surveyed by Morningstar (MORN, Financial) are not expecting the company’s bottom line to turn positive until calendar 2026 (or fiscal 2025), though Yahoo Finance’s analysts are much more optimistic, projecting it can become profitable as early as the fourth quarter of fiscal 2023. As we can see, opinions on the company’s future vary wildly.

Snowflake itself has not provided bottom-line guidance, though in its earnings report for the second quarter of fiscal 2023, it did project a positive operating income margin of 2% for the full year, which would be a step in the right direction.

The stock is down 43% since it went public in September of 2020, so it is much cheaper now than it was before. Whether or not it is still pricey at current levels depends on how the company can perform in the coming years. At $143.36 per share, the stock would someday need to make around $6 per share in order to be considered cheap now.

Guru investors

Greenblatt’s firm picked up a new holding worth 423,947 shares in Snowflake in the third quarter, when shares averaged $165.57 apiece. Previously, it held a tiny position of just over 1,000 shares in the stock from the second quarter of 2021 through the first quarter of 2022 before selling out at around $259.22 per share.

Berkshire is the top guru shareholder of Snowflake with 1.91% of the company’s shares outstanding. It purchased $250 million worth of Snowflake shares at the IPO price, quickly adding another 4.04 million shares at the debut price and has held on since then as of its latest 13F report. Given the size of the position, it is likely one of Buffett’s portfolio managers that is responsible for this investment. Todd Combs and Ted Weschler are known to be more familiar with the technology sector.

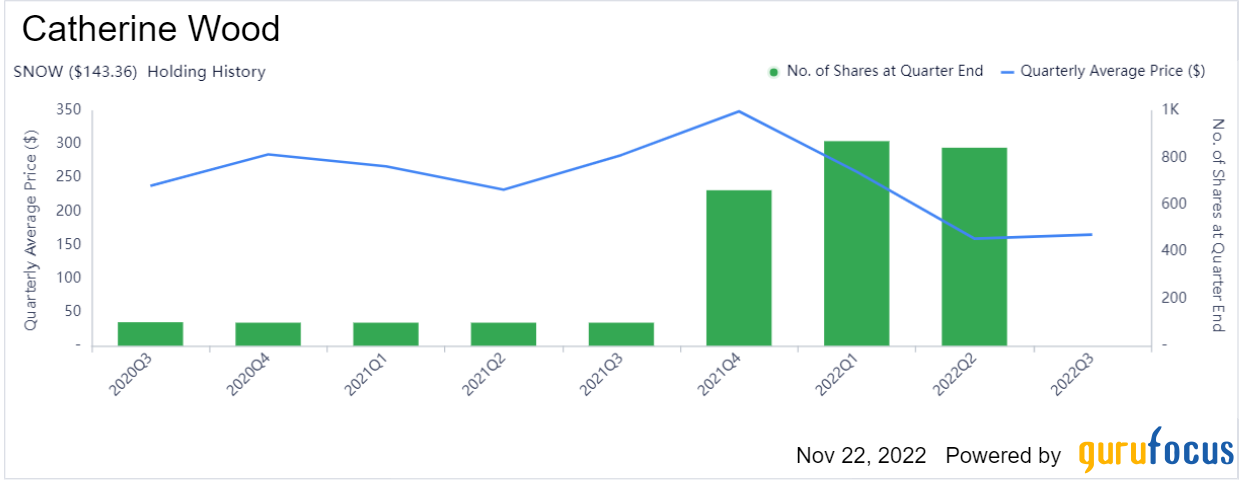

Other gurus with large stakes in Snowflake include Frank Sands (Trades, Portfolio) and Baillie Gifford (Trades, Portfolio). On the other hand, Catherine Wood (Trades, Portfolio) sold out of the stock in the third quarter of 2022.

See also

Greenblatt’s other notable trades during the quarter included additions to the iShares Core S&P 500 ETF (IVV, Financial) and the S&P 500 ETF TRUST ETF (SPY, Financial) and reductions to Intuit Inc. (INTU, Financial) and PayPal Holdings Inc. (PYPL, Financial).

As of the quarter’s end, the 13F equity portfolio included shares of 1,157 stocks valued at a total of $3.34 billion. The turnover for the period was 25%.

The top holding was the firm’s own exchange-traded fund, the Gotham Enhanced 500 ETF (GSPY, Financial), with 7.09% of the equity portfolio, followed by the S&P 500 ETF TRUST ETF with 5.21% and Snowflake with 2.16%, making Snowflake its number one non-ETF position.

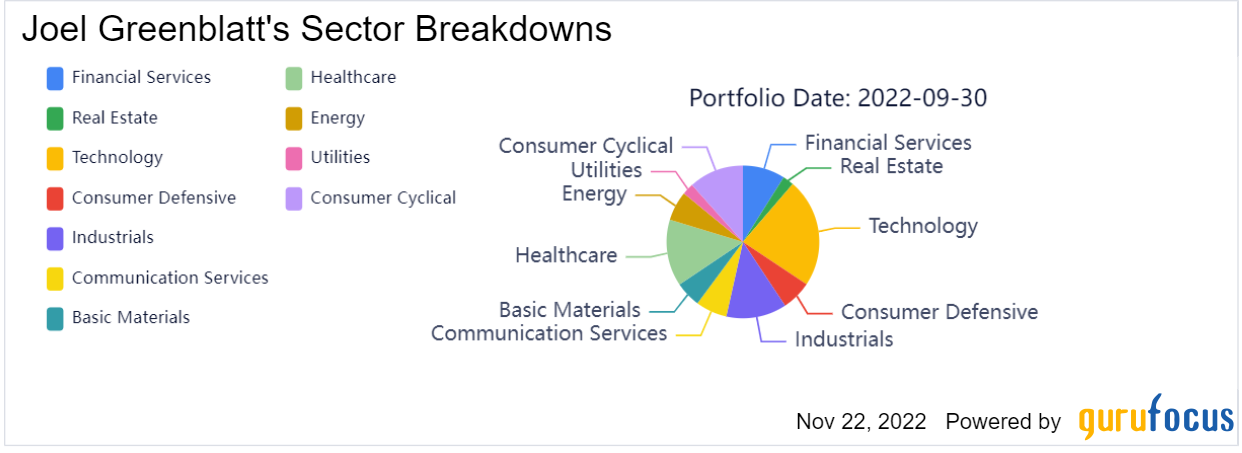

In terms of sector weighting, the firm was most invested in technology, health care and industrials.