The banking sector has taken a hit in the last two quarters due to an aggressive Federal Reserve, high inflation, a struggling economy and lower stock market activity. Higher interest rates dry up the market, resulting in less room for leverage buyouts, new debt issues, mergers, acquisitions, etc. Even though the investment banking arm of Morgan Stanley (MS, Financial) is smaller than some of its peers, it is one of the firms most affected by rate hikes because of its credit ratings business.

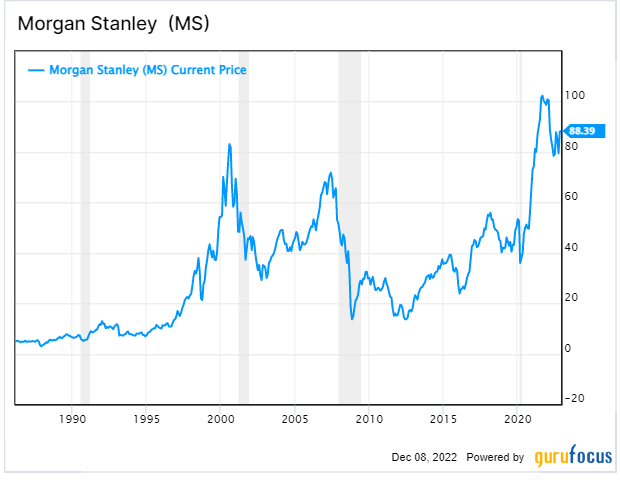

Putting these short-term issues aside, though, Morgan Stanley has shown resiliency over the years and has healthy shareholder returns in the form of dividends and share buybacks. Additionally, the launch of the new exchange-traded funds will help the firm to diversify a little more, achieve some trading flexibility and limit its leverage. Thus, could a value opportunity open up soon for investors interested in Morgan Stanley?

Morgan Stanley is being dealt heavy blows

Investors hoping for a solid third quarter from Morgan Stanley stand bitterly disappointed. The investment bank's third-quarter results were far below expectations, with a drop in both revenue and profit. The cause of this disappointing performance was the weak global economy, which has been hit hard by the afteraffects of the pandemic and the raging bull market that was born from extreme monetary stimulus.

With businesses worldwide struggling, there has been less demand for Morgan Stanley's services. This has hit the bank's bottom line, with its shares falling sharply in response to the news.

However, despite this weak quarter, Morgan Stanley remains one of the strongest banks in the world and is expected to bounce back when the economy recovers. Perhaps this is why the stock is still miles above pre-Covid levels.

Morgan Stanley’s revenue fell by 11.9% to $12.99 billion in the third quarter and missed analyst estimates by $320 million. Moreover, the earnings of $1.47 per diluted share were significantly below the $1.97 per share reported in the third quarter of 2021. The major culprit was its investment banking revenue, down 54% from the prior year and worse than most of its peers. However, the banking giant saw significant growth in its net interest income, which saw a surge of 49% year-over-year, slightly offsetting the negative effects of its investment banking segment.

Moreover, the good news is that part of the company’s revenue comes from the asset management arm, which is expected to deliver $20 billion by the end of this year. The wealth management segment reported revenues of $6.1 billion in the third quarter compared to $5.9 billion last year. The segment also picked up $65 billion in net new assets, a great sign considering the circumstances.

Shareholder returns continue to be healthy

At a time when many investors are reeling from negative earnings results, Morgan Stanley believes that returning capital to shareholders in the form of buybacks and dividends is a wonderful way to reward them for their loyalty in continuing to hold the stock. It is the best time to pursue this strategy, as it will help to shore up investor confidence and encourage more people to invest in the stock market.

While some critics argue that this strategy is a short-term fix, Morgan Stanley believes it is a sound long-term investment. By returning capital to shareholders, the company is signaling its confidence in the future of its business and its commitment to rewarding its investors. This is a crucial message to send in today's uncertain economic climate.

At the time of writing, Morgan Stanley has a trailing dividend yield of 3.39% compared to the 3.02% industry average. Furthermore, the company has a payout ratio of 0.42 compared to the sector average of 0.24

In addition, Morgan Stanley had announced a share repurchase program of up to $20 billion earlier in June 2022. The repurchase program was set to initiate in the latest quarter with no expiration date. Under the program, Morgan Stanley purchased $2.6 billion in shares in the third quarter.

On top of that, Morgan Stanley issued new P series preferred stock in July with a 6.5% dividend yield and an initial price of $25 to the public.

Morgan Stanley enters the world of ETFs

In August, Morgan Stanley announced its plans to launch its first four exchange-traded funds. In November, the firm launched its first ETF after a long hiatus; the Innovator Equity Managed Floor ETF (SFLR, Financial). The highest weight in the fund has been given to the Information Technology sector at 30.12%, followed by the Health Care and Consumer Discretionary sectors at 14.55% and 11.36%, respectively.

Launching these ETFs is a great move from Morgan Stanley and will help immensely reduce investor concerns. Over the past few months, there has been a lot of uncertainty in the markets, and investors have been increasingly seeking out safe havens for their money. Given Morgan Stanley's strong reputation as a financial institution, these ETFs are likely to be well-received by investors looking for stability in these volatile times. Furthermore, the fact that the ETFs are based on indexes gives them an added layer of protection against market fluctuations. Overall, I think this is a smart move by Morgan Stanley that is likely to pay off handsomely in the current climate.

Takeaway

Morgan Stanley's investment bank and credit ratings businesses have taken a hit in the last few quarters due to a wide variety of economic factors. However, Morgan Stanley has a long history of market resilience. Plus, the company is doing well with dividends and shareholder returns. Additionally, launching the new exchange-traded funds will help the firm diversify and achieve greater flexibility. This move is strategic as it allows Morgan Stanley to enter into a market that is growing rapidly and where it can compete quite easily, given its size and scope. Furthermore, this diversification will help offset any potential losses from its core businesses in case of a further downturn.