Shares of Bath & Body Works Inc. (BBWI, Financial) rose after Daniel Loeb (Trades, Portfolio)’s Third Point disclosed it upped its stake in the specialty retailer on Thursday.

The guru’s New York-based hedge fund, which takes an event-driven, value-oriented approach to picking stocks, is known for entering activist positions in underperforming companies with a catalyst that will help unlock value for shareholders. Some of its more recent targets include Walt Disney Co. (DIS, Financial) and Cano Health Inc. (CANO, Financial).

The investment

The Columbus, Ohio-based company, which changed its name from L Brands Inc. following the spinoff of Victoria’s Secret & Co. (VSCO, Financial) in August 2021, appears to be the investor’s next target as, in a 13D regulatory filing with the SEC, he revealed he has built a position of just over 6% in the stock since October.

According to 13F filings for the third quarter, Loeb’s initial purchase consisted of 8.13 million shares, which occupy 4.81% of the equity portfolio and is his sixth-largest holding. The stock traded for an average price of $35.28 per share during the three-month period.

The new filing said he now holds 13.7 million shares in total.

Investors should be aware 13F filings do not give a complete picture of a firm’s holdings as the reports only include its positions in U.S. stocks and American depository receipts, but they can still provide valuable information. Further, the reports only reflect trades and holdings as of the most-recent portfolio filing date, which may or may not be held by the reporting firm today or even when this article was published.

The area of concern

Loeb indicated in the filing that he will push for changes within the company’s board of directors, citing decisions they have made that “raise questions about the adequacy of current governance practices.” He continued:

“The Reporting Persons believe that the Issuer, through the compensation committee of the Board, has made errors in structuring its executive compensation such that excessive awards have been made that are untethered to important performance metrics. In addition, the Reporting Persons have significant concerns about financial discipline, investor communication, and Board composition, including the ability of current Board members to make long-term value-maximizing decisions through responsible and thoughtful capital allocation.”

The guru then went on to emphasize he felt these issues can be resolved “with appropriate shareholder input,” but will seek to make changes to the board’s composition or take other measures before the next annual meeting if no resolution is reached.

Valuation

The specialty retail company, which is known for its variety of soaps, lotions, fragrances and candles, has a $9.87 billion market cap; its shares gained 1.07% to trade around $42.60 on Friday morning with a price-earnings ratio of 11.26 and a price-sales ratio of 1.36.

The GF Value Line suggests the stock is modestly undervalued currently based on its historical ratios, past financial performance and analysts’ future earnings projections.

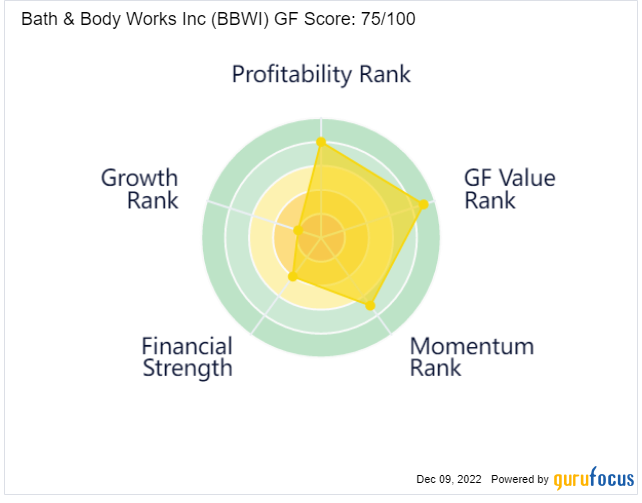

Further, the GF Score of 75 out of 100 indicates the company is likely to have average performance going forward. While Bath & Body Works received high ratings for profitability, GF Value and momentum, the financial strength rank was more moderate and growth was low.

Earnings update

On Nov. 16, Bath & Body Works released its financial results for the third quarter.

For the three months ended Oct. 29, the company posted $1.6 billion in revenue, which was down 5% from the prior-year quarter but up 46% from the same period in 2019.

Net income of $91 million decreased from $244.8 million last year. Earnings of 40 cents per share were also down from 66 cents.

In a statement, Executive Chair and Interim CEO Sarah Nash commented on the company’s performance in the “challenging environment.”

“We are pleased to have delivered better-than-anticipated bottom-line performance as the team remained focused on innovation and newness, continued to leverage our vertically integrated supply chain to chase into key winners, and took aggressive action to control costs and improve overall efficiencies,” she said.

Nash then went on to welcome Gina Boswell, who started earlier this month, as the company’s new CEO.

Looking ahead to the fourth quarter, Bath & Body Works expects earnings of $1.45 to $1.65 per share. As for the full-year outlook, earnings are anticipated to be between $3 and $3.20, which is up from the prior forecast of $2.70 to $3.

Dividend and warning signs

Distributing a quarterly dividend of 20 cents per share, the stock yields 1.86% and has a payout ratio of 0.20.

In addition to having inadequate interest coverage, GuruFocus noted the company’s Altman Z-Score of 2.63 indicates it is under some pressure. Bath & Body Works’ return on invested capital, however, eclipses its weighted average cost of capital, meaning value is being created as it grows.

The company is also seeing operating margin expansion and has strong returns on equity, assets and capital that top a majority of industry peers. The moderate Piotroski F-Score of 6 out of 9 indicates conditions are typical of a stable company. Due to a decline in revenue per share in recent years, however, the predictability rank of one out of five stars is on watch.

Guru investors

Of the gurus invested in Bath & Body Works, Steve Mandel (Trades, Portfolio) has the largest stake with 9.03% of its outstanding shares. PRIMECAP Management (Trades, Portfolio), Philippe Laffont (Trades, Portfolio) and Jim Simons (Trades, Portfolio)’ Renaissance Technologies also have notable holdings.

Portfolio composition and performance

The guru's $5.51 billion equity portfolio, which the 13F filing showed was composed of 59 stocks as of the end of the third quarter, is most heavily invested in the health care, utilities and consumer defensive sectors.

Other consumer cyclical stocks he held as of Sept. 30 were TJX Companies Inc. (TJX, Financial), Crown Holdings Inc. (CCK, Financial) and Membership Collective Group Inc. (MCG, Financial).

Third Point posted a 22.9% return for 2021, slightly underperforming the S&P 500’s return of 28.7%.