It’s the most wonderful time of the year, which means children of all ages are busy mailing their letters to Santa Claus and parents are searching for the best bargains to fill stockings ahead of the big day.

Although the Commerce Department reported on Thursday that retail sales for November declined 0.6% due to the uncertainty caused by rising interest rates, rampant inflation and other geopolitical concerns, the National Retail Federation’s annual survey found that consumers are still looking for some holiday cheer as it expects seasonal sales to increase between 6% and 8% from 2021 numbers.

As such, value investors may still find some treasures among consumer cyclical companies this Christmas. While these companies have been impacted over the past several years by the pandemic, supply chain shortages and rising costs related to inflation, their products remain popular and in demand among both children and adults.

According to GuruFocus’ Aggregated Portfolio, a Premium feature based on 13F filings, leisure and luxury stocks that were popular among gurus as of the end of the third quarter included Mattel Inc. (MAT, Financial), Signet Jewelers Ltd. (SIG, Financial), Capri Holdings Ltd. (CPRI, Financial), Planet Fitness Inc. (PLNT, Financial) and Johnson Outdoors Inc. (JOUT, Financial).

Investors should be aware that 13F filings do not give a complete picture of a firm’s holdings as the reports only include its positions in U.S. stocks and American depository receipts, but they can still provide valuable information. Further, the reports only reflect trades and holdings as of the most-recent portfolio filing date, which may or may not be held by the reporting firm today or even when this article was published.

Mattel

Holding a combined equity portfolio weight of 11.73%, nine gurus have positions in Mattel (MAT, Financial).

The El Segundo, California-based manufacturer of Barbie, Fisher-Price, Hot Wheels and American Girl toys has a $6.04 billion market cap; its shares were trading around $17.01 on Friday with a price-earnings ratio of 10.21, a price-book ratio of 3.07 and a price-sales ratio of 1.06.

The GF Value Line suggests the stock is modestly undervalued currently based on its historical ratios, past financial performance and analysts’ future earnings projections.

The GF Score of 71 out of 100, however, indicates the company is likely to have average performance going forward. While it received a high rating for GF Value, its profitability, financial strength and momentum ranks were more moderate and growth was low.

Mattel is also being supported by adequate interest coverage, an Altman Z-Score of 3.03, indicating it is in good shape, and a moderate Piotroski F-Score of 6 out of 9, which means conditions are typical for a stable company. Further, it has a predictability rank of one out of five stars. According to GuruFocus research, companies with this rank return an average of 1.1% annually over a 10-year period.

Of the gurus invested in Mattel, PRIMECAP Management (Trades, Portfolio) has the largest stake with 12.61% of its outstanding shares. John Rogers (Trades, Portfolio), Mason Hawkins (Trades, Portfolio), the T Rowe Price Equity Income Fund (Trades, Portfolio) and Steven Cohen (Trades, Portfolio) also have notable holdings.

Signet Jewelers

Eight gurus have positions in Signet Jewelers (SIG, Financial), representing a combined weight of 5.31%.

Headquartered in Bermuda, the world’s largest retailer of diamond jewelry, which has well-known brands like Kay Jewelers, Zales and Jared The Galleria of Jewelry under its umbrella, has a market cap of $3.02 billion; its shares were trading around $66.56 on Friday with a price-earnings ratio of 10.71, a price-book ratio of 2.24 and a price-sales ratio of 0.46.

According to the GF Value Line, the stock is fairly valued currently.

Further, the GF Score of 75 suggests the company will likely produce an average performance, driven by high ratings for momentum and profitability, middling marks for financial strength and growth and a low GF Value rank.

Although the company has a comfortable level of interest coverage, the Altman Z-Score of 2.79 indicates it is under some pressure. Further, it has a moderate Piotroski F-Score of 6 and the one-star predictability rank is on watch.

With 1.47% of its outstanding shares, Ken Heebner (Trades, Portfolio) is the company’s largest guru shareholder. Other gurus invested in Signet include Jeremy Grantham (Trades, Portfolio), Hotchkis & Wiley, Lee Ainslie (Trades, Portfolio), Cohen, Chuck Royce (Trades, Portfolio), Joel Greenblatt (Trades, Portfolio) and Barrow, Hanley, Mewhinney & Strauss.

Capri Holdings

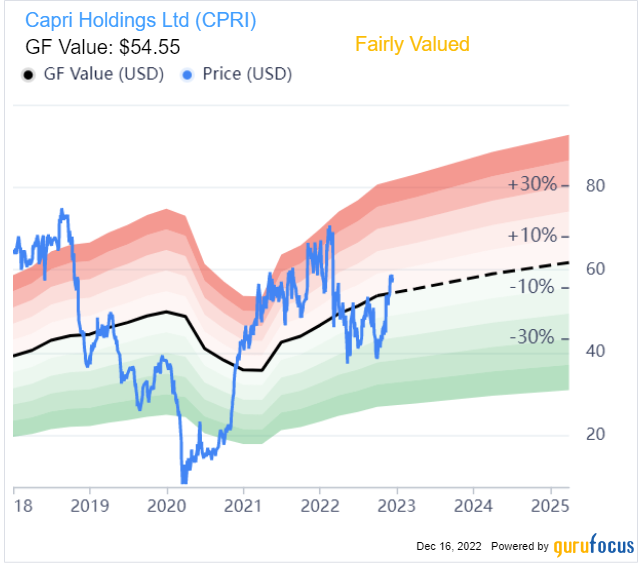

With a combined equity portfolio weight of 3.04%, eight gurus are invested in Capri Holdings (CPRI, Financial).

The New York-based fashion house, which owns luxury brands like Michael Kors, Versace and Jimmy Choo, has a $7.40 billion market cap; its shares were trading around $57.61 on Friday with a price-earnings ratio of 10.11, a price-book ratio of 3.51 and a price-sales ratio of 1.44.

Based on the GF Value Line, the stock appears to be fairly valued currently.

Capri is likely to have average performance in the future due to its GF Score of 79. Although the company had high ratings for profitability and momentum, its other three ranks were more moderate.

The company has adequate interest coverage and a high Altman Z-Score of 3.35. Further, it has a moderate Piotroski F-Score of 6 and a one-star predictability rank.

PRIMECAP Management (Trades, Portfolio) is Capri’s largest guru shareholder with a 2.77% stake. David Einhorn (Trades, Portfolio), Cohen, Jim Simons (Trades, Portfolio)’ Renaissance Technologies, Hotchkis & Wiley, Ken Fisher (Trades, Portfolio), Greenblatt and Paul Tudor Jones (Trades, Portfolio) also own the stock.

Planet Fitness

Planet Fitness (PLNT, Financial) is held by seven gurus with a combined equity portfolio weight of 0.51%.

The fitness chain known for being a “judgment-free zone,” which is headquartered in Hampton, New Hampshire, has a market cap of $6.37 billion; its shares were trading around $76.34 on Friday with a price-earnings ratio of 90.88 and a price-sales ratio of 7.74.

The GF Value Line suggests the stock, while undervalued, is a possible value trap currently. As such, investors should do thorough research before making a decision.

Additionally, the GF Score of 76 indicates the company is likely to have average performance going forward on the back of high ranks for three of the criteria, but middling marks for growth and a low rating for financial strength.

On top of insufficient interest coverage, Planet Fitness has a low Altman Z-Score of 1.52 that warns it could be at risk of bankruptcy. The Piotroski F-Score is moderate at 6, however.

Of the gurus invested in Planet Fitness, Ron Baron (Trades, Portfolio) has the largest stake with 1.20% of its outstanding shares. Jones, Cohen, Simons’ firm, Greenblatt, Caxton Associates (Trades, Portfolio) and Ainslie also have positions.

Johnson Outdoors

Accounting for a combined equity portfolio weight of 0.66%, seven gurus are invested in Johnson Outdoors (JOUT, Financial).

The Racine, Wisconsin-based company, which manufactures outdoor recreational products for camping, fishing, diving and other activities, has a $670.72 million market cap; its shares were trading around $65.80 on Friday with a price-earnings ratio of 15.07, a price-book ratio of 1.37 and a price-sales ratio of 0.90.

According to the GF Value Line, the stock, while undervalued, is a possible value trap, so potential investors should do their due diligence before making a decision.

The GF Score of 90 means the company has high outperformance potential. Johnson Outdoors recorded strong ratings for four of the criteria, but momentum was more moderate.

The company is supported by a comfortable level of interest coverage as well as a robust Altman Z-Score of 4.95. The Piotroski F-Score of 2, however, means operations are in poor shape. As a result of a slowdown in revenue per share growth, the three-star predictability rank is on watch. GuruFocus data shows companies with this rank return, on average, 8.2% annually.

With 5.16% of its outstanding shares, Chuck Royce (Trades, Portfolio) is Johnson Outdoors’ largest guru shareholder. Additional guru investors are Simons’ firm, Hotchkis & Wiley, Mario Gabelli (Trades, Portfolio), Diamond Hill Capital (Trades, Portfolio), Robert Olstein (Trades, Portfolio) and Grantham.

Other popular picks

Additional leisure and luxury companies that were broadly held by gurus as of Sept. 30 include Tapestry Inc. (TPR, Financial), Peloton Interactive Inc. (PTON, Financial), Movado Group Inc. (MOV, Financial), Vista Outdoor Inc. (VSTO, Financial) and SeaWorld Entertainment Inc. (SEAS, Financial).

Also check out: