CVS Health Corp. (CVS, Financial) announced that it was increasing its quarterly dividend payment by 10% to 60.5 cents per share for the upcoming Feb. 1, 2023 payment date. This marks the second straight December that the company has announced a 10% increase after CVS had held its dividend steady for 20 quarters in a row. The forward dividend yield is now a respectable 2.56%.

After such a long drought for dividend growth, back-to-back double-digit increases are a welcome occurrence for investors. Debt related to the Aetna acquisition had forced the company to maintain its dividend unchanged for a long period of time.

The second 10% increase in a row likely means that debt levels are much more manageable and that leadership feels the business is healthy enough to support a return to dividend growth.

Shares of CVS are down nearly 6% over the last year, but this compares favorably to the 21% decline in the company’s closet competitor Walgreens Boots Alliance (WBA, Financial) as well as to the 57% drop in the health care sector.

Dividend background

CVS completed its acquisition of Aetna, a leading health care insurance company, on Nov. 28, 2018. The total cost to CVS was $78 billion, inclusive of $8.1 billion of Aetna’s debt.

The transaction added millions of members to CVS’ customer pool while also saddling the company with an enormous amount of debt. According to the company’s 2018 annual report, debt at the end of the year stood at nearly $73 billion, compared to just $25.2 billion at the end of the prior year. The interest payments on long-term debt jumped from $10.5 billion to nearly $38 billion from 2017 to 2018. This was a massive burden on CVS’ balance sheet.

Approximately $30 billion of debt would be due by the end of 2023 following the addition of Aetna. As a result, all available capital had to used to address the company’s obligations. While the dividend wasn’t cut, it was paused for the 2017 to 2021 time period.

Despite the dividend pause, CVS’ dividend had a compound annual growth rate of more than 13% for the 2012 to 2021 period thanks to aggressive increases prior to the purchase of Aetna. Compare this growth to a peer Walgreens, which has CAGR of under 8% for the last decade. Even with its five-year pause, CVS still has a better dividend CAGR over the last 10 years compared to Walgreens. Dividend growth is in the company’s DNA as evidenced by the strong growth rates and its previous dividend growth streak of more than a decade.

CVS’ focus on reducing long-term debt has paid off. Through the end of the third quarter of 2022, the company had reduced its net debt position by more than $25 billion. This includes the repayment of $2.6 billion during the period. Long-term debt was two-thirds of what it was after the closing of the purchase of Aetna.

While the dividend freeze didn’t endear the company to some dividend growth investors, the ability to pay down obligations while maintaining payments is evidence that CVS’ business was strong enough to accomplish both tasks, a feat many other companies may not have been able to accomplish. This is because leadership was disciplined in their efforts to shore up the balance sheet. This disciplined use of capital has bettered positioned CVS moving forward.

CVS was able to maintain its dividend as the payout ratios were very reasonable. For example, the expected dividend payout ratio for 2022 is just 26%, which is nearly identical to the 10-year average. Had the payout ratios been higher before buying Aetna, the company likely would have had to cut its dividend in order to repay debt.

The free cash flow payout ratio is even more attractive. CVS distributed $2.8 billion of dividends over the last year while generating free cash flow of $19.5 billion for a payout ratio of just 14%. This is lower than the average free cash flow payout ratio of 21% that CVS had from 2018 through the end of last year. Even more impressive is how quickly free cash flow has grown since acquiring Aetna. For example, free cash flow totaled just $6.8 billion in 2018 before more than doubling to $15.7 billion last year.

CVS was able to maintain its dividend while paying down a substantial portion of its debt because of the amount of free cash flow being generated. Because the dividend pause was so long, CVS likely doesn’t get the credit from the market that I feel it deserves for being able to continue to pay its dividend while repaying more than $25 billion of debt in less than four years. Previous increases along with growth in free cash flow and much more manageable debt levels likely means that CVS will continue to raise its dividend at a high rate.

GF Score and valuation analysis

CVS has a GF Score of 88 out of 100, implying moderate outperformance potential based on a historical study by GuruFocus. This score is driven by a perfect score for momentum, solid scores for growth and profitability and middling scores for financial strength and value.

Some discussion of CVS’ performance on certain metrics is warranted, starting with financial strength. Debt levels are still elevated, which has caused the related metrics to be ranked near the bottom of the peer group. That said, the 7 out of 9 for the company’s Piotroski F-Score shows that the company has a solid financial footing. CVS’ return on invested capital of 6.6% was above its weighted average cost of capital of 4.3%, indicating value creation.

Moving on to the areas where CVS had its best showings, future expected revenue growth from Morningstar (MORN, Financial) analysts is in the middle of the pack even as the company has outperformed its peer group over the last three-to-five years. All of the short-term RSI indicators point to CVS having the potential to outperform between 63% to 78% of the competition.

CVS expects to earn between $8.55 to $8.65 per share for full-year 2022. At the midpoint of guidance, shares are trading at 11.1 times forward earnings. This compares to a price-earnings ratio of 13 that the stock averaged for the 2012 to 2021 period, according to Value Line. By this measure, shares seem undervalued.

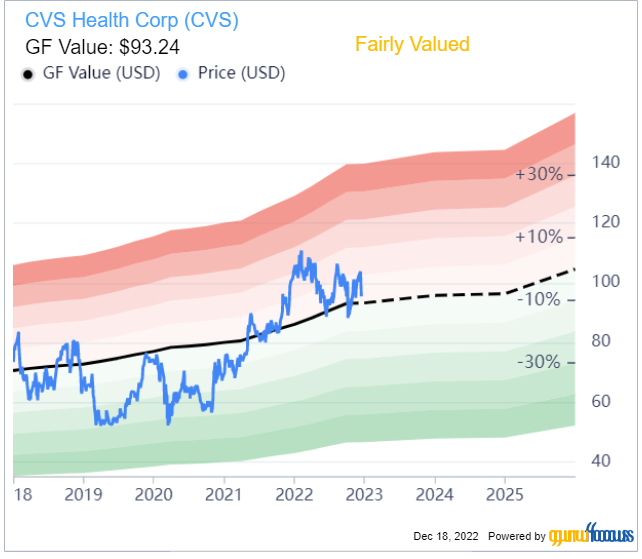

The GF Value chart shows the stock to be right around fair value. With a GF Value of $93.24, CVS has a price-to-GF-Value ratio of 1.03, earning the stock a rating of fairly valued from GuruFocus.

Final thoughts

CVS’ recent 10% dividend increase is the second of such magnitude in the last two years. This follows a lengthy period of a frozen dividend following the purchase of Aetna. Despite a nearly tripling of debt as a result of the acquisition, the company continued to pay its dividend.

CVS’ dividend growth over the last decade is still above that of its nearest competitor. With debt now more under control, the dividend is once again back in growth mode, implying that the business continues to perform well. The dividend has a low earnings payout ratio and an even lower free cash flow payout ratio. Shares also have a dividend yield that's better than the S&P 500, though that's not saying much.

Because of these factors, I believe that CVS is likely to offer a healthy and growing dividend for the foreseeable future.