It is that special time of year when people gather for the winter holidays, and for investors, it's often a time to rebalance our portfolios as well. Stocks are split between those on the “nice” list and those on the “naughty" list. Of course, whether a stock is “naughty” or "nice" is subjective, but one indicator investors can use to detect potentially bad investments is to look at whether a stock has high short interest.

High short interest means many investors are betting that a stock will fall in price. Generally, this is because they see the stock as either overvalued or having deteriorating fundamentals. However, not all stocks with high short interest are necessarily bad investments in my view - some of them could just be misunderstood Thus, in this article, we will take a look at two stocks with high short interest that I believe might not be as bad as they seem; let’s dive in.

Disclaimer: As these are highly shorted stocks, they are very risky. Nothing in this article should be considered financial advice; all opinions are solely the opinions of the author.

1. Marathon Digital Holdings

Marathon Digital Holdings (MARA, Financial) is a Bitcoin mining company that is planning to build one of the largest setups in the U.S. For those unfamiliar with crypto, Bitcoin is mined via the “proof of work” concept in which computational power is utilized to solve complex mathematical puzzles to “unlock” more Bitcoin.

Similar to natural resource mining such as oil and gold, mining Bitcoin makes sense economically when the price of the cryptocurrency is high. This was true in early 2021 when Bitcoin reached a high of $64,400 per coin. However, since that point, the price of Bitcoin has plummeted by close to 74% as a recessionary environment sparked a surge of selling in speculative assets with no real tangible value (like Bitcoin).

Bitcoin was previously thought of as an “inflation hedge" by some. However, it is clear that the asset has behaved more like a speculative growth stock outside of a bull market.

I believe the fall of crypto and many crypto-related stocks has also been exacerbated by the collapse of crypto trading exchange FTX. This was allegedly caused by the misappropriation of user funds, which were used as leverage by crypto trading firms such as Alameda Capital. It is not known yet whether the founder Sam Bankman-Fried purposely meant to defraud customers or just poorly managed the governance of the platform. However, we do know the collapse of FTX sent shockwaves through the cryptosphere.

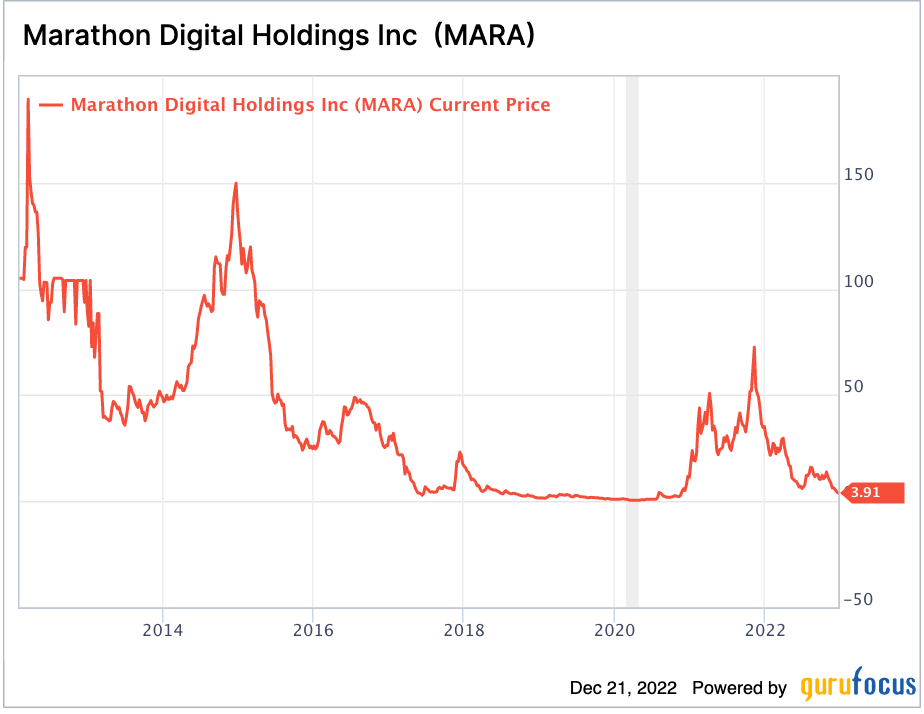

As mentioned prior, Marathon Digital operates a series of Bitcoin mines and thus benefits when crypto prices are high, but this also means it struggles when crypto prices are low. We are currently going through a “Crypto Winter," which is one reason why the company’s stock price has declined by nearly 95% since November 2021.

The company continues to be heavily shorted, with short interest of over 38% and over 42 million of its shares shorted.

A positive for the business is it operates in the U.S. across a geographically diverse range of facilities from Texas to Nebraska. This is a good thing because many crypto-related funds and institutional investors want to hold crypto that is mined economically and in the U.S. This is because there is some belief that the U.S. will be more lax in regulating crypto, and crypto mining companies in the U.S. often have more transparency in terms of their energy sourcing.

Marathon Digital is focusing on mining Bitcoin in an ethical and "environmentally friendly" manner. Its Texas facility is currently powered by wind and solar farms, making it 100% carbon-neutral. Given climate change is a hot topic and the number of investment funds with ESG (Environment, Social, Governance) mandates is increasing, Marathon Digital is in a good position to benefit, assuming crypto prices improve.

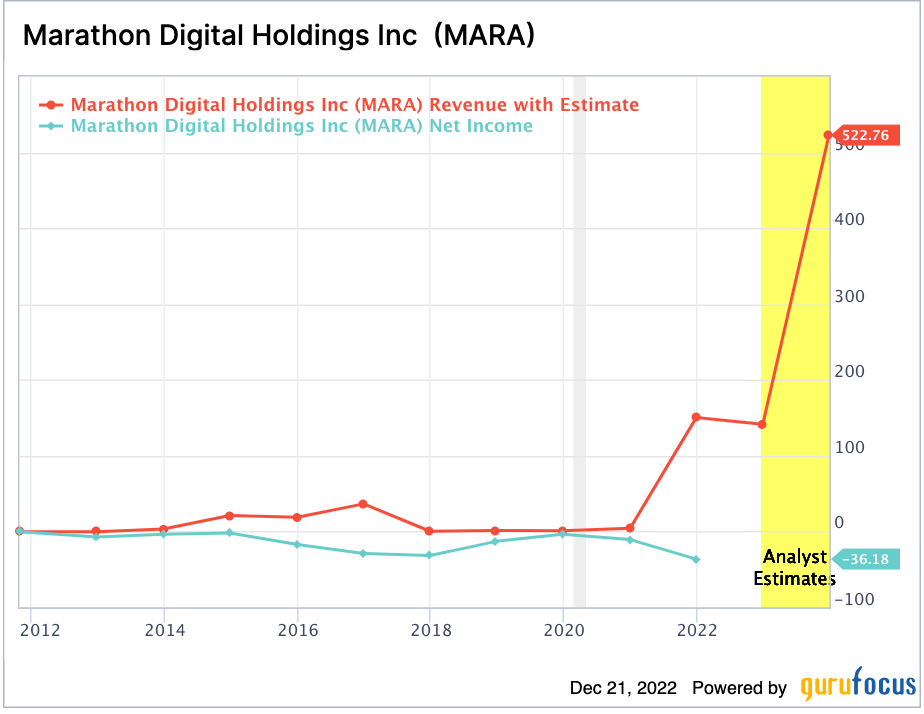

Marathon Digital’s revenue has fallen from $51.7 million in the third quarter of 2021 to just $12.7 million in the third quarter of 2022. This has been mainly driven by the aforementioned crypto price decline and zapped momentum in the crypto industry.

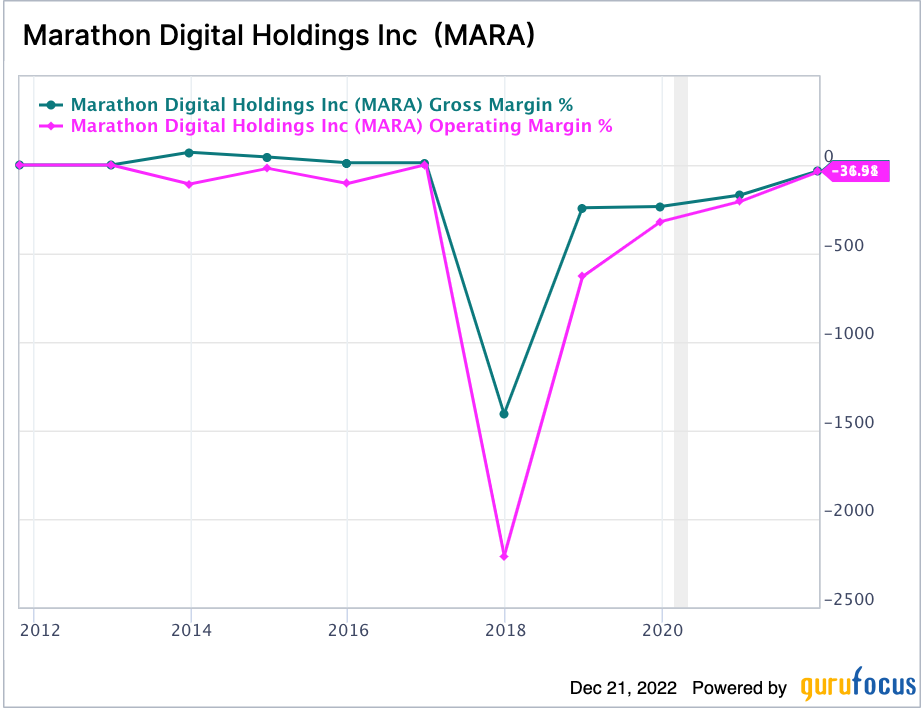

Its operating losses have also continued to balloon from $22.4 million in the year-ago quarter to $45.6 million in the recent quarter. The silver lining here is that the company is investing into building out its facilities and upgrading its Bitcoin mining computers to S19s, which have a faster hash rate and should improve margins in the long term.

The company’s cash and short term investment position has declined from $241.6 million to just $55.6 million. This was driven by a few factors including capital expenditures. However, Marathon Digital does have 11,285 Bitcoins which are valued at ~$190 million. Just last year the value of these coins would have been worth 3.4 times that amount, or ~$646 million. Therefore, you could say the company has a “hidden asset” if crypto prices improve, but that is not a certainty. In the meantime, the company will likely need to start selling down its Bitcoin at low prices to cover its operating expenses as it burns cash. Therefore it makes sense why the stock is so heavily shorted.

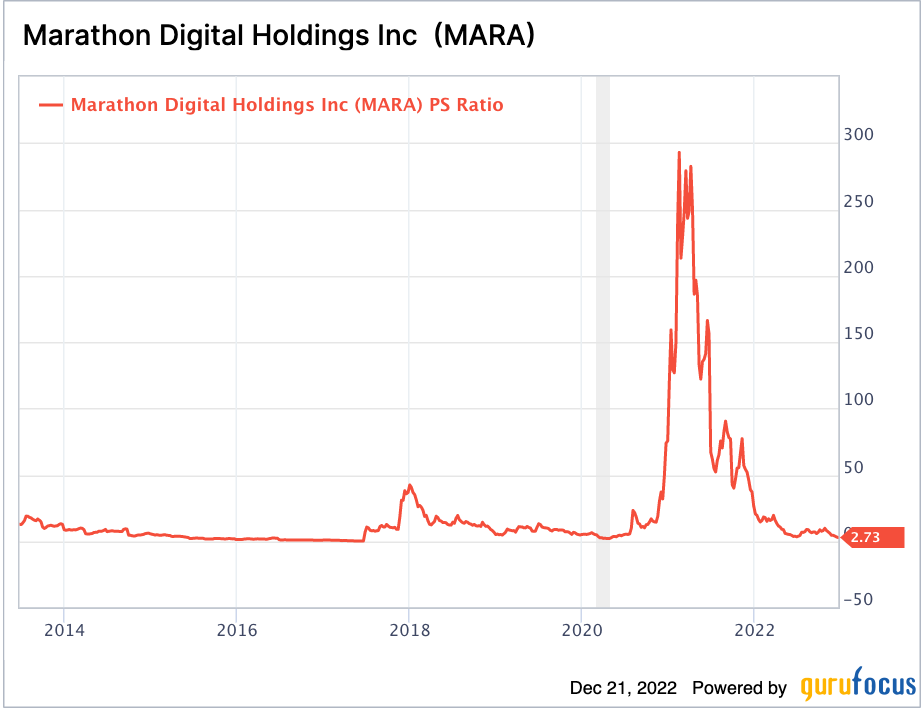

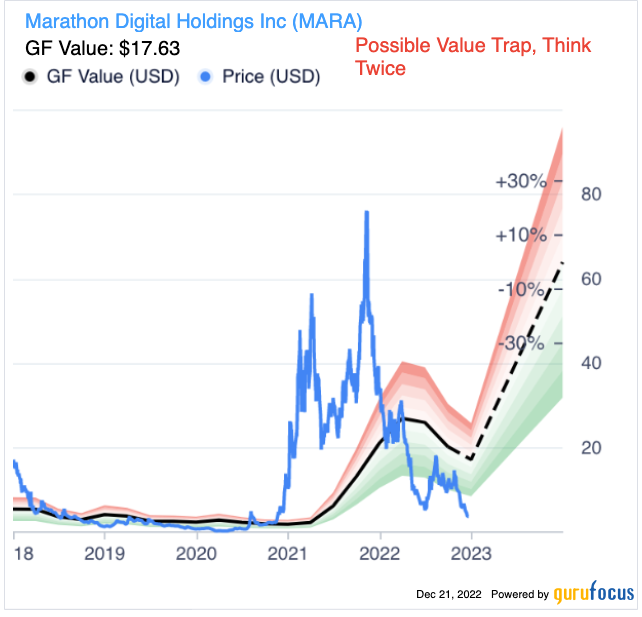

Valuing Marathon Digital is fairly challenging as it is really an asset play with extremely unpredictable assets. However, it should be noted the company trades at a price-sales ratio of just 2.8, which is 96% cheaper than its five-year average.

The GF Value calculator indicates a fair value of $17.73 per share for the stock, though it does warn of a possible value trap which I agree with given the uncertainty. I believe this makes shorting the stock a reasonable conclusion. However, if Bitcoin prices explode upwards, the stock could follow easily.

2. WeWork Inc.

WeWork Inc. (WE, Financial) operates a series of co-working space rentals with a focus on "chic and trendy" office environments. This includes 758 locations with 44.8 million square feet across 38 countries. The idea of the company’s facilities is to offer startups, freelancers and hybrid employees a place to work without the need to rent a large office.

On paper, this business model makes complete sense and one would expect immense popularity, especially given the rise in remote working following the 2020 lockdowns. However, the company has a patched history and I believe it was too early with the concept, had many governance issues and scaled too rapidly.

Founded in 2008, the company housed a number of startups at its first New York location. By 2014, it became the fastest growing lessor of new office in New York and one of the fastest in the U.S. as it aggressively expanded its operations. The business continued to raise immense amounts of capital from various investors such as SoftBank (TSE:9434, Financial).

However, in 2019 the company went public, and the extent of its losses and questionable valuation was revealed. Then a series of scandals hit the company, from cancer chemicals found in its offices to CEO Adam Neumann buying a $60 million jet while citing environmental friendly credientials and artificially inflating the company's valuation just to make himself rich.

Since than point, WeWork’s valuation has plummeted from $42 billion to just over $1 billion. Interestly enough, many short sellers are still bearish on the stock with a short interest of 27.88%, equating to ~60 million shares shorted.

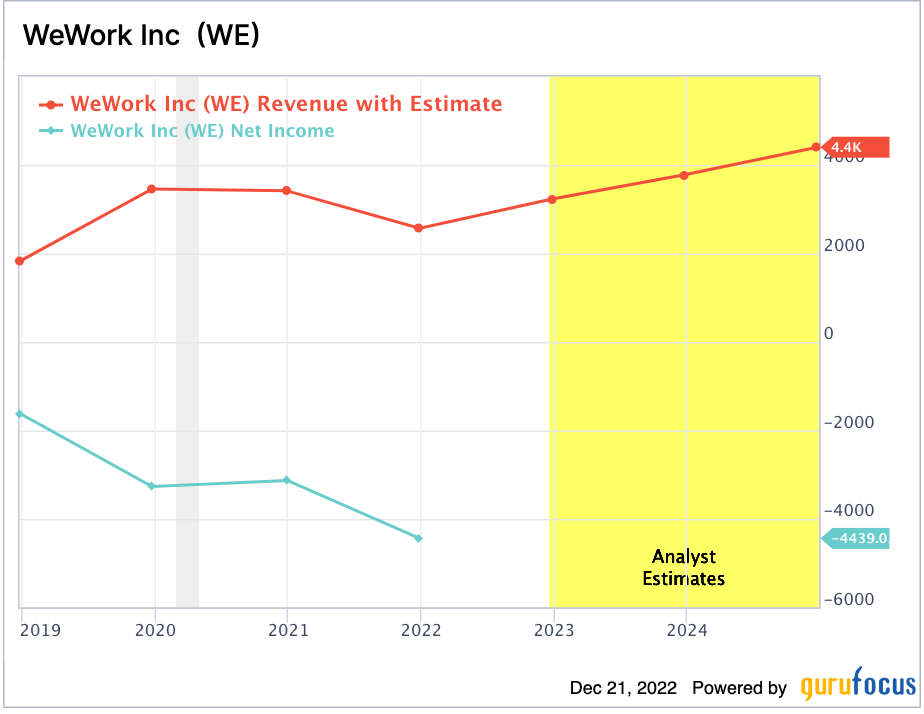

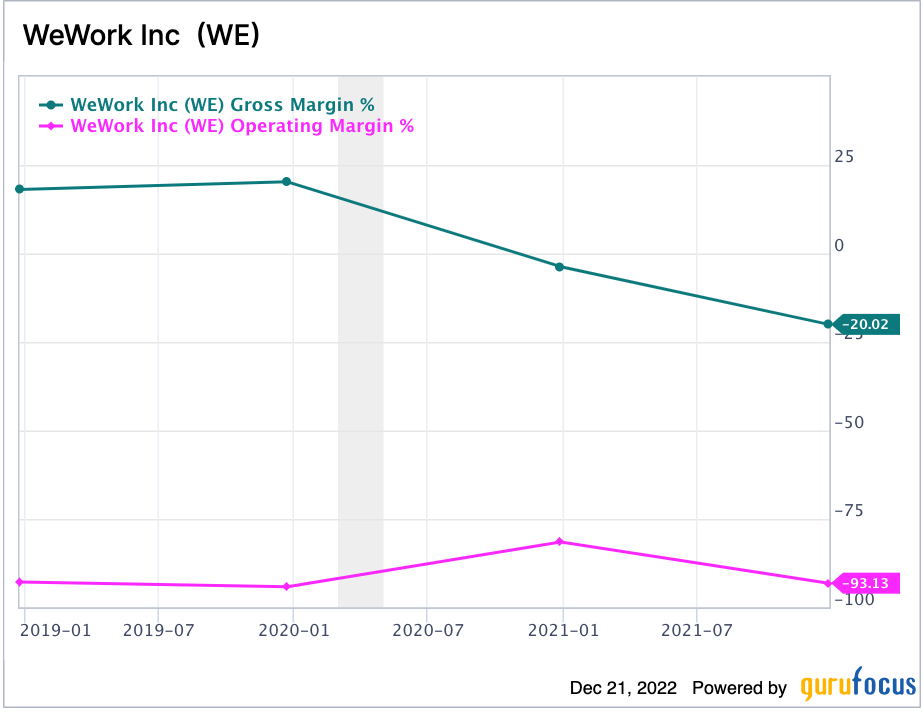

Moving forward from its checkered past, WeWork has actually increased its revenue from $661 million in the third quarter of 2021 to $817 in the third quarter of 2022.

The business has also improved its losses from $536 million a year ago $273 million in the recent quarter.

This is an improvement, but given the company has $460 million in cash and short term investments, the company has roughly two quarters of cash runway left unless it can improve its margins significantly. This will mean the business will need to raise further capital by issuing stock. Softbank would be unlikely to offer more capital after pouring billions into the company and then being sued by WeWork in 2020 for withdrawing its $3 billion offer to buy out the remaining shareholders.

WeWork trades at a price-sales ratio of 0.34, which is 92% cheaper than its five-year average. However, the company has still many fundamental issues and $19.69 billion in total debt. This mainly includes lease commitments, but it is still fairly worrying.

Final Thoughts

Both Marathon Digital and WeWork are companies which are going through a tremendous amount of headwinds. These are classic “bad stocks” and are definitely suited for Santa’s naughty list. Therefore it makes sense why they are heavily shorted, as investors aim to profit from further stock declines.

However, nothing is a certain in the stock market, and if crypto prices turn around, so could Marathon Digital. In addition, on paper, the growth in hybrid work should effectively make WeWork facilities enticing, if the company can survive the economic downturn and recover from the wreakage of its past mismanagement.