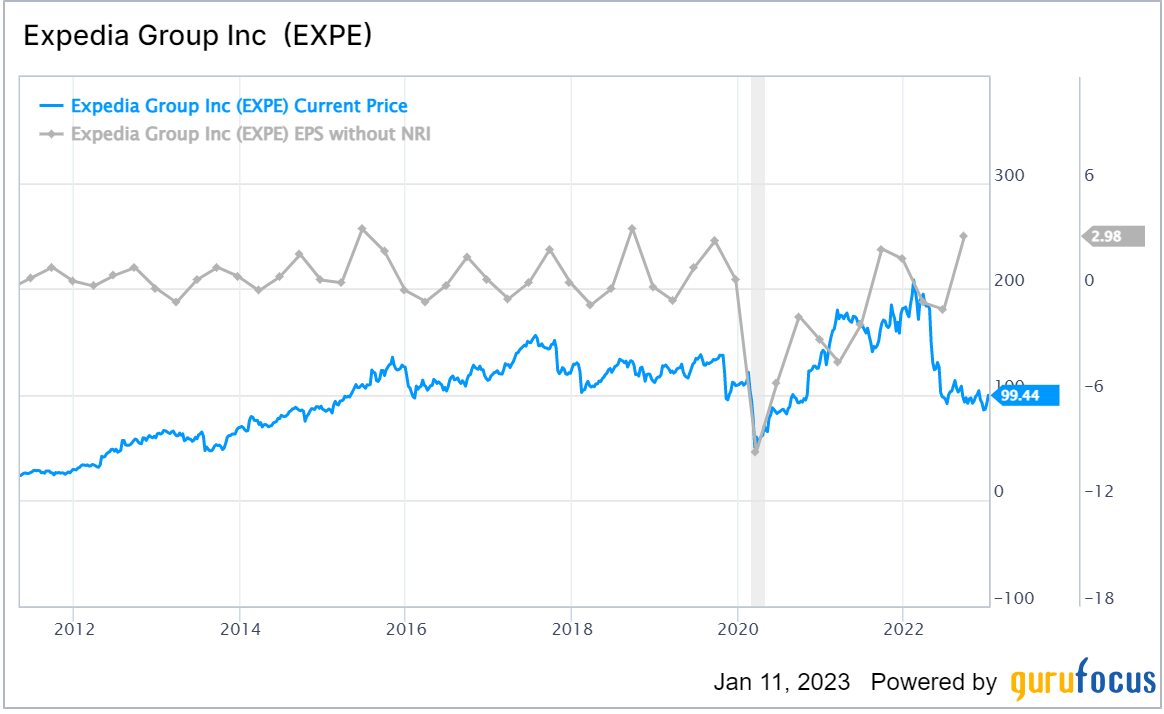

For the past few quarters, the earnings per share of online travel booking company Expedia Group Inc. (EXPE, Financial) have mostly recovered to pre-pandemic levels. Moreover, analysts are expecting further growth in the near future, with Morningstar (MORN, Financial) projecting a three-to-five-year earnings per share growth rate of 52% and a forward price-earnings ratio of 11.9.

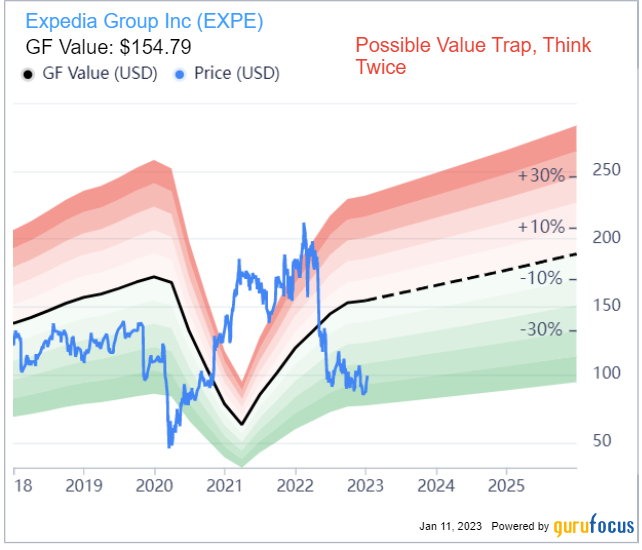

The stock price, on the other hand, has headed in the opposite direction. Investors had bid the stock up to unusually high valuation levels in 2021 through early 2022 on anticipation of the rebound in travel demand following the lifting of pandemic restrictions, and when stocks began struggling as inflation and interest rates soared, Expedia was pulled back down to earth.

Now that the stock is trading around pre-pandemic earnings and price levels, does it represent good value for investors? Based on earnings projections, it looks dirt cheap, but when we inspect the company’s financials, several red flags emerge that have the potential to drag down the stock’s per-share value in the coming years.

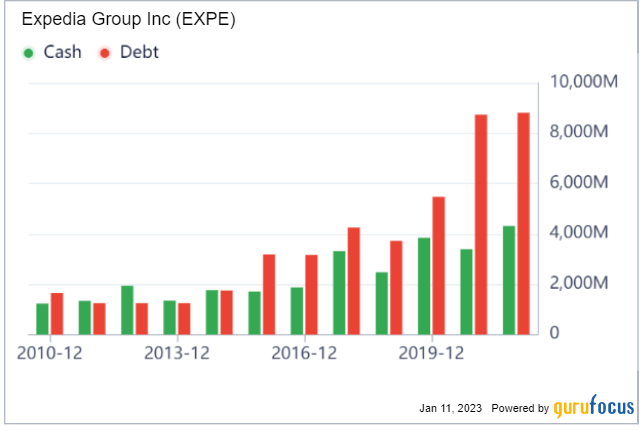

Contending with higher debt

One thing that has reduced the value of Expedia’s shares over the years is debt. While this problem was exacerbated due to the slump in travel demand caused by Covid-19, Expedia has actually been taking on increasing levels of debt for longer than that, as shown in the chart below:

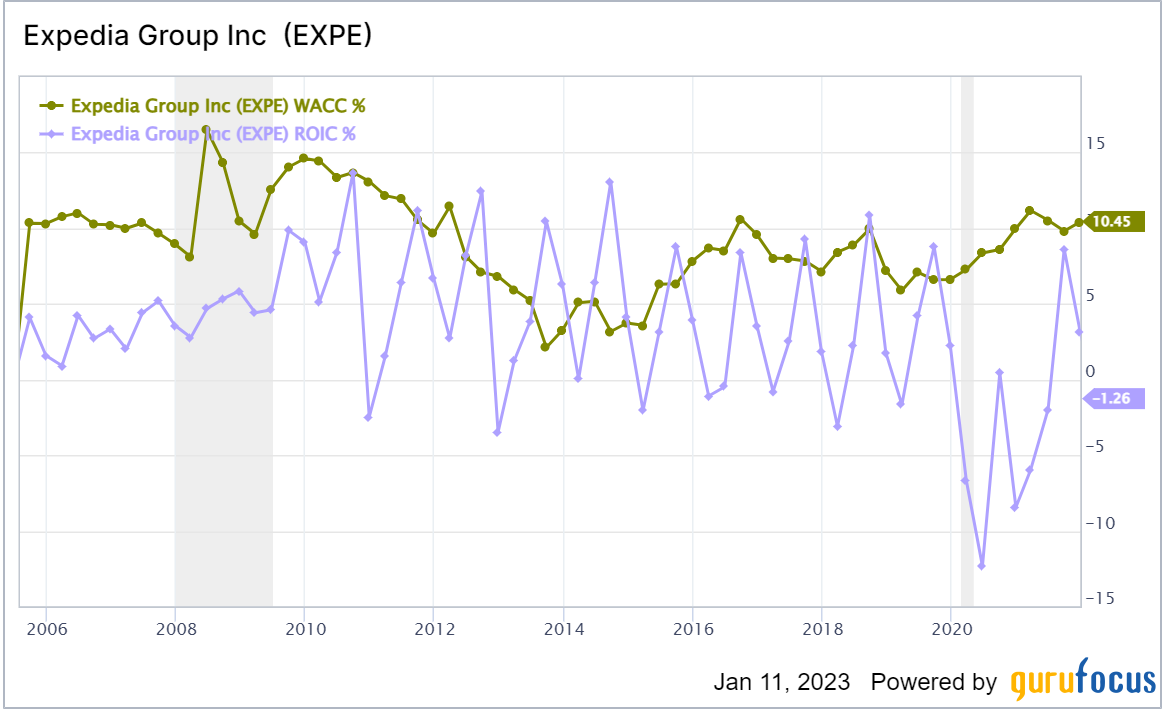

The core of the problem is the company is not earning enough on its borrowed funds to make up for the cost of borrowing said funds in the first place. The return on invested capital has been below the weighted average cost of capital for most of the company’s history, indicating value destruction.

One positive is that, due to improvements in operating income, the company has been able to maintain an adequate interest coverage ratio. The Piotroski F-Score of 7 out of 9 indicates a healthy financial situation overall, even though the financials have deteriorated.

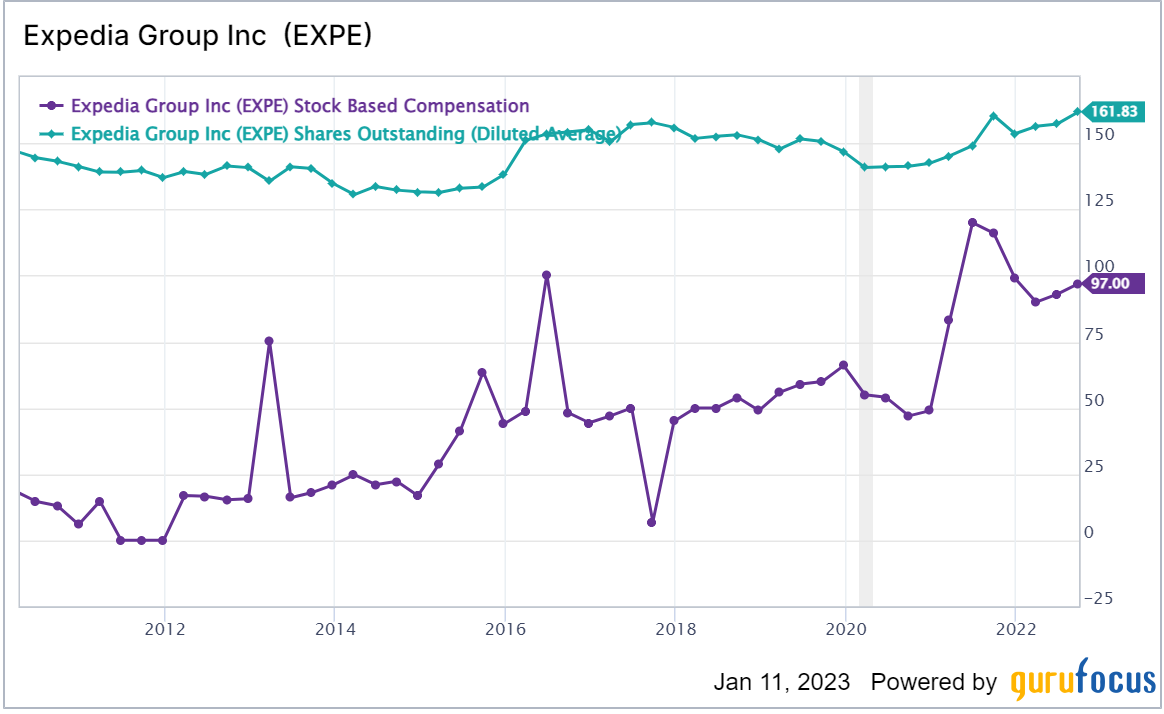

Stock-based compensation weighing in

Another issue to consider is that Expedia’s stock-based compensation is rather high – and the company doesn’t make up for it with share repurchases, either. The three-year share buyback ratio of -1.9% means the company is issuing more share than it buys back.

While high levels of stock-based compensation are great for the company’s top executives and can help retain talent, they are something investors need to watch out for because they dilute shareholder value via a combination of new share issuances and money going toward buybacks when it could have gone toward growing the company instead.

Are growth projections overblown?

To recap, Expedia’s earnings and share price are at approximately the same levels as they were before Covid as of this writing, but debt, stock-based compensation and built-in value destruction mean shares are worth less than they were back then. Since that’s the case, the only hope for shareholders is that future growth can make up the difference.

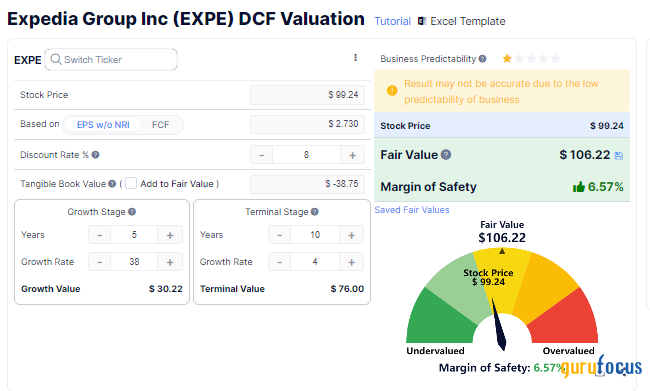

Are growth projections overblown, though? Yes and no. Since the company recorded a GAAP loss per share of $1.80 last year, the expected return to positive territory for full-year 2022 would be a huge boost. Excluding this return to profitability from calculations, the projected future growth rate according to Morningstar estimates should come closer to 38%.

If the company can truly achieve this kind of earnings growth, and if the U.S. manages to get inflation under control, allowing for a lower discount rate, the GuruFocus discounted cash flow calculator estimates the stock could be fairly valued at current levels:

Takeaway

My first thought upon seeing that Expedia’s stock had fallen to pre-Covid levels despite earnings recovery and strong growth projections was that the stock must surely be undervalued. However, after taking a closer look at the company’s financials, I no longer think that’s the case.

The company will need to achieve a fairly high growth rate in order to be worth its current valuation, and while its earnings history shows this should be feasible in times where economic growth is strong, there’s also the business model’s baked-in shareholder value destruction to consider. This isn’t something that investors want to see in a risk-off market, even if it may be overlooked in a bull market.

Speaking of the current risk-off market, some might say we are still overdue for a recession due to the aftereffects of extreme monetary stimulus measures in 2020 and 2021. The Federal Reserve has been slowly hiking interest rates, but it still hasn’t managed to bring inflation down to a manageable level yet. Even if we don’t have a pronounced recession, a period of slow growth will likely be needed at the very least to keep the economy healthy in the long run.

Overall, I find myself agreeing with the GF Value chart on Expedia. The GF Value chart rates the stock as a possible value trap. While it seems cheap compared to historical valuation levels, past returns and analysts’ estimates of future business performance, there are too many indicators of worsening financials that could impact shareholder value.