Baidu (BIDU, Financial) is the comany that operates the most popular search engine in China. The company is an established tech giant with a wide variety of tech ventures and had its IPO on the Nasdaq in 2005. Since that point, the stock price increased by over 2,000% to its high in February 2021. It was almost certainly overvalued at said all-time highs but has fallen nearly 70% since then as the Covid tech bubble popped.

The good news is that recently there has been positive news regarding U.S.-listed Chinese stocks with talk from Chinese regulators that the tech monopoly crackdown is easing. In addition, the SEC has made positive progress with its auditing of Chinese companies listed on U.S. exchanges, helping to ease delisting fears.

For Baidu specifically, its stock price has skyrocketed by 93% since October 2022 as a result of these positive developments. More recently, the stock popped by a huge 13% in a single day yesterday on the back of an investment in the stock reported by BlackRock (BLK, Financial). After these recent gains, can the stock still be considered undervalued? Let's take a look.

BlackRock investment

BlackRock is the world’s largest asset manager with approximately $10 trillion in assets under management.

According to a 13G filing with the SEC, the company has increased its stake in Baidu stock from 5% to 6.6% as of the end of 2022. This may seem like a small number, but given the size of Baidu, it is still rather significant.

Solid business model

Baidu’s mission is to make the world "simpler through technology." Founded in 2000, the company was one of the earliest search engines in China and became the leader in the market, with 544 monthly active users as of the end of 2020.

Similar to Alphabet's (GOOG, Financial)(GOOGL, Financial), Baidu's namesake search engine generates the majority (~70%) of its revenue from its “Core” search engine with advertising.

This is a great business model during good times as advertisers will spend billions of dollars in order to capture the search intent of users. However, a negative is the advertising market tends to be cyclical and during recessionary times it can suffer.

Baidu also offers a “Mobile Ecosystem” which includes a plethora of over a dozen applications. This includes the Baidu App as well as Haokan (which is a short video app, similar to TikTok) and many others.

Baidu has previously annouced plans to invest extensively into building out its live streaming capabilities. For example, in 2020 the company annouced its acquisition of live streaming company JOYY for ~$3.6 billion in cash.

The live streaming industry is a multi-billion-dollar market in China with applications from gaming to e-commerce. I believe e-commerce is the most lucrative and the live streaming shopping market in China was valued at a staggering $180 billion in 2022 with a total of 660 million viewers. This market is expected to expand to $720 billion by 2023, according to a study by iResearch.

Baidu is also considered to be a leader in Artificial Intelligence with its “Baidu Brain,” and there are rumors it plans to launch an AI equivalent of the viral chat bot ChatGPT very soon, which could have been a catalyst for the recent stock price boost in addition to the BlackRock investment.

The company is also a major leader in autonomous driving in China and has a series of robo taxi fleets across China in major cities Beijing, Shanghai and Guangzhou. Baidu scored commercial permits to run a robotaxi service in 2022 and is starting to scale out this lucractive business, which could distrupt the ridesharing industry as we known it.

Mixed financials

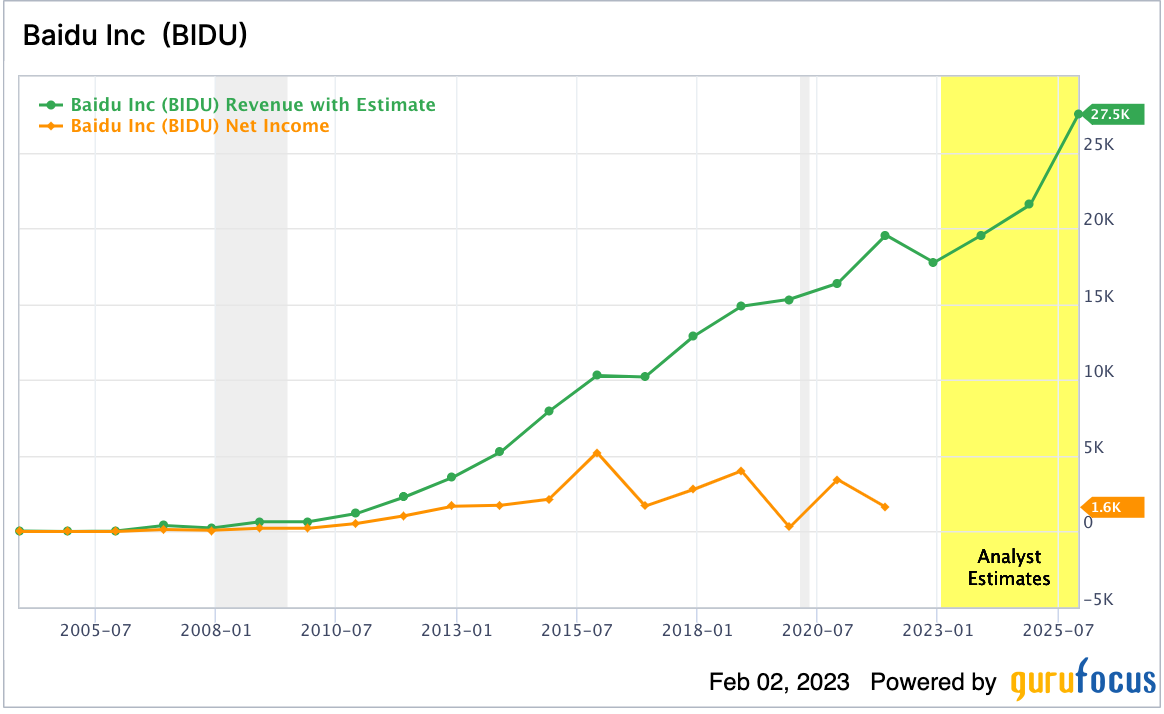

Baidu reported mixed financial results for the third quarter of 2022. The company reported $4.56 billion in revenue, which beat analyst estimates by $62.25 million, despite declining by over 14% year over year. This was mainly driven by a pullback in advertising spend due to the recessionary environment.

A positive for Baidu is its AI cloud business reported rapid growth of 24% year over year to $670 million.

Baidu is the fourth largest cloud provider in China and is poised to benefit from the digital transformation of organizations across the country. According to a study by McKinsey, China's huge manufacturing sector is poised for a digital transformation.

Baidu also reported solid results for its autonomous driving segment Apollo Go, which completed a staggering 474,000 rides in the quarter, which was an increased by 311% year over year. In total Baidu’s self-driving vehicles have done over 1.4 million rides.

On profitability, Baidu reported a loss per share of $0.12, which missed analyst expectations by $1.77. However, its adjusted earnings per share was $2.36.

Baidu cited a decline in the “fair value” of many of its long-term investments into equities, which equated to pape losses of $2.8 billion. This was expected due to the major sell off in the stock market globally.

Baidu has a strong balance sheet with $24.4 billion in cash and short term investments and debt of $13.4 billion, approximately $8.65 billion of which is long term debt.

Valuation

Baidu trades at a price-sales ratio of 2.69, which is 37% cheaper than its five-year average.

Analysts from Citigroup (C, Financial) have raised their price target to $176 from $166 per share.

The GF Value chart indicates a fair value of $145 per share, making the stock fairly valued.

Final thoughts

Baidu runs the dominant search engine in China and has a rapidly growing cloud business and a thriving autonomous vehicle business. Baidu is also poised to benefit from the AI opportunity and has huge potential to become the dominant market leader in this lucrative market. BlackRock's investment is also encouraging.